It looks like you're new here. If you want to get involved, click one of these buttons!

Most people hold them to maturity but you can buy/sell them at tiny bid/ask spread ANYTIME. There is nothing more liquid than T-Bills.@Junkster, T-Bills are now better than m-market funds. Buy those commission-free at Fido, Schwab, etc. There is a nearby thread on the details for T-Bills and T-Notes.

https://www.mutualfundobserver.com/discuss/discussion/59328/tough-day-in-bond-land#latest

Thanks yogi. Am ignorant on T-Bills. Always thought they weren’t as liquid as money market if I needed the money for an immediate fund trade?

Thanks yogi. Am ignorant on T-Bills. Always thought they weren’t as liquid as money market if I needed the money for an immediate fund trade?@Junkster, T-Bills are now better than m-market funds. Buy those commission-free at Fido, Schwab, etc. There is a nearby thread on the details for T-Bills and T-Notes.

https://www.mutualfundobserver.com/discuss/discussion/59328/tough-day-in-bond-land#latest

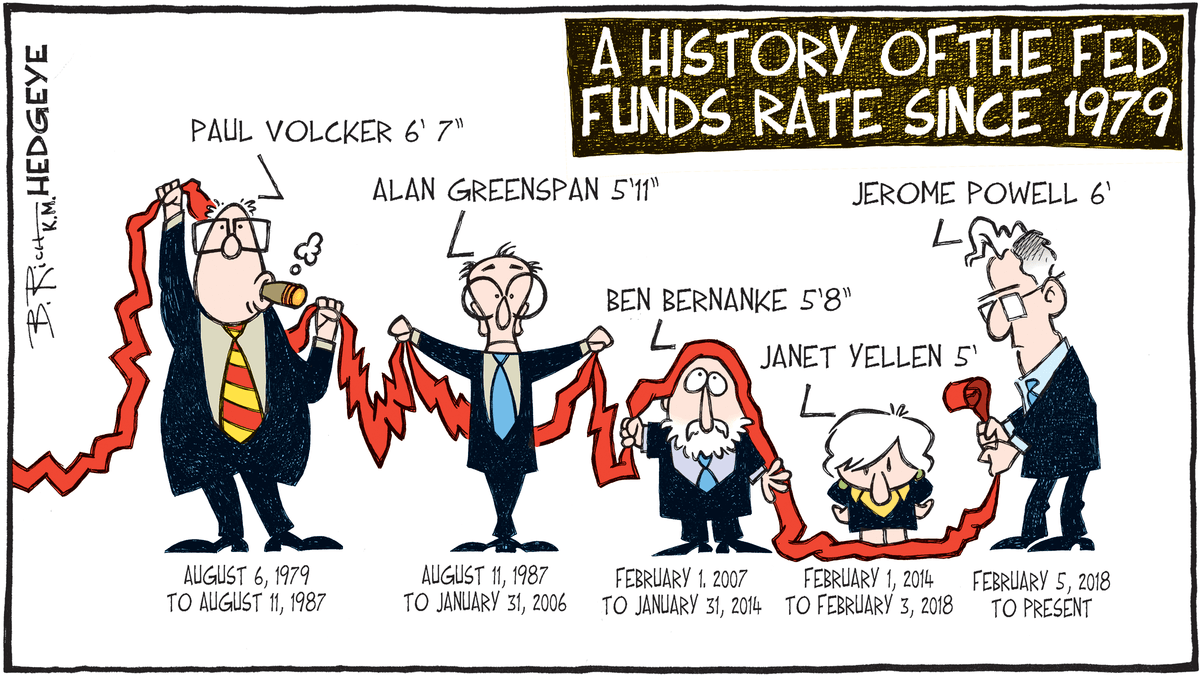

“I daresay you haven’t had much practice. Why, sometimes I’ve believed as many as six impossible things before breakfast.”The Fed lag is a bit hard to look past … with CPI now at 7.9%.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla