(Made you look.)

(And I’m not the only one who has.)

Those are emblematic of stories designed to tease you into clicking, just to discover what the secret financial move or stock is. The web is awash with them.

Why are people trying to tease you into clicking?

The nature of journalism has changed, and not for the better. Here’s the synopsis of my October 2019 AAII presentation on the matter:

- Under the traditional model of journalism, the “news hole” – the amount of news that could reach people – was limited to about an hour of broadcast news time and some number of column inches in your local paper. Back then, we paid journalists to gather and vet news candidates and we paid editors to screen out the worst of the trash: poorly sourced stories, invented controversies, and stuff that couldn’t be carefully checked before it reached the public. Journalists tended to be professionals and tended to value verification of stories.

- The launch of CNN in 1979 blew up the news hole. Suddenly, a network, and soon its competitors, had to find something … anything … to fill nearly 9,000 hours a year of airtime. That meant more “citizen journalists” – aka “person on the street” interviews and scrapping the verification process in favor of immediacy: “get it on air first” trumped “get it right.”

- The worldwide web dealt a near-fatal blow to traditional journalism. Every goober with a keyboard, an opinion and a modest set of technical skills could emerge as a journalist. “News” was everywhere, and everywhere “free.” People abandoned paid outlets, newspapers and magazines, in droves in favor of free and fascinating words from the web. The economic model of traditional journalism began to implode, and layoffs reached the tens of thousands. The standards of traditional journalism likewise imploded; get read, get seen, get eyeballs, get clicks all succeeded “get it right.”

- The arrival of the web in your pants pocket made it all much worse. People find it almost impossible to put their cellphones down. Researchers report that the average American has 80 sessions a day on their phone, where a “session” occurs any time you wake the phone up from sleep mode to do something with it. On average, we touch, tap or stroke our screens 2,000 times a day with the vast majority of touches tied to web surfing or social media use.

That addictiveness is not accidental, it’s a carefully designed element of our mediated connection. It’s not a side effect, it’s a design feature.

As a practical matter that means:

-

- You’re awash in a sea of noise.

- You’re paying a lot of attention to it.

This leads us to the one magic move which will dramatically reduce your losses, reduce your blood pressure, improve your sleep, brighten your smile and revive your romantic … oops, better not go there!

Turn off your browser for the next three months. The more specific and focused advice is:

Do an end-of-year gut check on your portfolio. Do you own more funds, ETFs and equities than you can count, much less follow? If so, check our Portfolio Pruning Guide <insert link>. Do you hold more than 50% equities in your portfolio? If so, check our research on The Discreet Charm of a Stock-Lite Portfolio. As an illustration, let’s look at the performance of several fund categories over this entire market cycle, beginning in October 2007.

| Lipper Category | Stock exposure | Maximum loss | Recovery period | Annualized returns |

| Conservative allocation | 30% | -24% | 29 | 4.1% |

| Moderate allocation | 60% | -35 | 38 | 4.6 |

| Aggressive allocation | 75-90% | -51 | 64 | 4.5 |

Here’s one way to read that: a stock-heavy portfolio crashed by 51% and took over five years to get you back to where you started. Your willingness to ride that roller coaster rewarded you with 4.5% returns. A stock-light portfolio lost less than half as much, recovered in less than half the time, and still returned 4.1%.d

Stop following the financial media, at least until the crocuses bloom in spring.

Why? Two reasons.

First, these people have no clue but have a vested financial interest in pretending they do.

Yup – these all appeared side-by-side on the same day. So, which is it? Are you about to lose all your money or have we dodged a stock market bubble? Do we have 10 more years of rising markets or will it all meltdown soon? Is Dalio staking billions in a bet against the market, or isn’t he? And, regardless, should you care?

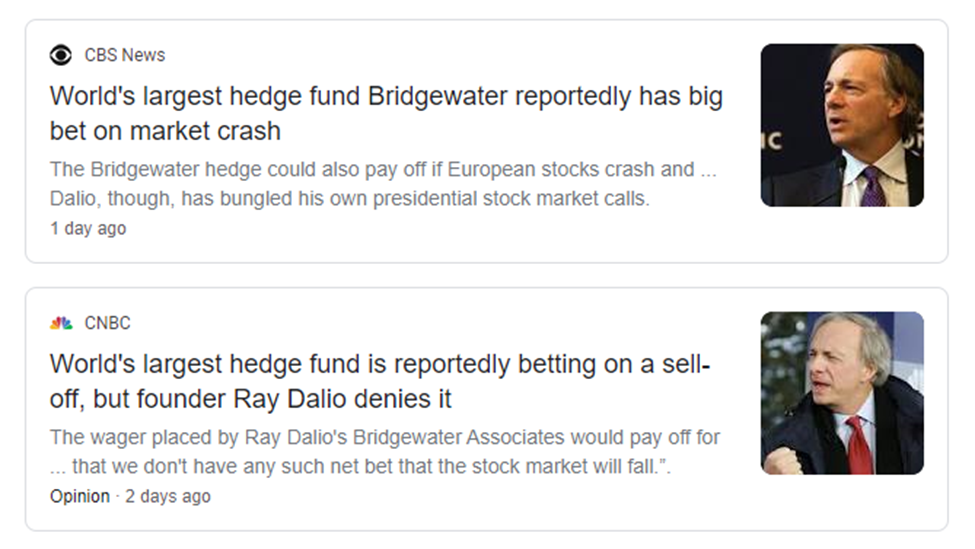

Second, you have no clue. In particular, most of us – individual investors and advisors alike – have no idea of what portfolio moves to make in the face of specific, individual threats. Read the chart below carefully, there’s going to be a quiz.

Quiz question #1: The Fed misjudges the strength of the economy in making its next move and imprudently reduced the overnight rate. What changes should you make in your asset allocation or sector exposure to buffer the effects of their error?

Quiz question #2: There is a sudden disruption in the US shadow banking system, interrupting capital access for low-income borrowers. Should you change your exposure to consumer discretionary stocks, high-yield bonds, both or neither?

Quiz question #3: The Saudis and Iranians are simultaneously stupid; oil spikes to $110 / barrel. What do you do? What do you do?

If your only answer is “Sell stocks! Sell stocks! Sell more stocks!” then you’re over-exposed to the stock market now. And you’re not particularly capable of making crafty tactical moves to exploit the stuff that keeps dominating the financial media’s headlines.

So why are you reading them? They create anxiety (that’s a design feature: they’re trying to tease and terrify because that’s what it takes to drag you in) and raise the risk that you’re going to do something ill-informed in the midst of a crisis. As actual bad-ness in the market or the economy manifests, the headlines (from the clueless) will become even more hysterical, making us feel and act worse.

What might you do instead?

How to read a book, again

A lot of us read fewer books than once we did, with many lamenting their diminished attention span and having lost the art of “getting into” a book.

Don’t demand “relevance.” There’s nothing dumber than selecting a book “because I need something that’s going to help me get ahead.” Meh. That’s “book as broccoli” and it doesn’t work. You’re far more likely to grow from immersing yourself into Ursula LeGuin’s Left Hand of Darkness or Barbara Tuchman’s A Distant Mirror: The Calamitous 14th Century – which will offer you possibilities you’d never imagined – than you’ll ever get from the latest tome on corporate culture or life coaching.

Fifteen minutes with a book is better than fifteen minutes without. Don’t deter yourself with impossible expectations. Some days I might find an hour, many days I can sneak in just 15-20 minutes lying in bed with my Kindle. Finding 15 minutes a day is a grand victory.

Celebrate stacks of unread books, they’re not signed of failure, they’re opportunities awaiting their moment.

Read free samples, which are available for almost all Kindle books. Download 20 samples to your e-reader, tablet or phone. It takes hardly more than five minutes with a book to know whether it’s a keeper or best in someone else’s library.

Don’t feel compelled to finish every book you start. Some authors need only five pages to create a spark, others have tried to stretch a fascinating 10 page essay into a dreadful 300 page book.

Avoid ghost-written pap from politicians, celebrities, celebrity-politicians, self-proclaimed gurus and their children. Any book that began with a consultant’s declaration “we need you to have authored a book” is best viewed as potential compost.

Read books.

Read books that others don’t read. Skip the bestsellers for the best thinkers. Skip the “books as broccoli” bit and try to reignite the delight you once felt, whether it was from The Lord of the Rings, Harry Potter and the Sorcerer’s Stone or A World Lit Only by Fire.

There are two arguments for that. First, if you want to be able to act differently you must first be able to think differently. Books feed thoughts. Books with unexpected perspectives feed unexpected thoughts. Second, books create distance. If you spend your every moment marinating in today’s panic – or today’s FOMO moment – you’re going to assume that whatever is loudest, whatever is brightest, whatever is most in your face, is most important.

It isn’t.

Books for the months ahead, recommendations from the folks at MFO and really smart people.

Ed Studzinski offers his book recommendations, both timely and timeless, in his essay this month.

