Silver Howdy folks,

@shipwreckedandalone Interesting discussion as I have been a silver fan since the Hunt Brothers tried to corner the market in the late 70s early 80s.

I've always been an advocate of everyone having a small percentage of physical gold and silver bullion as an investment - let's say

5-7%. More than this is speculation and while that's fine, it's different.

You mention the g/s ratio and it's about 77 to 1 which is extremely favorable for silver relative to gold. I also like silver because the leverage is much greater than with gold.

Different ways to play: bullion or the miners. Different markets and while they track each other over time, they can deviate a lot in the short term. With silver, the pure play bullion ETFs are taxable at the higher rate. Nasty. Make SURE you keep them in a deferred account. Of these, I prefer the Sprott offerings like CEF and PSLV. Then there are the miners. This is where the vast majority of the mutual funds invest - in the mining stocks for gold, silver, etc. Then there are the ETF miners and there are bunches. In silver, you have SILJ, SIL, and SLVP. I like the first because I like the junior silver miners. They're fun and a bit like a roller coaster ride at time. These are penny stocks and the leverage here can get insane.

http://www.kitcosilver.com/equities.htmlAs for physical bullion, you have to watch the premium, or vigorish. It's getting very nasty as I type. This is because demand for physical silver is very strong right now and the paper price is suppressed. This results in higher premiums. Here's my local dealer and their price quotes for various types of bullion, from plain vanilla to ASE. You want to buy top shelf bullion because it's more fungible.

http://libertycoinservice.com/wp-content/uploads/quotes/daily_quotes.pdfgood luck,

peace,

rono

VWINX @PRESSmUPThat is good news. You are correct that even as late as last fall Schwab said not available.

It looks like there is no purchase fee but $7

5 short term redemption fee. I have emailed Schwab to confirm.

But given above info, not sure I will not just buy IWB and ITM.

M* -- Bond Investors Facing Worst Losses in Years No where to hide. Timely look at bond market conditions....

``It's unclear what the neutral rate is,” Vataru says. ``It's a slightly untethered market.”

Worst Losses in Years

Worst Losses in Years

AAII Sentiment Survey, 3/23/22 For the week ending on 3/23/22, there was a significant improvement in the Survey but bearish remained the top sentiment (3

5.4%; above average) & neutral became the bottom sentiment (31.7%; average); bullish became the middle sentiment (32.8; below average). With all sentiments in 30s, ordering flip-flops are expected. Russia-Ukraine WAR has entered the 4th week & it has reached a stalemate stage on the ground & in negotiations but dislocations, injuries, deaths & property/facility destructions continue. There are hastily arranged extraordinary meetings of the NATO, G-7 & EU on Thursday (today). The developments may negatively affect the status of DOLLAR as the global reserve currency, & some currencies- & commodities- weighted basket may evolve in the near future. The FED has been talking VERY aggressively & that has significantly increased the rate hike expectations but the Fed may not follow through (that may be a new strategy). The stock market action was positive during the Survey week (Thursday - Wednesday).

https://ybbpersonalfinance.proboards.com/post/545/thread

Best Target-Date Funds (TDFs) for 2022 If it weren't for PRWCX/TRAIX we would most likely be taking advantage of TDF's. That could happen in the future if Giroux leaves/retires or if the 50-70 moderate allocation space becomes too equity heavy for us.

Powell Says Fed Is Ready to Raise Rates Faster If Needed Back in the 70s I did very well with a number of individual bonds. I've never had the same experience with bond funds. Don't really care for them. I'm with Mike- give me a 4-5% CD rather than bond funds.

Best Target-Date Funds (TDFs) for 2022

VWINX Thanks for the link. Looks like IWB + ITM beat the others with a little higher volatility than VTMFX.

This is even more interesting because of the higher expense ratio in the ETF (0.24 and 0.15% vs 0.09% for VTMFX)

Interesting after all the fuss Vanguard makes over their expenses

Powell Says Fed Is Ready to Raise Rates Faster If Needed Question, are bonds, bond funds in particular, affected only in the short term while rates are rising? If rates get to a new normal and plateau, don't they once again become a steady stream of income minus price volatility?

In at least one aspect, rising rates will be great for seniors, right? I would love to put a good chunk of money in a 4-5% CD rather than to risk the volatility of bond funds.

VWINX VTMFX may be easy to replicate. Its equity is R1000 with lower dividends to simulate R1000 itself and bonds are munis, so ITM or MUB should do. I am using phone to link to PV run (1/1/08 - 2/28/22), so let see if that works.

IWB + ITM

IWB + MUB

LI NK

VWINX I kept my Vanguard account basically for VTMFX. This is harder to duplicate that VWINX ( or if you have $50,000 VWIAX.

VTMFX has er of 0.09% and is 50% VWIUX and 50% VTCLX, although the % apparently vary a bit. Unfortunately there is no ETF version of VTCLX and the admiral shares of VWIUX are available only at Vanguard.

Powell Says Fed Is Ready to Raise Rates Faster If Needed It’s a fascinating game going on. Yeah - The Fed most always likes to jawbone first. The various statements are also a way of testing the markets to try and figure out how they would react to decisions being contemplated.

It’s mystifying why equities have withstood both this Fedspeak plus the war in the Ukraine. My best guess is it’s TINA. That will work until it doesn’t. Today I’m shifting a bit of excess cash into a HY short / intermediate term muni fund that’s been knocked down 5% YTD. Might fall a bit further - but ISTM the action at the short end has been a bit excessive.

“Faster is Better” Fed’s James Bullard “I think faster is better,” Bullard said, in an interview on Bloomberg Television. “ The St. Louis Fed president has advocated getting the Fed’s policy rate up to 3% this year. Bullard dissented last week when the Fed decided to raise interest rates rates by 25 basis points to a range of 0.25% to 0.5%. Source Conway Twitty disagrees …

Powell Says Fed Is Ready to Raise Rates Faster If Needed Powell wanted to see what his jawboning could accomplish. He knows the Fed SHOULD be raising rates quicker, but since that could crash markets......he can't bring himself to do it. So slow and steady we go.

Meanwhile we deal with high Negative real interest rates.

Cannot trust this Fed to actually follow through until its too late. I believe that is what happened from 1979-1981 with Volcker at the helm (the Prime rate rose to around 21.5%). Imagine locking up a CD at 20%+ per year? Shoot, I can't imagine rates over 5% ever again.

Silver $12.75 during GFC, so $11 makes sense. Silver seems attractive to me if it could be purchased at the right price in times of distress. Recycling makes estimating a cost to produce more difficult. Silver can't go bankrupt like stocks so risk is appealing to me. The nations debt situation makes it attractive. Silver/gold ratio is good. It has a steady demand in global jewelry and manufacturing. I would be willing to raise the normal portfolio allocation % at the right purchase price. I don't own it now.

VWINX Yep,

VYM+VCIT approximates

VWINX quite well. PV runs from 12/1/09-2/28/22 (12+ years). Elsewhere, other variations/refinements has also been tried.

LINK

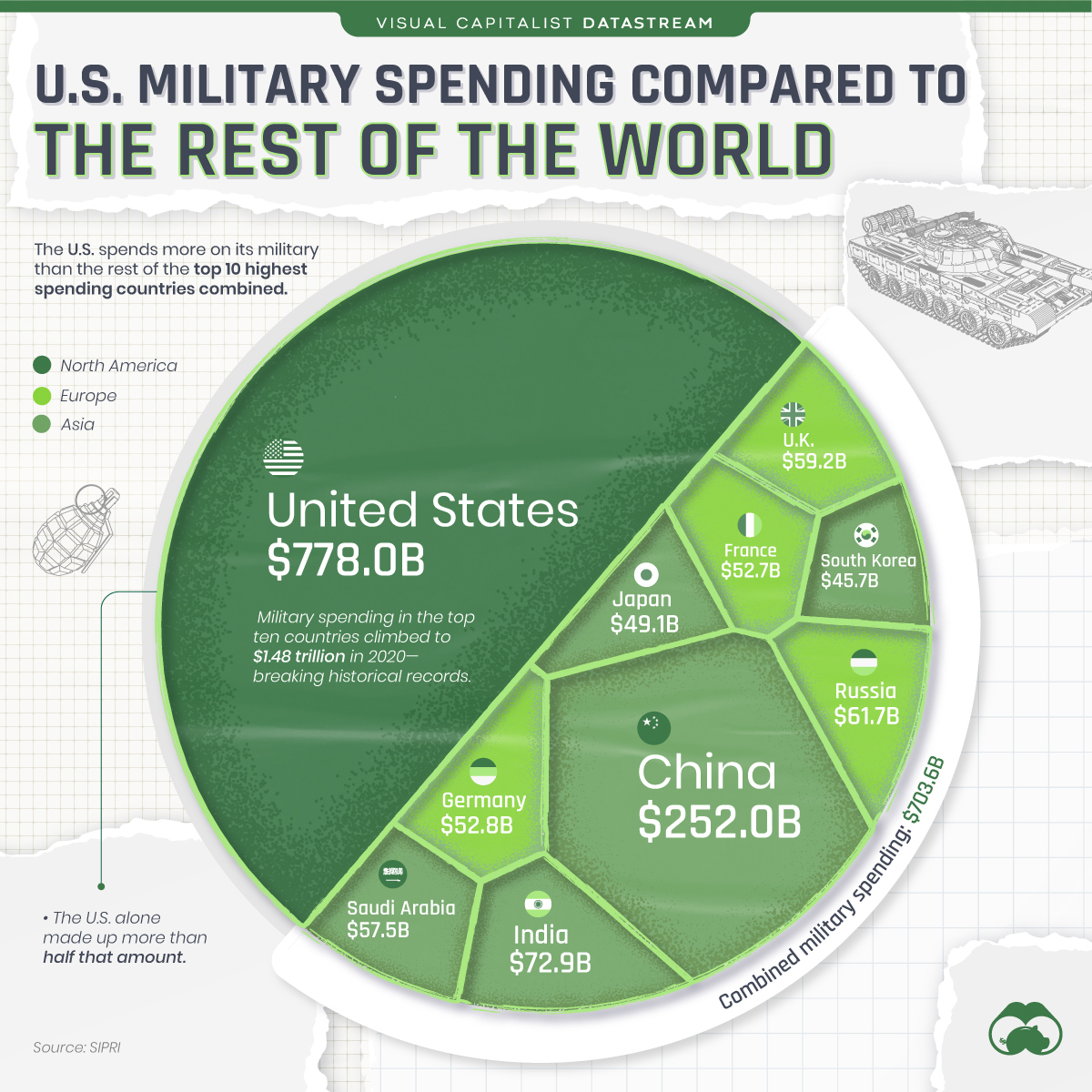

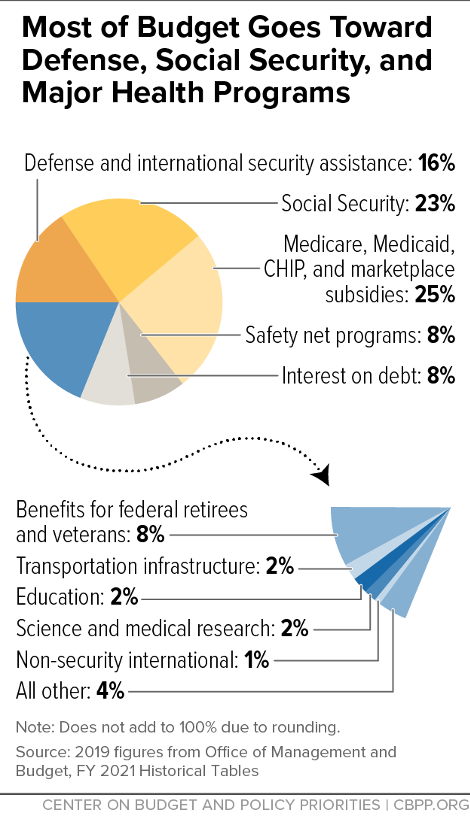

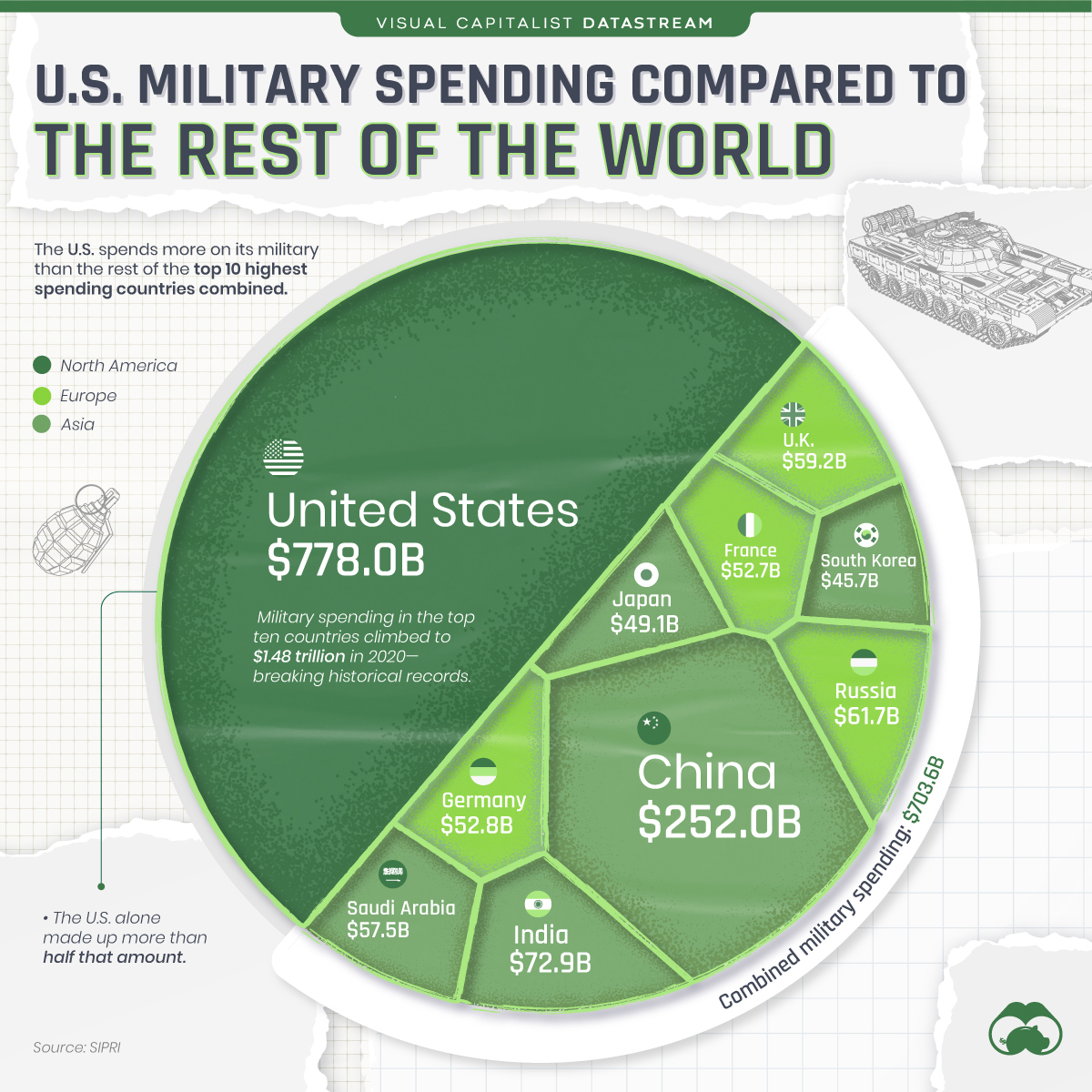

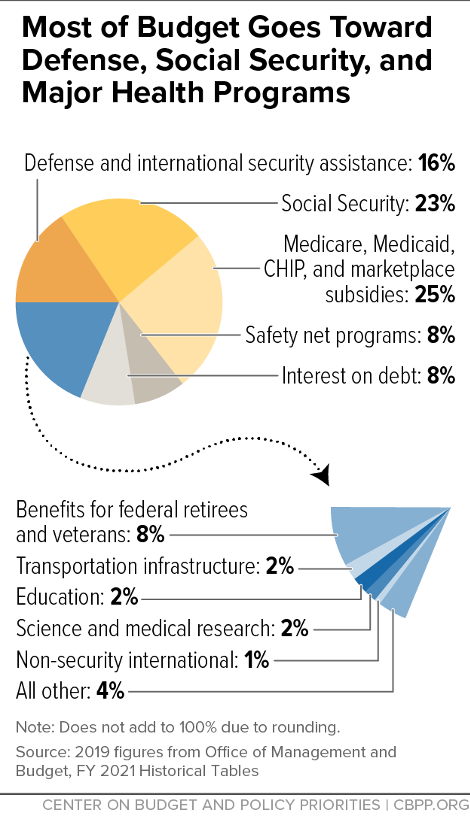

2022’s Most & Least Federally Dependent States What I find disingenuous is the fixation on welfare on the poor as wasteful socialist spending while embracing federal military spending, which historically has been double that of welfare spending and often goes to red states, propping up their economies via government spending and blue state tax dollars:

Historically, the defense spending has been about 16% of the federal budget versus about 8% for welfare. In the throes of the pandemic, welfare spending went to 13% and defense spending went to 19%:

Here's how the budge looked in 2019 before the pandemic:

2022’s Most & Least Federally Dependent States Yes to social programs that act as safety nets catching us when we fall so that we can once again climb off the net and return to the higher place we came from.

No to social programs that place us in pools that barely have enough water to swim in and are designed with such high walls one can never get out.

LB charts of State and Federal funding is much like City and State funding. A needy State just like a needy City will qualify for certain funds based on need. The bigger issue is how do we "ladder" people out of poverty.

Education, job training, and work opportunities as well as volunteerism are either underfunded, under utilized or poorly executed.

