Dear friends,

Welcome to the New Year. May it be blessed and joyful, full of mirth and mischief (really, what’s life without a bit of mischief?) for us all.

As I finish this essay on New Year’s Eve Day, the stock market is handing out returns with the enthusiasm (and responsibility) of a politician handing out tax cuts or a central banker handing out liquidity boosts. The Vanguard Total Stock Market Index (VTSMX) stands to end the year with a 30% gain.

Heck, it was almost impossible not to make good money this year. Take the case of a hypothetical investor (we’ll call him “Dave”) who starts by randomly deciding to split his investments evenly between US stocks, international stocks, bonds, and cash. And let’s further assume that Dave, being Dave, manages to sink his money into the worst performing domestic stock category (small value) and the worst-performing international (frontier markets) and worst bond (GNMA) and worst money market (national munis) categories. Our sad sack surrogate would still have made more than 10% gains this year.

In a normal world, returns from stocks are a combination of:

-

- growth in corporate earnings (roughly zero in 2019) plus

- dividends (about 1.7%) plus

- the rate of inflation (2.1%) plus

- the lunacy of other investors (if the fundamentals justify a 4% rise and the market delivers a 30% rise, lunacy necessarily accounts for 26% of the market’s gain).

Those seeking a term less judgmental than “lunacy” use “animal spirits.” Fair enough. Lyn Alden gave a fair illustration of how spirited animals might become, which she illustrated with the case of Apple and its stock:

Apple’s earnings were flat in 2019, with zero growth. Their phone sales were sluggish, which was partially offset by an increase in service revenue.

Flat earnings, zero growth, sluggish sales, stagnant product lines, glitch products, a rising suspicion that users need to be trapped in the Apple ecosystem to keep them loyal … all surely justifies the 86% rise in Apple’s stock price this year.

US corporate earnings, goosed by tax cuts and Fed interventions, have risen only 35% over the past decade, in which dividends and inflation are stuck at 2%. Meanwhile, the US stock market (measured by the rise of the Total Stock Market Index fund) has risen 241%. Neil Irwin of the New York Times frets about the implications of that past profligacy on our future returns.

But the interesting thing about this current moment in markets is that the prices of different assets look reasonable relative to one another while looking absurdly overvalued relative to those of decades past.

The buoyant stock market makes perfect sense in a world of very low long-term interest rates. The risk is not that one asset ends up being a bubble, but that all of them are.

Yet there’s nothing new about that risk. It has been the reality for the better part of the last decade, reflecting long-building, powerful forces. Market developments in 2019 suggest that they’re not going away in the foreseeable future; instead, it seems that’s just how the world is going to be.

All of which means we should enjoy our big market gains now — because they are essentially presaging a gloomy, even if not disastrous, economic decade to come. (Your Portfolio Is Probably Doing Great. That’s Bad News for the Future, 11/27/2019)

The Power of Click-Bait

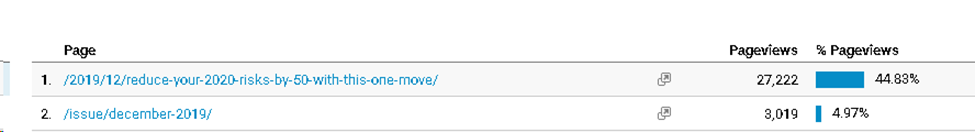

In order to parody click-bait journalism and encourage folks to take winter refuge in more sensible pursuits (we suggested read books that are a bit off the beaten path), we wrote a click-bait article title: Reduce your 2020 risks by 50% with this one move!

Within 24 hours, it became the most-read article in MFO history. Here’s the readership data from Google Analytics, showing readers for our most popular and second-most popular articles:

Yep. Nine times as many page-views for the click-bait as for anything else. Our best guess is that computers scan the internet for click-bait, then dispatch fleets of drones to descend and “scrape” the article for some unknown use. 27,000 “readers” on Day One, about 1,000 readers combined between Days 2 and 30.

That explains the continuing flood of bad articles. We argued that you should step away from your keyboard for the three winter months, read books, clear and reset your brain, engage with family. That’s not, we argued, an indulgence. It’s a necessity if you want to enjoy life and avoid making a series of horrendous decisions driven by bad “analysis” and “journalism” that pours from your screen onto the floor.

At base, these article writers must take speculation and present it as certainty. Their confidence buys your attention. That’s painfully illustrated by at least five December headlines announcing the imminence of a stock market collapse: 50% or so, maybe starting in January.

How do they know that?

They don’t.

Why do they say that?

It sells.

Will the market crash? Likely, at some point. Since we don’t know when, why, by how much or for how long, we continue to offer the same guidance:

-

- Focus on your real needs, not on the “beat the market” game

- Take no more risk than you need to meet your objectives

- Know how much risk you’re taking

- Remember that cheap, passive, market-weighted funds thrive in rising markets, but suffer in falling ones

- Entrust your money to managers only if you understand what they’re doing with your money, they have demonstrated the ability to manage risk intelligently and they invest alongside you.

- Then go enjoy life. Go for a walk and leave your phone behind. (Can you remember growing up where that advice would have been nonsense since phones were … well, phones and securely wired to the wall? Can you imagine how terrified most people would be at the very thought of venturing without that tether in their pockets now?) Make dinner for people you love. Rearrange the living room. Call your mom. Plant a tree. Compliment a stranger. Read a book. Smile, ponder, grow.

We’ve written guides and essays on pretty much all of the investment-related reflections above, and we’ll keep at it.

Celebrating the faith of friends, family and the MFO community

A number of folks this winter expressed a heartwarming, yet nearly inexplicable, faith in my ability to learn.

To you all, thanks and thanks again!

Thanks, too, to the good folks at Long/Short Advisors who shared a pail of delicious cookies. They didn’t survive long enough to make the picture.

Celebrating a world that’s better than we recognize

Yes, I know (climate crisis, political crisis, social media crisis, inequality crisis) and no, I’m not (crazy, Pollyanna).

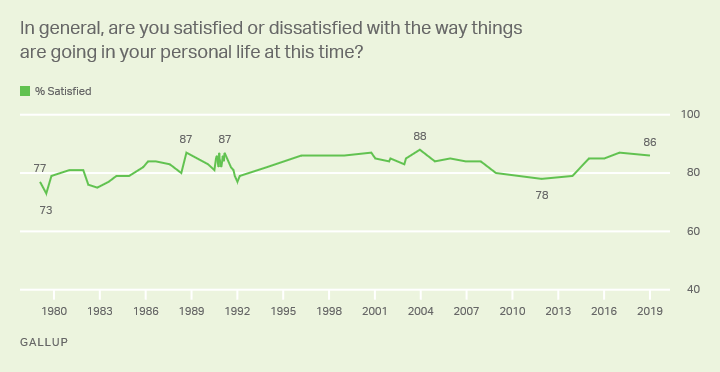

There’s an interesting paradox; most Americans think our country is moving in the wrong direction, and we’ve consistently believed that – through Republican and Democrat governments – since about the turn of the century. Before then, opinions varied. At the same time, the vast majority of Americans think things are pretty good in their own lives, and that’s been consistently true for decades.

Source: Gallup, Satisfaction with Personal Life (2019)

Here’s one possible resolution to the paradox: our life satisfaction is driven by what we directly experience, our social dissatisfaction is driven by what we’re told. Often enough, the sources of the disturbing news are people who directly benefit from our anxiety, either because it causes us to elect their candidates, fund their organizations or read their prose.

I’ll offer two minor start-of-year heresies for your consideration:

-

- outrage is good – it means that we’re not utterly complacent and can, under the best of conditions, set the stage for uniting to address problems.

- the sources of our outrage need to be kept in perspective – if we believe that all is chaos, we become attuned to seeing even more chaos, despair and lapse into complaint and inaction. Think of the post-WW1 poets, such as William B. Yeats:

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity. (The Second Coming, 1920)

That’s really not productive. And so I asked some folks, mostly smarter than myself, and stumbled across some others, uniformly smarter than me, “what do you see beyond the darkness?”

Tadas Viskanta, Huge gains have been made to alleviate poverty and disease

Tadas is the Director of Investor Education at Ritholtz Wealth Management and publisher since 2005 of the renowned Abnormal Returns which, daily, strives to bring “the best of the finance and investment blogosphere to its readers” through thoughtfully curated links and occasional snark.

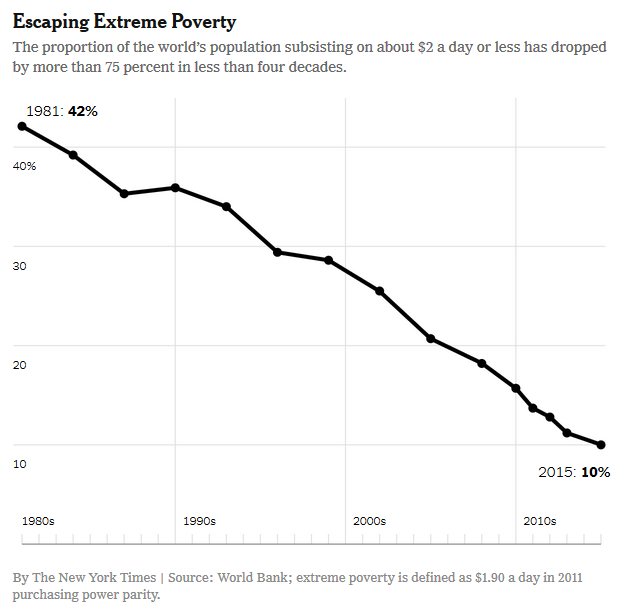

You are absolutely right that we need some antidote to all of the bad news One trend I have seen over the past few years is that “good news’ has become a bit of a growth industry. The amazing thing is that the vast majority of people do not see or recognize the huge gains that have been made to alleviate poverty and disease over the past few decades. We, humans, are resourceful creatures. If you leave aside existential threats (for now), humans will adjust. Even when it is a painful thing to do.

Being a master of the links, Tadas offered five. “This Matthew Ridley piece has gotten a lot of play.” (Mr. Ridley is a member of the British House of Lords, gadfly and author of The Rational Optimist. He describes himself as “a climate lukewarmer.”) Other resources for folks seeking a counterweight to pessimism are the Arbutus Foundation’s Reasons to Be Cheerful blog and Oxford University’s “Our World in Data: Research and data to make progress against the world’s largest problems.” Folks looking to add to their book stack might consider Hans Rosling, Factfulness: Ten Reasons We’re Wrong About the World–and Why Things Are Better Than You Think (2018) or Steven Pinker’s Enlightenment Now: The Case for Reason, Science, Humanism and Progress (2019).

It’s interesting to me that the conservative Mr. Ridley’s piece is, in many ways, echoed by the liberal Mr. Kristof’s.

Nicholas Kristof, 2019 has been the best year ever

For humanity overall, life just keeps getting better.

Photo courtesy of the Wikimedia Commons

Nicholas Kristof is an American journalist and political commentator. A winner of two Pulitzer Prizes, he is a regular CNN contributor and has written an op-ed column for The New York Times since November 2001. Kristof describes himself as “a progressive.” His essay, “This Has Been the Best Year Ever” appeared in the New York Times on December 29, 2019.

If you’re depressed by the state of the world, let me toss out an idea: In the long arc of human history, 2019 has been the best year ever.

The bad things that you fret about are true. But it’s also true that since modern humans emerged about 200,000 years ago, 2019 was probably the year in which children were least likely to die, adults were least likely to be illiterate and people were least likely to suffer excruciating and disfiguring diseases.

But … but … but President Trump! But climate change! War in Yemen! Starvation in Venezuela! Risk of nuclear war with North Korea. …

All those are important concerns, and that’s why I write about them regularly. Yet I fear that the news media and the humanitarian world focus so relentlessly on the bad news that we leave the public believing that every trend is going in the wrong direction. A majority of Americans say in polls that the share of the world population living in poverty is increasing — yet one of the trends of the last 50 years has been a huge reduction in global poverty.

The proportion of the world’s population subsisting on about $2 a day or less has dropped by more than 75 percent in less than four decades.

“Three things are true at the same time,” argues Max Roser, a research director in economics at the University of Oxford. “The world is much better, the world is awful, the world can be much better.”

I also take heart from the passion so many — especially young people — show to make the world a better place.”

Mr. Kristof’s final point provides a segue to …

Sarah Jackson, Twitter makes us better

Photo courtesy of Annenberg School of Communication

Sarah J. Jackson is a Presidential Associate Professor at the Annenberg School of Communication, at the University of Pennsylvania. (It’s my academic field, I can affirm that an appointment at Annenberg is a big honkin’ deal.) Her forthcoming book Hashtag Activism: Networks of Race and Gender Justice (MIT Press 2020) focuses on the use of Twitter in contemporary social movements. The essay from which this is excerpted appeared as “Twitter made us better,” New York Times, 12/27/2019.

It’s impossible to avoid news about how harmful social media can be …ubiquitous Russian bots …privacy violations, election meddling, and harassment.

Despite it all, the way we use Twitter made this decade better.

Rightful critiques of social media, and Twitter, in particular, shouldn’t obscure the significance of the conversations that have happened there over the past 10 years. As we enter 2020, powerful individuals and societal problems can no longer avoid public scrutiny. The online activism and commentary that take place on Twitter are often dismissed as expressions of “cancel culture” or “woke culture.” But a closer look reveals what’s really happening: Many people who lacked public platforms 10 years ago — the young and members of marginalized groups in particular — are speaking up, insisting on being heard.

Like all technological tools, Twitter can be exploited for evil and harnessed for good. Just as the printing press was used to publish content that argued fervently for slavery, it was also used by abolitionists to make the case for manumission. Just as radio and television were used to stir up the fervor of McCarthyism, they were also used to undermine it. Twitter has fallen short in many ways. But this decade, it helped ordinary people change our world.

Mitchell Baker not only (sort of) agrees but runs a global foundation to keep it going.

Mitchell Baker, people are speaking up and speaking out

Mitchell Baker is Chairwoman of Mozilla, the not-for-profit parent of the Firefox internet suite. This excerpt is from a December 2019 letter to Mozilla supporters.

As 2019 ends, I want to come to you with a message of hope. The world today — both online and off — has felt a bit daunting this year.

Which is why I want to tell you there is hope — lots and lots of hope — in the world today. Every day, I see more people speaking up and speaking out to demand change. Every day I see the media doing a better job of holding our big tech company friends to account. Every day I see my friends and colleagues here at Mozilla show up with a growing passion to keep up the fight for good in technology.

Yes, there are problems online and in the world, we must fix — misinformation seeps into too much of our lives, our privacy rights are constantly under attack, the bias in algorithms harms the most vulnerable. Mozilla exists to fight these problems. That is why I care so much about our work and our mission for good. Because at the end of the day, it is up to us to make a change.

When people who care step up with action, that is when change happens. And I see so many of you stepping up. Just think: when Mozilla shipped our first browser — Firefox 1.0 — in 2004, we did it with just 902 staff and volunteer contributors. As of last year, there are more than 15,000 people around the world helping bring Mozilla’s mission to life, the vast majority of those volunteers. This is why I have hope.

A recurrent thread seems to be the recognition that while we (uhhh … those of us subject to the taunt “okay, Boomer”) have let things get seriously awry, our children, inheritors of the problem, seem determined to face it.

Lewis Braham, Millennials take climate science seriously

Lewis Braham is a distinguished financial journalist, author of The House that Bogle Built: How John Bogle and Vanguard Reinvented the Mutual Fund Industry (2011), and a contributor to MFO’s discussion community.

I would say there have been some positive developments in science, particularly in the realm of quantum computing, in the treatments of certain diseases and in the discovery of a living — once thought extinct— giant squid. You can see many interesting discoveries here,

These positive developments, however, must be taken in context with the devastating and increasingly accurate discoveries regarding climate change and the failure of world governments to take them seriously enough. One interesting and I regard as positive change is some millennials are opting not to have children or only have one child because of climate change concerns. Ultimately classical economists would see this as bad news, but such population control is actually good for the planet. So I see it as good news. Millennials take climate science seriously. I’m not sure if this helps but I hope it does and that you have an excellent new year.

A.K. Sandoval-Strausz, Latino immigrants have saved the American city

Photo courtesy of Hachette Book Group

K. Sandoval-Strausz is director of the Latinx studies program and associate professor of history at Penn State University. He’s the author of Hotel: An American History (2007) and Barrio America: How Latino Immigrants Saved the American City (2019). Dr. Sandoval-Strausz’s work was featured on a Marketplace podcast, 12/26/2019.

Considering the severity of the urban crisis, it is hardly surprising that few people expected the recovery that was already taking hold by the mid-1990s — but interestingly, everyone seemed to agree that cities had been saved by people with lots of money … But they overlooked the indispensable role played by Latina and Latino migrants and immigrants, who had started to repopulate and revive declining neighborhoods at least two decades before the “back to-the-city” movement became a significant trend among prosperous and mostly white Anglo professionals. Hispanic newcomers to U.S. cities were more numerous than the returning yuppies.

Over the course of half a century, Latino migrants and immigrants revitalized the cities of the United States, saving scores of neighborhoods from abandonment and replenishing the population in many places that would otherwise have continued to empty out. Their earnings and expenditures served as a form of large-scale urban reinvestment. As workers, they powered metropolitan economies by performing essential labor at countless offices, construction sites, restaurants, day cares, farms, hotels, and homes, while also allowing thousands of manufacturing firms to keep production in the United States rather than moving jobs overseas. As tenants and homeowners, they made distressed residential real estate viable again by renting, maintaining, and renovating countless houses and apartment buildings. As entrepreneurs and customers, they opened local businesses and served as a clientele for revived inner-city commerce, bringing activity and energy back to once-hushed streets and sidewalks. In fiscal terms, their economic activity produced a rebound in sales tax receipts, property tax revenues, and utility payments, adding billions of dollars to once-strapped city budgets, allowing municipalities to pay teachers, maintenance workers, firefighters, and police officers — though the proceeds of these greater revenues were not necessarily spent in the neighborhoods that these newcomers had done so much to improve. Immigrants also helped reverse the crime wave of the 1970s and 1980s and make cities safer than at any time since the 1950s. In sum, they helped remedy a profound national crisis that most observers thought was hopeless.

And elsewhere, coffee!

Research published in the European Journal of Epidemiology (2019) concluded that drinking as little as two cups of coffee a day can increase your life expectancy by up to two years. That’s based on what’s called a “meta-analysis” of 40 other published studies who drew from the experiences of 3.9 million subjects.

Two cups, two years? The path to immortality might lie before me!

Thanks and thanks and thanks!

Thanks to folks who’ve shared books, cookies, kind words, and inspiration.

Thanks to the 249,393 folks who came by in 2019, sharing part of their year with us as we share as much help as we can offer. Thanks, most especially, to the 2,997 of you who are registered members of the discussion board, an active, snappy crowd.

Thanks to the many folks who stepped up to help us meet the terms of our two modest matching grants in December. Challenge One sought five new members. Charles reports that, as of December 30, we have 20 new members. That’s the best single month in a long, long time and we celebrate the growing recognition of MFO Premium’s value. Challenge Two sought $500 to unrestricted contributions. We received two contributions that each, alone, would more than cover the challenge along with a bunch of non-Premium contributions ranging from $10 – 100. We’re deeply grateful for them all.

Not to name names, but we’d like to recognize folks who sent checks this month: Jon V from Gig Harbor (lovely town and a lovely place to enjoy your retirement), Carlyn of Seattle, Richard, Kevin, Rad (we’re so glad to be helpful!), the good folks at S&F Investments (mug #3 is in the mail!), Sharon (we appreciate your continued support!), Rick (we’re happy you enjoy the Premium site), Sheila, the Ellie and Dan Fund, and several anonymous donors. Through our PayPal link we heard from Jeroen, John, Sunny (a Happy New Year to you, as well!), William from Arcadia (thanks for the vote of confidence!), Vincent (we’re glad you keep coming back!), Barry (you’re an ace!), Robert G, Raymond, the estimable Victoria Odinotska (who, on November 30th, “celebrated 30th anniversary of my landing at the shores of United States (in JFK to be precise) with two suitcases and a $100 in my pocket to start a new life. I have been living a miracle of a life!” A million cheers, Victoria, happy tears and warm hugs), Edwin, Michael, Joseph, Dale, Altaf, Jason, Cynthia, and Charles.

As always, to our loyal subscribers, Greg, the two Williams, James, Matthew, Brian, Joseph, Seshadri, David, and Doug.

And, finally, to Ted “The Linkster” Didesch (1937-2019). We’ll miss you, sir.

Joyfully,