Lynn Bolin, engineer, data guy, and MFO columnist

Mastering the Market Cycle is a good read in my opinion because it is a topic that I believe in and practice. I like it because it is a good refresher on business cycles with good philosophic insights into market cycles. Distortions in perceptions of risk by some in the media have been driving the markets for the past two years. I particularly like Mr. Marks’s philosophy that investors should adjust their balance toward aggressiveness and defensiveness over time in response to the investment environment.

Warren Buffett, impossibly rich guy

The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor (2013), by Howard Marks and Paul Johnson. Mr. Marks gets an awful lot of respect for the quality of his thought and writing, so it seemed worthwhile to share two of his works with one, one more technical and one more global.

Bill Gates, rich guy, a friend of and card-playing partner with the aforementioned rich guy.

The Myth of the Strong Leader: Political Leadership in the Modern Age (2014). “From one of the world’s preeminent political historians, a magisterial study of political leadership around the world, from the advent of parliamentary democracy to the age of Obama.”

Charles Boccadoro, retired engineer, teacher and impresario of MFO Premium and its suite of tools

Salt, Fat, Acid Heat by Samin Nosrat will forever change the way you think about food, cooking, and even eating.

Amit Wadhwaney, value investor, founder of Moerus Capital, manager of the Bronze-rating Moerus Worldwide Value and one of the most thoughtful people I’ve ever interviewed.

Silence in the Age of Noise (2018) by Erling Kagge.

The second one is: The Joy of Missing Out: The Art of Restraint in an Age of Excess (2019) by Svend Brinkmann.

Amit writes, “Neither is prescriptive, notwithstanding the obvious opinions of the respective authors. The first I shared with my colleagues a year or two ago, silence being one of the prized intangibles of a workplace (as a starter). The second one, a more recent book is about the joys of self-restraint on pragmatic, moral, psychological and even aesthetic grounds-a sort of celebration of stoicism. But as I mentioned earlier, neither is a how-to manual which is precisely what makes (or should make), in my mind the lessons and attraction universal.

“There you go … a pair of slender volumes, rich in content if one is willing to pause and allow them to sink in. And now, off I go into the busy, chaotic streets of Mumbai to my first meeting.”

Cheryl Welsch a.k.a. Chip, MFO co-founder, technical director, college dean

“Because, on many days, my sanity depends on the distance from my workplace and the 150 emails that, on average, wash over me. I was going to recommend Jeffrey Buller’s Positive Academic Leadership (2013), which is set in higher ed but says really sensible things to all of us who are trying to make a difference, but I was afraid our readers would think that’s too narrow. Besides, the cover is dull. So I chose Ande (“Andy”) Li’s The Healer’s Girl (2018) as a beautiful escape into a fantastical, sci-fi world full of strong characters, healing and magick, mystery and suspense.

David Sherman, founder of Cohanzick Asset Management and manager of RiverPark Short-Term High Yield, the most consistent and most consistently-reliable fund in my portfolio.

Happy Thanksgiving!

I am actually composing my 2019 Holiday Books over the weekend. Some difficult choices this year and I definitely need to narrow the message and list. In the spirit of your e-mail, the one book up first would be Ryan Holiday, Stillness Is the Key (2019). I’m writing this on my cell phone, so I decided to copy and paste a bit from Goodreads rather than trust my thumbs.

In Stillness Is the Key, Holiday draws on timeless Stoic and Buddhist philosophy to show why slowing down is the secret weapon for those charging ahead. All great leaders, thinkers, artists, athletes, and visionaries share one indelible quality. It enables them to conquer their tempers. To avoid distraction and discover great insights. To achieve happiness and do the right thing. Ryan Holiday calls it stillness–to be steady while the world spins around you.

David Welsch, a.k.a. Chip’s son and MFO’s part-time technical assistant

I thought about recommending Atlas Obscura: An Explorer’s Guide to the World’s Hidden Wonders or How to Swear Around the World, but then remembered that there’s nothing like a good horror novel to take my mind off just about everything except the strange noise coming from the basement. I’ve just pulled out my old copy of The Shining by Stephen King. I read it when I was about 15, but now I’d like to read it again before I read the sequel, Doctor Sleep.

Snowball’s potpourri

This essay began with the argument that people are intentionally designing products to scramble your attention and impair your judgment. If you find that somewhere between puzzling and infuriating, the place to begin your education is with Tim Wu’s Attention Merchants: The Epic Scramble to Get Inside Our Heads (2017). Like Malcolm Gladwell, Mr. Wu writes on a broad array of topics, and writes well. Unless Mr. Gladwell, Mr. Wu has a serious academic perch as a professor of law at Columbia.

To folks who declare “the world is broken, we’re spinning out of control, chaos rules!” I nod and say, “well, yes. Yes, it is. And it always is. It just means it’s time to start pulling together, instead of pulling apart.” That (relative) calm is informed, in part, by my training as a historian and by my fascination with two cataclysmic periods in Western history: the Middle Ages (sometimes called “the Dark Ages”) and the maelstrom bounded by the start of the First World War and the end of the Great Depression. (When a reporter asked the great British economist John Maynard Keynes if there had ever been anything like the Great Depression, he said, “Yes. It was called the Dark Ages and it lasted 400 years.”)

My favorite broad-brush portraits of “the Dark Ages” are Barbara Tuchman’s A Distant Mirror: The Calamitous 14th Century (1987) and William Manchester’s A World Lit Only by Fire: The Medieval Mind and the Renaissance: Portrait of an Age (1993).

Neither of them is state-of-the-art, neither really appeals to academic historians who fuss about the fact that they gloss over bunches of interpretive debates and get some of the facts wrong. And yet they are compelling, engaging, enlightening and right about 95% of the time. That’s an average we should all aspire to. Manchester is more broad-brushed, Tuchman uses the life of a single noble family as a lens with which to examine broad questions. Both are a little bit depressing (Ummm … the “fire” of Manchester’s title was from the burning of martyrs) and both offer a profound sense of how far we’ve come and how much we’ve overcome.

I’m working steadily through Bradley Hart’s Hitler’s American Friends: The Third Reich’s Supporters in the United States (2018), a study of Depression-era demagoguery and our responses.

I’m working steadily through Bradley Hart’s Hitler’s American Friends: The Third Reich’s Supporters in the United States (2018), a study of Depression-era demagoguery and our responses.

Some will love Hart’s writing because he’s willing to draw explicit parallels to the contemporary alt-Right movement and its enablers; others will detest it for the same reason. As a guy who teaches about demagogues to students who think the world began at right around the time they began noticing it, I’m really enjoying Hart’s sharp, focused portraits of groups like the German-American Bund, Silver Legion and the National Union for Social Justice.

I’m often befuddled by people’s tendency to dismiss really good stories as “children’s fiction.” Perhaps I am too child-like, but I’ve found rather some glee in engaging tales that a bright 10-year-old might share with me. Two I’ve read this fall are T. Kingfisher’s Minor Mage and Patricia Wrede’s Dealing with Dragons.

From there we switch to something as far from amiable children’s tales as we can. (Ummm … good Baptists should avert their gaze and move to safer grounds about now. Just sayin’.)

For folks who are suffering Fifty Shades of Grey withdrawal, (1) huh? and (2) there’s better. A friend, both of ours and of MFO, wrote a tale both darker and better than the plodding Grey corpus.

For folks who are suffering Fifty Shades of Grey withdrawal, (1) huh? and (2) there’s better. A friend, both of ours and of MFO, wrote a tale both darker and better than the plodding Grey corpus.

The pseudonymous Jasmine shared the tale of the tale:

I can’t say for sure when I started writing Mindgames. I have a definite recollection of staying after work in the late 1980s and writing on an electric typewriter there. (I stayed so late that my boss inquired whether I was living in the office.) But I think there may have been an even earlier beginning in a spiral notebook.

The story was a romance about a slavegirl named Mariah. She was brave and strong and obnoxious and would prefer death to continued servitude. She trusted no one and believed that friendship was a weakness. The hero was a healer named Gabriel. He arrived in Riviera on a mission of mercy for which he had traveled by horseback hundreds of miles across uninhabited land. Of course, he was horrified by the decadence of Riviera. And of course, he could see past Mariah’s hard facade into her true self.

As I was writing, I was busy living my life. There were years when I didn’t have time to work on Mindgames at all. When I did work on it, it was in stolen 30-minute increments.

In the meantime, the internet had come into being. After a few years of lurking on erotic story sites, I started to publish the early chapters of Mindgames. To my amazement people loved it. It was one of the most popular and highest-rated stories on the biggest BDSM story site. If the counter was correct, it had millions of views.

At its heart, it was still a smutty romance, but this was no 250-page Harlequin. Minor characters became major. I explored the entire society. After all, why shouldn’t I? The internet was a new world. I could do what I wanted on it. I started to think of the book as a Trojan horse. People came to read a dirty story but ended up with something a little deeper, a tale about speaking truth to power. The tag line became, “How one person can change the world, or be destroyed by it.”

I know she’s hosted a book club discussion over her novel. The mind boggles as to the whole “tea and bondage” discussion, with cute little cucumber sandwiches. Life is rich.

Bottom line

Stop making yourself crazy. Start making yourself thoughtful in ways that your friends would never have seen coming. It’s possible, and a great way to use the dark evenings of the coming season.