November is up Hi, expat!

Any leads on publicly-accessible versions of NDR's research? I spent about a half hour looking. The links at Ned Davis's "news" page lead mostly to bearish, locked stories. "Given the extent of indicator deterioration, last week's action has moved us closer to the latter conclusion (that the stock market is in the early stages of a bear market)," Ned Davis Research said in a note early Monday" (CNBC Pro) and "By this measure, the current stock market is anything but healthy. The 10-week moving average of weekly readings recently rose to 5.7%, well above the level that many researchers use as the threshold for a “sell” signal. (Fosback, for example, set this threshold at 5%, considering readings above that level as evidence of “extreme market divergence and ... bearish.” The threshold employed by Ned Davis Research, the Venice, Florida-based research firm, is 4.4%.)" (Hulbert).

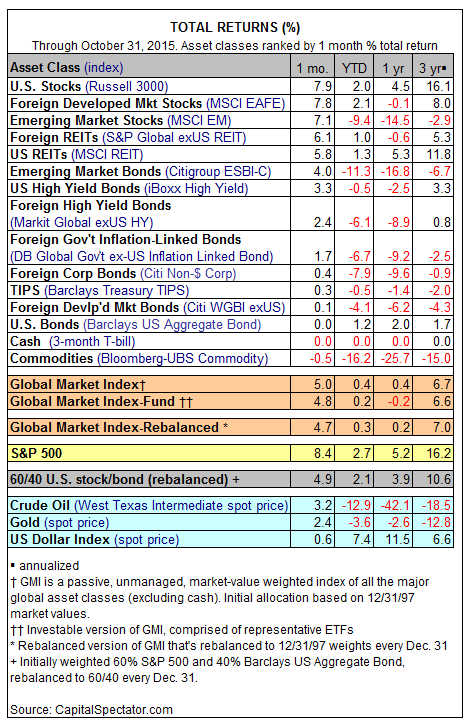

I found one (danged fluffy) piece in Seeking Alpha that quotes an NDR headline ("Bottom in place: Overweight equities") without letting me find or understand the original. I searched for references to Ned Davis and "bull" in news articles for the past month. From that I learned that "Raw materials may be in the fourth year of a 20-year 'bear super-cycle,' according to the Ned Davis Research Group" and that gold might drop into the 600s from its current 1100s (locked article). There's the note that NDR says November - January are the best times to be in the market (I agree). Beyond that, it was pretty slim pickings.

Two things about my occasional (or more than occasional) market commentaries. One is that I try to rely on folks where I can get to the original research or analysis, rather than relying on a CNBC soundbite. I like GMO and Leuthold in particular because they've got a long public record and seem willing to own up to their limits. The other is that my impulse is to be neither bearish nor bullish; mostly I'm trying to get people to think beyond their immediate impulse, whether that's to panic (our September stuff denouncing the panic-mongers) or return to the "permanent high plateau" (November). Since the market goes up more than it goes down, I probably spend more time chanting "remember, thou too are mortal" (memento mori) than "live it up!" (dum vivimus, vivamus).

For what that's worth,

David (who, you're right, isn't grading that stack of papers to his left)