Contrary to stereotypes, there is no evidence that people on welfare are lazy. Indeed, surveys of welfare recipients consistently show their desire for a job. But there is also evidence that many are reluctant to accept available employment opportunities. Despite work requirements included in the 1996 welfare reform, the U.S. Department of Health and Human Services says less than 42% of adult welfare recipients participate in work activities nationwide. Why the contradiction?

Perhaps it’s because, while poor people are not lazy, they are not stupid either. If you pay people more not to work than they can earn at a job, many won’t work.

A new study by the Cato Institute found that in many states, it does indeed pay better to be on welfare than it does to work.

Most reports on welfare focus on only a single program, the cash benefit program: Temporary Assistance for Needy Families. This focus leaves the mis-impression that welfare benefits are quite low, providing a bare, subsistence-level income. In reality, the federal government funds 126 separate programs for low-income people, 72 of which provide either cash or in-kind benefits to individuals.

Because there are so many categories of welfare recipients and so many different types of benefits, it is extremely difficult to determine how many people get what combination of benefits. For the purposes of this study, we assumed a hypothetical family consisting of a mother with two children, ages 1 and 4, and calculated the combined total of seven benefits that family could receive in all 50 states.

why-get-off-welfare

Morningstar Portf. Manager speed That's one hell of a fast connection. Mine here in SF is only about 10 and 2, and that's plenty fast enough for everything that I'm doing, including watching two Amazon Prime downloads simultaneously (though on relatively small screens).

...Just to be sure: we're talking

Mbps. And a repeat test shows 127.6 and 30.

5. and i'm in Hawaii, though the test server used is 2

500 miles away in Los Angeles. (Speakeasy Speed Test.) ..... Anyhow, the problem has to be with the Morningstar function.

Powell Says Fed Is Ready to Raise Rates Faster If Needed The CME FedWatch tool is based on current fed fund futures quotes around the FOMC meetings and the assumption of gradual fed fund rate changes (+/- 0.2

5%). In the list below, more than

50% probability is used to indicate rate hike; “+” is shown after the FOMC date to indicate that rate hike can be at that or a later FOMC.

2nd & 3rd rate hike, FOMC

5/4/22+ (so, possible

50-bps hike)

4th &

5th rate hikes, FOMC 6/1

5/22+ (so, possible

50-bps hike)

6th rate hike, FOMC 7/27/22+

7th rate hike, FOMC 9/21/22+

8th rate hike, FOMC 11/2/22+

9th rate hike, FOMC 12/14/22+

Powell's tough talk moved the rate hike expectations a LOT. Some say that the strategy may be to talk very tough, move the fed fund futures markets and then may be do less than what is in the market.

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html