Unsinkable Small Caps: Russell 2000′s Winning Streak Longest In 20 Years Good morning,

It is for certain my small/mid cap sleeve found in the growth area of my portfolio has been the bread winner thus far this year with a year-to-date return of better than 25%. My second best performing sleeve is my domestic equity sleeve found in the growth & income area with a year-to-date return of 10.1% and is followed by my domestic hybrid sleeve which is also a member of the growth & income area with a return of 9.6%. Overall, my investment return for the portfolio as a whole, according to Morningstar's Portfolio Manager, is 8.0% which betters the year-to-date return of the Lipper Balanced Index at 6.3%. Thus far, my better performing sleeves have more than offset my laggards.

As of my last Morningstar Instant Xray analysis (11/25/2016) my asset allocation bubbled at 20% cash, 25% bonds, 33% domestic stocks, 17% foreign stocks and 5% other. This is a little different from my last report of equities being a total of 52%. Seems, my hybrid funds which make up about 40% of my portfolio must have made some asset adjustments for this equity allocation to change. I find it interesting to follow their changing asset movements and how these changes effect my portfolio's asset allocation. I believe, some of my hybrid type funds help keep me positioned in the more faster moving market currents as their investment spectrum encompasses a wide range and variety of assets.

Since, December will soon be here, in only a few days, I don't plan to do any buying until the first part of the new year, if then. During December, I'll collect most of my fund distributions and build cash. I'm not certain what will transpire should the Fed's raise interest rates in December, or January, and it's resulting effects on equities. I do believe it certain that bond prices, for the most part, will continue to adjust downward as interest rates rise. It will be interesting to see what shakes out with the fast money crowd. Since, I am well diverisfied I am most likely to benefit from the fast money crowd's forever changing positioning. I am thinking of adding to my bank loan fund in the near term along with some select stock funds ... but, looking to see how December goes. Looking out, as interest rates rise and when I can get a CD yield in the 2.5% range I'll start to rebuild my CD ladder ... but, CD rates will have to become higher than the average total return I have achieved, thus far, with my short term and limited term bond funds.

To quote a strategy found in baseball ... I am not looking to hit the long ball just play short ball and advance the runners. And, if the long ball should come, perhaps it will score some runners just as the outsized returns of my small/mid cap sleeve, in essence, did.

I hope all had a great Thanksiving ... and, I wish all Happy Holidays as December arrives along with continued "Good Investing."

Old_Skeet

Unsinkable Small Caps: Russell 2000′s Winning Streak Longest In 20 Years FYI: (Click On Article Title At Top Of Google Search)

Perhaps nowhere else in financial markets is speculation on the ultimate success of Trompononics more rampant than in shares of small U.S. stocks.

Small company shares on Friday notch their longest winning streak in 20 years on a shortened Black Friday trading session. The Russell 2000 Index rose 0.4% in in the shortened session to book its 1

5th advance in row. This streak ties a run last seen in February 1996. The longest ever streak, 21, was hit back in 1988.

Regards,

Ted

https://www.google.com/#q=Unsinkable+Small+Caps:+Russell+2000′s+Winning+Streak+Longest+in+20+Years+wsj

CASH RICH FUNDS

AAII Investor Sentiment: Bull Camp Expands For Third Straight Week More Optimism or " a sense of relief that the election was finally over"

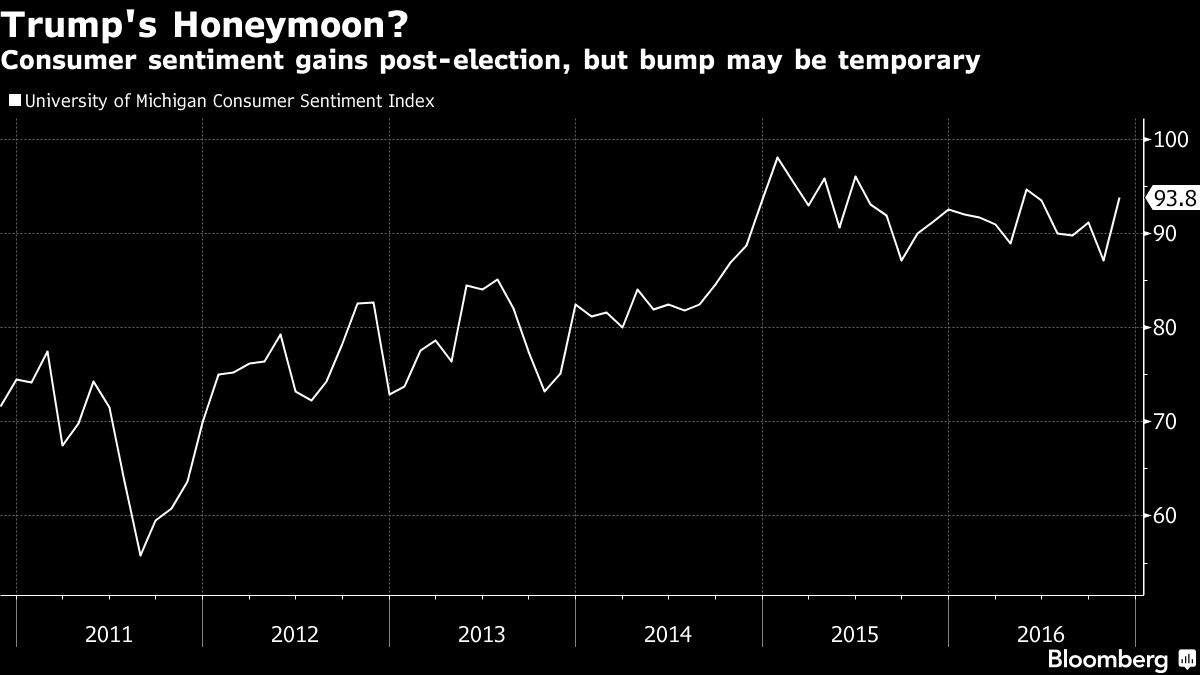

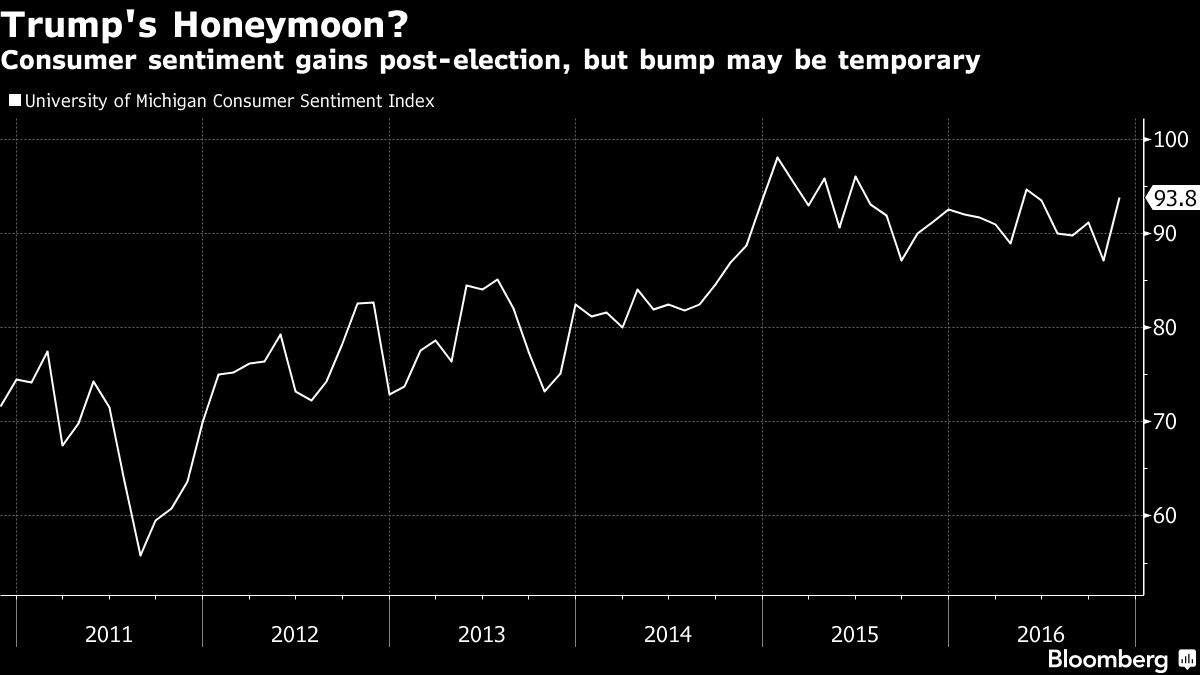

The final index of consumer sentiment for November jumped to 93.8 from a preliminary reading of 91.6, according to a report released on Wednesday.

This report took on added significance because it showed results of the first postelection survey.

"The initial reaction of consumers to Trump's victory was to express greater optimism about their personal finances as well as improved prospects for the national economy," said Richard Curtin, the survey's chief economist.

Curtin said the survey showed that the improved optimism was widespread — across all income and age subgroups across the country.

However, it may have been exaggerated by a sense of relief that the election was finally over he said.http://www.businessinsider.com/umich-consumer-confidence-november-23-2016-2016-11Final Results for November 2016

2016 Y-Y vs 201

5 % Change

Index of Consumer Sentiment 93.8 +2.7%

Current Economic Conditions 107.3 +2.9%

Index of Consumer Expectations 8

5.2 +2.8%

...and it was perhaps exaggerated by what most considered a surprising victory as well as by a widespread sense of relief that the election had finally ended. To be sure, no surge in economic expectations can long be sustained without actual improvements in economic conditions. Presidential honeymoons represent a period in which the promise of gains holds sway over actual economic conditions.

http://www.sca.isr.umich.edu/Image source:

Consumer confidence rose more than previously reported to a six-month high in November, showing Americans became more optimistic about their finances and the economy after Donald Trump won the presidential election.

by Patricia Laya Bloomberg News

November 23, 2016 — 9:00 AM CST

http://www.bloomberg.com/news/articles/2016-11-23/consumer-sentiment-in-u-s-jumps-after-trump-election-victory

AAII Investor Sentiment: Bull Camp Expands For Third Straight Week FYI: he post-election surge in individual investor optimism continued this week as AAII Bullish Sentiment increased from 46.7% up to 49.9%. So after finally breaking above 40% for the first time in

54 weeks last week, now it is testing

50%! This week’s increase in bullish sentiment is the highest weekly reading since January 201

5 and the largest three-week increase (26.2

5 percentage points) in over six years. Think about it this way — in the last three weeks, bullish sentiment has more than doubled!

Regards,

Ted

https://www.bespokepremium.com/think-big-blog/bull-camp-expands-for-third-straight-week/AAII Website:

http://www.aaii.com/sentimentsurvey

John Waggoner: Emerging Markets Sink After Trump Victory The purchase of an equal weighted blend of small cap value,

emerging small cap, and large cap value or mid cap growth from the Nov 1 to May 1 period, then switched to utilities, Long U.S. treasuries, or cash ( depending on risk model heuristic ) from May 1 to Nov1 has produced risk adjusted median rolling 1

5 year total return periods > 1600%

tinyurl.com/hh3ymn8 ( or 22.4% CAGR vs. 14.8% for Berkshire Hathaway since 1986 ) since 19

54.

Would rather examine and trust 60+ years of repeatable empirical data as evidence vs. a couple weeks of post election event market behavior and anecdote !

John Waggoner: Emerging Markets Sink After Trump Victory

Artisan Global Small Cap Fund To Be Liquidated @claimui. Isn't ARTGX doing well because it has some US stocks? higher dollar is what is killing international stocks. One would expect ARTKX to underperform ARTGX.

To clarify, I meant that they are doing well compared to their respective categories. ARTKX is in the top

5-10% for the "foreign large blend" category; ARTGX is in the top 10-20% for the "world stock" category.

You are correct that ARTGX is doing better than ARTKX (presumably because of the better performance of US stocks) on an absolute basis, but ARTKX is doing better than ARTGX when compared to their categories/benchmarks -- although both are doing well in general.