It looks like you're new here. If you want to get involved, click one of these buttons!

If I were making such an investment today I would choose MSFBX.

Too rich for Mrs. Ruffles’s blood - suffered a 40% drawdown in 2008-09

Not according to Yahoo, MSFBX has been steady from the data I have seen.

https://finance.yahoo.com/quote/MSFBX/performance?p=MSFBX

Got the data straight from the MFO Premium Profile. No need to go outside the family.Plus I think some international exposure is warranted at this time.............

Nice idea but not really necessary as she has a good chunk of international in her other accounts.

If I were making such an investment today I would choose MSFBX.

Too rich for Mrs. Ruffles’s blood - suffered a 40% drawdown in 2008-09

Not according to Yahoo, MSFBX has been steady from the data I have seen.

https://finance.yahoo.com/quote/MSFBX/performance?p=MSFBXMSFBX, how could I resist? :-)

Look instead at 2007-2008

Yahoo:

https://finance.yahoo.com/quote/MSFBX/history?period1=1197244800&period2=1227225600&interval=1d&filter=history&frequency=1d

M* chart

If I were making such an investment today I would choose MSFBX.

Too rich for Mrs. Ruffles’s blood - suffered a 40% drawdown in 2008-09

Not according to Yahoo, MSFBX has been steady from the data I have seen.

https://finance.yahoo.com/quote/MSFBX/performance?p=MSFBX

LOL. I am the same. I think I get annoyed at the work it takes to have conviction about one stock....then it doesn't work out.I'm more comfortable losing $1000 in a mutual that losing $500 in stocks. There is no logical explanation but that's how I'm wired and why I only trade stocks hours to days.

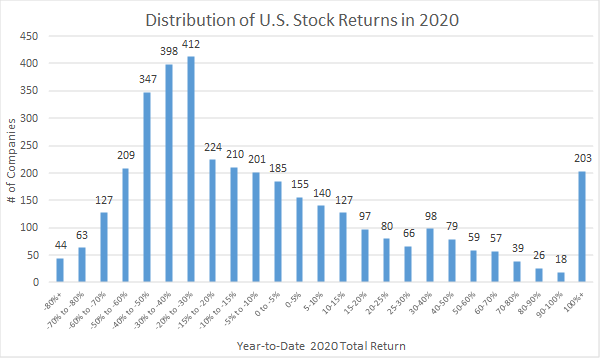

I decided to examine year-to-date returns of every component in the S&P Total Market Index (ITOT), including large caps, mid caps, small caps, and even smaller listed companies that do not qualify for the small-cap index.

https://seekingalpha.com/article/4377000-distribution-of-u-s-stock-returns-in-2020?utm_medium=email&utm_source=seeking_alpha&mail_subject=ploutos-distribution-of-u-s-stock-returns-in-2020&utm_campaign=rta-author-article&utm_content=link-0Of the nearly 3,664 listed stocks with full year 2020 returns, the median return (e.g. the 1832nd ranked return) is -14.75%. There is a large gap between the median return for U.S. stocks in 2020, and the weighted average mean performance for large cap stocks that are up between 4-5% on the year.

I'm a trader and don't recommend what I do to others. My posts are generic unless someone asks me specifically about my portfolio.@FD1000; I'm guessing you bought in around 3/25/20 ?

Derf

Nope, I sold over 90% at the end of 02/2020 and the rest days later.

Made several good trades with QQQ+PCI in 03/2020.

Start investing back in bond funds to over 99+% in 04/2020.

I had a huge % in GWMEX for several months. I owned IOFIX only in the last several weeks.

I wish I was brave enough to buy IOFIX on 3/25/2020. It made over 50% since then.

How do you square owning IOFIX with your later comment in this string to avoid risky funds?

That’s one that’s slipped below my radar but the downside capture of 125 gives me pause.PLBBX is a balanced fund with no transaction fee at Fidelity.

https://troweprice.com/personal-investing/resources/insights/finding-overlooked-opportunities-in-the-covid-19-market.html?cid=PI_Investment_Pilot_CAF_NoRM_EM_NonSubscriber_202009&bid=506188743&PlacementGUID=em_PI_PI_Investment_Pilot_CAF_NoRM_EM_NonSubscriber_202009-PI_Investment_Pilot_CAF_NoRM_EM_NonSubscriber_202009_20200929DG: One of our favorite sectors continues to be utilities. The equity market has yet to fully grasp just how attractive utilities are today relative to the past. The emergence of low-cost renewables is a game changer for the industry. This megatrend will likely continue for the next two decades to drive an elongated cycle for replacing coal, nuclear, and inefficient natural gas with wind, solar, and battery solutions that can drive mid- to high-single-digit rate base growth, mid-single-plus earnings per share growth with attractive dividends, only modest growth in customer bills, and a dramatic reduction in carbon emissions. Given this very attractive long-term outlook combined with this significant underperformance, we believe the long-term opportunity for utilities is compelling.

Utilities is the one sector in which higher taxes don’t negatively impact earnings, as taxes are a pass-through item from a regulatory standpoint. Utilities would also benefit from a likely extension, and potential expansion, of wind and solar tax credits for renewables.

Also discussed opportunities in fixed income.

You're right SFnative. Just googled and found the article below from April 2020. Two PMs actually not mentioned in the recent articles also left earlier in the year: Lydia So who was lead pm on the Asia Small Fund and had been with the firm for 15 years based on her linkedin, and Rahul Gupta who was co manager of Pacific Tiger fund (this is the one you referenced) both left the firm in April 2020. Tiffany Hsiao actually took over Asia Small when Lydia departed before leaving herself a few months later.Not trying to pile on Matthews, because I don't currently own any of their funds, but another PM recently departed after co-managing the Pacific Tiger fund for several years. He was replaced by two people, one of whom had earlier been at Matthews but then spent a short while at Seafarer (leaving there under what looked like less than the best of circumstances). Matthews appears to be a fund company in flux right now.

Too rich for Mrs. Ruffles’s blood - suffered a 40% drawdown in 2008-09If I were making such an investment today I would choose MSFBX.

I neglected to mention that this is a Roth IRA, while her other inherited accounts are Trad IRAs and 403(b)s. Converting the Roth IRA to a Trad IRA would have its own unwanted tax consequences.

If she inherited multiple IRAs from the same person, she could combine them into a larger inherited IRA. That wouldn't solve the problem of having to take RMDs, but it could simplify and/or give her more flexibility.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla