Doug Ramsey, Leuthold CIO, on investing in the markets ahead With the current popularity of index funds, it's interesting to note the launch of the Vanguard 500 Index

(initially named First Index Investment Trust) was not a success.

The plan in 1976 was to raise $150 million but only $11.32 million was raised.

Vanguard 500 Index grew to $100 million in 1982 but $58 million of this amount was attributed to a fund merger. This fund also had an 8.5% sales charge!

Excerpted from Charley Ellis' book The Index Revolution:

"In the fall of 1974, Nobel Laureate Paul Samuelson had written 'Challenge to Judgment,' an article arguing that a passive portfolio would outperform a majority of active managers and pleading for a fund that would replicate the Standard & Poor’s (S&P) 500 index. Two years later, in his regular Newsweek column, Samuelson reported, 'Sooner than I expected, my explicit prayer has been answered' by the launch of the Bogle-LeBaron First Index Fund."

"Samuelson notwithstanding, the First Index launch was not a success. Planned to raise $150 million, the offering raised less than 8 percent of that, collecting only $11,320,000. As a 'load' fund, with an 8.5 percent sales charge, aiming to achieve only average performance, it could not gain traction. The fund then had performance problems. While outperforming over two-thirds of actively managed funds in its first five years, in the next few years it fell behind more than three-quarters of equity mutual funds. High fixed brokerage commissions were one problem. A larger problem came with 'tracking' difficulties. To minimize costs, the portfolio did not own all the smaller-capitalization stocks in the S&P 500. Instead, it sampled the smaller stocks just as that group enjoyed an unusually strong run, so the fund failed to deliver on its 'match the market' promise."

"Renamed Vanguard Index 500 in 1980 and tracking the index closely, the fund grew to $100 million in 1982, but only because $58 million—more than half—came by merging into the fund another Vanguard fund 'that had outlived its usefulness.' Finally, as index funds began to gain acceptance with some investors, the Vanguard fund reached $500 million in 1987."

Debate Over 60/40 Allocation Continues … Jack Hough from Barron's writes about perceived problems with the 60/40 asset mix.

Jared Woodard, head of the Research Investment Committee at BofA Securities,

states there is strong evidence that 60/40 is broken now.

He believes investors in popular index funds will be disappointed in the future.

Mr. Woodard suggests investors pursue

"less-crowded sources of yield and growth.""BofA recommends preferred stocks for high, stable yields through, for example, the Global X U.S. Preferred ETF (PFFD); municipal bonds for relative value, as in iShares National Muni Bond (MUB); convertible bonds for growth and yield, like in SPDR Bloomberg Convertible Securities (CWB); and a smidgen in something short and safe, such as Schwab Intermediate-Term U.S. Treasury (SCHR).""For the stock side, BofA Securities estimates that equal-weight index funds such as the Invesco S&P 500 Equal Weight ETF (RSP) are now priced for double the return of traditional funds that weight companies by market value."Link

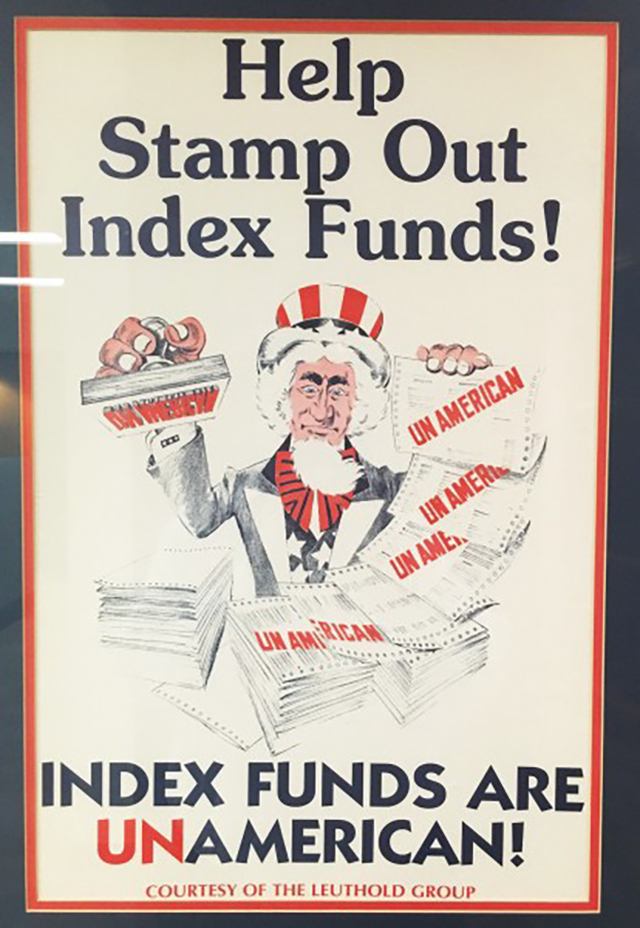

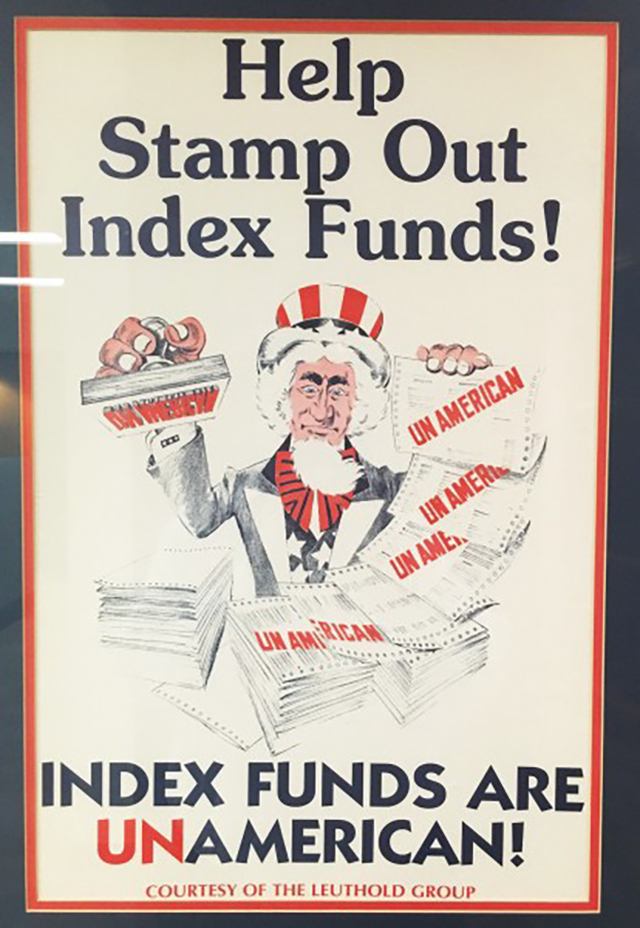

Doug Ramsey, Leuthold CIO, on investing in the markets ahead I have great respect for Leuthold and think they may well be right in this particular case, but having been to Vanguard's offices, I can't help remembering this framed poster described here:

https://ritholtz.com/2014/02/the-best-investment-advice-youll-never-get-2/

In July 1971, the first index fund was created by McQuown and Fouse with a $6 million contribution from the Samsonite Luggage pension fund, which had been referred to Fouse by Bill Sharpe, who was already teaching at Stanford. It was Sharpe’s academic work in the 1960s that formed the theoretical underpinning of indexing and would later earn him the Nobel Prize. The small initial fund performed well, and institutional managers and their trustees took note.....

...But even in San Francisco, as in the country’s other financial centers, Fouse and McQuown’s findings were not a welcome development for brokers, portfolio managers, or anyone else who thrived on the industry’s high salaries and fees. As a result, the counterattack against indexing began to unfold. Fund managers denied that they had been gouging investors or that there was any conflict of interest in their profession. Workout gear appeared with the slogan “Beat the S&P 500,” and a Minneapolis-based firm, the Leuthold Group, distributed a large poster nationwide depicting the classic Uncle Sam character saying, “Index Funds Are UnAmerican,” implying that anyone who was not trying to beat the averages was nothing more than an unpatriotic wimp. (That poster still hangs on the office walls of many financial planners and fund managers.)

I suspect that poster might be a collector's item now. Bogle welcomed the challenge and found it amusing.

M* Rekenthaler on Retirement Income @hank Does a 103

5 exchange ring a bell? Still valid.

@catch22 - Nope. Simply a “403-B Custodial Transfer.” Odd in the sense that you were still making systematic contributions to the workplace plan and yet could turn right around and transfer that money to a new custodian (ie: another fund house). Partial transfers were allowed. It remained a 403-B and was still subject to all the rules governing them, including age. You simply filled out an app form & mailed it to the new custodian. I ended up, for better or worse, with a handfull of such accounts. Noteworthy - The employer’s name / ID appeared on those new accounts. You weren’t “leaving” the existing plan, but simply widening the scope of investments.

ISTM that ability stemmed from a loophole in the IRS code. I suspect courts had taken a look at it and chosen not to curtail the process.

M* Rekenthaler on Retirement Income @catch22, 103

5 exchanges are for personal annuities.

Workplace tax-deferred annuities (401k/403b/4

57b) can be rolled over into T-IRA - in-service cash rollovers if allowed by plans, and cash rollovers on retirement/resignation/termination from jobs.

M* Rekenthaler on Retirement Income @hank Does a 103

5 exchange ring a bell? Still valid.

