It looks like you're new here. If you want to get involved, click one of these buttons!

I have some limited indirect exposure. But I do not hold any gold / precious metals funds or stocks at this time..If so, what is your rationale, and what has your experience been?

I agree with the above and what I have been posting for many years.Studies have indicated exploiting the momentum factor can generate alpha.

Skilled traders who use momentum may be able to harvest some of this alpha.

Numerous studies also indicate active trading often leads to poor performance.

I contend the vast majority of individual investors should create a sensible investment

plan and then strive to minimize trading activity.

Hi, Catch!@Crash

Hmmmm.....

FSPGX (Fido LCG index.) Even being 10% of a portfolio having some individual holdings and other stuff would definitely be worthy of a :)

M* performance

Whatever floats one's boat.

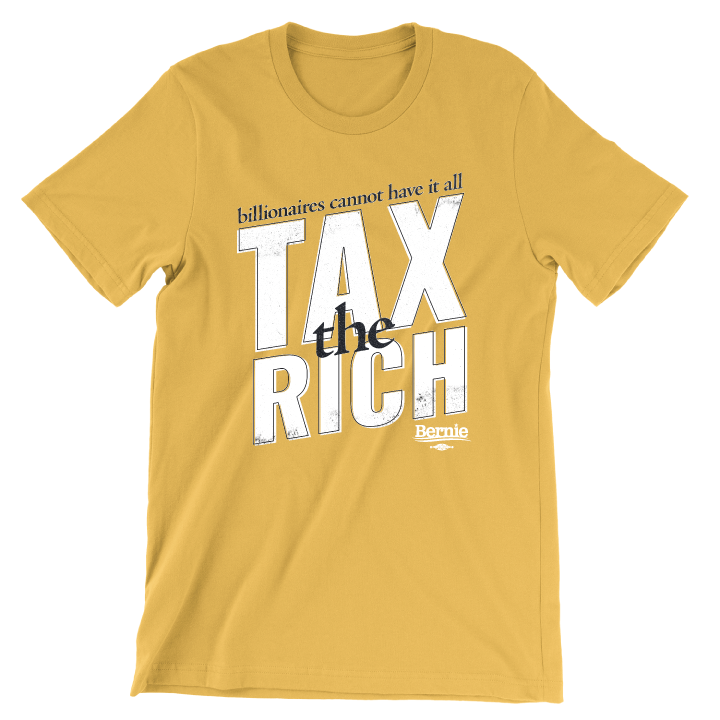

Well said. Or, to summarize, there's the Uniparty and then there's MAGA.Once upon a time,,, the party that supported capitalism and democracy had a left and right wing. They were called the Democrats and the Republicans. The members of both parties were mostly politicians, not statesmen but they took care of the country and themselves.,,and often worked together to keep the system rolling. The Democratic wing of the capitalist part still exists,,, supporting the rule of law,, capitalism and democracy. The right wing of the capitalist party no longer exists. It has been replaced by the cult of maga,,,, which exploits racism,, sexism, xenophobia, transphobia and homophobia while replacing democracy with a dictatorship. Some of the 1% ers who could care less about culture wars support maga just so they will longer have to pay any taxes or comply with any regulations to their enterprises. Perhaps the most surprising part of this sad story is the vast majority of those supporting maga are voting against their own economic interests and their life will be undeniably worse under the regime they are hoping for.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla