* "Gary1952">What is too conservative? I have a basic AA of 50/50. But the 50% bond OEFs have 50% (25% overall) in low duration/lower yielding "safer" type funds. The other 50% (25% overall) is in higher yielding multi/non-traditional funds. I own no "ballast" funds such as core/core plus OEFs. Is this too conservative or not conservative enough? My goal is to target 3-4% yearly income from divs, CDs and growth.

My market correlation for 10 years is .35%. The max draw down is -.42% for the bond OEFs.

I know it is my judgment but I am curious what others think.

Gary, In a more specific response to your post, you and I use very similar kinds of funds, although I break my funds down into funds for my taxable account, and funds for my tax exempt (IRA) account. In my taxable account if use more of the "safer" bond oefs, but with a wide variation if diversity. So, for example, DHEAX is the short term bond fund I use, but I consider it more risky than DBLSX and less risky than FIJEX. There is an argument that you could use just one of these short term bond funds, or you could use more than one of these funds for more diversification. I use 4 very different nontraditional bond oefs in my taxable account because they are all "conservative" for me, but they don't always perform the same in a given set of market conditions. PUTIX is my most risky nontraditional bond oef, MWCIX is my least risky nontraditional bond oef. I also own a municipal bond oef which is a HY MUNI (AAHMX) and this is one of the least risky HY Munis you can own. I used it to replace BTMIX, which is a very good short term investment grade muni bond oef, but I felt I was ready to move up in risk. I have considered NVHAX, but it is more risky than AAHMX, and NHHAX has some history of significant peak to trough losses and a larger "worst 3 month performance period" than AAHMX. I am still considering adding NVHAX to my portfolio in 2020, but if I do, I will probably make it much smaller position than AAHMX. In the past I have used MMHAX as longer duration and more risky bond oef, but I am not inclined to use it right now because I am not comfortable with its risk level. I am very clear that many investors will use much more risky bond oefs in their taxable account because there are a lot of pundits thinking they will sail through 2020 in the same way they sailed through 2019--that may fit their conservative criteria, but not mine.

When it comes to my IRA account, I use several multisector bond oefs that are more risky than what I will use in my taxable account. I rank order multisector bond oefs in roughly the following low to higher risk: ANGIX, VCFAX, PIMIX, PTIAX, JMUTX, JMSIX, PUCZX, IOFIX. All investors can make an argument for these funds being "conservative" based on the criteria they use. For me, I have chosen to only use VCFAX and PIMIX, but I don't dismiss the rationale from others to use some of these other funds. For me, I would not touch IOFIX with a 10 foot pole, but there are many others who believe this is the next great multisector bond oef.

At any rate, it appears to me that you are using relatively conservative bond oefs, but you could very easily change your criteria for other bond oefs to fit your investing roles you have defined for each fund.

Investment Thoughts January 2020 First time poster, greetings to all, posting some investment thoughts via stream of consciousness, all feedback welcome

I'm heavily invested in Dominion Energy Reliability Notes, paying 2.7% / $50k+ investments, you are lower on the capital structure here, full access to your funds at any time, no FDIC but backed by the financial strength of the company. Does anyone have any experience investing in these Notes or have additional input?

Following closely the Bond OEF Investing for more Conservative Investors...does anyone on that thread really trust/know what their funds are invested in? Even conservative funds with asset backed holdings rated highly by the rating agencies you have to wonder don't you? Crazy how many high priced homes I see owned by folks who drive older beat up cars. Don't want to sound elitist but something tells me they are leveraged to the hilt which could spell trouble if interest rates/job market/economy changes. Driving up Sheridan Road in the affluent North Shore burbs of CHI seems every fifth McMansion is up for sale...and same homes been for sale seems like over two years...escape from taxes and/or many of those folks living in those expensive homes know we are in an epic asset bubble?

Heavily invested in Brookfield Asset Management (BAM) and Berkshire - B (BRK/B), consider them a sort of "defacto", well managed, mutual funds without the fees. Follow Akre and Ackman via GuruFocus new holdings, have invested in Agilent (A) and Descartes Systems Group (DSGX). Heavily invested in Medtronic (MDT) and Teleflex (TFX), we're all getting older and looking for the repeal of the ridiculous Medical Device Tax (taxes profits not revenue, huh, who thought that was a good idea, companies thus cut jobs or sent solid paying jobs overseas).

Not a fan of Mutual funds, no out performance, "skimming off the top" with their management fees. ETFs are not for me, do like their low cost but too linked to herd behavior, what goes up must come down, no? I'm amazed by how many folks who invest in their 401Ks etc just follow what they are told by the "plan representatives" and have no idea how the markets work or what they are invested in.

Investment style is "anti-fragile" ala Taleb. Majority % of investments in safe, very conservative investments (T-Bills, 5 year CDs), smaller % in DERI Dominion Notes and ~15-20% in handful of stocks mentioned above.

Comments?

Good investing to all,

B

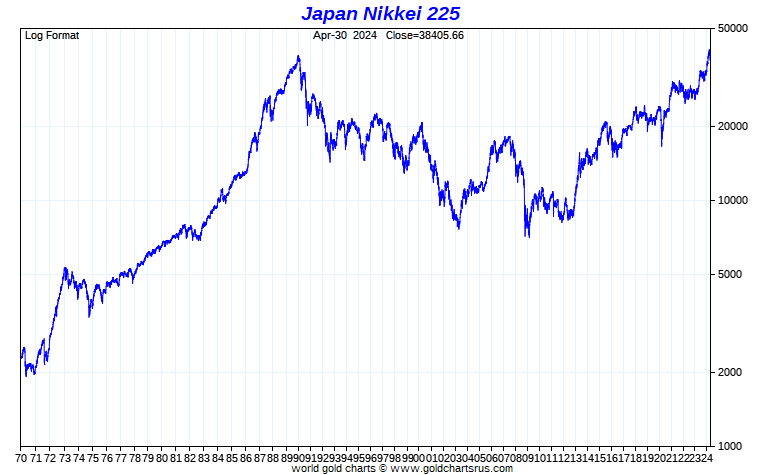

Opinion: What should your retirement wish be for 2020 The Nikkei graph:

J.P.Morgan Guide to the Markets Q1 2020 There is an awful lot to look at here in this PDF but I'd like to draw your attention in particular to the charts on page 61 showing investors retreating from the market (defined as the S&P

500) as the market marches higher and page 64 the 20 year returns by asset class. A few surprises in there for me.

J.P. Morgan Guide PDF

* What is too conservative? I have a basic AA of 50/50. But the 50% bond OEFs have 50% (25% overall) in low duration/lower yielding "safer" type funds. The other 50% (25% overall) is in higher yielding multi/non-traditional funds. I own no "ballast" funds such as core/core plus OEFs. Is this too conservative or not conservative enough? My goal is to target 3-4% yearly income from divs, CDs and growth.

My market correlation for 10 years is .35%. The max draw down is -.42% for the bond OEFs.

I know it is my judgment but I am curious what others think.

* Crash, I appreciate your willingness to make active posts. If you have thoughts about types of posts, that might inspire lurkers/readers, to engage with comments, thoughts, questions, I would be very open to working in partnership with others to try to keep this thread from dying from lack of interest. Unfortunately, with the way MFO is designed, you almost have to make a post every day or 2, before it is buried. At M*, there were several "categories" for discussion--Bonds had their own discussion forum, along with about 20 other discussion forums. This thread has become one of the most viewed threads in the past month (3.5K views) but there have been literally about a hundred new threads, that often get no comments, but they ultimately bury more popular threads, at least from a view criteria. It takes a lot of work to just keep a thread from falling on to the 2nd or 3rd page of the most recent threads on MFO, and just getting lost and buried.

* I started this thread about a month ago in December 2019, to see if this would be viable option for investors to discuss bond oefs. What I have learned is that there are a large number of individuals who "view" the thread (3.5K), but very few who care to make a post and help the thread be an active discussion forum--about 80 total posts on the thread, many of them are mine. The way MFO works, if there is no active posting, then the thread gets buried with more recent threads, more recent posts, and the thread ultimately dies of lack of attention. If anyone wants to keep this thread alive, I would be open to ideas of what would help that happen, otherwise I will just let it fade away, with my thanks to those few who were willing to participate in making active posts.

Opinion: What should your retirement wish be for 2020 Hi

@hankThis Nikkei

graph is view only; but provides a look back to 1970 representing your notations about performance.

Bridgewater Associates says flagship fund will be flat on the year https://nypost.com/2020/01/07/bridgewater-associates-says-flagship-fund-will-be-flat-on-the-year/amp/Bridgewater Associates says flagship fund will be flat on the year

The world’s largest hedge fund is proving a bit of a lightweight.

Ray Dalio’s Bridgewater Associates has notified investors that its flagship Pure Alpha fund will be flat on the year — ending an 18-year winning streak, according to Institutional Investor.

It’s unclear what Dalio told investors in reporting the disappointing results, but flat returns could be difficult to justify in a year when the S&P

500 index returned 31.

5 percent.

7 Best Fixed-Income Funds As Fed Keeps Rates Steady The title says 7 best. What makes them the "best"? The article does not define that.

+1

I would look at flexible bond funds where managers can add performance + possibly better risk attributes.

Fund Spy: International-Stock Funds Bounce Back in 2019. DODFX is a volatile fund that can have multi-year streaks of good or bad performance. I was going to say that despite that, it's not a white knuckle fund - with performances in, say, the top 2% or bottom 2% - until I checked. It came in at the 98th percentile in 2015 and the 2nd percentile in 2016.

That sequence goes to show that you have to look at this fund over several years. Its 72nd percentile performance in 2017 and 81st percentile standing in 2018, when combined with its 7th percentile returns in 2019 and also YTD lands it in the top 3/8th (38th percentile) over three years.

Another good year and this fund is going to wind up with a great 3 year record and it will have pulled its 5 year record up quite a bit. If one is willing to hang tight, I don't see a reason to believe that it won't continue to do well, long term. It reopened in part because of nearly a half decade of outflows. So while large, I don't expect size to be a significant issue.

Small Growth Fund For what interest it holds, Wasatch Small-Cap Growth is the only SCG fund that's both a Great Owl (risk-adjusted, entire market cycle) and Honor Roll (total returns, 1,3,5 years) fund; it has the additional endorsement of Morningstar, which recently elevated it to "Gold."

The Wasatch site says the fund is closed "to most new investors through third party intermediaries" which suggests it might not be closed to direct investment.

How to Pick a First Bond Fund Try this:

https://www.morningstar.com/articles/959057/how-to-pick-a-first-bond-fund(Generally, all one needs to do is copy / paste a portion of the text and than run a Google search.)

Agree, John should include & back-test his links. I glanced at the article and thought it looked superficial. In today’s low rate environment, picking a bond fund doesn’t exite me much. But if you just fell off the turnip truck (we’ve all been there) than maybe this is an incisive read.

8 of best low cost index funds https://money.usnews.com/investing/funds/slideshows/best-low-cost-index-funds8 of best low cost index funds

Index funds help users keep more money so their earnings can compound faster.

Best low-cost index funds to buy:

Vanguard Total Stock Market ETF (VTI)

Vanguard

500 Index Admiral (VFIAX)

iShares Russell 2000 ETF (IWM)

JPMorgan Diversified Return International Equity ETF (JPIN)

iShares PHLX Semiconductor ETF (SOXX)

iShares U.S. Aerospace & Defense ETF (ITA)

SPDR S&P Oil & Gas Exploration & Production ETF (XOP)

VanEck Vectors Gold Miners ETF (GDX)

Small Growth Fund ????? AOFAX 5.25% load.

AOFIX I see is no-load. Wonder why? Anyhow, it looks to be closed to new investors now..... And after looking again, so is AOFAX.

Small Growth Fund PRDSX, TRP fund. No load, a quant fund.

1-year: 29.74%

3 years: 14.24%

5 years: 11.9

5%

10 years: 14.99%

I've held it for several years. No plans to divest from it. It's true love. And you know, there's only two things that money can't buy: and that's true love and HOMEGROWN TOMATOES! Rest In Peace, Guy Clark. We miss ya.

Muni Bond party should continue in 2020 Over the years I have been using a high % in one of the following funds NHMAX ORNAX OPTAX PHMIX by using momentum.

My HY Munis fund opened the year with a bang (already 0.7+% in just a week). All my taxable is invested in that fund. Time for me to add more money to HY Munis in IRAs, just like I did last year because it's better than Multisector funds.

See YTD (

chart)