Dear friends,

Welcome to the last 2019 issue of Mutual Fund Observer. Thanks for being here.

There’s rather a lot going on with this month’s issue whose theme might be “get some perspective while it’s still possible.” We’ll talk a bit about preparing for less hospitable markets. Vanguard’s Total Stock Market Index is up 27% YTD without a notable stumble along the way; it simply doesn’t get more hospitable. Since the economy, earnings and CPI didn’t grow by anywhere near that much, most of the gain comes from “multiple expansion,” the willingness of investors to pay more today than they did yesterday for the same thing. Vanguard itself is not enthused. Joe Davis, Vanguard’s chief economist and investment strategist warned in mid-November.

Our near-term outlook for global equity markets remains guarded, and the chance of a large drawdown for equities and other high-beta [more volatile] assets remains elevated and significantly higher than it would be in a normal market environment. (MarketWatch, 11/19/2019)

High-quality fixed-income assets, he says, “remain a key diversifier.”

So we’ll highlight some of the funds that might help, and rather a lot that won’t. And, as part of maintaining a healthy mind as well as a healthy perspective, we’ll share the argument for fewer hours with web browsers and more with books.

Well, books and smart people.

Make Me Smart

Really, that’s more of a challenge than you’d imagine.

“Make Me Smart” is an exceptional weekly podcast on technology, the economy, and culture. It’s produced by American Public Media, NPR’s chill next-door neighbor, which also hosts the Marketplace franchise. The show generally runs 30 minutes, unless they don’t have 30 minutes’ worth of good stuff. Then it’s shorter. I like that. Generally, they have one question or guest which occupies half the show, and then give-and-take about the week’s events.

It feels a lot like having lunch with two really smart, amiable old friends. A recent episode focused on the team of economists who received this year’s Nobel Prize in Economic Science. Their work, on global poverty reduction, might be summarized by the phrase “look before you leap.” The hosts and I both seemed astounded that you could revolutionize the field of economics by pointing out that policies made in the absence of careful evidence are likely to be failed policies. The team spent a lot of time looking at efforts to improve education in Kenyan. Starting point: the Kenyan system is a disaster, with no resources for the students, no textbooks, 80 students per class and teachers who live in poverty.

Easy conclusion: add resources, provide textbooks, raise class sizes, pay teachers more.

Their strategy is to rigorously test each of those “solutions” before implementing them. The surprising results: almost all of them are wastes of money, with just one “obvious” solution showing any promise at all. Their guest, French economist Esther Duflo, offered the conclusion that all of us should probably keep taped to our monitors:

Your intuition can be so wrong. It is quite likely that your idea is not that great. You’re going to learn it in the field and that learning is quite helpful because you are going to progressively learn, what is the real issue? If you have to humility to realize that, most of the time, our great ideas are not all that great.

Nobel Laureate economist Esther Duflo, Make Me Smart November 19, 2019

A week earlier they had a slightly outraged discussion of an infuriating situation: Apple released a credit card that it said that drew on the Apple cachet and the promised to be different from those dirty old bank credit cards. And then it turned out to be wildly sexist: in one couple after the next (including, famously, Apple co-founder Steve Wozniak), the system issued vastly higher credit limits to the male partner than to the female. When pressed on the issue, Apple reps said they couldn’t explain it and that it wasn’t sexist “because it was all done by an algorithm.” The algorithms in question either wrote themselves (?) or were written by the bank behind Apple’s “this ain’t no stinkin’ bank” card.

It would be quite worthwhile to listen.

Yuh … hold it right there, bubba

From my inbox this week:

“Without even doing any in-depth analysis dot dot dot”? Any article that leads with “I haven’t bothered to do any analysis” is a great candidate for emphatic use of the “delete” button.

Here’s their argument, in brief: the fund’s raw returns have lagged, the fund charges 1.8%, buy an index fund.

Thank goodness they didn’t waste time with any of that in-depth research stuff that might have noted that this is a conservatively managed quant fund, that it currently holds 32% cash, that its risk-adjusted returns are strong, and that its total returns have pretty much clubbed its peers since inception. All of which might, or might not, be more relevant than its 1.8% e.r.

If you’re interested in a bit more from us…

BottomLine Personal interviewed me about interesting funds “below the radar.” The result was the article “The Best Stock Funds You Never Heard Of.” That spawned a lively debate on the MFO discussion board.

A few upgrades and experiments

New at MFO Premium this month, Charles has added an “averages and indexes” comparison to the fund screener.

That allows for easy, direct comparisons between the three for any of the dozens of specific periods (including entire market cycles, multi-decade periods and down markets) we compute.

We’re also testing a new element for each of our fund-specific pieces: brokerage availability. As with many of our changes, that was the result of a thoughtful recommendation by an MFO reader. Carlyn Steiner wrote in mid-October,

It would be helpful if you could note where a fund may be purchased when you review it. Also, short of opening an account at Harbor and at Seafarer to purchase a single fund, can you tell me where I might buy each of the funds, Harbor and Seafarer …

That took a bit of doing, and Morningstar’s generosity. Brokerage information used to be part of Morningstar’s online profiles of each fund but they found limited user interest and dropped the feature. I was stymied about how to address Carlyn’s request until Michael Laske, a Product Manager at Morningstar Research Services, reached out with the offer of providing brokerage information for all of the funds they cover. With the perfectly sensible proviso that I cannot directly share the whole list, we’re able to use it to highlight availability in each Launch Alert, Elevator Talk, and profile.

Beginning this month, we’ve added the feature. David Welsch is faithfully retconning all of the profiles we’ve published this year; that is, he’s editing each to integrate the brokerage information.

Reaction on the discussion board was mixed, at best. Lots of folks suggested just checking directly with your brokerage. Please do let us know what you think. We can continue, expand or terminate the experiment, all of which is based on your needs.

Thanks to Michael and the folks at Morningstar for their generosity and support!

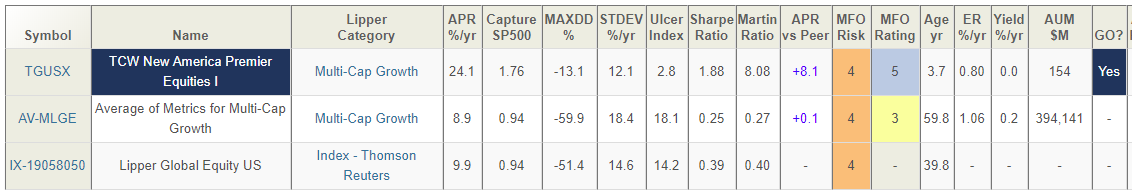

The month’s Elevator Talk with Joe Shaposhnik of TCW New America Premier Equities was also seeded by a reader suggestion. Michael Weingarten wrote to us on November 15 about a couple of funds.

A while back you mentioned that we should email you if we’d like to suggest funds for a writeup in the monthly commentary. There are 2 funds that I’m very interested in learning more about. FAMEX is one that you analyzed several years ago and I thought it would be very interesting to revisit them. The fund held up incredibly well in the Fall selloff last year and I was curious if they had modified their strategy to be more conservative after their large drop in 2008 (49%). I really enjoyed your analysis on this one. The second fund is TGUSX. This one is only 3 years old and has had an incredible risk-adjusted performance. There’s not a lot of info available on this fund. Thanks very much and have a great weekend.

By happenstance, Mr. Shaposhnik had also begun a conversation with us. The confluence resulted in this month’s Elevator Talk and January’s update to the FAM Dividend Focus (FAMEX). Following your suggestions, we’re also working on the father/son funds at Yacktman and YCG.

Matching grant/challenge grant offer.

The only source of support for MFO is reader contributions. We’re frequently offered the opportunity to host “paid placements” or Google ads. We’ve always refused such offers, for two reasons. First, ads are annoying, distracting and intrusive; they make it difficult to read our content. Second, they would represent a compromise in our independence. We’d much rather do good work on a shoestring budget than provide compromised content in exchange for cash. Not. Gonna. Do. It.

What’s “a shoestring budget” look like. In broad terms, it costs $24,000 a year to keep the lights on here and at MFO Premium. That doesn’t account for any compensation to our staff or contributors. In general, in the years where we run a surplus, we try to share a year-end honorarium to the folks who make MFO happen. It is, otherwise, a volunteer effort.

That’s modestly below the $1.02 billion in revenue that Morningstar reported for 2018.

We hit the break-even point in about two years out of three, mostly because of the contributions we receive in December.

In past Decembers, Deb Walters – our fund-raising strategist and good friend – personally underwrote challenge grants to give folks the incentive to do what they’ve been intending on doing all along. When Deb passed away at her home in New Mexico this summer, we lost both a friend and a leader.

This year two anonymous donors have offered up modest challenges, for which we’re grateful.

Challenge One targets new memberships to MFO Premium. Our potential donor will match five new memberships to MFO Premium, a tax-deductible $120, but we do need to reach the threshold of at least five new members.

Challenge Two is triggered by other reader contributions in excess of $500; that is, if we receive at least $500 from folks other than the Challenge One crew, they’ll chip in another $500.

If it’s in your budget and your best interest, we’d encourage you to make a tax-deductible year-end contribution to MFO. Contributions of $120 or more get you a year’s access to MFO Premium, home of the unique fund screener that we’ve built for folks who want information – sophisticated risk measures, rolling returns, correlations between funds – that are normally unavailable to regular folks. If you would like to receive access to MFO Premium, please use the MFO Premium link! Contributions made through that link are automated and seamless, which gets you access more quickly and smoothly.

If you’d like to simply support the mission of MFO but aren’t interested in Premium access, please use our “regular” PayPal link. Similarly, you’re welcome to write a check (and a note! We love reading your notes!). If you do write a check and would like MFO Premium access, just remember to share an email address with us. Whether you choose to give $1 or $10,000, we’re grateful and we’ll keep digging on your behalf.

Some folks have chosen to use our PayPal link to create regular monthly contributions, which we find almost freakishly cool. Thanks especially to the folks at S&F Investments for their generous, ongoing support (We owe you a third MFO mug, we thought there was only an S and an F!) and, as ever, to Greg, Doug, David, Seshadri, Brian, Matthew, James, William, and the other William, whose continued monthly support makes us smile. Thanks, too, to Larry, Rae, Ira, Wilson, Dan, Leah, Marvin, Richard, and Binod for your kind contributions in October and November.

Wishing you a joyful holiday season,