It looks like you're new here. If you want to get involved, click one of these buttons!

" />

" />

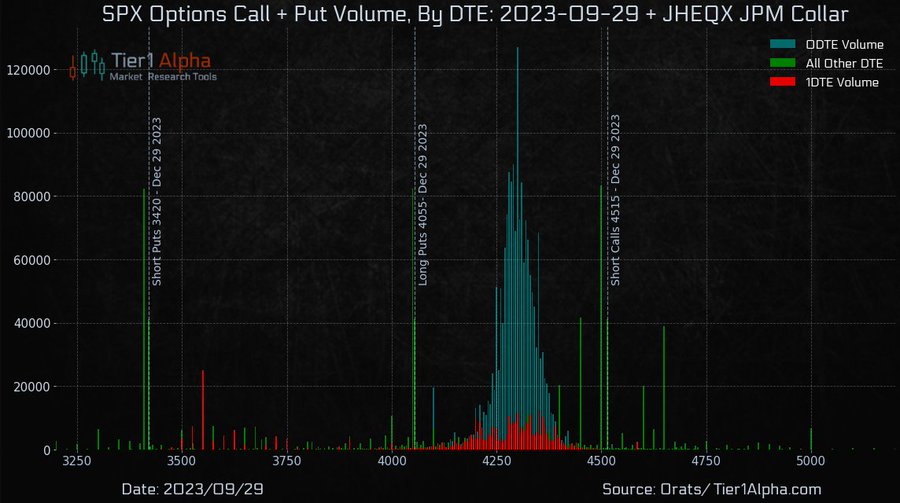

After all, JHEQX has quarterly index-option rolls (options are NOT on individual stock holdings). Fund is huge at $16+ billion (AUM peak was in 2021; [...] See this brochure for explanation of index-options overlay to achieve 60-40 effect from all stock portfolio. IMO, why not just go for a real/genuine 60-40 fund?

https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/literature/brochure/BRO-HE.pdf

Thanks Yogi.WisdomTree presentaion isn't very user-friendly. But from your link (repeated below), Fund Reports & Schedule/Tax Supplement Reports, you can Download "WisdomTree Fund Distribution 2022 - Tax Supplement". Then in the Secondary Layout tab, Col 11, you will find % from Treasury obligations. For USFR, that was 99.666489% in 2022. Unfortunately, this info isn't in 1099 and you have to hunt for it at fund websites.

https://www.wisdomtree.com/investments/resource-library/fact-sheets-reports#tab-EFFF2124-78F5-46F4-B816-6D4252E4BC97

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla