It looks like you're new here. If you want to get involved, click one of these buttons!

:-)Boeing makes the MOP. They appear to specialize in things that fall from the sky and result in destruction.

https://breakingdefense.com/2024/05/northrop-wins-7-billion-air-force-contract-for-more-b-2-sustainment-upgrades/The Air Force awarded Northrop Grumman a [service] contract worth up to $7 billion ... set to run through 2029.

...

The Air Force is notionally planning to retire the dual-capable B-2 in the early 2030s — replacing it with the B-21 Raider, also a Northrop Grumman product ... Officials expect to buy at least 100 B-21s, which will replace both the B-2 and Boeing B-1 Lancer. The Air Force will then drop to a two-bomber fleet, [... the B-21s] and Boeing’s B-52 Stratofortress

add:The iron dome has its limits. Waves of drones cannot be all shot down simultaneously. Three potential targets:

1. Israel.

2. Strait of Hormuz. It’s only 6 miles wide, and thus susceptible to attack. Tsp tankers made U-turn a way form this area. Oil prices rose to $75 barrel.

3. US bases in Middle East.

https://www.seattlebank.com/about/updates/updates-detail.html?cId=84542&title=understanding-tax-implications-of-certificates-of-depositShort-Term: Interest earned on CDs with terms of one year or less is considered taxable income in the year that the CD interest is paid out.

Long-Term: CDs with terms over a year are taxed as interest is earned over the CD term. Interest is considered taxable income in the year that you are legally entitled to it. For example, if you have a CD with a term of five years, you will owe tax on the interest paid in each of the years that you hold the CD before maturity.

Oooh, that's the kind of screening I like. :)I've been looking through LC Bl funds that have done well over the past three years without having gorged on the Mag 7, while also having turned in good performances YTD. Ideally I'd also like them to have more than a smattering of foreign stocks (indicating more flexibility).

If I use 20% Mag 7 as a threshold (as of a couple of weeks ago), AFIFX comes in well under the wire at 17.5%. And it typically holds over 15% foreign (per M* analysis); currently 16.5%. In contrast, AICFX misses the cut at 22.5% Mag 7 (about 30% more), and it holds just half as much in foreign stocks (8.6%).

U.S. officials say that strikes conducted on three key Iranian nuclear sites have devastated its nuclear program, but independent experts analyzing commercial satellite imagery say the nation's long-running nuclear enterprise is far from destroyed.

"At the end of the day there are some really important things that haven't been hit," says Jeffrey Lewis, a professor at the Middlebury Institute of International Studies at Monterey, who tracks Iran's nuclear facilities. "If this ends here, it's a really incomplete strike."

In particular Lewis says the strike doesn't seem to have touched Iran's stocks of highly enriched uranium: "Today, it still has that material and we still don't know where it is," he says.

"I think you have to assume that significant amounts of this enriched uranium still exist, so this is not over by any means," agrees David Albright, the president of the Institute for Science and International Security, which has closely tracked Iran's nuclear program for years.

The independent assessments stand in stark contrast to congratulatory statements from the Trump Administration in the wake of the strikes: "Iran's nuclear ambitions have been obliterated," Secretary of Defense Pete Hegseth said during a Pentagon press conference on Sunday. "The operation President Trump planned was bold and it was brilliant."

Both Lewis and Albright say that the strikes themselves may well have been effective, although it is difficult to say for sure. Satellite imagery shows six deep holes in the ground around Fordo, and ashy debris over much of the site. Albright believes that bunker-busters were used to try and strike at the enrichment facility's ventilation system, along with the main hall where uranium-enriching centrifuges were kept.

"I think the purpose of the attack was to take out centrifuges and infrastructure and they feel they accomplished that," Albright says.

But as evidence that the strikes may have missed the uranium stocks, both Albright and Lewis point to commercial satellite imagery from the days before the strike. The images show trucks at two key sites — Isfahan and Fordo. The trucks appear to be sealing tunnels that serve as entrances to underground facilities used to store uranium, possibly in anticipation of an American attack.

Both experts believe Iranians could have also moved their enriched uranium out of the sites in the run-up to the U.S. strikes: "There were trucks seen in imagery apparently hauling stuff away," Albright says. "One would assume that any enriched uranium stocks were hauled away."

The International Atomic Energy Agency had assessed that Iran has more than 400 kilograms of 60% enriched uranium 235 — enough for around ten bombs, according to independent experts. That 60% enriched uranium is carried in relatively small containers that could fit easily into cars, says Albright.

Although Albright believes the program has been substantially set back, he thinks it could still be reconstituted. He says Iran may also have thousands of uranium-enriching centrifuges that were never installed in Natanz and Fordo. It might be possible to move the uranium to another, covert facility, where it could be enriched to the required 90% for a nuclear weapon in a relatively short period of time. Even then, Iran would have to take further steps to fashion the uranium into a weapon.

"The program has been seriously set back, but there's a lot of odds and ends," Albright says. Ultimately he thinks the only way to truly end Iran's nuclear program is through additional nuclear inspections by international monitors and cooperation from the Iranian regime, probably though some kind of diplomatic agreement.

Lewis agrees: "Even the most brilliant bombing campaign probably is not going to get us where we want to be," he says.

One thing I did find out was that Washington Mutual used to skip alcohol and tobacco stocks. They changed in 2022 because they didn't want to get crosswise with the anti-esg crowd.

The Legal List idea is kind of outdated now. It was replaced in most jurisdictions by the Prudent Investor Rule, especially after the Uniform Prudent Investor Act was adopted by most U.S. states starting in the 1990s. As Modern Portfolio Theory became more widely accepted, fund managers moved toward broader risk-adjusted return frameworks that include a wider variety of asset classes and sectors. Obviously, many funds still follow its the style, but most don’t really talk about it anymore in their marketing or official rules. One big exception is Washington Mutual Investors.

as far as criteria the courts used, it was largely credit quality, dividend history, established blue chippiness, avoiding high risk (junk bonds, penny stocks), needed income focus and there were even industry and sector restrictions.

Thank you for the detail. I now have some new search terms.

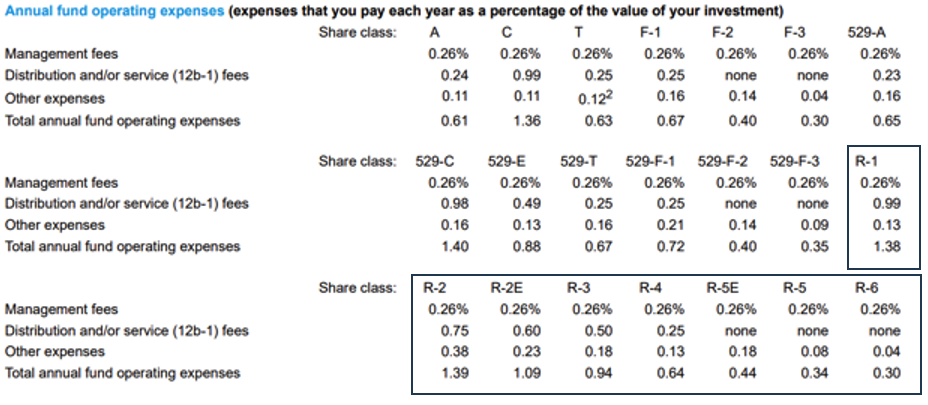

In addition to a bazillion share classes, American Funds has a lot of strategies that seem very similar to each other.

IMO it wasn't always this way. their size has almost created this predicament. There is very little you can do when you try and build a portfolio of a few hundred stocks and are over 100 billion in size.

in the early 90's American Mutual was all Large Value stocks and about 15% bonds. Washington Mutual was 75/25 Large Value/Large Growth and Investment co of Am was a true Large blend. Meanwhile Growth Fund was largely a Midcap blend.

They all still have mild differences and over long periods have slightly different outcomes but in the end its still hard to figure the difference.

Drove up to the island for a couple hours today. Nice there. But the car’s outside thermometer was recording 99 degrees at 6 PM driving home thru Indian River. Hottest I can ever remember seeing anywhere. Not even in FLA have I ever seen it above 95!Reporting from a very hot weather Michigan …

IMO it wasn't always this way. their size has almost created this predicament. There is very little you can do when you try and build a portfolio of a few hundred stocks and are over 100 billion in size.

The Legal List idea is kind of outdated now. It was replaced in most jurisdictions by the Prudent Investor Rule, especially after the Uniform Prudent Investor Act was adopted by most U.S. states starting in the 1990s. As Modern Portfolio Theory became more widely accepted, fund managers moved toward broader risk-adjusted return frameworks that include a wider variety of asset classes and sectors. Obviously, many funds still follow its the style, but most don’t really talk about it anymore in their marketing or official rules. One big exception is Washington Mutual Investors.

as far as criteria the courts used, it was largely credit quality, dividend history, established blue chippiness, avoiding high risk (junk bonds, penny stocks), needed income focus and there were even industry and sector restrictions.

Thank you for the detail. I now have some new search terms.

In addition to a bazillion share classes, American Funds has a lot of strategies that seem very similar to each other.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla