Real Estate Weekly Review: REITs See Biggest Weekly Decline In 2 Years

Oct. 7, 2016 6:

51 PM ET

Hoya Capital Real Estate

Summary

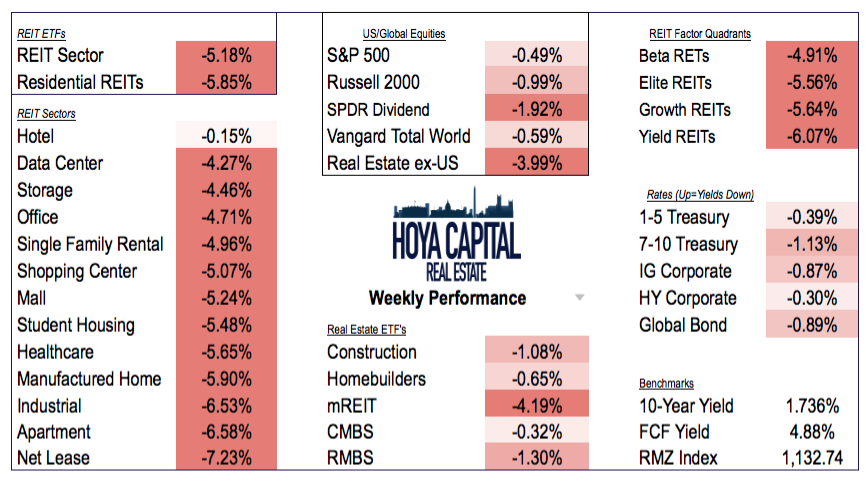

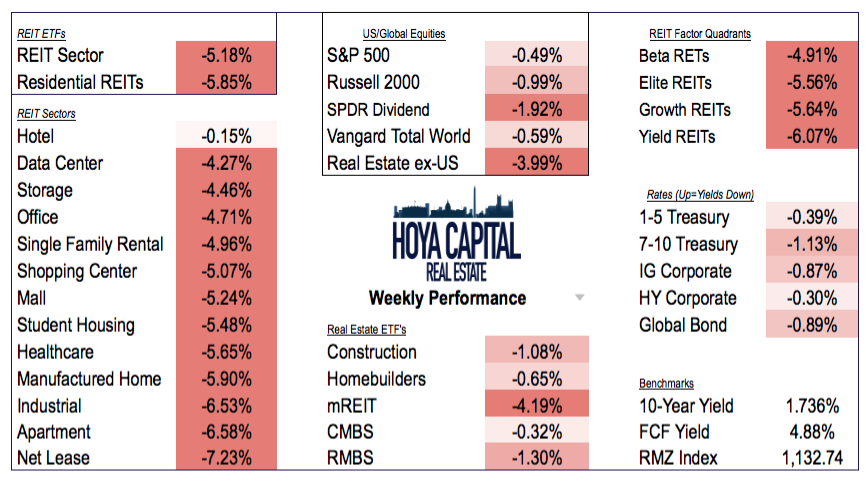

The REIT Index retreated by

5% this week following 2% decline last week. All sectors were lower. REITs are now up only 3% YTD, down 13% from its recent highs.

With graphics and charts

http://seekingalpha.com/article/4010922-real-estate-weekly-review-reits-see-biggest-weekly-decline-2-yearsArticle featuring Cohen and Steers ,the company. Bloomberg.com Charles Stein

September 12, 2016

Cohen & Steers Inc., this year’s top-performing money manager, has prospered by satisfying the appetites of investors who crave higher yields.

Assets at the company, which specializes in real estate investment trusts and preferred securities, rose 17 percent to $61.

5 billion in the first seven months of the year, driven by market appreciation and more than $4.

5 billion in net customer deposits.

The company’s oldest mutual fund, the $6 billion Cohen & Steers Realty Shares, returned more than 12 percent annualized over the past 2

5 years, compared with 9.2 percent for the S&P

500 Index. The fund, up 12 percent this year, has a dividend yield of 2.

5 percent, superior to the payouts on the 10-year Treasury note or the S&P

500. Its performance is similar to the Vanguard REIT Index Fund over the past three and five years.

“Higher-yielding REITs are attractive in a low-yield environment,” said Alec Lucas, a Morningstar analyst who follows the real estate fund.

The attraction extends beyond the U.S. With bond yields depressed throughout the developed world, Cohen & Steers’s president and chief investment officer, Joseph Harvey, told analysts on a July conference call that investors “are scrambling for yield and we believe our strategies will continue to benefit.”

The firm pulled in $840 million during the second quarter from its subadvisory business in Japan through a partnership with Daiwa Asset Management. Most of the money went into U.S. REITs, which are popular in Japan.

The $6.8 billion Cohen & Steers Preferred Securities and Income Fund, which has a dividend yield of

5.3 percent, gathered $1.4 billion in deposits in the first seven months of 2016, data from Morningstar show. Preferred shares, considered a stock-debt hybrid, tend to appeal to income-oriented investors.

http://www.bloomberg.com/news/articles/2016-09-12/year-s-top-money-manager-gets-boost-from-yield-starved-investors