By Ira Artman, December 2019

Do we pay attention to the competitive environment? Absolutely. Are we reactive to what one competitor does? Absolutely not…

Investors always have to ask themselves when they see an offering like this [zero fee expense ratio mutual funds], ‘What’s the catch?”‘ The question becomes what else are investors going to be charged in other products? …

That’s what Vanguard CIO Greg Davis said in August 2018, immediately following Fidelity’s announcement that it would offer no-fee index funds.

Within a month, Fidelity’s new zero-fee funds had taken in nearly $1 billion in assets. By August month-end:

- The Fidelity Zero Total Market Index fund grew to $753.5 million in assets under management; and

- The Fidelity Zero International Index fund attracted $234.2 million.

Three months later, on 19 Nov 2018, Vanguard “hit back” at Fidelity’s zero-fee funds and cut the minimum initial investments needed to access 38 of its cheap Admiral share fund classes from $10,000 to $3,000.

Vanguard also said:

- It had closed the more expensive Investor share classes of those index funds to new investors and expects to roll over all existing money in Investor shares of the funds to Admiral shares by April of 2019.

- It estimated that these moves were expected to deliver an estimated [annual] $71 million in aggregate savings, for investors that rolled their money over to the cheaper Admiral shares.

What Vanguard did not say was that – for investors in its own LifeStrategy funds – Vanguard did not yet have an answer to the questions posed by its CIO —“What’s the catch? … What else are investors going to be charged in other products?”

As summarized on the Bogleheads wiki, the Vanguard LifeStrategy Funds are lifecycle offerings, providing investors with a variety of highly diversified all-in-one portfolios. The products are structured as funds-of-funds, charging only weighted averages of the expense ratios associated with the underlying index funds. The LifeStrategy funds have a fixed target asset allocation.

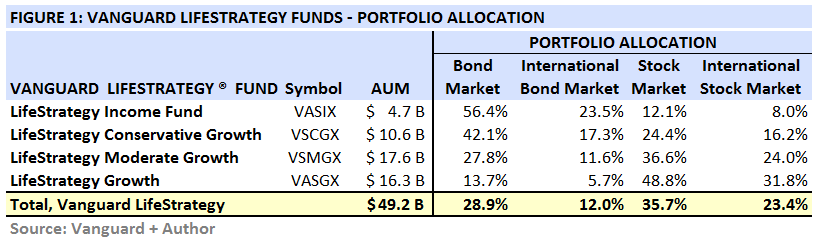

There are four LifeStrategy Funds – Income, Conservative Growth, Moderate Growth, and Growth. The funds were started by Vanguard twenty-five years ago, in 1994. Each fund invests in other Vanguard index funds – See FIGURE 1, below. The Vanguard Index Funds, in turn, invest in the broad US Bond Market, International Bond Market, US Stock Market, and International Stock Market.

The LifeStrategy Funds offer investors static portfolios with consistent risk profiles:

- Income Fund: 20% stocks/80% bonds

- Conservative Growth Fund: 40% stocks/60% bonds

- Moderate Growth Fund: 60% stocks/40% bonds

- Growth Fund: 80% stocks/20% bonds

The LifeStrategy Funds are large funds. The smallest, Income Fund, has total assets of $4.7 billion, while the largest Moderate Growth Fund has total assets of $17.6 billion. Collectively, the aggregate assets of the four Vanguard LifeStrategy Funds total $49.2 billion, as of Dec 2019.

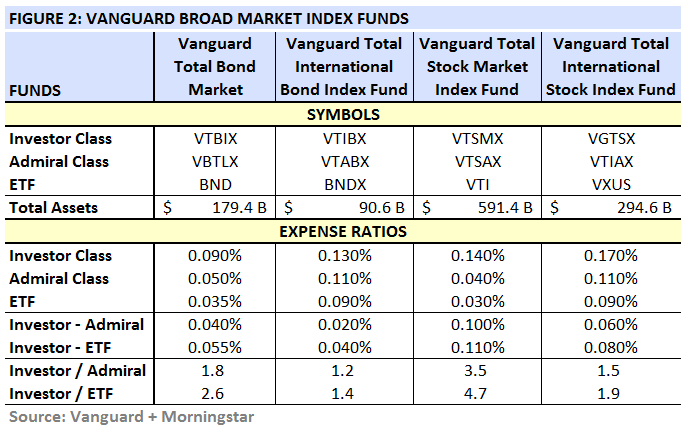

The four LifeStrategy funds invest in the Investor Share classes of each of the following four index funds – VTBIX (US Bonds), VTIBX (International Bonds), VTSMX (US Stocks), and VGSTX (International Stocks). FIGURE 2, below, summarizes the symbols used to access these funds, as well as their respective expense ratios and total assets under management (or AUM).

The expense ratios of the four Investor class funds range from 17 bps for the Total International Stock Market Index Fund, to 9 bps for the Total Bond Market Index Fund.

The problem – that is, “the catch” (What else are investors going to be charged in other products?) – for Vanguard LifeStrategy investors– is that Vanguard offers identical funds or ETFs that track the same index and have the same management team, but are much less expensive than the Investor Share classes held by the LifeStrategy Funds.

The expense ratios of the respective Admiral share classes – which now require only $3,000 to open – are 2 to 10 bps cheaper than the corresponding Investor share classes owned by the LifeStrategy funds.

The largest expense differentials (i.e., ‘Investor – Admiral’ in FIGURE 2) can be found among the stock funds (US stock @ 10 bps and International Stock at 6 bps). The bond fund differentials are closer (US bond at 4 bps, International Bond at 6 bps.)

Or to put it another way, if we take the ratio of the respective a) expense ratios of the Investor share classes, over the b) expense ratios of the Admiral share classes, the Investor shares are 3.5 times to 1.2 times more expensive than the respective Admiral share classes — See the ‘Investor/Admiral’ line in FIGURE 2 above.

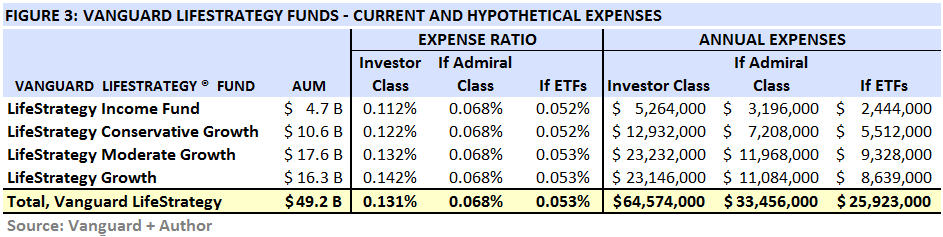

One might say “So what – what’s a bp here or there”? To make a long story short – not much. Unless, of course, you are talking about billions of dollars. Which we are. So take a look at FIGURE 3, below.

FIGURE 3 shows the weighted average expense ratio (i.e., “ER”) for each of the LifeStrategy funds, based on the expense ratios of the underlying index funds, as previously summarized in FIGURE 1, above. The “weights” are the “Portfolio Allocation” percentages that are listed in FIGURE 1 for each asset type (US Bonds, International Bonds, US Stocks, and International Stocks.) The expense ratios that are weighted are those appearing in FIGURE 2.

| EXAMPLE | Investor Class Expense Ratio and Annual Expenses for the LifeStrategy Income Fund (VASIX). VASIX ER = 11.2 bps in FIGURE 3, above. | |||

| VASIX ER | (56.4% x 9bps) + 5.076 bps | (23.5% x 13bps) + 3.055 bps | (12.1% x 14bps) + 1.694 bps | (8.0% x 17 bps) + 1.360 bps |

| = 11.185 bps, which after rounding, is equal to the 11.2 bps shown in FIGURE 3, above. $ 4.7 Billion x VASIX ER of 11.2 bps = $5,254,000. | ||||

| In other words, it costs just under $5.3 million to run VASIX — with AUM of $4.7 billion and an Expense Ratio of 11.2 bps — for a year. This $5.3 million figure will vary as VASIX’s AUM and Expense Ratio varies. | ||||

All of the other Expense Ratios and Annual Expenses in FIGURE 3, above, are similarly calculated.

The LifeStrategy Funds currently invest in Investor share classes of the various stock and bond index funds. The calculated Investor Class expense ratios for the LifeStrategy Funds match, after rounding to the bp, the expense ratios reported by Vanguard on its website:

- Income 11 bps

- Conservative Growth 12 bps

- Moderate Growth 13 bps

- Growth Fund 14 bps

But what if the LifeStrategy Funds could invest in the cheaper Admiral share classes? Well, their expenses should fall. In aggregate – see FIGURE 2 – a switch from Investor to Admiral shares might reduce investor class expenses from 13.1 bps, on average, to only 6.8 bps.

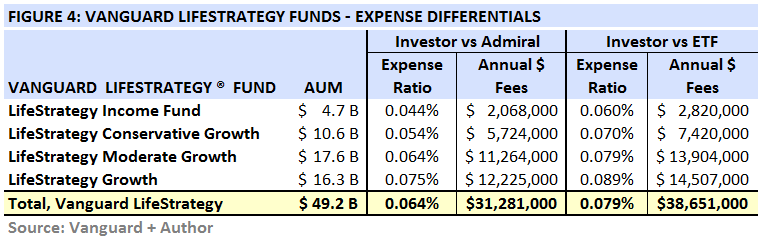

For the total $49.2 billion currently invested in LifeStrategy Funds, their costs might drop by almost half, from $64.6 million per year to $33.2 million per year — see FIGURE 3. These differentials are summarized in FIGURE 4, below.

EXAMPLE Expense Investor vs Admiral Differential (ER and Annual $ Fees) for the LifeStrategy Income Fund (VASIX)

VASIX ER Differential = 4.4 bps and Annual $ Fees Differential = $2,068,000 in FIGURE 4, above.

| VASIX ER Differential |

= VASIX ER Investor Class – VASIX ER Admiral Class = 11.2 bps – 6.8 bps. [These numbers come from FIGURE 3.] = 4.4 bps. |

| VASIX Fee Differential | = $4.7 Billion x 4.4 bps = $2,068,000. [See FIGURE 4.] |

All of the other Expense Ratio Differentials and Annual Fee Differentials in FIGURE 4, above, are similarly calculated.

Saving roughly $30 to $40 million per year is nothing to sneeze at – even for Vanguard. In the Nov 2018 Press Release announcing a lowering of the Admiral Share Class minimums from $10,000 to $3,000, Vanguard touted in the first paragraph of the press release that the lowered minimums would save investors $71 million, which is of the same order of magnitude as the $30 to $40 million estimated in FIGURE 4, above.

So what gives? Why doesn’t Vanguard let its LifeStrategy Funds buy Admiral Share classes?

Because it seems that it can’t.

Mike Piper, author of the ObliviousInvestor blog, corresponded with the head of Public Relations for Vanguard’s US business, in 2017.

Piper: Why don’t the LifeStrategy and Target Retirement funds use Admiral shares as the underlying holdings?

Vanguard PR Department: Vanguard is unable to offer multiple share classes on funds of funds due to the structure in which we operate, and the agreement we have with the SEC regarding multiple share classes. Our funds of funds have no direct costs — the costs are derived only from the ERs of the underlying funds. According to that agreement, we must be able to offer a differentiated cost advantage between share classes. (Therefore, because there is no direct cost associated with a fund of funds — it’s not possible for us to offer such an advantage).

Calls to Vanguard asking “Why don’t LifeStrategy Funds own Admiral Share classes?” produced answers ranging from the wrong (“There is no relationship between the LifeStrategy Fund costs and the costs of the funds that they own”) to the interesting (“LifeStrategy funds own Investor Class shares because the extra Investor Class fees offset the rebalancing costs of the LifeStrategy Funds”).

Page B36 of the LifeStrategy Fund Statement of Additional Information (“SAI”) says:

… Each [LifeStrategy] Fund will bear its own direct expenses, such as legal, auditing, and custodial fees. In addition, … the Funds’ direct expenses will be offset … by a reimbursement from Vanguard for (1) the Funds’ contributions to the cost of operating the underlying Vanguard funds in which the Funds invest, and (2) certain savings in administrative and marketing costs that Vanguard expects to derive from the Funds’ operations. The Funds expect that the reimbursements should be sufficient to offset most or all of the direct expenses incurred by each Fund. Therefore, the Funds are expected to operate at a very low—or zero—direct expense ratio. Of course, there is no guarantee that this will always be the case. Although the Funds are not expected to incur any net expenses directly, the Funds’ shareholders indirectly bear the expenses of the underlying Vanguard funds…

The last sentence of the SAI paragraph would seem to rule out the “no relationship” answer. But there may be some justification for the “rebalancing” response. Perhaps it does cost $31,281,000 per year (See FIGURE 4) to rebalance the LifeStrategy Funds?

Daniel Wiener, editor of The Independent Adviser for Vanguard Investors, stated in a recent phone call that Vanguard’s statements about fund expense ratios can be confusing. Re-emphasizing what he observed in a 2019 Citywire article about Vanguard expense cuts, Wiener said that Vanguard’s cuts were ‘old news’:

The prospectus only says this is what Vanguard may charge. Until you have an audited annual report, you don’t know what the fund or ETF has charged. But Vanguard has actually been charging these lower fees for months.

Despite Vanguard’s agreement with the SEC (mentioned by the ObliviousInvestor blog, see above), there are rumors of a possible workaround to the no-multiple-share-class “catch” for funds-of-funds, such as the LifeStrategy VASIX, VSCGX, VSMGX, and VASGX. These rumors were posted on the ‘Bogleheads’ website – www.bogleheads.org.

If so, this workaround solution may be spelled B-N-D-B-N-D-X-V-T-I-V-X-U-S – See FIGURE 1. These are the letters in the symbols of the very inexpensive ETF Shares that are linked to the respective Investor Share Class stock and bond index funds that are owned by the LifeStrategy funds.

According to the ‘boglehead’, posting in Jun 2019:

My family & I met w Vanguard reps last week. Excellent service all around…

Was perhaps the best investment meeting we’ve ever had. I cannot say enough about the superb care & interest taken. Vanguard has always exceeded our expectations & won multi-generational admiration in our family.

Also, I heard that their Target & LifeStrategy Funds may be moving to ETFs in the next few years, which makes sense in so many ways. Mutual funds will always be there, but adjustments to those all-in-ones that they steward make good sense…

The Vg reps told us that last week & it was presented as fresh news.

Mutual funds will always be available at Vg. ETFs will always be available at Vg. But, there’s a migration over to ETFs inside Target & LifeStrategy expected over the next couple of years.

Or, at least, that’s what I heard them say!

If the conversion within the LifeStrategy fund-of-funds – from Investor Shares to ETFs – occurs, it would seem to follow the tax-free conversion process that was described to the SEC, approved by Vanguard’s board, and explained on Vanguard’s website.

As described in the Vanguard Funds Multiple Class Plan filed with the SEC in 2013:

-

- Conversion into ETF Shares. Except as otherwise provided,

a shareholder may convert Investor Shares, Admiral Shares, Signal Shares

or Institutional Shares into ETF Shares of the same fund (if available),

provided that: (i) the share class out of which the shareholder is converting

and the ETF Shares declare and distribute dividends on the same schedule;

(ii) the shares to be converted are not held through an employee benefit

plan; and (iii) following the conversion, the shareholder will hold ETF

Shares through a brokerage account. Any such conversion will occur at the

respective net asset values of the share classes next calculated after

Vanguard’s receipt of the shareholder’s request in good order. Vanguard

or the Fund may charge an administrative fee to process conversion

transactions.

- Conversion into ETF Shares. Except as otherwise provided,

As explained by Vanguard in an ETF “FAQ”:

Can I convert my conventional Vanguard mutual fund shares to Vanguard ETF Shares?

Yes. Most funds that offer ETF Shares will allow you to convert from conventional shares of the same fund to ETF Shares. (Four of our bond ETFs—Total Bond Market, Short-Term Bond, Intermediate-Term Bond, and Long-Term Bond—don’t allow for conversions.)

Conversions are allowed from both Investor and Admiral™ Shares and are tax-free if you own your mutual fund and ETF Shares through Vanguard.

Keep in mind that you can’t convert ETF Shares back to conventional shares. If you decide in the future to sell your Vanguard ETF Shares and repurchase conventional shares, that transaction could be taxable.

If you have a brokerage account at Vanguard, there’s no charge to convert conventional shares to ETF Shares. If you have questions, contact us.

Time will tell if Vanguard can deliver on the boglehead-predicted inclusion of ETF shares in the LifeStrategy funds. If not, then Vanguard may need to greet its new LifeStrategy fund-of-fund investors with a rarely heard salutation:

- “Welcome to Vanguard. We can get it for you retail!”

NOTES

[1] Greg Davis, Bloomberg News, “Vanguard exec: Investors should look for ‘the catch’ in Fidelity’s no-fee funds”, https://www.investmentnews.com/article/20180803/FREE/180809965/vanguard-exec-investors-should-look-for-the-catch-in-fidelitys-no, 8 Aug 2018.

