The Brown Capital Management Small Company Fund reopening to new investors https://www.sec.gov/Archives/edgar/data/869351/000183988223010046/small-497_042023.htm497

1 small-497_042023.htm SUPPLEMENT DATED APRIL 20, 2023

BROWN CAPITAL MANAGEMENT MUTUAL FUNDS

The Brown Capital Management Small Company Fund

BCSIX - Investor Shares

BCSSX - Institutional Shares

Supplement dated April 20, 2023 to The Brown Capital Management Small Company Fund’s Summary Prospectuses, Prospectuses and Statement of Additional Information all dated August

1, 2022

This Supplement is to give notice that effective May

1, 2023, The Brown Capital Management Small Company Fund will be re-opened to new investors. Accordingly, the section of the Prospectuses and Summary Prospectuses titled “Special Note Regarding The Brown Capital Management Small Company Fund” is hereby removed from the Prospectuses and the Summary Prospectuses of the Fund. Shares of The Brown Capital Management Small Company Fund may be purchased as described in the Fund’s current Prospectuses, Summary Prospectuses and Statement of Additional Information.

For additional information concerning how to purchase Shares of The Brown Capital Management Small Company Fund, please call the Fund toll-free at

1.877.892.4BCM.

Brown Capital Management Mutual Funds

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

What Beat the S&P 500 Over the Past Three Decades? Doing Nothing I once read an interesting quote about rebalancing, I forget from who. Basically it said rebalancing can be like digging out your flowers and watering the weeds.

Sounds like Buffett was quoting

Peter Lynch.To rebalance or not rebalance? That is the question …

I’d say it depends on age, purpose, resources and what you’re trying to accomplish.

Related thought - Do folks give any thought as to why they select each holding for inclusion in their portfolios in the first place? Surely, they did their homework, gave it a lot of thought, and had confidence in each holding’s long term potential. If it merited inclusion at a specified weighting then, why change your mind because it hasn’t “grown” as much as the other investments? Not everything moves in the same direction all of the time.

Is cash a “weed”? Likely over time your equity holdings will outdistance your cash / fixed income holdings. That’s how it’s supposed to work. Following Lynch’s thinking would mean not trimming profits and rebalancing into cash. Buffet talks a good line. I don’t know of anyone who has enunciated so much thought in so few words time and time again as he - except perhaps for Benjamin Franklin. Neither, I suspect, has always hewed

100% to their stated dictum.

Debt ceiling jitters lift US credit default swaps to highest since 2011 @Sven. +

10! “ Does anyone follow the debt ceiling debate?” Thank you for bringing this up. I started a thread in Feb. about default denialism. The country, this board, my family,,, still in denial. X date is getting closer and the government is not getting closer to a resolution. I am starting to consider a major portfolio realignment because I am of an age where I don’t have years to wait for recovery. Problem is I am not at all certain where to hide. I am thinking that with the possibility of an economic slow down increasing and the likelihood of default increasing it might not be a bad time to be out of the market. But where to hide? Anyway,,,,thanks Sven for asking the right question.

Debt ceiling jitters lift US credit default swaps to highest since 2011 I don't really follow the debt ceiling debate, but with such an un-stabilizing group in Washington I have been trying to prepare for it by the way of increasing my gold percentage. I've been adding periodically in 2023. I don't believe waiting for dips which may never fit your criteria. That can leave you on the side lines. I try to use the old

@rono momentum procedure.

FWIW, I'm to chicken to put a huge percentage into a momentum play, so my ceiling at this point is

10% of my self managed holdings in IAU.

