It looks like you're new here. If you want to get involved, click one of these buttons!

I'm not in a rush to get on a commercial flight anytime soon.I hear that the airlines still pack the planes. The only social distancing they practice is before boarding. Face covering is mandatory and yet some still fight this public health rule. It will be sometime before the airlines return to normal when the COVID-19 is contained with the vaccines.

Outside of some superficial similarities, ground rent is something completely different from lease revenue bonds.In Baltimore since forever, homeowners have paid land-rent upon which their homes sit. Ya, pretty effing crazy. Just like the Excise Tax on the car. So, you have the right to buy a car if you can afford it. And you most likely will park the car in a space provided, if you rent, or on your own property, if you own a home. So, for the privilege of parking the car, you have to pay the tax, every year. I call it the Extortion Tax. Dunno if there's one in my new State, after the move. ...Oops, just looked. And of course, THIS crap is really HELPFUL: (LAUGH!)

https://tax.hawaii.gov/geninfo/get/

https://www.peoples-law.org/understanding-ground-rent-marylandIn the present day, ground rent is commonly viewed as a dying, yet no less legally binding, vestige of Maryland’s colonial past. Almost all of the remaining national instances of ground rent are confined to the Greater Baltimore area, isolated areas of Pennsylvania, and most of Hawaii.

No one but no one thinks there has been no inflation over those spans. I mean, duh. It is more recently where there is reasonable disagreement.

People don’t think there’s inflation. Look at what you paid for a house or a new addition to your home or a new car 10, 20, 30 years ago and tell me that.

You are doing fine going forward with your balanced allocation. Lots of uncertainty and volatility now. Being rational is not easy. got luck out when I rebalanced several week ago. Now I can sit back and watch the slow train wreck.Personally, equities have been good to me for the past 50 years, with a few scary times in between. So, I’m not about to “jump ship”, although at nearly 74, I’m widely diversified with perhaps 30-40% in equities. Some bonds. Some commodities. Some cash. Some hedge-type funds. People don’t think there’s inflation. Look at what you paid for a house or a new addition to your home or a new car 10, 20, 30 years ago and tell me that. Sure, TVs and computers have fallen in price. You can’t eat them, drive them or sleep inside of on

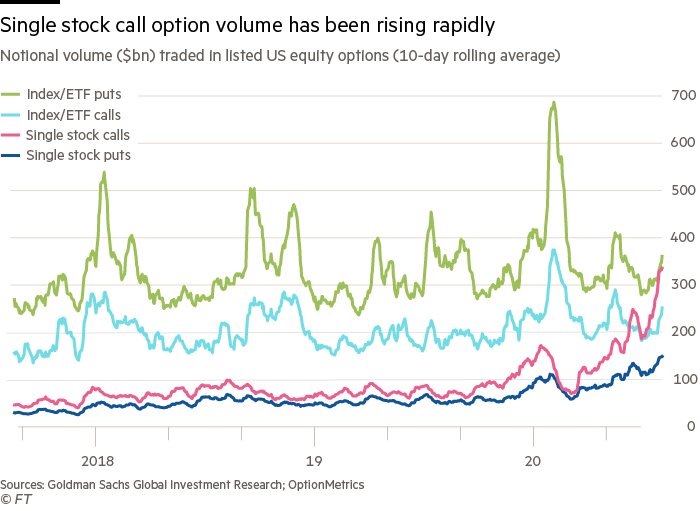

Well, it's been a helluva 2 days! I suppose we're just falling back to earth. But this is yet another example of the way the System is shot through with loopholes and exploitable omissions. Good thing I'm not in charge. Heads would roll. And the whole mechanism would be tighter. The frequency of this sort of news story is becoming less and less an exceptional sort of thing. So... I can't actually read the article, but I can understand LB's header. So, a handful of people "took the money and ran," eh? Suck-holes.Interesting:https://ft.com/content/75587aa6-1f1f-4e9d-b334-3ff866753fa2

I wonder what this means in the selloff if anything.

Thank you for the linkAccording to the following article, Robinhood users' trading did not influence the price of most stocks. However, these users did impact prices for certain small, speculative issues.

Link

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla