It looks like you're new here. If you want to get involved, click one of these buttons!

Schools teach, or at least they used to, that there are three sets of stakeholders in a company. The two mentioned here - the owners and the employees - and a third, the customers. Boeing shortchanged its customers by compromising safety, by hiding information, by marketing the MAX as something it was not.Yet in recent decades, Boeing — like so many American corporations — began shoveling money to investors and executives, while shortchanging its employees and cutting costs.

https://www.theatlantic.com/business/archive/2016/12/short-term-thinking/511874/Almost 80 percent of chief financial officers at 400 of America’s largest public companies say they would sacrifice a firm’s economic value to meet the quarter’s earnings expectations. ... (This dynamic backfired at Wells Fargo, where employees pressured to meet quarterly targets opened accounts without customers’ permission.)

Dow 30K in the face of the worst worldwide natural disaster of our lifetime. Yeah, thank god this is coming to an end. Biden and his Merrymen of hacks will do so much better. As a commentator so perfectly put it yesterday....Kerry finally got his dream job, hanging out in fancy central European hotels making deals that are terrible for America. IMHO nothing about this administration is likely to make day-to-day living better for anyone posting here...or for most of America for that matter. Peace to all, and happy T-Day!the current administration had no transition plan and was not ready to take power in January, 2017. Grifters and inhabitants of the swamp saw the opportunity and cashed in.

So true and it gets worse towards the end. In addition, the incompetence from top down in so many aspects is unreal. So much for a successful businessman trying to run a country.

So true and it gets worse towards the end. In addition, the incompetence from top down in so many aspects is unreal. So much for a successful businessman trying to run a country.the current administration had no transition plan and was not ready to take power in January, 2017. Grifters and inhabitants of the swamp saw the opportunity and cashed in.

Seems these 11 sector etfs are each representative of a subset of only Large Cap companies in the Large cap Asset class.Here is a link that provides a quick visual overview of relative and absolute performance of the 11 Sector SPDRs over various time periods....

https://sectorspdr.com/sectorspdr/tools/sector-tracker

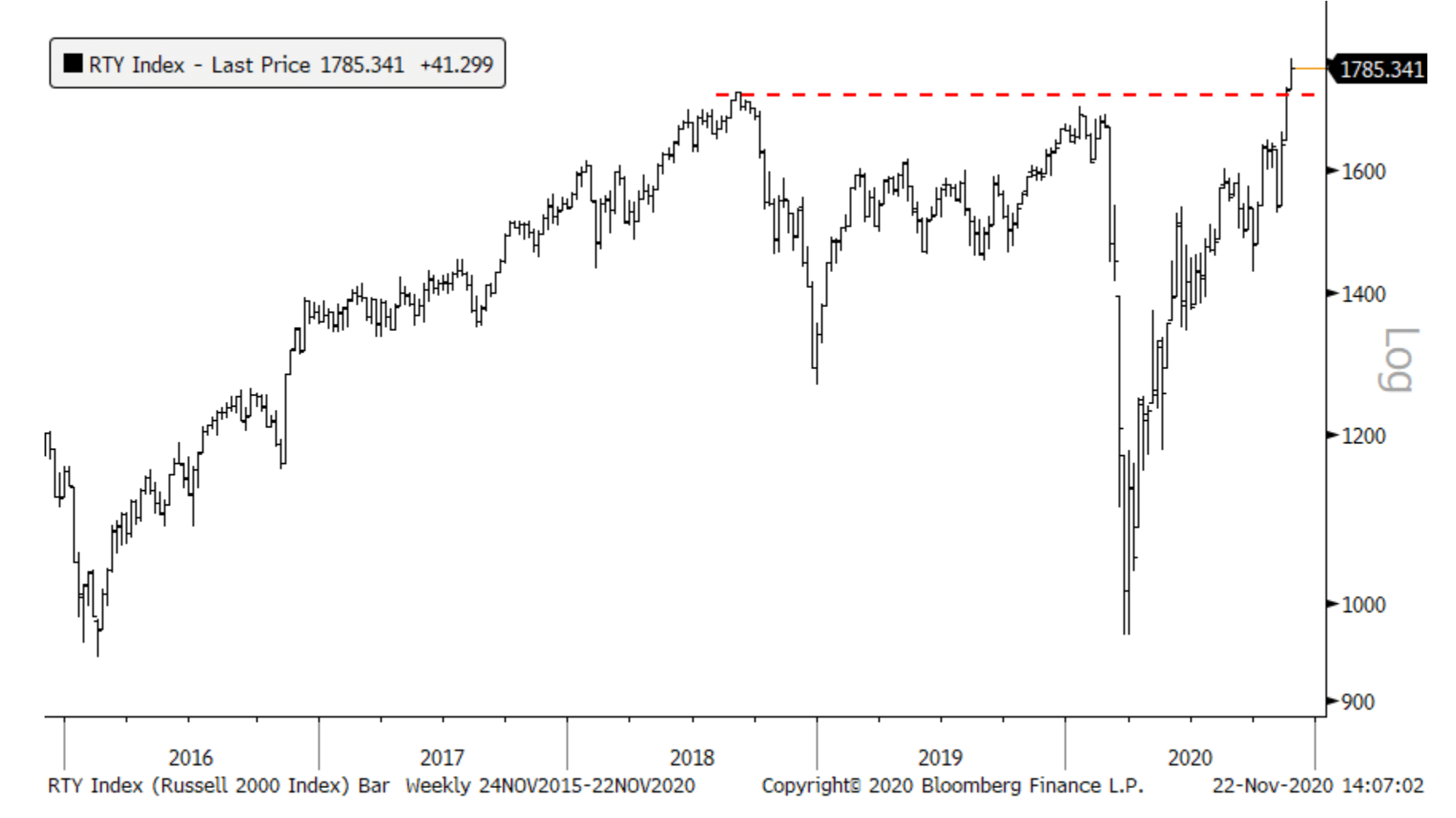

small-caps-break-out-of-two-year-consolidationAccording to Jon Krinsky at Baycrest, 83% of the Russell 3k names got back above their 200-day moving averages last week, a record going back seven years to 2013. It wasn’t bearish then and it’s not likely to be bearish now.

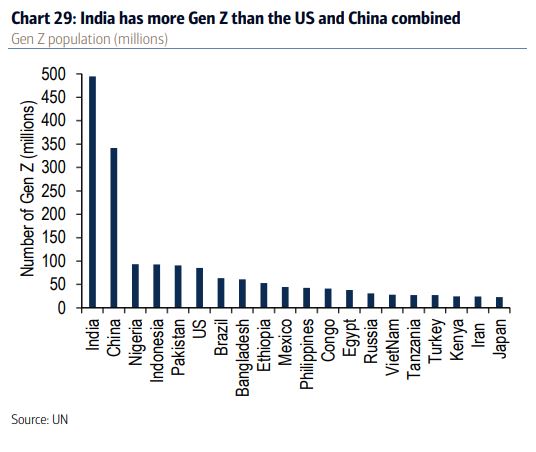

move-over-millennialsIt’s time to shift our attention to the next generation, Gen Z. These are the 2.5 billion people born between 1996 and 2016.

Gen Z is the single largest age cohort, representing 32% of the global population (2.5 Billion), Nine in 10 of these young people live in emerging markets……half a billion of them are in India, more than the combined population of Gen Zers in China and the United States.

Thematic Investing - OK Zoomer: Gen Z PrimerDemographics have big implications for everyone. It shapes societies. It transforms political systems. It makes economies run.

Check out the whole report if you want to learn more about where we’re going.

The firms where I've had employer-sponsored plans have generally performed distributions in kind only to IRAs held at the same firm. Note that unlike IRA transfers, rollovers from employer-sponsored plans must be initiated on the sending side, not on the receiving end.somewhat OT, but can anyone find a link for closing a vanguard 403B and rolling the money out in-kin to another firm? I am having trouble assisting one of my kids in this ...

I bet that's one of their priorities, but do you think they'd actually and explicitly SAY so???Will funds like PRWCX PRHYX reopen ?

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla