Objective and strategy

Driehaus Emerging Markets Small Cap Growth Fund seeks superior risk-adjusted returns over full market cycles relative to those of the MSCI Emerging Markets Small Cap Index. The managers combine about 100 small cap names with an actively-managed portfolio hedge. They create the hedge by purchasing sector, country, or broad market index options, generally.

Adviser

Driehaus Capital Management is a privately-held investment management firm based in Chicago. They have about $12 billion in assets under management as of January 31, 2014. The firm manages five broad sets of strategies (global, emerging markets, and U.S. growth equity, hedged equity, and alternative investment) for a global collection of institutional investors, family offices, and financial advisors. Driehaus also advises the 10 Driehaus funds which have about $8 billion in assets between them, more than half of that in Driehaus Active Income (LCMAX, closed) and 90% in three funds (LCMAX, Driehaus Select Credit DRSLX, also closed and Driehaus Emerging Markets Growth DREGX).

Managers

Chad Cleaver and Howard Schwab. Mr. Cleaver is the lead manager on this fund and co-manager for the Emerging Markets Growth strategy. He’s responsible for the strategy’s portfolio construction and buy/sell decisions. He began his career with the Board of Governors of the Federal Reserve System and joined Driehaus Capital Management in 2004. Mr. Schwab is the lead portfolio manager for the Emerging Markets Growth strategy and co-manager here and with the International Small Cap Growth strategy. In his role as lead portfolio manager, Mr. Schwab is responsible for the strategy’s portfolio construction. As co-manager he oversees the research team and evaluates investment ideas. He is also involved in analyzing macro-level trends and associated market risks. Mr. Schwab joined Driehaus Capital Management in 2001. Both of the managers have undergraduate degrees from strong liberal arts colleges, as well as the requisite graduate degrees and certifications.

Strategy capacity and closure

Between $600 – 800 million, at which point the firm would soft-close the fund as they’ve done to several others. DRESX is the only manifestation of the strategy.

Active Share

Active share is a measure of a portfolio’s independence, the degree to which is differs from its benchmark. The combination of agnosticism about their benchmark, fundamental security selection that often identifies out-of-index names and their calls typically results in a high active share. The most recent calculation (February 2014) places it at 96.4.

Management’s stake in the fund

Each of the managers has invested between $100,000 and $500,000 in the fund. They have a comparable amount invested in the Emerging Markets Growth Fund (DREGX), which they also co-manage. As of March 2013, insiders own 23% of the fund shares, including 8.4% held by the Driehaus Family Partnership.

Opening date

The fund began life on December 1, 2008 as Driehaus Emerging Markets Small Cap Growth Fund, L.P. It converted to a mutual fund on August 22, 2011.

Minimum investment

$10,000, reduced to $2000 for IRAs.

Expense ratio

1.25%, after waivers, on assets of $109.5 million (as of July 2023).

Comments

Emerging markets small cap stocks are underappreciated. The common stereotype is just like other emerging markets stocks, only more so: more growth, more volatility, more thrills, more chills.

That stereotype is wrong. Stock ownership derives value from the call it gives you on a firm’s earnings, and the characteristic of EM small cap earnings are fundamentally and substantially different from those of larger EM firms. In particular, EM small caps represent, or offer:

Different countries: not all countries are equally amenable to entrepreneurship. In Russia, for instance, 60% of the market capitalization is in just five large firms. In Brazil, it’s closer to 25%.

Different sectors: small caps are generally not in sectors that require huge capital outlays or provide large economies of scale. They’re substantially underrepresented in the energy and telecom sectors but overrepresented in manufacturing, consumer stocks and health care.

More local exposure: the small cap sectors tend to be driven by relatively local demand and conditions, rather than global macro-factors. On whole EM small caps derive about 24% of their earnings from international markets (including their immediate neighbors) while EM large caps have a 50% greater exposure. As a result, about 20% of the volatility in global cap small stocks is explained by macro factors, compared to 33% for all global stocks.

Higher dividends: EM small caps, as a group, pay about 3.2% while large caps pay 3.0%.

Greater insider ownership: about 44% of the stock for EM small caps is held by corporate insiders against 34% for larger EM stocks. The more important question might be who doesn’t own EM small caps. “State-owned enterprises” are more commonly larger firms whose financial decisions may be driven more by the government’s needs than the private investors’. Only 2% of the stock of EM small caps is owned by local governments.

Historically higher returns: from 2001-2013, EM small caps returned 12.7% annually versus 11.1% for EM large caps and 3.7% for US large caps.

But, oddly, slower growth (11.2% EPS growth versus 12.2% for all EM) and comparable volatility (26.1 SD versus 24.4 for large caps).

The data understates the magnitude of those differences because of biases built into EM indexes. Those indexes are created to support exchange-traded and other passive investment products (no one builds indexes just for the heck of it). In order to be useful, they have to be built to support massive, rapid trades so that if a hedge fund wants to plunk a couple hundred million into EM small caps this morning and get back out in the afternoon, it can. To accommodate that, indexes build in liquidity, scalability and tradeability screens. That means indexes (hence ETFs) exclude about 600 publicly-traded EM small caps – about 25% of that universe – and those microcap names are among the firms least like the larger-cap indexes.

The downfall of EM small caps comes as a result of liquidity crises: street protests in Turkey, a corporate failure in Mexico, a somber statement by a bank in Malaysia and suddenly institutional investors are dumping baskets of stocks, driving down the good with the bad and driving small stocks down most of all. Templeton Emerging Markets Small Cap (TEMMX), for example, lost 66% of its value during the 2007-09 crash.

Driehaus thinks it has a way to harness the substantial and intriguing potential of EM small caps while buffering a chunk of the downside risk. Their strategy has two elements.

They construct a long portfolio of about 100 stocks. In general they’re looking for firms at “growth inflection points.” The translation is stocks where a change in the price trend is foreseeable. They often draw on insights from behavioral finance to identify securities mispriced because of investor biases in reacting to changes in the magnitude, acceleration or duration of growth prospects.

They hedge the portfolio with options. They call purchase or write options on ETFs, or short ETFs when no option is available. The extent of the hedge varies with market conditions; a 10-40% hedge would be in the normal range. In general they attempt to hedge country, sector and market risk. They can use options strategies offensively but mostly they’re for defense.

The available evidence suggests their strategy works well. Really well. Really, really well. Over the past three years (through 12/30/13), the fund has excelled in all of the standard risk metrics when benchmarked against the MSCI Emerging Markets Small Cap Index.

|

|

Driehaus |

MSCI EM Small Cap |

|

Beta |

0.73 |

1.00 |

|

Standard deviation |

16.2 |

19.1 |

|

Downside deviation |

11.9 |

15.0 |

|

Downside capture |

56.4% |

100% |

|

# negative months |

11 |

18 |

The strategy of winning-by-not-losing has been vastly profitable over the past three, volatile years. Between January 2011 – December 2013, DRESX returned 7.4% annually while its EM small cap peers lost 3.2% and EM stocks overall dropped 1.7% annually.

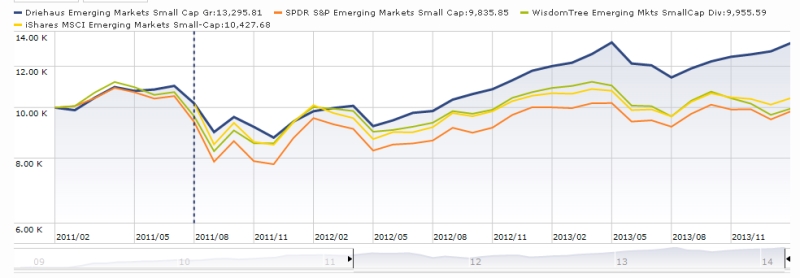

The universal question is, “but aren’t there cheaper, passive alternatives?” There are four or five EM small cap ETFs. They are, on whole, inferior to Driehaus. While they boast lower expenses, they’re marred by inferior portfolios designed for tradeability rather than value, and inferior performance. Here’s the past three years of DRESX (the blue line) and the SPDR, WisdomTree and iShares ETFs:

Bottom Line

For long-term investors, substantial emerging markets exposure makes sense. Actively managing that investment to avoid the substantial, inherent biases which afflict EM indexes, and the passive products built around them, makes sense. In general, that means that the most attractive corner of the EM universe – measured by both fundamentals and diversification value – are smaller cap stocks. There are only 18 funds oriented to small- and mid-cap EM stocks and just seven true small caps. Driehaus’s careful portfolio construction and effective hedging should put them high on any EM investor’s due diligence list. They’ve done really first-rate work.

Fund website

The Driehaus Emerging Markets Small Cap Growth homepage links to an embarrassing richness of information on the fund, its portfolio and its performance. The country-by-country attribution tables are, for the average investor, probably a bit much but the statistical information is unmatched.

Much of the information on EM small caps as a group was presented in two MSCI research papers, “Adding Global Small Caps: The New Investable Equity Opportunity Set?” (October 2012) and “Small Caps – No Small Oversight: Institutional Investors and Global Small Cap Equities” (March 2012). Both are available from MSCI but require free registration and I felt it unfair to link directly to them. In addition, Advisory Research has a nice summary of the EM small cap distinctions in a short marketing piece entitled “Investing in value oriented emerging market small cap and mid cap equities” (October 2013).

© Mutual Fund Observer, 2014. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.