It looks like you're new here. If you want to get involved, click one of these buttons!

Let me see if I've got this right. USPS failed to deliver a letter to you. If not for the good graces of a neighbor, you never would have known what happened to the letter, let alone recovered it. And you are willing to place any measure of trust in the USPS?I was recently notified by USPS Informed Delivery that a letter from TRP will be delivered. ... I did not receive the said letter... Two days later my neighbor brought over the TRP letter.

...

I would trust USPS over TRP for service reliability.

https://www.journalofaccountancy.com/news/2009/feb/late1099bmailings/Until this year [2009], the deadline for sending Form 1099-B, Proceeds From Broker and Barter Exchange Transactions, was Jan. 31, the same as for Form W-2 and other information reporting forms. Congress extended the deadline to Feb. 15 in the Emergency Economic Stabilization Act of 2008, which also will require brokers to report the cost basis of securities sold, effective in phases starting in 2011.

The article showed the sector changes over 4 years.FUNDS. Ivascyn (and Murata) of multisector giant PONAX / PIMIX are loading up on agency MBS and TIPS but reducing exposure to corporates, nonagency MBS (a Pimco specialty) and HY. Credit spreads are tight, stocks are (still) expensive, so it's focusing on credit quality. The yield-curve is almost flat. He doesn’t expect high inflation or recession and has increased Fund duration a bit. Fund is well positioned for 5-yr timeframe and has a generous distribution. It’s unclear how (or, if) the Administration will calibrate policies with economic data and market signals. (etf cousin is PYLD, riskier CEF cousins are indefinite-term PDI and limited-term PDO, PAXS.) (By @LewisBraham at MFO).

https://www.barrons.com/articles/top-bond-fund-manager-buying-now-2168a117?refsec=funds&mod=topics_funds

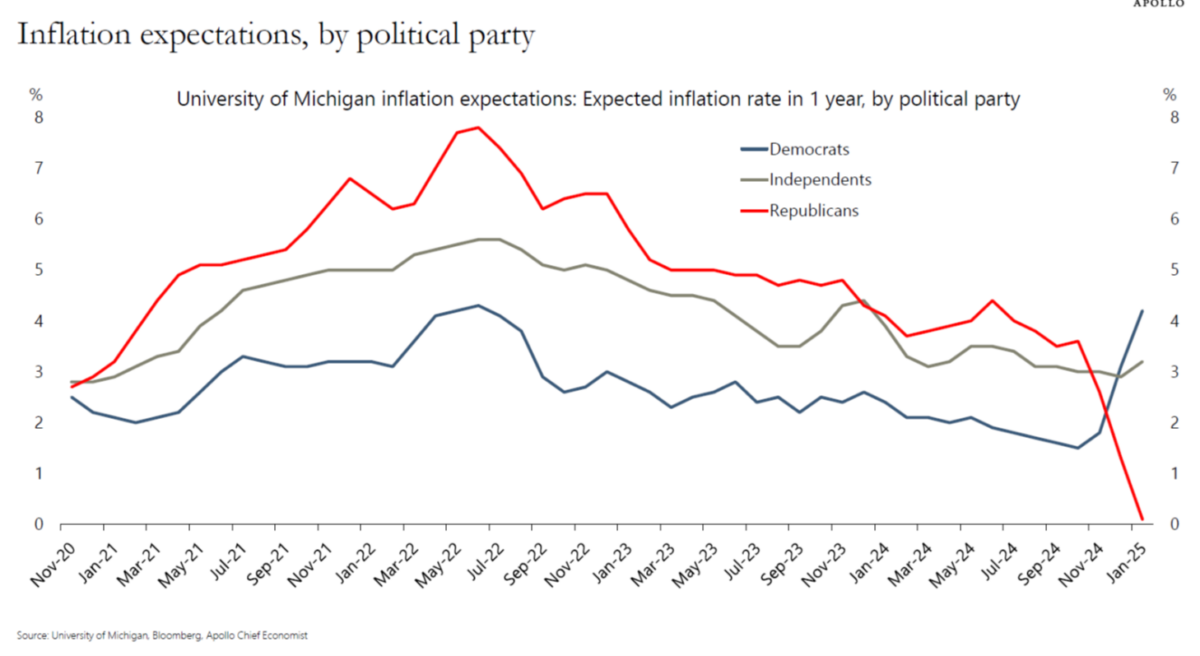

I read Yardini from yesterday and thought of you.It's amazing how many people are so sure that stock decline is related to a prez they don't like.

But when the price goes up they forget it conviently.

U.S. safety regulators on Thursday recalled virtually all Cybertrucks on the road, the eighth recall since deliveries to customers began just over a year ago.

The National Highway Traffic Safety Administration’s recall, which covers more than 46,000 Cybertrucks, warned that an exterior panel that runs along the left and right side of the windshield can detach while driving, creating a dangerous road hazard for other drivers, increasing the risk of a crash.

The stainless steel strip is bound to the truck’s assembly with a structural adhesive, the NHTSA report said. The remedy uses an adhesive that’s not been found to be vulnerable to “environmental embrittlement,” the NHTSA said, and includes additional reinforcements.

Five of the Cybertruck’s recalls have required Tesla drivers to bring their vehicles into the shop. The most sweeping have included recalls related to failed front windshield wiper motor controllers and malfunctioning pedal pads, which Tesla said were treated with an unapproved soap during assembly that allowed them to become trapped, leading to “unintended acceleration.”

Even before the Cybertruck began to roll off production lines, the truck was subject to snafus and delays. Its glitzy 2019 unveiling event may be most memorable for an incident in which a prototype’s supposedly unbreakable glass failed to stand up to a metal ball thrown at its driver window. Amidst the pandemic, Tesla pushed Cybertruck production from 2021 to late 2022 and finally to late 2023. Meanwhile, its base price jumped from $40,000 to $61,000.

Leaked internal documents later obtained by the German newspaper Handelsblatt and WIRED showed that, by January 2022, Tesla was still struggling internally with a preproduction “alpha” version of the vehicle, which had basic issues with suspension, body sealing, noise levels, handling, and braking.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla