It looks like you're new here. If you want to get involved, click one of these buttons!

Tesla has a page dedicated to economic Electric and Solar incentives (none of which addresses the negative impact lithium mining has on the environment):Policy-makers have two broad types of instruments available for changing consumption and production habits in society. They can use traditional regulatory approaches (sometimes referred to as command-and-control approaches) that set specific standards across polluters, or they can use economic incentive or market-based policies that rely on market forces to correct for producer and consumer behavior. Incentives are extensively discussed in several EPA reports:

I believe technology eventually helps solve natural and man made problems. Tesla may be on the right track."Tesla made more than $1 billion from ... regulatory credits over the past four quarters. ... That is more than double its profits over the past four quarters." So Tesla's profitability at this point is due to its cars being "clean" rather than their selling at a profit.

the-carbon-footprint-of-tesla-manufacturingThe Union of Concerned Scientists did the best and most rigorous assessment of the carbon footprint of Tesla's and other electric vehicles vs internal combustion vehicles including hybrids. They found that the manufacturing of a full-sized Tesla Model S rear-wheel drive car with an 85 KWH battery was equivalent to a full-sized internal combustion car except for the battery, which added 15% or one metric ton of CO2 emissions to the total manufacturing.

However, they found that this was trivial compared to the emissions avoided due to not burning fossil fuels to move the car. Before anyone says "But electricity is generated from coal!", they took that into account too, and it's included in the 53% overall reduction.

inconvenient-truth-carbon-credits-dont-work-deforestation-redd-acre-cambodia“This is an example of hope,” he said, as we stood behind his office at the Federal University of Acre, a tropical campus carved into the Amazon rain forest. Brown placed his hand on a spindly trunk, ordering me to follow his lead. “There is a flow of water going up that stem, and there is a flow of sap coming down, and when it comes down it has carbon compounds,” he said. “Do you feel that?”

I couldn’t feel a thing. But that invisible process holds the key to a massive flow of cash into Brazil and an equally pivotal opportunity for countries trying to head off climate change without throwing their economies into turmoil. If the carbon in these trees could be quantified, then Acre could sell credits to polluters emitting clouds of CO₂. Whatever they release theoretically would be offset, or canceled out, by the rain forest.

Five thousand miles away in California, politicians, scientists, oil tycoons and tree huggers are bursting with excitement over the idea. The state is the second-largest carbon polluter in America, and its oil and gas industry emits about 50 million metric tons of CO₂ a year. What if Chevron or Shell or Phillips 66 could offset some of their damage by paying Brazil not to cut down trees?

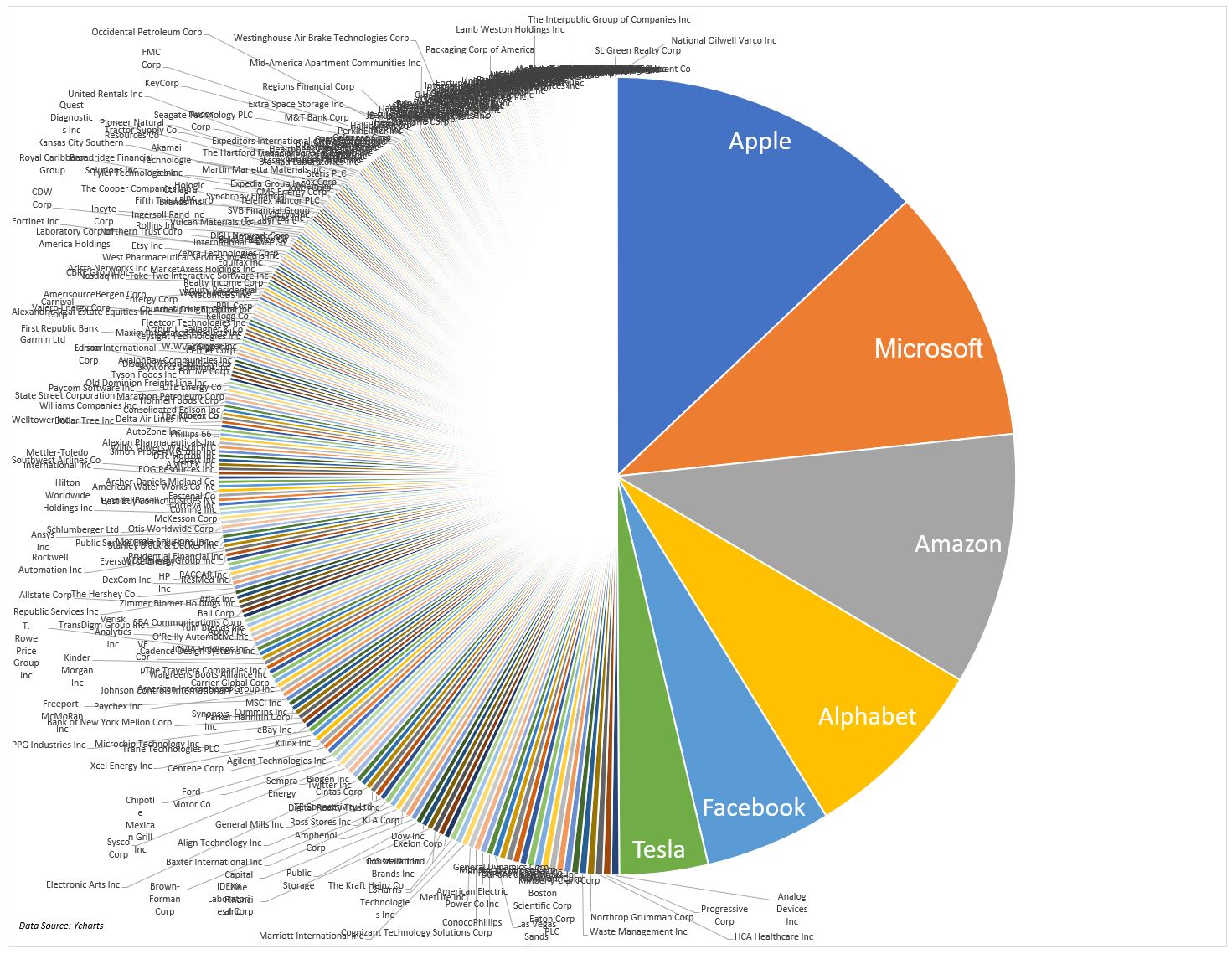

global-investing/2020/12/01/tesla-sp-500-2S&P still hasn’t announced what stock Tesla will be replacing, saying it will release that decision after the market closes Dec. 11.

The S&P 500 isn’t the only index affected. Several other benchmarks will be rejiggered to accommodate the car maker, as well as any deletions from the S&P 500.

Tesla, for example, is the largest weighted stock in S&P’s completion index, a benchmark tracking all U.S. stocks except those in S&P 500, and will have to be removed. Any stock taken out of the S&P 500 will trigger its addition back into the completion index, as well as step downs into S&P’s mid and small-cap benchmarks.

State Street’s Mr. Bartolini said at least five of its exchange-traded funds will have to be rebalanced as a result of Tesla’s addition, including the biggest ETF in the world, the SPDR S&P 500 Trust ETF, and its growth-focused ETF, the SPDR Portfolio S&P 500 Growth ETF.

Tesla’s inclusion “will require a fairly numerous amount of trades,” said Mr. Bartolini.

If you look at 3 years prior to the crash and compare VCFIX,IOFIX,SEMMX,PIMIX (link) you see the following:I am willing to revisit usage of funds like VCFIX/VCFAX as a fund that was considered one of the safer, less riisky funds, prior to the crash, especially when you look at its relatively smooth performance track since the crash. When a reputable brokerage, like Schwab, is willing to put it on its Select fund list, I tend to give that fund more "benefit of the doubt" than funds like IOFIX, DHEAX, and SEMPX, which had terrible crash performance

I like and own JASVX but it is not exactly the same type of fund as PIMIX at this point. Also not sure I see PIMIX doing so bad outside of this year (still up 4.6%) and last. Agree that the bloat won't allow "secret sauce" outperformance going forward, but still can be a good fund. Definitely watching closely. My concern with JASVX is it's outsized performance this year. I have a rule that when you see a fund outperform that much you need to expect that it could underperform just as badly, like IOFIX. Put differently, I'd tell my elderly mom it's fine to park a good chunk of her savings in PIMIX, not so sure about JASVX. But being the bond master I'm interested in your take on this.10 years is too long. PIMIX was great until 01/2018 but its AUM got much bigger than 5-6 years ago, the managers had to look outside their best ideas in securitized and now more HY and EM and the yield is now at 4%.

For mostly special securitized and still lower SD you can use JASVX. 2 of the managers are from SEMMX but this fund performance was much better in March 2020 than SEMMX,PIMIX,VCFIX and good YTD. I know it's new but the managers aren't. YTD (chart)

You have setup a classic strawman argument. I never denied climate change nor the science surrounding it. In fact, I've conceded two of your main points, i.e., that the earth is warming and that human activity is probably a significant contributor. Now, will you concede my main points, i.e., (1) the earth's climate is constantly changing independent of human activity and always has been? (2) No one knows what direction the earth's climate will take in the future independent of human activity? (3) despite dire predictions the earth's climate has over the past century warmed less than 2 degrees (probably closer to one degree)? (4) John Kerry lives on an island despite alleged concerns that it will fall into the sea in his lifetime (J/K)? We can disagree about my other main point, i.e., that there is probably little we can realistically do to change human activity enough to prevent additional modest increases in climate over the next century without causing substantial damage to the environment and people in other respects? This is the real and fair debate among knowledgeable people, and to deny it makes you the ignorant one. Some honest and good people do care about an entire industry and its workers being told to shut down. If your brother, son, daughter or best friend made their living as a coal minor or working an oil rig I think you would see this point. I doubt you know any of those types.@wxman123Sure, there is another side of everything, just not a side that exists in the realm of rational scientific study in the case of climate change. One can still believe the earth is flat if one likes or that Jesus walked with the dinosaurs. I suspect though that climate science denying posters like you who in my experience always claim they’re nature lovers and real experts on science and it’s just that the libtard lame stream media and a global cabal of thousands of climate scientists have everything wrong—I suspect deep down you don’t really believe the climate science denial you’re espousing. Deep down you know the science is true but just don’t care and figure I just want to make more money any way I can living exactly the way I always have and no one no matter how much scientific evidence they provide is going to tell me I’m wrong. Climate science denial is merely an expedience, a means to an end of business as usual, of preserving the status quo and all of the profits that supports, regardless of the environmental consequences.The idea that there is not another side to the climate debate is a real issue,

Sure, there is another side of everything, just not a side that exists in the realm of rational scientific study in the case of climate change. One can still believe the earth is flat if one likes or that Jesus walked with the dinosaurs. I suspect though that climate science denying posters like you who in my experience always claim they’re nature lovers and real experts on science and it’s just that the libtard lame stream media and a global cabal of thousands of climate scientists have everything wrong—I suspect deep down you don’t really believe the climate science denial you’re espousing. Deep down you know the science is true but just don’t care and figure I just want to make more money any way I can living exactly the way I always have and no one no matter how much scientific evidence they provide is going to tell me I’m wrong. Climate science denial is merely an expedience, a means to an end of business as usual, of preserving the status quo and all of the profits that supports, regardless of the environmental consequences.The idea that there is not another side to the climate debate is a real issue,

Says you based on what you believe. And, you are an elitist not because of your politics but because you belittle other points of view. The idea that there is not another side to the climate debate is a real issue, maybe even an "existential" one.@wxman123 You are confusing scientific facts with opinions. The planet's rapidly warming climate doesn't care whether you're a Democrat or Republican or whether I'm a "elitist" in your opinion or not. But then again, it is well known that facts have a liberal bias. Climate change isn't a small threat. It is an existential one.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla