Do you hold gold mutual funds in your portfolio? OP, as of this writing, gold comprises 5.8% of my financial assets. Most of that is bullion in the form of 1oz Maple Leafs which I self-custody. A lesser portion is in the bullion ETF SGOL, in my IRA. Most of the bullion was acquired in 2000-2003. My investment framework does not consider gold to be an investment, but rather portfolio insurance. We insure our home, our car, our health, and our life. Seems like a no-brainer to insure the portfolio which makes these other assets possible. Unlike those other insurances -- where your premium is paid to an insurance company, gold is still your asset.

Have to laugh at the silly objections I sometimes read from the gold-haters.

Go to portfoliovizualizer.com. Run a asset comparison from 2000-current. Gold has actually outperformed the S&P. Its true if you stretch back the time to include the 80s-90's Superbull, the S&P outperforms. But keep in mind, the 'setup' for that 20 year period of outperformance was very cheap equities. We have no such setup for equities here. So the likelihood of a massive outperformance by equities vs gold strikes me as unlikely.

Some argue 'if you are a good stock trader, why buy gold'. Well, some people seem to inhabit Lake Woebegone, where everyone is 'above average'. I don't live there.Moreover, think back to the great traders of the 1990s. Where are they now? Consider, a lot of people who manage money professionally, are highly overrated, IMO. Consider Bruce Berkowitz (Fairholme). Or more recently, Kathy Woods Retail investors have increasingly moved to indexing because 'trading' is less of an investment strategy, and more of a hobby/recreational activity. Most professionals do not beat their best-fit index over time. Buy an index. And buy some gold.

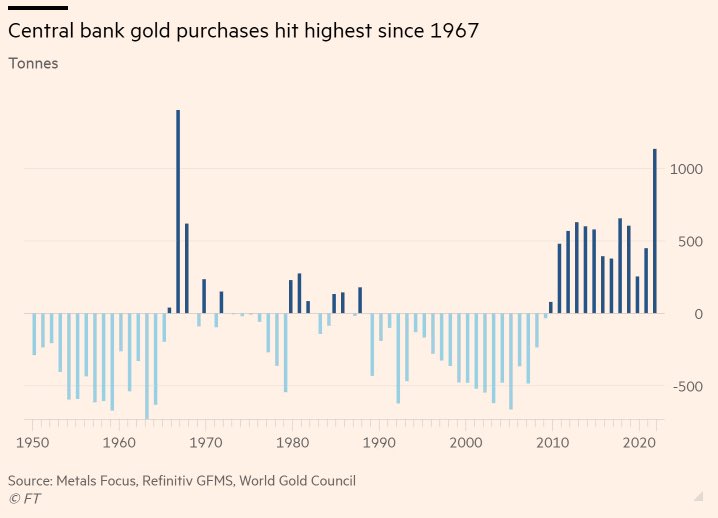

I know, I know, Warren Buffet hates gold. You know who likes gold? The Federal Reserve, the BOJ, the ECB, the BOE, the Bank of China, and every other CB. Maybe they are just too dumb to understand that gold is a worthless 'barbarous relic'? More likely, they have an institutional understanding of long-term cycles of what we call 'money', and that gold is, ultimately, the "base money" on which every monetary system is based. Many Asian cultures prominently use gold as a way to store their household wealth. They do this because they know their govts end up ruining their fiat and banking systems. Gold is UNDER-owned bigly in the West, because no living person has experienced what it is like to have a major monetary reset. Maybe we won't experience it -- but taking out some insurance seems prudent to me.

Bringing it back to a more 'personal' perspective, the bullion which I self-custody is 'private money'. No custodian is telling the govt you have it. No future ex-spouse, can demand a chunk of the asset which she doesn't know about. No future creditor can lay claim to it, unless you volunteer the info.

My post is long in the tooth. It's late. I'm tired. So I will stop here.

January MFO Ratings Posted Just posted all ratings to

MFO Premium site through May, which includes month to date performance through Friday,

5 July.

The holiday week was a good one for equities! Weeks To Date (through yesterday), QQQ up 21.

5% and SPY 17.4.

The Mid-Year Review is now Wednesday, 10 July, at 11 a.m. Pacific, where we will discuss latest features, including Flows and ETF Benchmarks (a Deveshism). Please join in by registering

here.

January MFO Ratings Posted Word of caution on CD ... Schwab and Fidelity post highest yielding rates on their CD summary table. Unfortunately, nearly all these are callable. Non-callable seems to be about 0.5% lower. Something to consider, especially with ladders.

I've recommended that they add a row for highest yielding callable and well as non-callable rates; otherwise, it feels gimmicky and misleading. I'm confident they will take my recommendation to heart.

A good description of what I'm seeing from Fed site:

"Investors often turn to federally insured certificates of deposit, sold by banks or brokers, when stock markets are volatile. Rising interest rates and stock market drops have made CDs more attractive, especially to older investors. But what many investors don't realize - and some stockbrokers apparently aren't adequately disclosing - is that, unlike traditional CDs, with 'callable' CDs only the issuer, and not the investor, can redeem the CD without a substantial penalty. Callable CDs are being marketed via newspaper ads, telephone solicitations and direct mail."

Bloomberg Real Yield 05 July show seems not to be available?

Did they have a show yesterday? I do not recall Comcast giving me the recording. May be Bloomy gave some staff a long weekend.

Bloomberg Real Yield 05 July show seems not to be available?