It looks like you're new here. If you want to get involved, click one of these buttons!

President Trump unleashed his fury about weakness in the labor market on Friday, saying without evidence that the data were “manipulated” and that he was firing the Senate-confirmed Department of Labor official responsible for pulling together the numbers each month.

In a long post on social media on Friday, Mr. Trump said he had directed his team to fire Erika McEntarfer, the commissioner of the Bureau of Labor Statistics who was confirmed on a bipartisan basis in 2024.

Only hours earlier, Stephen Miran, the chair of the White House Council of Economic Advisers, offered a much different explanation for the jobs revision. In an appearance on CNBC, he said much of the change was the result of “quirks in the seasonal adjustment process” and even the president’s own policies, particularly on immigration, potentially affecting hiring numbers for May and June. He made no mention of any concerns about manipulated data.

OK folks- any government statistics are now only what Trump says they are. Good luck to everyone !Donald Trump has said he’s ordered the firing of Erika McEntarfer, the commissioner of the US Bureau of Labor Statistics, hours after data showed US employment growth was weaker than expected for the last few months.

McEntarfer was nominated by former president Joe Biden to serve in the role in 2023 and was confirmed by the US Senate the following year.

In a Truth Social post, Trump suggested (with no evidence) that the employment figures were inaccurate and insisted the US economy was booming under his administration.

“We need accurate Jobs Numbers. I have directed my Team to fire this Biden Political Appointee, IMMEDIATELY. She will be replaced with someone much more competent and qualified,” Trump wrote.

The bureau released revised job stats today which showed the US economy added only 73,000 jobs in July, far lower than expected, amid ongoing concerns with Trump’s escalating trade war.

In the report, the BLS also slashed the number of jobs added in May, revising the figure down by 125,000, from 144,000 to only 19,000, and June, which was revised down by 133,000, from 147,000 to just 14,000 – a combined 258,000 fewer jobs than previously reported.

And yet ol' Donnie would absolutely blow a screed-laced gasket if some country 'sanctioned' a judge here for something similar.Excellent post this a.m. from Krugman about the attempted tariff extortion on Brazil to save his authoritarian pal Bolsonaro from trial, conviction, and prison.

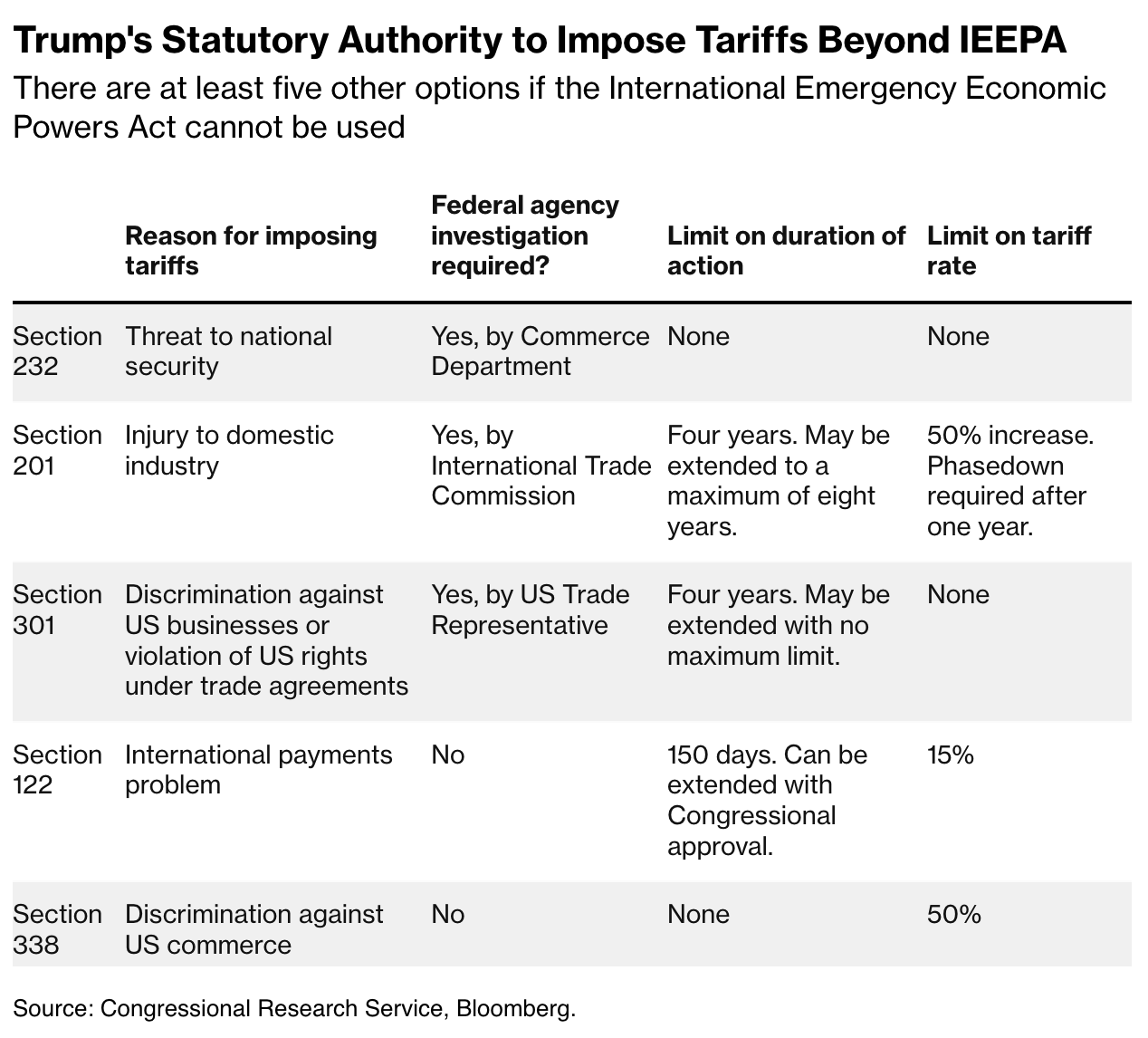

Short version: It's delusions of grandeur to an absurd level: Dump doesn't have "the juice" to pull it off. Brazil isn't dependent enough on the U.S. to get them to blow up their legal landscape to please Dump. And it's clearly illegal to use tariffs to interfere in the entirely internal affairs of another nation.

Oh, and if anyone's worried about orange juice prices, it's exempted from the 50%, making the extortion demand even more absurd.

Investment implications: Don't need to worry overly much about investments in Brazil or in OJ, e.g., Tropicana (PepsiCo) and Simply Orange (Coca-Cola).

This is why you don't elect a reality TV dufus to run the country.Hi @Old_Joe Apparently, there is a delay of the newest tariffs. Reportedly, if your watch ships prior to August 8th, you're good to go. Canada's new 35% rate apparently isn't clear what the new rate will apply towards.

AND, The White House also has plans for 50% tariffs on Brazil which are set to be in fully in effect one day sooner — as that order is operating under its own seven-day clock that began Wednesday.

Lastly, it's hard to read the full rules of these agreements written on cheap paper napkins with cheap ink pens.

Stock BILT GLIFXAlso, as with gold assets, there are airport stocks and there are airport stocks. Some airport companies actually own the airports (just as some gold holdings are really gold) while other companies manage airport operations (just as some gold holdings are mining operations).

AENA SME SA 6.61% 1.86%

FLUGHAFEN ZUERICH AG 0.74% 1.62%

VINCI SA 0.50% 4.87%

AEROPORTS DE PARIS SA 0.98%

JAPAN AIRPORT TERMINAL LTD 0.92%

Ferrovial SE 7.74%

Auckland International Airport Ltd 1.12%

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla