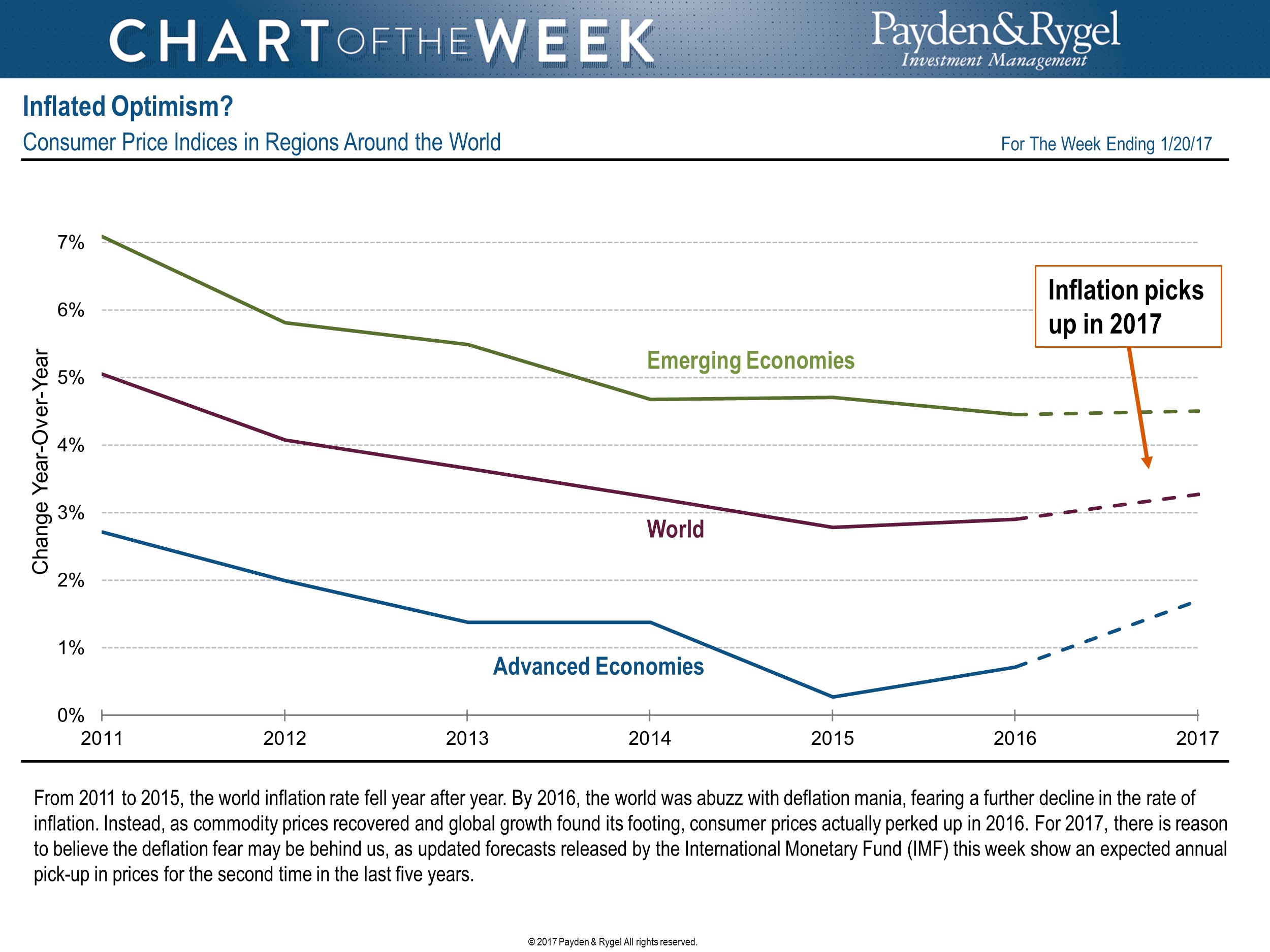

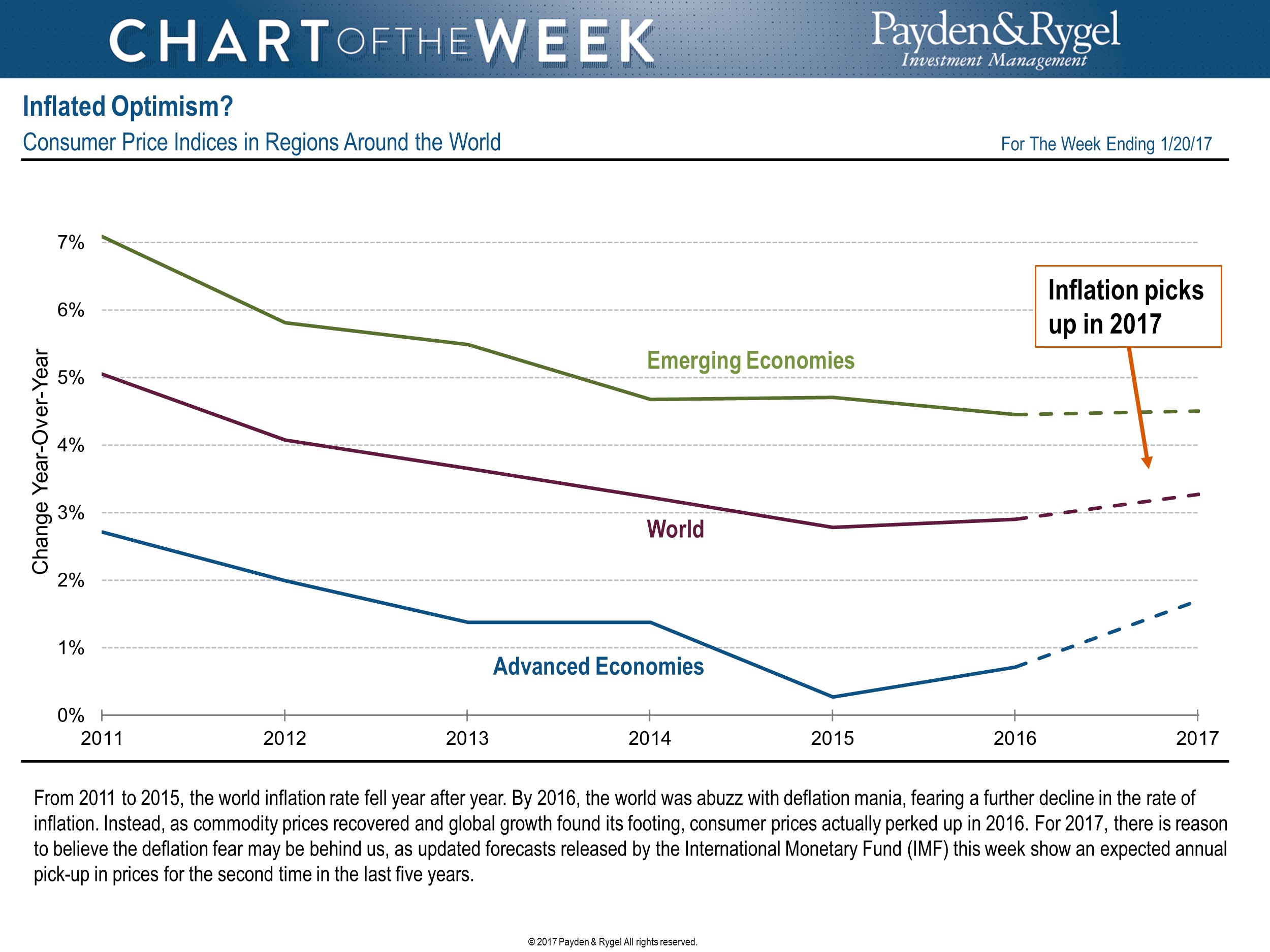

Inflated Optimism?

Economic Overview:Week Ending January 20, 20

17 © 20

17 Payden & Rygel All rights reserved.

From 20

11 to 20

15, the world inflation rate fell year after year. By 20

16, the world was abuzz with deflation mania, fearing a further decline in the rate of inflation. Instead, as commodity prices recovered and global growth found its footing, consumer prices perked up in 20

16. For 20

17, there is a reason to believe the deflation fear may be behind us, as updated forecasts released by the International Monetary Fund (IMF) this week show an expected annual pick-up in prices for the second time in the last five years.

Highlights of the Week:Treasuries:

Highlights of the Week:Treasuries: Treasury markets absorbed stronger inflation and housing data this week. Yields ground higher every day in this holiday-shortened week. The icing on the cake was Yellen’s speech on Wednesday where no one anticipated any remarks with regards to monetary policy and received hawkish ones at that.

Securitized Products: The ABS market is following along with Ford auto receivables bringing a fully compliant ABS deal both regarding the 5% risk retention requirement and full loan level disclosure. The queue for next week is also full of issuers ready to hit the marketplace.

High Yield:In this environment, the market has room to compress further, particularly given low expected default rates. Prudent, valuation-conscious investors should be rewarded.

Emerging Markets: The latest activity

data from China was a reminder of the country’s adjustment from investment-led to consumption-driven growth. December industrial production and xed asset investment growth eased modestly to 6.0% year-over-year (y/y) and 8.

1% y/y, respectively, while

retail sales came better than expected at 10.9% y/y.Municipals Municipal bond funds experienced a second consecutive week of in ows, taking in an additional $511.74 million. Investor demand has been strong, with $10 billion in new issuance well received and broad follow-through in secondary trading.

https://www.payden.com/weekly/wir012017.pdf

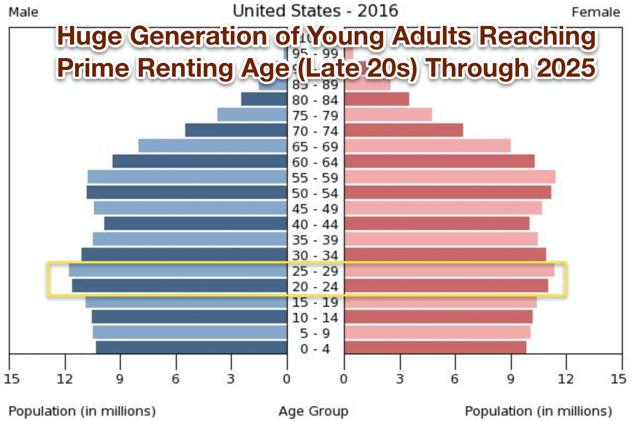

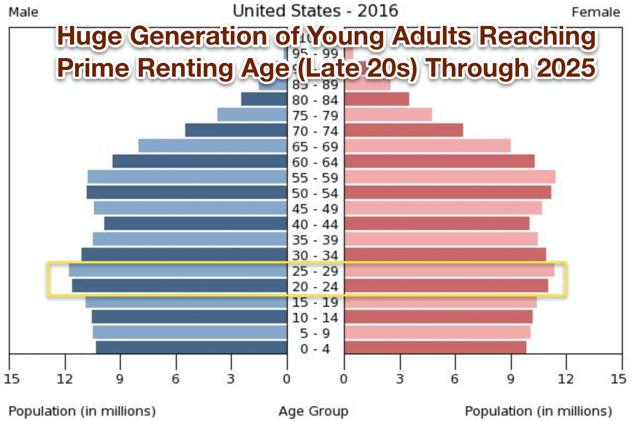

Honey. I think the kids are (finally ) leaving ! + We Look Back At Obama Years From Hoya Capital

...demographics over the next ten years are highly favorable to apartment demand. Rent growth data will certainly be interesting over the next several years: it will be a battle between high levels of supply and high levels of demand.

Real Estate Weekly: Trump Takes Office, We Look Back At Obama Years

Hoya Capital Real Estate Jan. 20, 2017

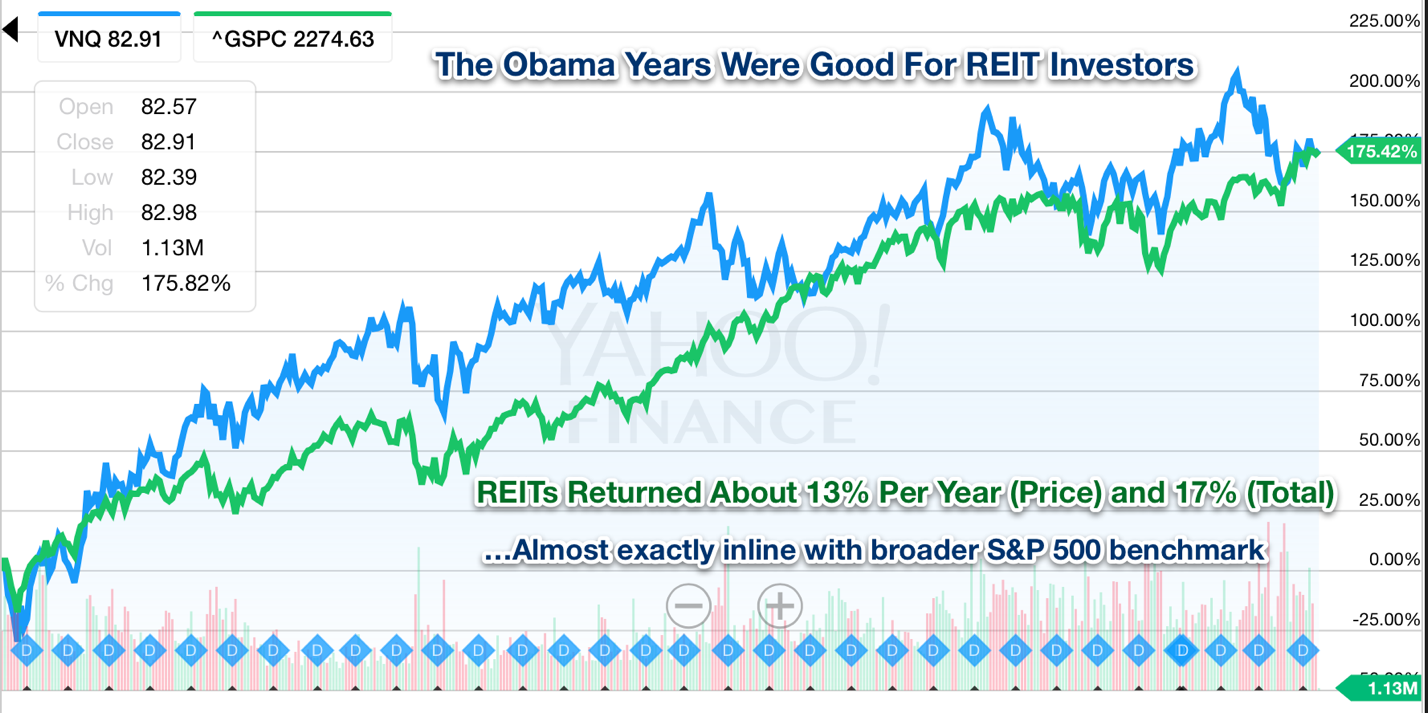

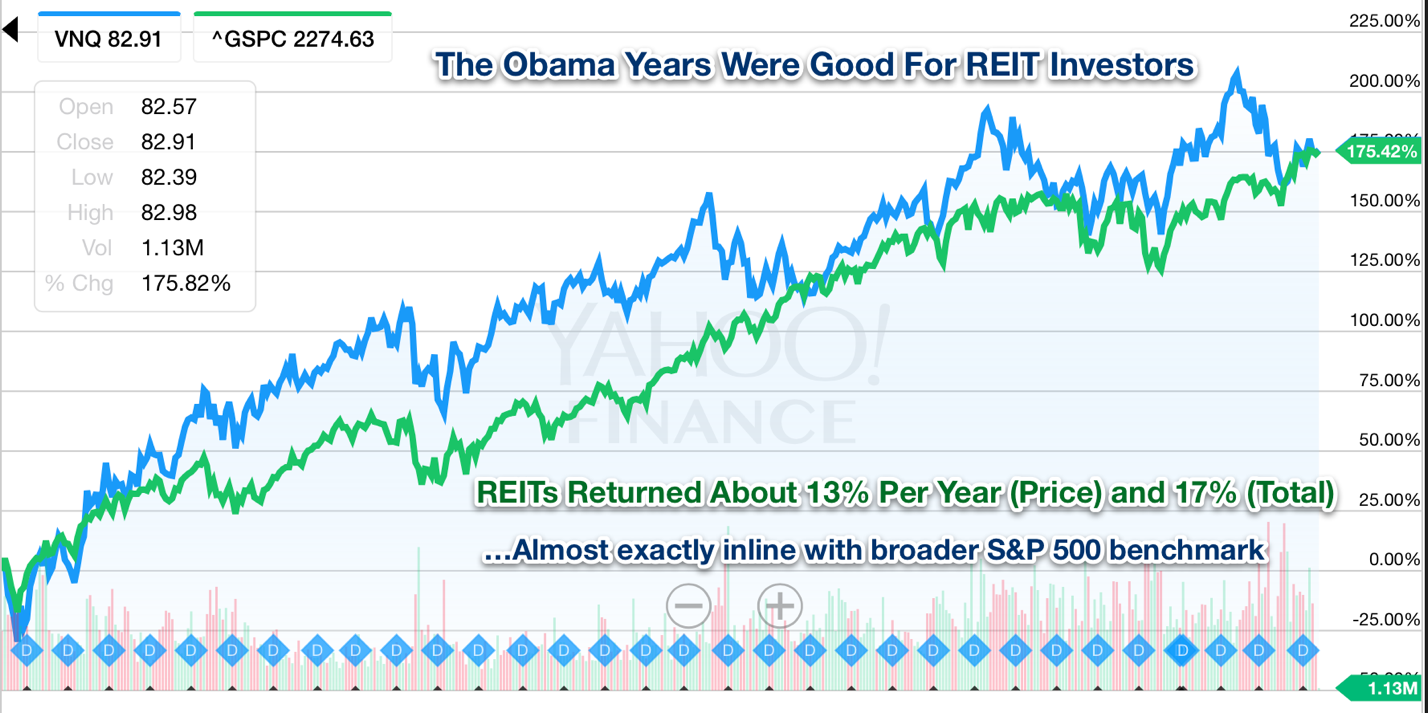

With Donald Trump taking office this week, we think it's interesting to look back at the performance of REITs under the Obama Administration.

REITs returned an average of 13% per year (price) and roughly 17% including dividends. Interesting, this 175% holding period return is almost exactly inline with the broader S&P 500 index.

It's important to note the context, though. Obama took office at almost the exact bottom of an 80% decline in REIT values over the preceding 18 months as the REIT ETF bottomed just a month after inauguration.

Bottom Line So how will real estate perform under Trump? Well, we can pretty confidently say that commercial real estate won't perform as well under Trump as they did under Obama, but that should be rather obvious. Trump enters office at a time that commercial real estate values are near record highs and valuations appear healthy. Based on prevailing cap rate and economic growth expectations, REIT investors should continue to expect a 5-8% average annual total return with plenty of annual volatility.

http://seekingalpha.com/article/4038310-real-estate-weekly-trump-takes-office-look-back-obama-years

Treasury yields are up since Election Day. The benchmark 10-year Treasury is currently trading at 2.47% (as of Jan. 19, based on daily data via Treasury.gov). That’s up from 1.90% on Election Day and close to the highest level in two years.

http://www.capitalspectator.com/moderate-us-growth-prevails-at-dawn-of-trump-era/