[2] Fidelity, “Fidelity Rewrites the Rules of Investing to Deliver Unparalleled Value and Simplicity to Investors”, https://www.fidelity.com/about-fidelity/individual-investing/fidelity-rewrites-the-rules-of-investing-to-deliver-unparalleled-value-and-simplicity-to-investors, 1 Aug 2018.

[3] Andrew Jones, “Fidelity zero-fee funds attract almost $1bn in first month”, https://citywireusa.com/professional-buyer/news/fidelity-zero-fee-funds-attract-almost-1bn-in-first-month/a1151844, 8 Sep 2018.

[4] Ian Wenik, “Vanguard hits back at Fidelity’s zero-fee funds with Admiral cuts”, https://citywireusa.com/professional-buyer/news/vanguard-hits-back-at-fidelitys-zero-fee-funds-with-admiral-cuts/a1177374, 19 Nov 2018.

[5] Vanguard Press Release, “Vanguard Shareholders To Save Estimated $80 Million Through Broader Access To Low-Cost Admiral Shares”, https://pressroom.vanguard.com/news/Press-Release-Vanguard-Lowers-Investment-Minimum-of-Admiral-Shares-111918.html, 19 Nov 2018.

[6] Bogleheads wiki, https://www.bogleheads.org/wiki/Vanguard_LifeStrategy_Funds, last edited 9 Jul 2018.

[7] Financer.com, https://financer.com/us/vanguard-lifestrategy-income-fund, 30 Nov 2019.

[8] James Chen, Investopedia, https://www.investopedia.com/terms/b/basispoint.asp, 29 Jul 2019.

A ‘bp’ or basis point refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001.

[9] Vanguard, LifeStrategy Funds, https://investor.vanguard.com/mutual-funds/lifestrategy/#/, accessed Dec 2019.

[10] Mike Piper, “Why Don’t Vanguard’s Target Retirement and LifeStrategy Funds Own Admiral Shares?”, https://obliviousinvestor.com/vanguard-target-retirement-lifestrategy-admiral-shares, 24 Jul 2017.

[11] Vanguard, “Security starts with you (and us)”, http://pages.e-vanguard.com/180719SP, 2018.

[12] Bogleheads/newcollegeman, “RE: Insights from Vanguard”, https://www.bogleheads.org/forum/viewtopic.php?f=10&t=282782#p4580477, 6 Jun 2019.

[13] Daniel Wiener, Phone call with Ira Artman, 24 Dec 2019.

[14] Vicky Ge Huang – Citywire, “Vanguard announces fee cuts on 10 ETFs”, https://citywireusa.com/professional-buyer/news/vanguard-announces-fee-cuts-on-10-etfs/a1204641, 26 Feb 2019.

[15] Financial Times/Lexicon, Definition of a Boglehead, http://markets.ft.com/research/Lexicon/Term?term=Boglehead, “Bogleheads are those who follow the investment principles of Jack Bogle, founder of Vanguard, the low-cost … fund specialist. Boglehead principles aim at modest, simple, investment and savings plans. To invest like a Boglehead you should build a simple portfolio based on index investing. For example, a typical holding would be a stock market index tracking fund (either through an index-tracking mutual fund or an exchange-traded fund), a global stock market index fund, and a bond index fund. Bogleheads, typically, do not favour alternative investments such as hedge funds. Bogleheads are also long-term investors and do not believe in trying to time the market.”

[16] Boglehead/newcollegeman, “RE: Insights from Vanguard”, https://www.bogleheads.org/forum/viewtopic.php?f=10&t=282782#p4580477, 6 Jun 2019.

[17] Board of Directors, The Vanguard Group, “Vanguard Funds Multiple Class Plan”, https://www.sec.gov/Archives/edgar/data/1409957/000093247113007109/multipleclassplanvanguardfun.pdf, 22 Mar 2013.

[18] Vanguard Group, “Common ETF Questions – Can I Convert?”, https://investor.vanguard.com/etf/faqs#convert, accessed Dec 2019.

[19] 20th Century Fox, “I Can Get It For You Wholesale”, https://en.wikipedia.org/wiki/I_Can_Get_It_for_You_Wholesale_(film), https://www.classicfilmfreak.com/2015/08/20/i-can-get-it-for-you-wholesale-1951-with-susan-hayward, Movie Poster, 1951.