FPA U.S. Value Distributes CGs Early---"Size Matters" Well, for those holding it still, don't say you weren't put on notice. :)

SURPRISE!!! [this notice just came to me via e-mail]:

FPA U.S. Value Fund, Inc. (FPPFX) Estimated Capital Gains Distribution

Los Angeles (September 22, 2015) - As discussed in the June 4, 2015 announcement, “FPA Launches U.S. Value Strategy,” the strategy change has resulted in the realization of significant long-term capital gains. Currently, this amount is approximately $38.00 per share. It is important to note that the actual distribution rate will be calculated as of September 30, 2015, and may change from this preliminary amount. The distribution is payable on October 2, 2015. This distribution will be taxable in 2015 and reported to shareholders on the Form 1099 they will receive in early 2016. FPA expects to reopen the Fund to new investors in October, following the distribution and completion of the portfolio transition.

TOLLX Thanks, catch22. I just noticed that myself. Also, GLFOX is not as heavily invested in energy per se. I see about 8.5 % whereas TOLLX is about 25%. I'm sure that's part of the difference as well.

That's probably the core difference - pipeline companies and other such energy infrastructure names have done terribly this year.

"Smart-Beta" in ETF Structure, the J Hancock/DFA Way More smartness comes to the indexing space in the form of an ETF (believe in the Force, Luke, just believe in The Force).

As first announced (er, sorry, "unveiled"), in July:

http://blogs.barrons.com/focusonfunds/2015/07/13/john-hancock-to-partner-with-dimensional-fund-advisors-on-smart-beta-etfs/John Hancock Investments filed the paperwork with the SEC to offer six factor-based ETFs, to be subadvised by Dimensional Fund Advisors. I assumed they would be some kind of enhanced index funds, or index funds enhanced by some kind of smartness ("smart-beta").

And so they become, as described upon their initiation yesterday:

http://blogs.barrons.com/focusonfunds/2015/09/29/john-hancockdfa-multifactor-etfs-debut/?mod=BOL_hp_blog_fofJohn Hancock Investments’ first exchange-traded funds hit the market on Tuesday.

Hancock’s six “smart-beta” stock ETFs are are driven by Dimensional Fund Advisors, the market-beating investment firm that adheres to the academic work of Eugene Fama and Kenneth French. Four of the index-tracking ETFs target market sectors, while two others aim at large- and medium-sized companies.

John Hancock Multifactor Large Cap ETF (JHML) (0.35%)

John Hancock Multifactor Mid Cap ETF (JHMM) (0.45%)

John Hancock Multifactor Consumer Discretionary ETF (JHMC) (0.5%)

John Hancock Multifactor Financials ETF (JHMF) (0.5%)

John Hancock Multifactor Healthcare ETF (JHMH) (0.5%)

John Hancock Multifactor Technology ETF (JHMT) (0.5%)Who knows? Maybe some or all of them will work out just fine.

I think DFA uses 4 factors to take a measure of things, but I can't recall what they are. Perhaps someone could step into this thread and specify what those factors are.

TOLLX The semi-annual was released on 9/8 and has some information about performance during the relevant period.

GLFOX PP.

5-6, 2nd col. IIRC

TOLLX Thanks, catch22. I just noticed that myself. Also, GLFOX is not as heavily invested in energy per se. I see about 8.5 % whereas TOLLX is about 25%. I'm sure that's part of the difference as well.

TOLLX If interested, one can dig through the composition to discover whether this fund is invested as per its name. I have not reviewed the holdings at the home page of this fund.

Fidelity compositionNote: style map indicates "large value", but investment style per M* indicates sm/mid cap.

TOLLX There are so many stocks/funds in negative territory and getting worse. I've been through this a number of time in my 40-50 years as an investor. And you know what, I mostly held all the stocks/funds I had because they were some of the best. it was painful but profitable and I was never in a position where I had to sell so that's what I'm doing and so should you. Just keep the cash position available for your needs a year or so.

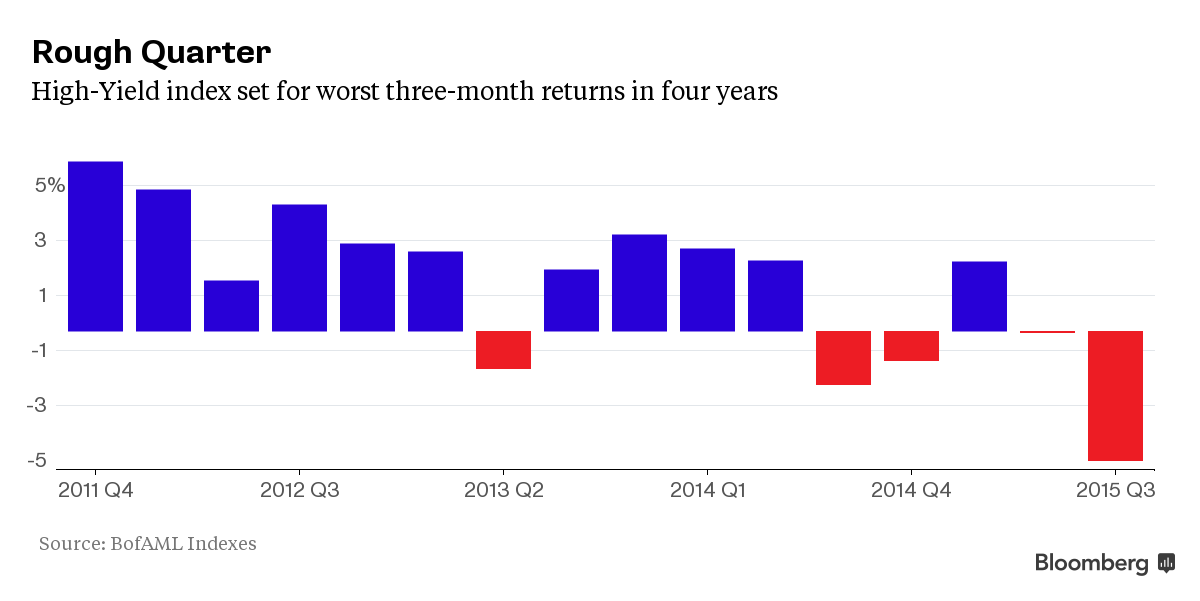

High yield corp bonds getting killed today

2015 Capital gains distribution estimates

Grandeur Peak Global Micro Cap Fund subscription offering info I get where you're coming from and definitely don't disagree with the argument for 1) allocating to small/micro caps (to harvest the "small cap premium") and 2) going active in the space - tons of inefficiencies for good (and even average) managers to generate alpha... 2.00% is just a little steep for me. I don't really like paying more than 1.50%, but did make an exception for GPEOX.

Grandeur Peak Global Micro Cap Fund subscription offering info Sometimes you get what you pay for.

Since inception, Grandeur Peak Emerging Opportunities has outperformed its average peer by 9.5% annually. Global Opportunities has outperformed by 6.5%, Global Reach by 5.0%, and International Opportunities by 4.1%.

While low-cost index funds and ETFs have some advantages, there are also some places where they can't go - or can't go well. International micro-caps are one such place. When last I checked, the SPIVA analysis still showed that as one corner of the market where active beat passive. The reason's simple: indexed products need to be highly liquid and scalable. The space Grandeur Peak specializes in, isn't. Similarly, larger fund companies need products that meet those same requirements (Fidelity would have no conceivable use for a fund that had to close at $25 million or $125 million or pretty much anything short of a few billion) so when they try investing in this space, they limit themselves to the larger, more liquid names. Those, as it turns out, aren't automatically the most attractive opportunities. The French and Fama research, for example, tend to find "the small cap premium" primarily in micro- and nano-cap stocks rather than in the companies with a billion dollar market cap.

One of my better long-term performers is Wasatch Microcap Value (WAMVX), a small fund from the firm that the GP guys left. WAMVX is very small, charges over 2% and has beaten its peers by 2.5% annually for more than a decade. I approached it with the same skepticism that you have, a skepticism that I really do respect. My conclusion was that the manager was capable of earning his keep, so I invested. I'd be happier if he charged 1% and I was ahead by 3.5% annually but that deal wasn't available.

For what that's worth,

David

Grandeur Peak Global Micro Cap Fund subscription offering info It's a compelling fund that they're offering, but I can't see myself investing in this through a taxable account.

Actually, David piqued my interest with his mentioning of YASLX/YASSX in the update email. Down quite a bit for the year, but that's always a great time to jump in. Avg market cap of the portfolio is 569 mm according to M*. Low turnover, quality boutique firm. Question is, how small will they keep it?

It may be a viable option if GPMCX isn't in the cards for everyone.

2015 Capital gains distribution estimates

Sequoia Fund Suffers Big Loss? @rjb112no, it was definitely not in the last

5 years...more like the '08-'09 bottom. I think the fund was probably bleeding assets and needed some inflows.

Sequoia Fund Suffers Big Loss? @scott: yes, I'm quite familiar with the history of the fund, and Buffett closing down his partnerships and recommending the investors go with Bill Ruane. I was referring to any recent recommendations of SEQUX by Buffett.......say in the past

5 years.....

@little5bee: "I just remembered seeing Uncle Warren on CNBC and recommending it. It was open then"

Do you recall approximately what year that was little

5bee?

Thanks!

Sequoia Fund Suffers Big Loss? @little5bee: "I remember Warren Buffett singing the praises of SEQUX during the recession"

@scott: "I believe Buffett has recommended Sequoia as a Berkshire alternative for quite some time."

I've never seen or heard Buffett recommend SEQUX, and would love to see this in writing or hear him.....do you have a reference, source or URL that I can read? Or a URL to an interview of his where he recommends it?

Thanks!

http://www.bloomberg.com/bw/magazine/for-sequoia-life-after-warren-buffett-is-sweet-01052012.html"Sequoia Fund was founded by Richard Cunniff and William Ruane, a friend of Buffett’s since both studied under legendary value investor Benjamin Graham at Columbia University in 19

51. When Buffett shut down his investment partnership in 1969 to concentrate on Berkshire Hathaway, he recommended that his clients invest with Ruane. “Bill formed Sequoia Fund to take care of the smaller investor,” Buffett writes in an e-mail. “A significant percentage of my former partners went with him and many of those still living have their holdings of Sequoia.”

Sequoia Fund Suffers Big Loss? @little5bee: "I remember Warren Buffett singing the praises of SEQUX during the recession"

@scott: "I believe Buffett has recommended Sequoia as a Berkshire alternative for quite some time."

I've never seen or heard Buffett recommend SEQUX, and would love to see this in writing or hear him.....do you have a reference, source or URL that I can read? Or a URL to an interview of his where he recommends it?

Thanks!

Sequoia Fund Suffers Big Loss? I remember Warren Buffett singing the praises of SEQUX during the recession...hmmm...interesting, considering he is a vocal proponenet of everyone paying his/her "fair share". Thanks for the background info

@LewisBraham!

Buffett is a tremendous example of say one thing, do another. I believe Buffett has recommended Sequoia as a Berkshire alternative for quite some time.

Too bad some of the other Berkshire alternatives (Loews, Leucadia) have done poorly in recent years.