JP Morgan Fund Could Rattle Markets Friday

Good question, yogi.

Quickly checking out a few well established moderate allocation (60/40) funds like VWELX, JABAX and FBALX, for example, shows that JHEQX has a better risk/reward profile.

JHEQX has not only a better performance record over the past

1, 3 and 5 years than VWELX and JABAX, but also a significantly lower standard deviation, 8.7 vs.

12.3, respectively.

While FBALX has a slightly better performance, its standard deviation is significantly higher at

13.8.

As a retired investor, I prefer to invest in funds with lower standard deviations if the total returns of similar funds are more or less the same, never mind if they are less.

Good luck,

Fred

The Nightview Fund (Nite) in registration They say a picture is worth a thousand words. Here's the bar chart of the predecessor (privately offered) fund's performance. I don't care what this fund is investing in, I'll pass.

The Nightview Fund (Nite) in registration

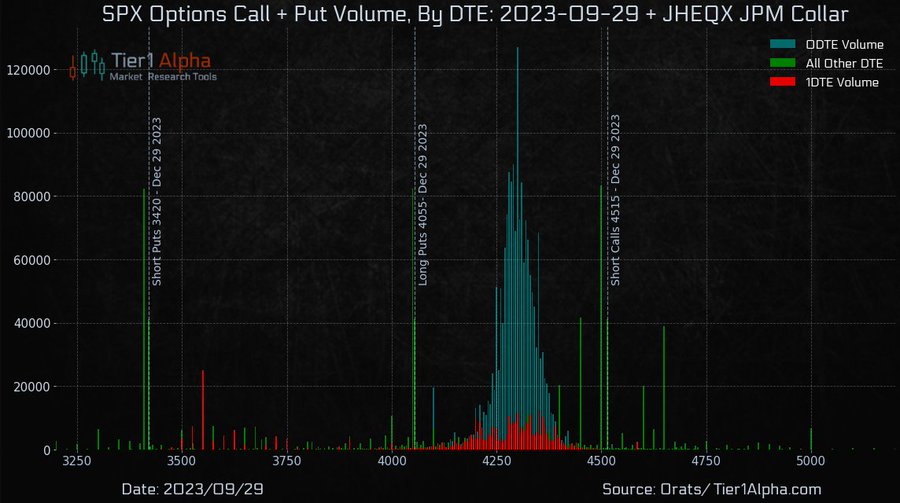

JP Morgan Fund Could Rattle Markets Friday After all, JHEQX has quarterly index-option rolls (options are NOT on individual stock holdings). Fund is huge at $

16+ billion (AUM peak was in 202

1; M* shows outflows in much of 2022 but some inflows in 2023). The current quarterly index option roll is indeed THIS week. So, expect these articles to be recycled with updated info. See this brochure for explanation of index-options overlay to achieve 60-40 effect from all stock portfolio. IMO, why not just go for a real/genuine 60-40 fund?

https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/literature/brochure/BRO-HE.pdf

JP Morgan Fund Could Rattle Markets Friday +

1 Yogi / I guess I’m even more confused than

@Old_Joe claims to be. I saw it first in

Bloomberg. Appears the same story makes the circuit every few years. I’d swear I’ve seen a Reuters piece dated 2023 - but can’t find it this morning.

JP Morgan Fund Could Rattle Markets Friday

JP Morgan Fund Could Rattle Markets Friday +1 old joe

JP Morgan Fund Could Rattle Markets Friday “It was written on Thur 10-27-2022.”

Not bad. You’re only off here by 11 months. Yes - a genius you are. I’m in awe.

The top 8 Companies in S&P 500 are carrying the index It's a known fact for years that the high tech leads the market and why QQQ made so much more than SPY. See the last

13 years.

https://schrts.co/CJwZWTcfThe above stocks are all high tech, except BRK.B but this one has so much of Apple anyway.

AAII Sentiment Survey, 9/27/23

AAII Sentiment Survey, 9/27/23 Those months had quite negative Bull Bear Spreads.

March 2023 range was -27.9% to -16.9%

October 2022 range was -35.6% to -19.1%

Fund Allocations (Cumulative), 8/31/23 Fund Allocations (Cumulative), 8/3

1/23

There were noticeable shifts away from stocks into m-mkt funds. The changes for OEFs + ETFs were based on a total AUM of about $32.35 trillion in the previous month, so +/-

1% change was about +/- $323.5 billion. Also note that these changes were from both fund inflows/outflows & price changes. #Funds #OEFs #ETFs #ICI

OEFs & ETFs: Stocks 58.67%, Hybrids 4.87%, Bonds

18.89%, M-Mkt

17.57%

https://ybbpersonalfinance.proboards.com/post/1194/thread

JP Morgan Fund Could Rattle Markets Friday BB, my mistake.

Back to the article. It was written on Thur 10-27-2022. The next day had no rattle.

Is the article still relevant for tomorrow=Friday?

JP Morgan Fund Could Rattle Markets Friday @FD1000, You quoted me as a header to your post and the rest of your post is not comprehensible to me in light of the quoted text. What is that I said you found objectionable?

" />

" />