Doug Ramsey, Leuthold CIO, on investing in the markets ahead the valuation on small caps relative to large caps is as extreme as the late 1990s. Remember that the S&P 50 corrected by 50% in 2000-02. The S&P Equal Weight index and small caps vastly outperformed back then.

Reading this in other places lately. Along with the return of dividends, value . . . and the Talking Heads?

I'm still waiting...I'm still waiting...I'm still waiting...

I'm still waiting...I'm still waiting...I'm still waiting...

I'm still waiting...I'm still waiting...

The feeling returns

Whenever we close our eyes

Lifting my head

Looking around inside

The island of doubt

It's like the taste of medicine

Working by hindsight

Got the message from the oxygen

Making a list

Find the cost of opportunity

Doing it right

Facts are useless in emergencies

The feeling returns

Whenever we close our eyes

Lifting my head

Looking around inside

Happy Friday:

M* Rekenthaler on Retirement Income if I recall properly, 403B's were pushed by lobbying groups of the insurance companies to become part of the IRS code. 401k's came later.

College contributions to participants’ annuities have been “before tax” dollars to the individuals since the start of TIAA [by the Carnegie Foundation] in 1918, as are employer contributions to qualified pension plans. This was formalized in broader amendments to the Internal Revenue Code in 1942. In the 1950s, the School of Medicine at Washington University of St. Louis ... and the Johns Hopkins Medical School offered their medical doctors on the staff an arrangement whereby doctors could designate their entire salary or any part of it as annuity premiums, before taxes. Many doctors jumped at this chance.

...

The IRS became interested, and a high Treasury official, Dan Throop Smith, a former professor at the Harvard Business School, pressed an amendment to the Internal Revenue Code that would limit tax-deferred college contributions to annuities to 10 percent of current salary.

...

The final result was a reasonable compromise, permitting annuity contributions of up to 20 percent of current salary, with a formula for past service. In the Technical Amendments Act of 1958, Congress added Section 403(b) to the Internal Revenue Code as a replacement for all that had gone before in the college world.

...But the unexpected development was that the individual could voluntarily elect to fill the rest of the 20 percent if his or her employer was not contributing the full amount. The individual could transform part of his or her salary into “employer contributions” to an annuity under Section 403(b) by so-called salary reduction.

...

Congress established 401(k) plans in 1981, permitting employer-sponsored deferred compensation arrangements within certain parameters.

https://pensionresearchcouncil.wharton.upenn.edu/wp-content/uploads/2015/09/tiaa04031670.pdfPension plans are little more than annuities funded by employers who put money into them; money that could instead have been used to increase employee pay. Section 403(b) makes this relationship between pension funding and reduced pay more explicit. It lets employees elect to forgo even more of their pay in exchange for greater employer pension contributions. Same as with Keoghs and 401(k) plans that came later.

M* Rekenthaler on Retirement Income 403b for educational and nonprofit institutions originated much earlier and had simpler rules.

401k for corporations came later and accidently. Their rules are more complex and features more restrictive. The fear was that companies with lots of resources would play games with direct-contribution 401k as they did with their direct-benefit pensions. Some 401k reforms only now provide features that were already available in 403b, and many were asking, "So, where is the beef?"

The insurance industry lobbied hard to include annuities among the default options for auto-signups for 401k/403b but only the TDFs were approved. Most recently, a 401k reform allows income/annuitization within the TDF framework and that has forced cooperation among the fund families and insurance companies (only they can provide annuities).

Workplace annuity leader TIAA should be mentioned. There are only 8 CREF VAs covering stocks, bonds, hybrid, m-mkt. The ERs for the cheapest R3 class (for large institutions) range from 0.17-0.26% (all-in), while the ERs for the most expensive R1 class (for small institutions) range from 0.41-0.49% (all-in). These are low ERs by any standard. Some workplace plans may have additional plan level fees that vary depending on whether the institutions subsidize 403b program as HR benefit.

CREF Stock VA is the oldest VA around (1952).

Of course, TIAA also has general (non-workplace) annuity programs that are much more expensive, but that isn't TIAA's main business.

M* Rekenthaler on Retirement Income @hank @yogibearbull et al

A unique annuity.

Fidelity Personal Retirement AnnuityA 'lite' overview: Fido's annual fee = .2

5%. There are

55+ fund choices for investments, each having their own ER's. So, if fund 'x' has an ER of .7

5%, + the .2

5% fee, ones total annual charge would be 1%.

Tax deferred growth.

There may be some changes since I first read through the prospectus several years ago.

The link will provide the full overview.

@msf and I discussed this annuity choice several years ago.

And

@hank, if I recall properly, 403B's were pushed by lobbying groups of the insurance companies to become part of the IRS code. 401k's came later.

TCAF, an ETF Cousin of Closed Price PRWCX Go to their website for top 5 portfolio effective 6/23.

What happened to CCOR? That's great

@davidmoran. Way to go man.

The stock count is right in line with their declared strategy to own 20-2

5 stocks. So it's nice to know they aren't suffering from strategy creep.

Depending on who you can believe in this crazy internet world, they're around 90% equities and their secret sauce is around10% AGPXX and around -.03 options on stocks in their portfolio. That's not the kind of thing that keeps me up at night. YMMV.

M* All of this is duly noted here. Thanks for taking the time to spell it all out! One small detail continues to bug me: M* has made it difficult now, to compare funds using the charting feature , for a 10-year time span. 1,3,5 years is pre-set. And "Maximum." But that could be back to 1911 or only as far back as last Tuesday.

In order to compare funds for 10 years, you must enter it yourself. And when you do, the lovely, fabulous and marvelous people at Morningstar seem to have instructed the chart to go to the first or last day of the month, not the day you have entered. It's maddening. And so, I'm using M* less and less.

I have tried Simply Wall Street. Have a couple of portfolios there. For a few days, going back some weeks now, they were all discombobulated. I went back to see what's what by now, and it seems to be functional again.

TCAF, an ETF Cousin of Closed Price PRWCX PRWCX portfolio Top Five. (dated 31 March.)

Microsoft.

Apple.

United Health.

Amazon.

Fortive. (What do THEY do?)

TCAF is quite obviously not a clone, and there is no bond component, either.

I wouldn't own TCAF because the top 5 are what they are. All the companies I love to hate. Granted, PRWCX has owned them, too. Probably does own them still, I'm not sure. I did not look this time, past the Top Five.

Yes, TCAF is bound to attract attention. And Giroux is quite capable. i am using TRP brokerage, still. But I'm less and less impressed with their other funds.....

TCAF, an ETF Cousin of Closed Price PRWCX

TCAF, an ETF Cousin of Closed Price PRWCX I saw that top 25% of AUM were the huge high-flying tech stocks too. It makes me hesitate to add-to this ETF at this time (I did buy a few shares on the 2nd day to more easily monitor it's progress). All, except GOOGL, have 14-day RSI scores around 70. Maybe not a good buying opportunity. But that said, these tech stocks seem to have been more defensive than any other equity category this YTD.

NASDAQ was up over 30% YTD as of yesterday. Apple hit an all time high. By contrast, the Dow was essentially unchanged YTD. What a disparity. Some pretty good funds aren’t doing much this year. VWINX was up less than 2% YTD as of yesterday. And we all know the sad tale of “safe” CCOR which was off 11-12% YTD at last check. Not meant to pick on any particular fund. Just to point out how crazy the markets have been lately.

I have trouble dealing with fame (in this case Giroux’s), so vacated PRWCX early last year and am staying far away from the obvious attempt by TRP to capitalize on Giroux’s name with a semi-clone that’s much different than PRWCX by many accounts here. Hey, they’ve been losing AUM. Who can blame them?

Re TRP - I think they generally do a good job with their diversified “spectrum-type” allocation funds. Some have reasonable fees. You can gain exposure to a literal rainbow of various equity or fixed income areas in one fund. And I’ve used TCHP in the past as a short term trading instrument. But you don’t want to be holding much of that one when tech tanks. It will be interesting to observe the extent to which TCAF sees use as a short term trading tool rather than a solid long term portfolio hold like its tamer cousin.

TCAF, an ETF Cousin of Closed Price PRWCX I saw that top 25% of AUM was the huge high-flying tech stocks too. It makes me hesitate to add-to this ETF at this time (I did buy a few shares on the 2nd day to more easily monitor it's progress). All, except GOOGL, have 14-day RSI scores around 70. Maybe not a good buying opportunity. But that said, these tech stocks seem to have been more defensive than any other equity category this YTD.

TCAF, an ETF Cousin of Closed Price PRWCX It appears based on todays NAV move, that TCAF is going to run hot (relative SPY). Not a problem if you want that. 25% of AUM are AAPL, AMZN, NVDA, MSFT, GOOGL.

This brings up the question will the T/O be higher than I would have thought? IOW's will TCAF be more tactical in nature.

I don't need to pay .31 to get a lineup like that.

Doug Ramsey, Leuthold CIO, on investing in the markets ahead

TCAF, an ETF Cousin of Closed Price PRWCX It appears based on todays NAV move, that TCAF is going to run hot (relative SPY). Not a problem if you want that. 25% of AUM are AAPL, AMZN, NVDA, MSFT, GOOGL.

This brings up the question will the T/O be higher than I would have thought? IOW's will TCAF be more tactical in nature.