Ah, Rules Based Investing, the magic elixir to investing success! It is the answer to the gloomy conclusions of both behavioral finance scholars and Pogo. Guys with PhDs have taken reams of paper and thousands of hours of computing time to document what  Pogo knew 50 years ago: in the search for the source of our problems, we rarely need to look much past our mirrors. Our impulsiveness, fits of greed and spasms of fear, overconfidence, and hesitance, sabotage our portfolios. Rules-based investing attempts to take the emotion out of our decisions by laying out a series of simple triggers and mechanical responses: for a simple example, if the S&P 500 does X, you do Y.

Pogo knew 50 years ago: in the search for the source of our problems, we rarely need to look much past our mirrors. Our impulsiveness, fits of greed and spasms of fear, overconfidence, and hesitance, sabotage our portfolios. Rules-based investing attempts to take the emotion out of our decisions by laying out a series of simple triggers and mechanical responses: for a simple example, if the S&P 500 does X, you do Y.

Look up Rules Based Investing on the internet and you find companies wanting to manage your money – to sell you something – a service or a subscription. Rules Based Investing is often associated with quantitative trading such as Smart Beta funds – funds that apply rules faster and more efficiently than you can. Few of these funds have been stress tested during hard times. These rules are usually oriented toward investors who trade frequently. I briefly cover my Investment Model and Ranking System at the start of this article.

While I do use a rules based system for picking funds and making allocations, I am going to look at a broader set of issues over the next several columns. I’ll argue in favor of six rules of investing that I describe are more about rules for lifetime investing. In this month’s essay I’m going to:

-

- lay out the six rules that I’ll be talking with you about

- review the current financial environment and the funds fit to it, and,

- explain the importance of developing a financial plan, Rule #1.

I’ll close by offering some resources for developing a financial plan.

Let’s go!

Six Rules of Investing

These are a broader set of rules that are more important to follow. Below are the most important rules of investing for the individual investor. The topics are broad that I will write these as a series of articles. The goals are inter-related, making financial planning a continuous process that should be done over a lifetime.

Rule #1: Develop a Financial Plan

Rule #2: Know the Short and Long Term Investment Environment

Rule #3: Manage Risk First

Rule #4: Invest Appropriate for the Business Cycle and Long Term Trends

Rule #5: Understand the Impact of Taxes on Investments

Rule #6: Develop a Simple Investment Process Based on Rules and Guidelines

THE INVESTMENT ENVIRONMENT AND FIT FUNDS

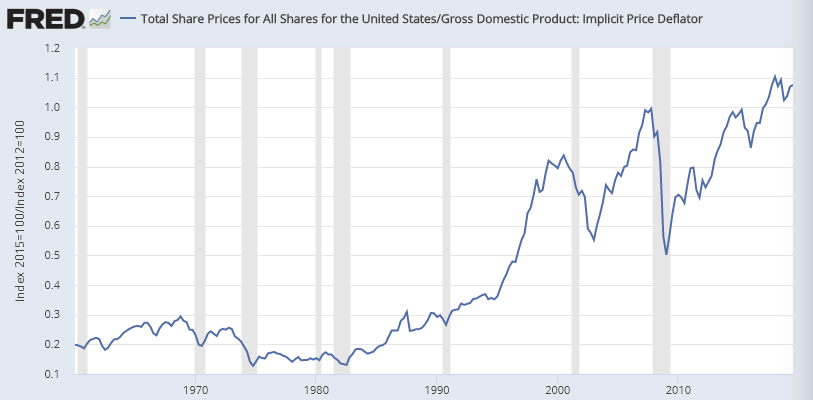

Few people understand was “the long run” actually means when we talk about “stocks for the long run.” The chart below was a surprise to me when I first saw one like it about 15 years ago. It is the inflation-adjusted stock market prices. It took 25 years for stock prices to permanently rise above the level of 1960 when adjusted for inflation. Valuations and inflation have a major impact on long term investing.

FIGURE #1: Inflation-Adjusted Stock Returns

Source: Created by the author based on St. Louis Fed Reserve (FRED) & S&P Dow Jones Indices

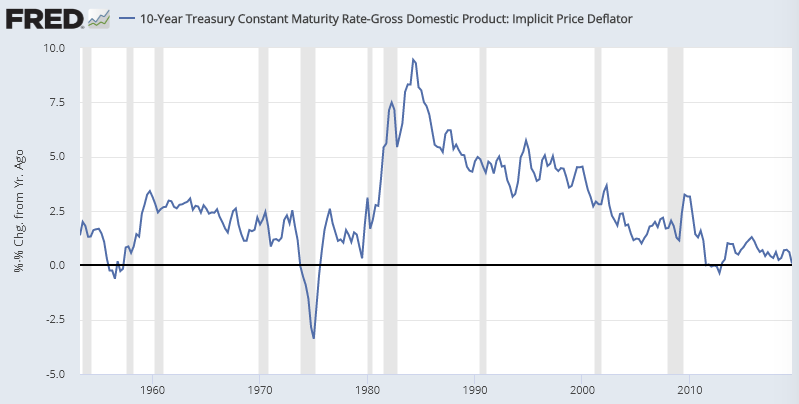

The next chart is equally descriptive. It shows the inflation-adjusted 10 year Treasury rate. Inflation-adjusted savings have typically been above 2.5% for most of the past 70 years, but have been very low since the 2007 recession. Note that with inflation rising and bond rates dropping, real interest rates are near zero when adjusted for inflation. This is something that has only occurred three other times in the past 70 years.

FIGURE #2: Inflation-Adjusted 10 Year Treasury Rates

Source: Created by the author based on St. Louis Fed Reserve (FRED) & S&P Dow Jones Indices

As a result of low stock and bond returns and longer lives, companies have shifted responsibility for funding retirement from themselves to their employees; that is, from defined benefit company pension plans to the defined contribution plans. The responsibility for managing one’s retirement is increasingly shifted to individuals in a landscape with increasing complexity, more choices, and higher risk.

In short, “getting it right” is getting both more challenging and more important.

Review of Investment Environment

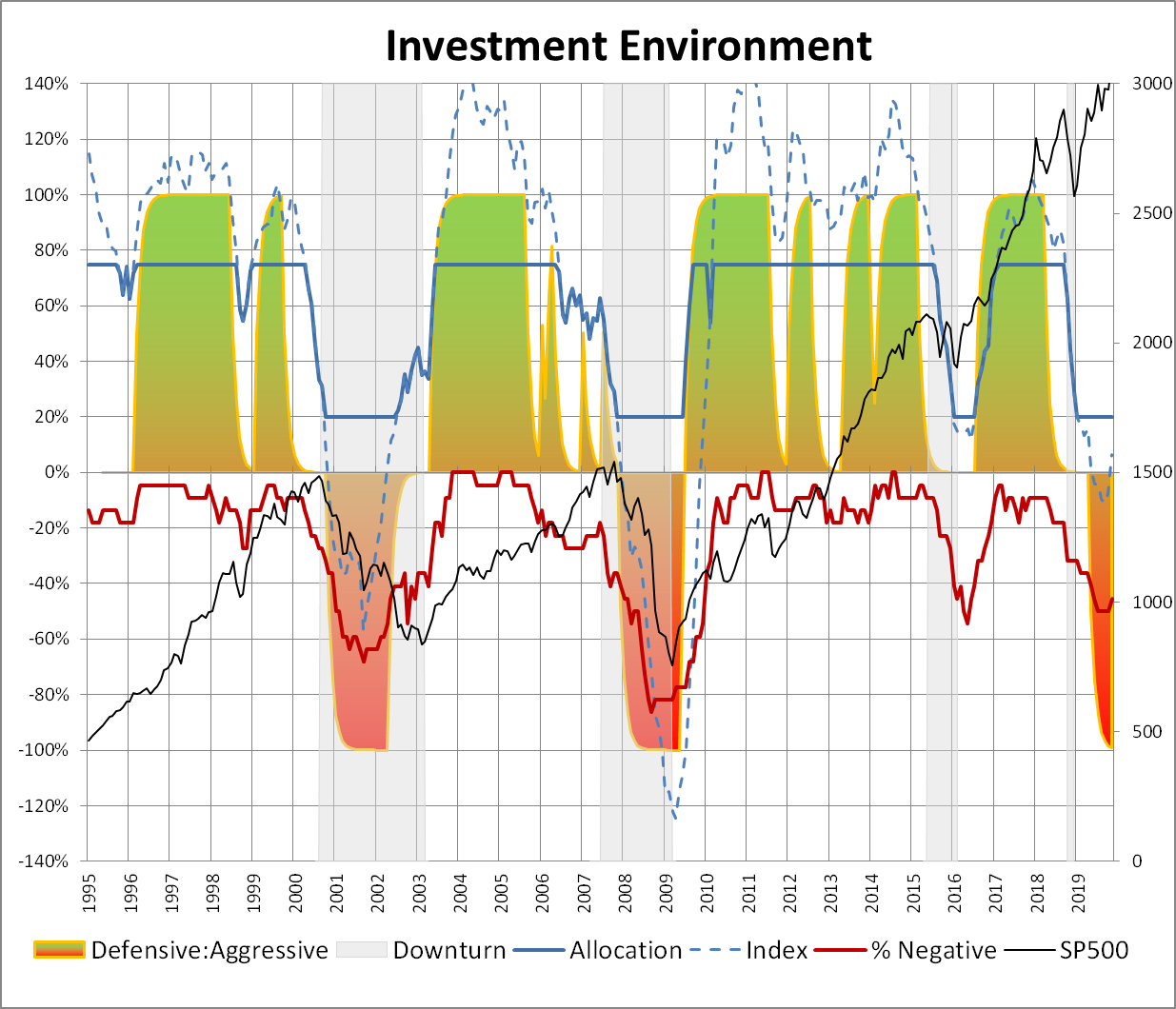

The Investment Environment has begun to improve, but risks and valuations remain elevated. Bonds are no longer benefiting from falling rates. Fund investors continue to reduce equity holdings in favor of municipal bond funds, in particular. Stock buybacks are supporting the equity markets but that support is declining. As someone nearing retirement, my preference, in this environment, is to hold stock allocations at conservative levels. Below is my Investment Model. The red shaded area suggests that investors should remain conservative, but the dashed blue line shows that the investment environment is improving.