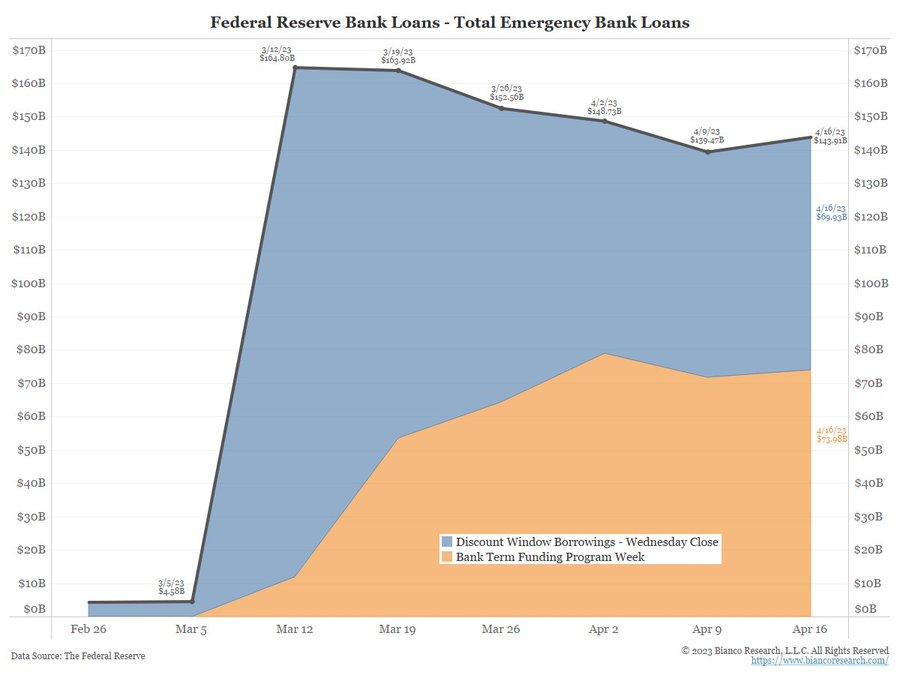

Debt ceiling jitters lift US credit default swaps to highest since 2011 Another puzzle is an unusually high spread of 121 bps for 1m-3m T-Bills. April started out with more normal 20 bps spread. Something is fishy with the liquidity.

Earlier estimates for debt-ceiling drop-dead date were in August, but weak tax receipts may have moved it to June.

Debt ceiling jitters lift US credit default swaps to highest since 2011 Does anyone follow the debt ceiling debate? The deadline is June 2023 and that is less than 2 months away. The default of US treasury is unthinkable. But it came close when S&P downgraded US a treasury from AAA to AA+ while Moody’s and Fitch, have decided not to downgrade the government at this time. Market fell accordingly the following days.

Moody’s and Fitch, have decided not to downgrade the government at this time.Another piece I read this morning,

Spreads on U.S. five-year credit default swaps - market-based gauges of the risk of a default - widened to 49 basis points, data from S&P Global Market Intelligence showed, more than double the level they stood at in January.

A showdown over U.S. government efforts to raise the $31.4 trillion debt ceiling for the world's largest economy have sent jitters through global financial markets.

JPMorgan said in a note published late Wednesday it expected the debt ceiling to become an issue as early as May, and that the debate over both the ceiling and the federal funding bill would run "dangerously close" to final deadlines.

Debt ceiling jitters lift US credit default swaps to highest since 2011

Are fund prices currently messed up on various trackers? This started last evening when 1 of my 2 tracking apps sent out a message from the administrator that they were unable to obtain day-end prices from Yahoo, but that we could go into settings and change our price source to Google. I did that with a couple holdings but didn’t resolve issue. Both of my main tracking apps and also some free online services are still showing varying prices and performance for identical funds this morning.

Anybody else encounter issues with yesterday’s quotes? PRPFX is the one I’ve worked on. One tracker has it $47.98, a 5 cent gain. The other says $48.09, a 16 cent gain. MSN Money (Bing) shows currently $47.93, with no reference to the last daily move. If just that 1 fund, I wouldn’t mind. But several others are affected.

Added later - CNBC is at 47.93 (PRPFX) which agrees with MSN Money, but neither tracking app. M* also says 47.93 and down 0.33%. And Google now has $47.93. Looks like both of my tracking apps are screwed up.

AAII Sentiment Survey, 4/19/23 AAII Sentiment Survey, 4/

19/23

For the week ending on 4/

19/23, neutral remained the top sentiment (37.7%; above average) & bullish remained the bottom sentiment (27.2%; below average); bearish remained the middle sentiment (35.

1%; above average); Bull-Bear Spread was -7.9% (below average). Investor concerns: Inflation (moderating but high); economy; the Fed; dollar; crypto regulations; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (60+ weeks, 2/24/22- ); geopolitical. For the Survey week (Th-Wed), stocks were up, bonds down, oil down sharply, gold down, dollar up. An unusually high

1m-3m T-Bill spread points to some liquidity issue developing. #AAII #Sentiment #Markets

https://ybbpersonalfinance.proboards.com/post/1016/thread