“Other” in Fido’s analytics tool? (Excerpted from Fidelity’s Glossary of Terms

“Other-The "Other" category includes non-asset class holdings (i.e., other than stocks, bonds, and short-term investments), including, without limitation, derivative securities, options, preferreds, convertibles, warrants, and precious metals, as well as some Internal Revenue Code Section 529 qualified tuition program (529 plan) investment trust holdings.”

“Other Holdings-Any interest held in a selected account that cannot be placed within one of the following categories: Equity, Fixed Income, Cash, Mutual Fund, or Exchange Traded Product (ETP).”

My attempt to sort these components out on a specific fund basis was unsuccessful.

Added - Follow-up Ques:

* Can we assume that if your fund invests in commodities or real estate it is likely doing so through derivatives and so those investments would be included under Fidelity’s “other” classification?

September Commentary, The Young Investor’s Indolent Portfolio @Charles, good to see addition of eTF benchmarks (eTF to avoid confusion with MFO Premium ticker ETF - not recognized at Yahoo Finance, Morningstar, etc).

Just to clarify my understanding of the related MFO Premium data, these new benchmarks are used to assess relative performance only, and the MPT stats are largely unchanged. So, we see various levels of depth of data, but no additional column added for the eTF benchmarks.

R vs peer, BF BM, SP

500, etc (widest possible benchmarks)

beta vs SP

500, BF BM

alpha vs ? (unspecified; Definitions generically mention benchmark)

Of course,

SD isn't benchmark dependent. Similar for

Sharpe Ratio.

MFO Risk is also relative to overall market "as defined by SP

500 index".

AAII Sentiment Survey, 9/4/24 AAII Sentiment Survey, 9/4/24

BULLISH remained the top sentiment (4

5.3%, high) & bearish became the bottom sentiment (20.4%, low); neutral became the middle sentiment (29.8%, below average); Bull-Bear Spread was +20.4% (high). Investor concerns: Elections, budget, inflation, economy, the Fed, dollar, Russia-Ukraine (132+ weeks), Israel-Hamas (47+ weeks), geopolitical. For the Survey week (Th-Wed), stocks down, bonds up, oil down, gold down, dollar flat. NYSE %Above

50-dMA 61.38% (positive). Large divergence between 2-yr at 3.76% & fed funds

5.2

5-

5.

50% (2-yr is an indicator of where the fed fund rates may be headed in a few months). #AAII #Sentiment #Markets

https://ybbpersonalfinance.proboards.com/post/1640/thread

Berkshire Hathaway: A mutual fund in disguise? From my memory of the last Q, BRK has about $600b in investments + cash. So, the operating businesses are being valued by the markets at $400b. They make about $40-50b (annualized) in profits.

Buy Sell Why: ad infinitum. I believe I’m done on this thread. Friday I consolidated down from 10 positions (10% each) to 8 positions (12.5% each). One of the 8 positions is cash - but largely kept in short term bond funds. The 2 positions dumped were the long-short fund NLSAX and a 3-stock collection that totaled 10%. While FLO has climbed a little this week, both NSRGY and RIO have gotten hit since I sold. RIO in particular looks to be down 6 or 7% over the past couple days Whew! Made a little playing - but not worth the time, attention, aggravation individual stocks require. I’ll leave that game for some of a different temperment.

September Commentary, The Young Investor’s Indolent Portfolio Hi David, And yes, for the young one's to start investing. Many can't or won't for a variety of reasons; but for those who can help promote such a situation, do your best to poke and prod. The results can be very gratifying on a personal level. The investments can be very simple for the task.

Thank you for your write; and everyone else for the contributions this month.

From my write of August 22: A Conservative portfolio design, thread.

A real world example of a very lazy portfolio using two index funds.

Criteria:

--- Utah 529 education account, open for 18 years

--- inception, May 2006

--- self directed with self choice(s) of investment sectors

--- 13 years of contributions (1st and 15th of each month) = $ cost averaging

--- 5 years to date; no additional contributions

--- the 50/50 equity/bond portfolio is reset to 50/50 each September, per the Utah 529 contract

The institutional funds (for 529 accounts) are VITPX (U.S. Total stock market) and VBMPX (U.S. Total IG bond market). All distributions reinvested in the fund(s).

The annualized returns data are from Vanguard, M* and the 529 account.

--- annualized 15 year combined return = 8.125%

--- YTD return = 10.47%

Remain curious,

Catch

DJT in your portfolio - the first two funds reporting (edited) From a

report in The Guardian:Stock plunge wipes out Trump Media’s extraordinary market gains

Shares in Trump Media & Technology Group (TMTG ), owner of Truth Social, closed below $17 on Wednesday, reversing all their gains since the company’s rapid rise took hold in January.

The former president has been prohibited by a lock-up agreement from starting to sell shares in the firm until late September. While his majority stake in the firm is still worth some $2bn on paper, its value has fallen dramatically from $4.9bn in March.

As a business, TMTG is not growing rapidly. It generated sales of just $4.13m in 2023, according to regulatory filings, and lost $58.2m.

Nor is Truth Social growing rapidly as a platform. While TMTG has not disclosed the size of its user base, the research firm Similarweb estimated that in March it had 7.7m visits – while X, formerly Twitter, had 6.1bn. That same month, however, TMTG was valued at almost $10bn on the stock market.

Comment: Knowing Trump, I'm sure he's using this paper loss to offset actual income somehow, somewhere.

Americans Are Really, Really Bullish on Stocks If you followed FD's guidance, you regularly purchased and sold funds

at very opportune times and never experienced losses greater than 3%!

What's not to like?

Easy, peasy... ;-)

When US LC are not doing well (2000 - 2009), it's an easy way to lose money for years!

However, FD does not believe in diversification (regardless of the empirical data)

and would like everyone to know he wouldn't be caught dead in an underperforming fund

for any appreciable length of time.

First, you take things out of context. If you want to present what I do, please be accurate. The 3% loss is only for bond funds + a tedious trading + selling to MM in high risk markets.

Second, my older system when I was an accumulator:About every 4 months, I screened wide-range funds and selected the best risk/adjusted performing funds based on 1-3 months + also looking good for 1-3 years. This exercise limits funds that lag for months-years. The main idea is to be mostly in the right 1-2 categories.

You can see an example for indexes (I used managed funds because I believed in star managers) (

here).

DJT in your portfolio - the first two funds reporting (edited) Some would say $1 is quite generous.

Might be worth a gambit at $1

5.98. I see a reasonable chance the election ends up in the courts. Stock would soar briefly in that event. Then sell it fast before the final verdict is rendered.

Gotta know when to hold ‘em - know when to fold ‘em … :)

BONDS The week that was.... December 31, 2024..... Bond NAV's...Most positive. FINAL REPORT 2024 The Bloomberg Aggregate Bond Market Index, which BND tracks, dates back to 1976.

Let's put this in perspective.

Prior to 2022, the index experienced only four calendar year losses:

1994 - (-2.9%)

2013 - (-2.0%)

2021 - (-1.5%)

1999 - (-0.8%)

The Bloomberg Aggregate Bond Market Index's 13% loss in 2022 was, by far, its largest loss ever.

The performance that year was highly irregular.

It was irregular. The following are not the "norm" either...losing twice 40-

50% during 2000-2009 or BND making only 1.7% annually for 10 years or QQQ making over 1600% since 04/2009.

LT stats do not tell us about the markets ahead of us. If you join/avoid 1-2 of these, it can improve someone's portfolio by a lot.

BTW, these are not weekly/monthly trades, some of them are years in the making.

Americans Are Really, Really Bullish on Stocks I do my best to steer clear of The Crowded Trade. It's fun, too, to uncover a good stock that's not getting much or any attention. No more penny stocks for me, though. Diversify, but do not di-worse-ify. Growing cash at the moment. Bullish, but valuations are very high. My plan is to let my stuff ride. When there's a pullback, I'll buy.

For years now the top high tech drove the US stock market to new highs and much more than international, SC, and value. You could used SPY,VOO or QQQ was better. These companies are globally well known.

If you missed them, you made less money.

If you bought others, you made less money.

If you were out waiting for an opportunity, you made less money.

If you thought they are overvalued, you made less money.

If you stayed clear of the crowd, you made less money.

When US LC are doing well, it's the easiest way to make money and it lasts for years. 199

5-2000 + 2009-2024 is more than 20 years

Berkshire Hathaway: A mutual fund in disguise? @ybb. Don't know enough to assess point 1. But point 2, yes, seems fair.

March 2020 unsettled even The Great One. He's in good company. He moved quickly enough to dump all the airline holdings though.

The Fed and Congress really did respond quickly, fortunately for us. Like going to war, but instead of paying people to build airplanes and bombs, they paid them to stay home ... and, likely, not topple the government. Actually, many governments did same thing.

Those images of stacked coffins rocked our world.

The value investing environment you describe sounds right too.

People only invest if they perceive there is a future. Even value investors! In March 2020, for a few short moments, it felt like an asteroid was inbound.

So, likely took a while for WB and company to recover.

Those who did not hesitate and jumped into BRKA (and other funds) during that time have been rewarded handsomely.

They still believed!

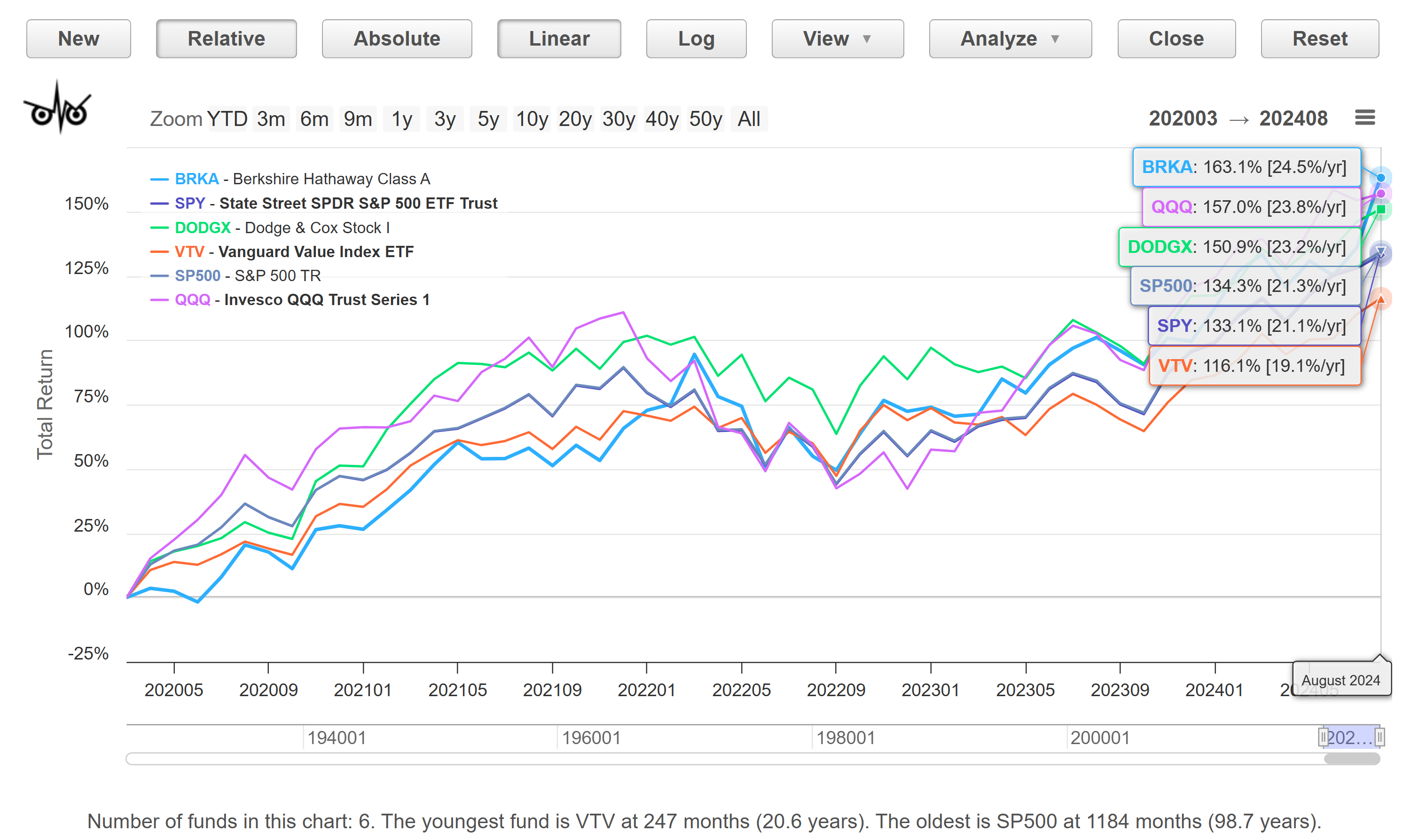

Performance Since COVID Trough - March 2020

DJT in your portfolio - the first two funds reporting (edited) DJT closed at $16.98 per share, down another 6% today, Wednesday Sept 4. It's obvious that Biden and the Democrats HAVE RIGGED THE STOCK MARKET TOO !!!!!

It's still $1

5.98 overpriced though....

(I'll give $1 of value in their share price to reflect their IT equipment and other capital expenses lol)

When Interest Rates Go Down, Hucksters Spring Up

BoC cuts, eyeing more ahead. News link.

RIP Bob Brinker (82) Many listened to his radio shows or subscribed to his newsletter "Marketimer" - despite its name, it didn't promote active timing. His approach was simple and steady investing and he focused on financial freedom. He rarely made big calls, but when he did, those moved the markets. I think that we was aware of this, so he made/published big calls rarely.

From X/Twitter

LINK,

https://tipswatch.com/2024/09/04/remembering-bob-brinker-and-his-life-changing-advice/

Berkshire Hathaway: A mutual fund in disguise? @Mark. Devish enlightened me once about BRKA's moves to cash. Unlike say Eric Cinnamond's funds, and I'm a fan, owning BRKA doesn't come with a 1.4

5% er. And there is no tax consequence. None that is apparent, anyway. As for not holding SP

500, see comment below.

Berkshire Hathaway: A mutual fund in disguise? I think BRK currently stands with roughly 45% cash after all the selling. I thought Mr. Buffett was a fan of the S&P 500. Timing maybe?

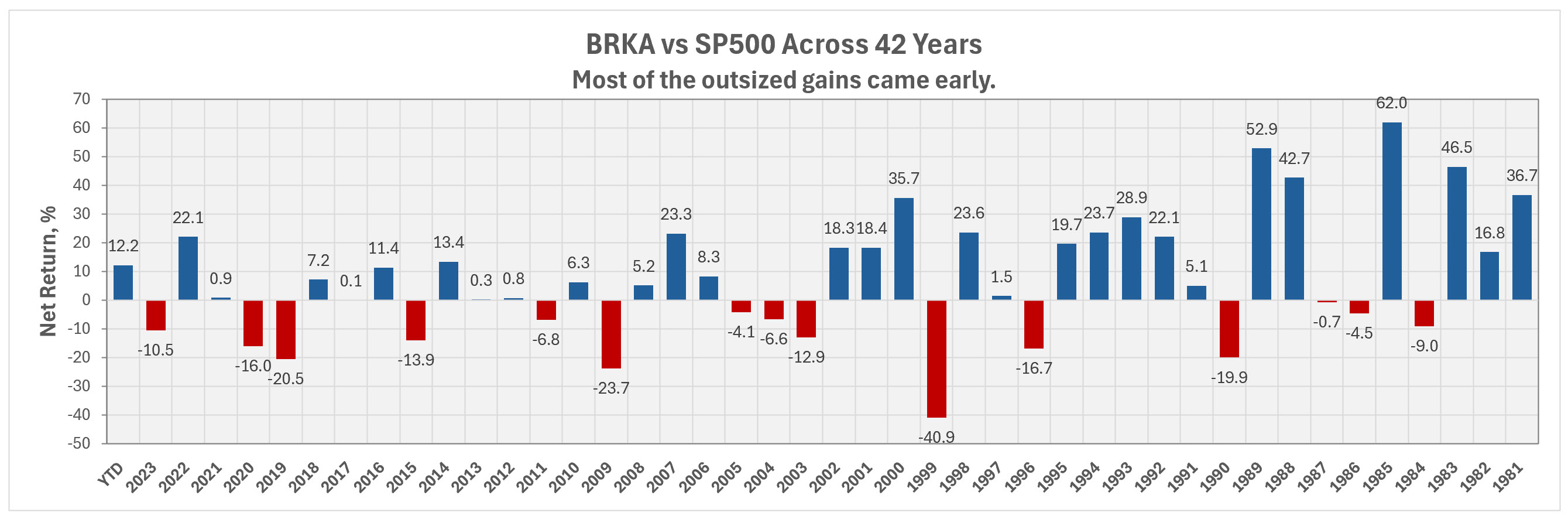

Berkshire Hathaway: A mutual fund in disguise? Certainly, wonderful this year!

But, in fairness, most of the outsized returns (versus say SP

500) came in first 20 years, not the last ...

Berkshire Hathaway Calendar Year Outperformance

Berkshire Hathaway Past 20-Year Growth

And without last month's August surge, SPY and BRKA dead even on this chart.

Americans Are Really, Really Bullish on Stocks "Americans have rarely been this giddy about the stock market.

They are piling into stocks as major indexes reach new highs and placing bets

that the rally that has driven the S&P 500 up 18% this year has more room to run.""Investors have been reassured in recent weeks by data showing the economy is still humming along

and Federal Reserve Chair Jerome Powell’s signals that an interest-rate cut is just a few weeks away.""Even during the brief turmoil in early August, investors kept buying stocks.

U.S. equity funds drew inflows for eight consecutive weeks through late August, according to EPFR data."Contrarian indicator?

BTW, where are the dental patients' yachts?

https://www.msn.com/en-us/money/markets/americans-are-really-really-bullish-on-stocks/ar-AA1pSZoi