FIGURE #3: Investment Environment

Source: Created by the Author

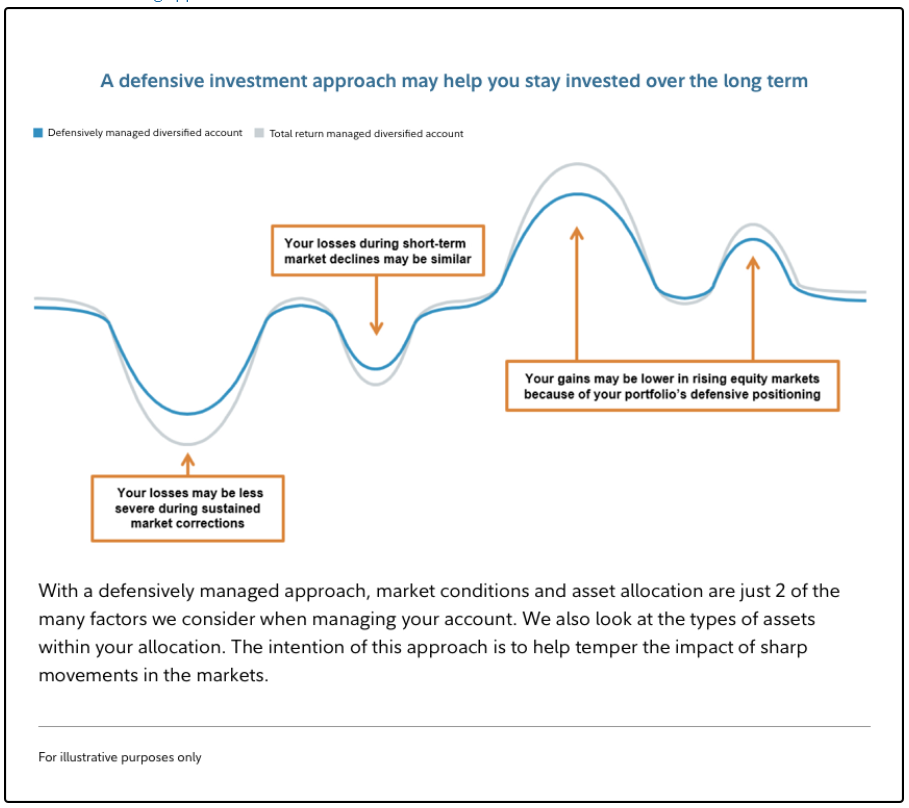

Investing according to the business cycle is about managing risk. Figure #4 below from Fidelity shows a conceptual impact of the strategy. An investor takes less risk in the late stage of the business cycle and loses less during bear markets which leaves him better prepared for the recovery stage.

FIGURE #4: Conceptual Results of Investing According to the Business Cycle

Source: Fidelity

Several investment advisers suggest that there is the possibility of higher inflation and a weakening dollar related to higher budget deficits and falling rates. The impact is that gold and commodities may do well. I monitor but don’t react until I see trends developing.

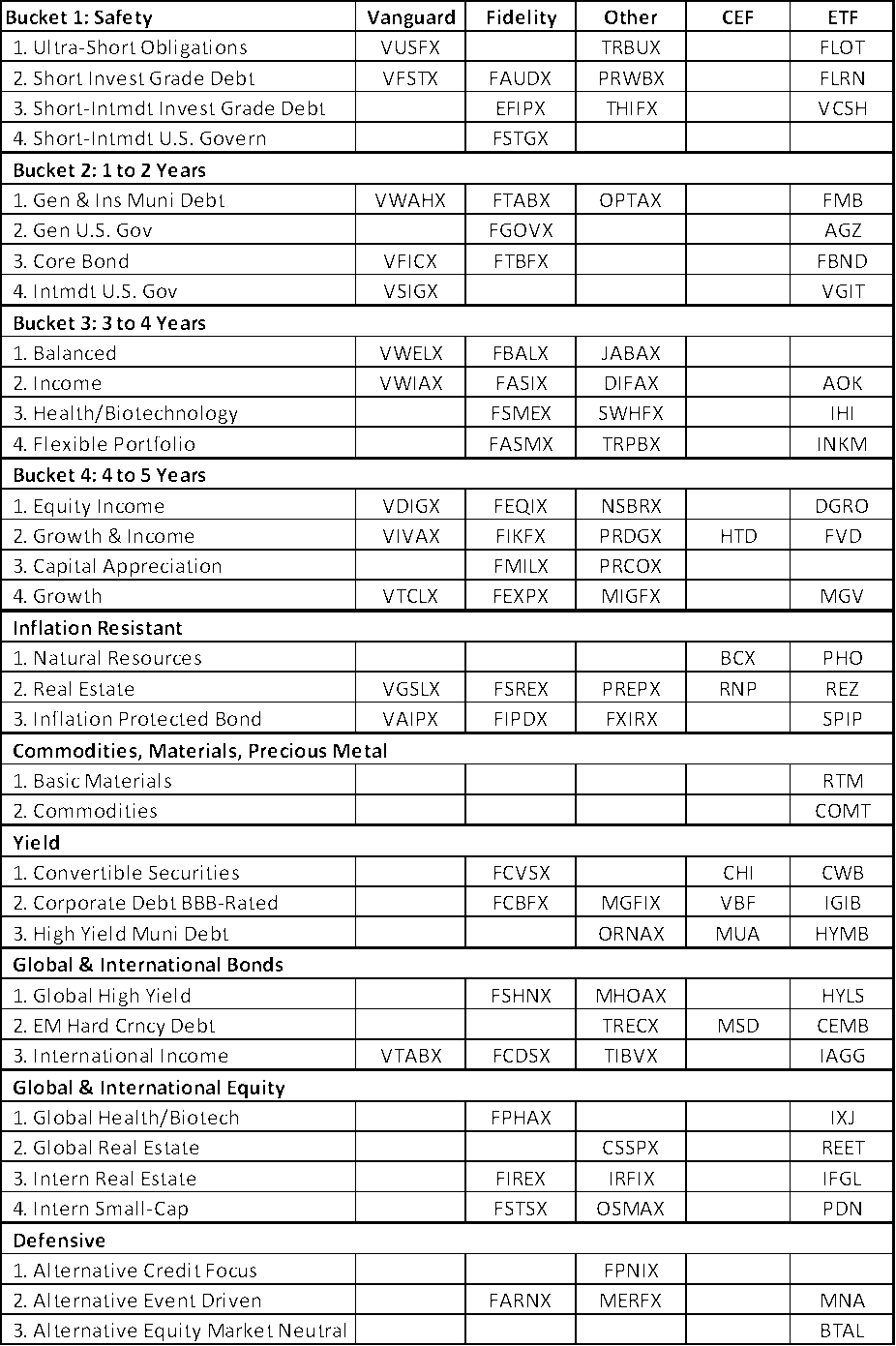

Review of November Funds

An investor should be able to summarize his or her investment strategy on a napkin. Here is my rules based system. Each month, I extract about a thousand funds from the Lipper database using the Mutual Fund Observer screens. The funds are ranked based on momentum, risk, risk-adjusted returns, yield, and quality factors. The top funds are grouped into four buckets based on risk and additional buckets for inflation, commodities, income, global bonds, global stocks, and defense. I follow Benjamin Graham’s guidelines of never having more than 75% in stocks nor less than 25%. To be diversified, I own funds from at least six of the buckets.

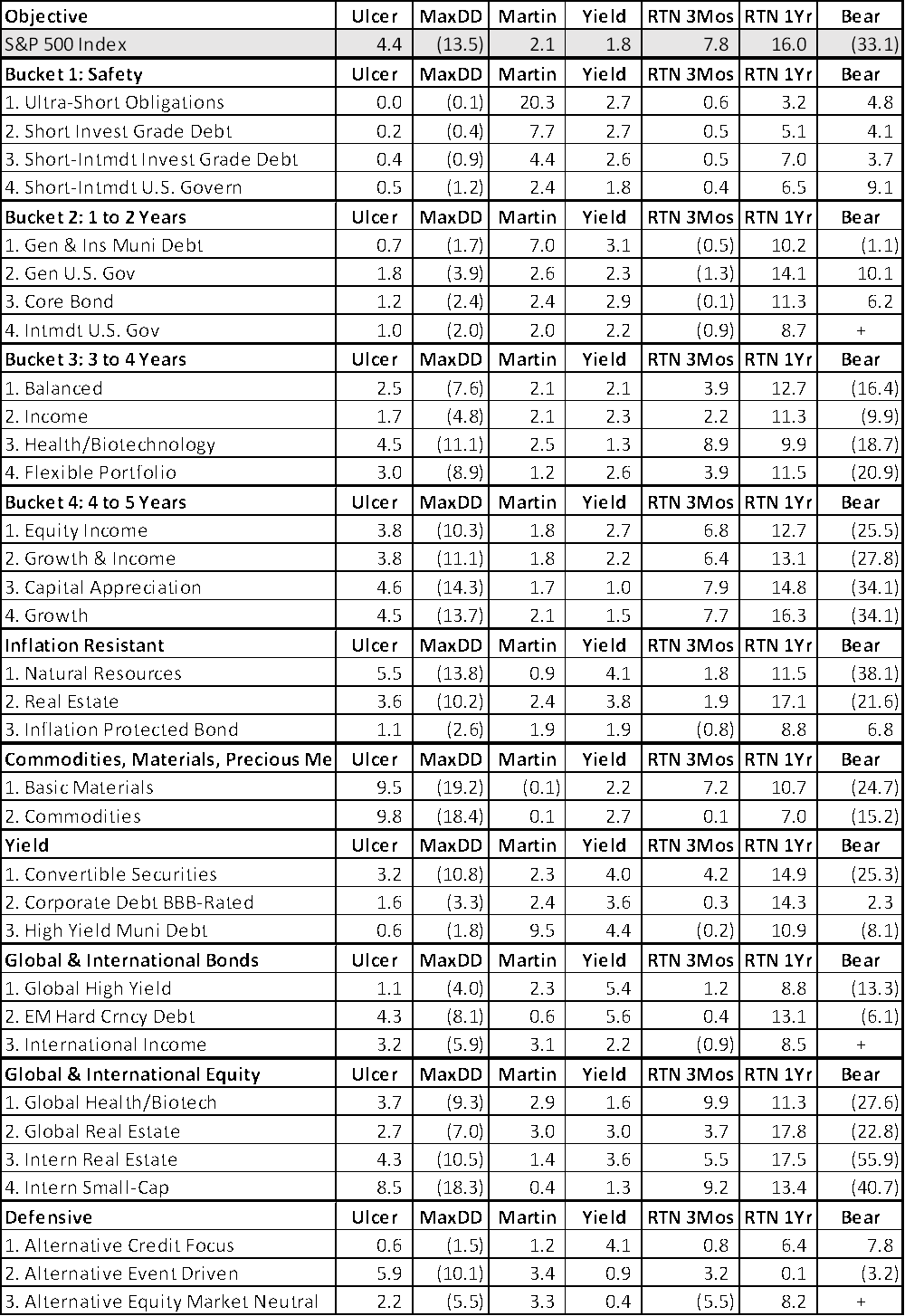

Risks in the economy are related to global negative yields, high budget and debt levels high valuations, the potential for interest rates to rise, weakening dollar, and inflation potential. I have adjusted the Ranking System to better account for these risks. The top-ranked Objectives and funds are shown in Tables #1 and #2. The Bear column refers to the average category performance during the past two recessions.

It is noteworthy that the bond funds in Bucket #2 have had negative returns over the past three months. Bucket #3 (balanced, income, Healthcare, and flexible portfolios) is where I prefer to be concentrated at this time. For Bucket #4, I think it is too early to move into growth funds and prefer Equity Income. I prefer quality debt but do own corporate bond funds. It is also interesting to note that the Global Equity Funds lie between Buckets #3 and #4 for risk (Ulcer Index) and Risk Adjusted Returns (Martin Ratio). I believe that this is due to the high budget deficits, falling interest rates, and higher valuations in the U.S. It is a trend worth monitoring.

For diversity, I like international income funds and global real estate. Top Ranked value, equity core, and income have returned about 8% over the past three months compared to 6% for low volatility funds.

TABLE #1: Top Ranked Lipper Objectives

Source: Created by the Author based on Mutual Fund Observer

TABLE #2: Top Ranked Funds for Top Ranked Lipper Objectives

Source: Created by the Author based on Mutual Fund Observer

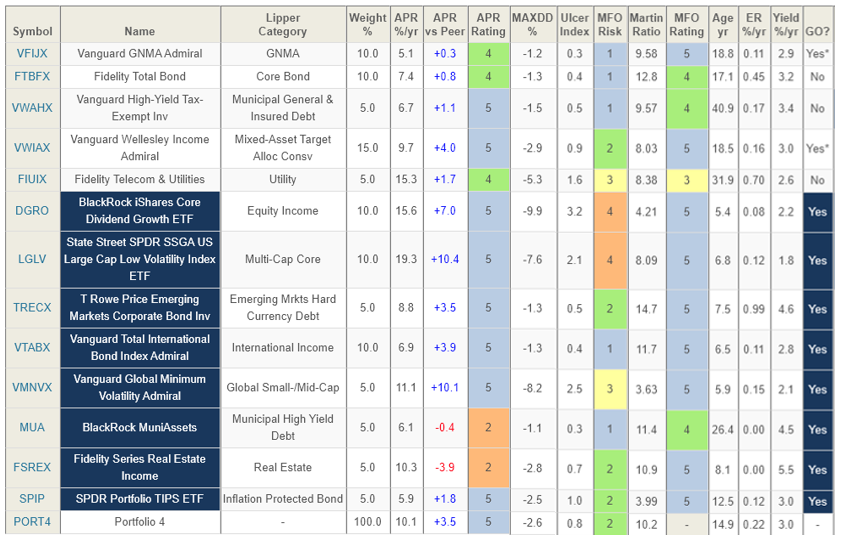

I selected two funds from each bucket and set up Portfolio Visualizer to select one or more funds from each of the buckets excluding commodities and to assign allocations. The link to Portfolio Visualizer can be found here. The resulting portfolio is shown using MFO Portfolio since June 2018. The Portfolio is rated “Conservative” (MFO Risk = 2). The Ulcer Index (length and duration of drawdown) is low (less than 1). The Martin Ratio (risk-adjusted return) is high (10.2). Overall the returns were 10.1% annualized with a maximum drawdown of less than 3%. Some of the rules built into my Ranking System are evident from the results (Momentum, Risk, Risk-Adjusted Returns, Momentum, Yield, and Quality). Age and Fund Family Rating are part of the Quality Index and are used to ensure a proven track record. The Great Owl Classification is part of my Ranking System. Another rule that I use is to restrict sector funds, riskier funds, and Closed End Funds to 5% allocation per fund or less. The yield for the portfolio is 3.0%.

TABLE #3: Model Portfolio

Source: Created by the Author based on Mutual Fund Observer

Figure #5 shows the performance of this portfolio since January 2018. The portfolio performed well in 2018 being defensive, and well in 2019 due to falling rates and the rebound in equities. How will funds perform in 2020? Will they behave more like 2018 or 2019? I have no crystal ball but build my portfolio based on the anticipation of low market returns with high volatility.

FIGURE #5: Performance of Model Portfolio

Source: Portfolio Visualizer

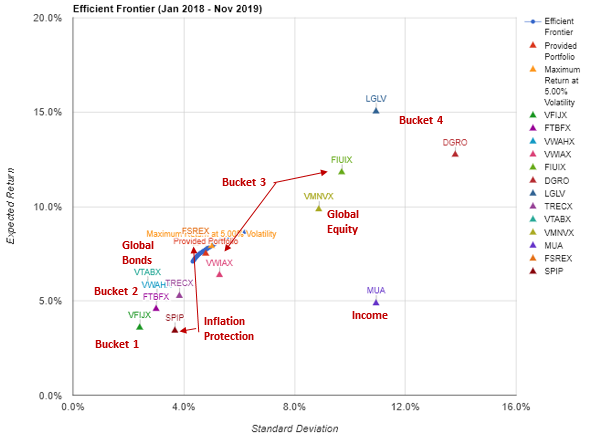

Figure #6 is the efficient frontier for the funds in the portfolio for the time period starting January 2018. The Blackrock Muni Assets Fund (MUA) is a closed end fund with a yield of 4.5%. Closed end funds typically have higher volatility. The funds in the lower-left corner are the low risk, low reward funds in Bucket #1. As the funds move to the upper right they become higher volatility, higher reward.

FIGURE #6: Efficient Frontier of Model Portfolio

Source: Portfolio Visualizer

I have done an end of year rebalance from intermediate bonds and equities to short-term bonds and money market funds. I expect a run of the mill correction in 2020 and use model portfolios as shopping baskets of funds to buy when the next correction occurs.

RULE #1: DEVELOP A FINANCIAL PLAN

My first exposure to financial planning was about a decade ago when I read Retire Secure!: A Guide To Getting The Most Out Of What You’ve Got by James Lange. I developed two habits inspired by the book. I developed a lifetime budget complete with expenses, estimated returns, and inflation. I also switched contributions to my Roth 401k because earnings will grow tax-free as long as I have them and heirs can inherit them without paying taxes.

Later, I started using the Fidelity Retirement Tool which takes into account pensions and retirement dates, social security, inflation and market conditions. Plans should have a margin of safety built into them for inflation, health care costs, longevity, and market volatility. I talked over the results with a Fidelity advisor and moved funds from my employer-sponsored account into a traditional IRA which has more funds available to choose from.

Following simple rules of retirement planning such as starting early, building up to a savings rate of 15% of your income or more, maintaining emergency funds, having enough insurance, keeping debt low, and investing appropriately will allow many people to have a more secure retirement.

The first rule is “Develop a Financial Plan”. It is the basis for knowing how much risk you need to take and the required savings rate to reach your goals.

Partnering with a financial adviser who is well versed in all of the rules, regulations, options, and opportunities facing you makes much more sense than trying to educate yourself from the ground up.

From The 5 Years Before You Retire: Retirement Planning When You Need It the Most (2014) by Emily Guy Birken.

Once you have established your Personal Principles, it is then time to move on to setting your goals. Without goads, life is lived at the behest of a collection of circumstances.

The Ultimate Financial Plan, Jim Stovall and Tim Maurer

Having a disciplined financial plan is a short term sacrifice for long term gains. Just as important, it provides an investor with options to afford to change to more enjoyable work, to go back to school, to buy that house as well as financial security to get through hard times. There are many advantages to developing a financial plan. First, it educates people on how much it takes to retire and hopefully develops a disciplined approach to saving. Secondly, it helps people develop disciplined plans for investing. Thirdly, it can provide a long term view on how to manage risk and taxes.

Developing and reviewing a lifetime financial plan has proven very beneficial to me. It answers many questions but raises even more. I read books about retirement and estate planning, and talk annually with a financial planner. I have built up pensions and will be taking an annuity instead of lump-sum buy out. I am deferring social security partly for the higher payout, but more as another source of insurance for my wife. My wife and/or I are covered with life, health, and/or longevity insurance. In this article, I review some of the factors I have reviewed preparing for my own retirement, as well as some of the things that I still need to consider.

People should save 15% of their income over their lifetimes in order to meet retirement needs, but most fall short of this amount. Saving for retirement should begin as early as possible in life even though starting salary may be relatively low and starting a new career and family take precedence. Saving for many of us is a choice. The old adage to “pay yourself first” means to prioritize a savings plan. If investors save automatically then they are more likely to have enough saved for retirement and emergencies. Sacrificing now benefits the saver as those savings continue to grow with compound interest.

What Help Is Available?

I like the quote below from 10 Best Robo-Advisors of 2020 in which the author recommends that if one does use a robo-adviser that you do also use a professional.

“Disclaimer: Our content is intended to be for informational purposes only and should not be understood as financial advice. We recommend that you consult a professional that can help you achieve your goals when making life’s important financial decisions.”

There are many sources available for getting help in developing a financial plan. A good place to start researching financial plans is with these three Consumer Reports. Finding advisers to meet general planning advice, insurance and estate planning, or tax expertise read What Do the Letters after a Financial Adviser’s Name Really Mean? If you are trying to decide if you want a robo-adviser, human adviser, or a hybrid system take the survey in Find the Adviser That Suits Your Style. If you are looking for a highly rated company or service then Investment Company Guide provides some insights but is a teaser to subscribe to Consumer Reports.

Many of us are locked into one or more investment companies because they manage our employer-sponsored savings plans. I have been with Charles Schwab, Fidelity, and Vanguard for up to 35 years. They each have their strengths. For this article, I looked at the advisory services at Vanguard, Fidelity and Charles Schwab. As one gets older, accumulates more or experiences life’s challenges, he or she may want to consider financial advisory services or managed accounts. Here is a good review of managed accounts at Fidelity and Charles Schwab by Brokerage-Review.com. Smart asset profiles investment companies in Fidelity Wealth Management Review, Vanguard Personal Advisor Services Review, and Charles Schwab Wealth Management Review.

Resources for Developing a Financial Plan

The AARP Retirement Survival Guide, Julie Jason

Tax-Free Retirement (2017), Patrick Kelley

The 5 Years Before You Retire, Emily Guy Birken

IRAs, 401(k)s, & Other Retirement Plans – Taking Your Money Out (2006), by Twila Slesnick, Ph.D. & Attorney John C. Suttle, CPA

The Ultimate Financial Plan, by Jim Stovall and Tim Maurer

Retire Secure!: A Guide To Getting The Most Out Of What You’ve Got, James Lange

What Should I Do with My 401k?: Should I Buy an Annuity?, Tim Clairmont

Closing

I like to manage my own investments using Mutual Fund Observer Premium and other tools. I know my strengths and weaknesses and seek help in financial planning. As I enter retirement, I will continue to experiment with the services described in this article.

I wish everyone a happy and prosperous new year!!!

Disclaimer

I am not an economist nor an investment professional. I became interested in economic forecasting and modeling in 2007 when a mortgage loan officer told me that there was a huge financial crisis coming. There were signs of financial stress if you knew where to look. I have read dozens of books on business cycles since then. Discovering the rich database at the St. Louis Federal Reserve (FRED) provides most of the data to create an Investment Model. The tools at Mutual Fund Observer provide the means for implementing and validating the Investment Model.