Sentiment & Market Indicators, 10/1/25 SENTIMENT & MARKET INDICATORS, 10/1/2

5AAII Bull-Bear Spread +3.7% (below average; bipolar)

CNN Fear & Greed Index

52 (neutral)

NYSE %Above

50-dMA 60.38% (positive)

SP

500 %Above

50-dMA

58.00% (positive)

These are contrarian indicators.

INVESTOR CONCERNS: Budget, debt, tariffs, inflation, jobs, Fed, dollar, recession, geopolitical, Russia-Ukraine (188+ weeks), Israel-Hamas (67+27 weeks).

For the Survey week (Th-Wed), stocks up, bonds up, oil down, gold up, dollar flat.

US Government shutdown started on 10/1/2

5. There is US-Israel proposal for peace in Middle East. There are no active peace talks now for Russia-Ukraine war. Supremes scheduled hearing for Fed Governor Cook case in 01/2026.

#AAII #CNN #Sentiment

https://ybbpersonalfinance.proboards.com/post/2235/thread

fed shutdown? mr.mkt doesnt care Just want to mention: Wed Oct 1st, '25 p.m. SWVXX yield = 3.98%. I'll tough it out here, growing some short-term money for next year's fancy trip. I guess I won't miss the difference between 3.98% and 4.00%. Yes, it could slide further down.

AKRE. Focus Fund to convert to an ETF AKRIX has had outflows since 01/2022, the AUM peaked in 11/2021 - from MFOP.

AKRE. Focus Fund to convert to an ETF Sadly, much of this thread was compromised during the recent server crash, but it should be noted that the shareholders approved the ETF transition. AKRIX/AKREX will become an ETF (AKRE) on Oct 27, 2025. It should also be noted that AKRIX has lost about $1.5billion (and about 12% of its stock value) over the past month as many investors have decided to part ways rather than adjust their fund/etf management structure as required in the ETF registration.

I'll stick it out...if only to see how a moderately large MF transitions to a moderately large ETF.

BLX BLX. Listed on NYSE and Mexican bourse.

The report linked here quotes a lot of 2Q2

5 stats. A bit dated, but the article itself is dated 26 Sept, '2

5. Since I own this puppy, it was great to see some new information.

"...

Fee income has emerged as a critical driver of profitability, aligning with Bladex's strategy to reduce dependence on market rates. In Q2 2025, fee income reached a record $20 million, surging 88% quarter-over-quarter and 59% year-over-year. A significant portion of this was attributed to Bladex's role as global coordinator and mandated lead arranger for a $1.6 billion syndicated facility for Staatsolie, Suriname's national oil company—the largest syndicated facility in the bank's 46-year history. Beyond this transaction, recurring fees from letters of credit also saw strong growth, up 20% year-over-year to $7.8 million in Q2 2025. For the full year 2024, fee income reached an unprecedented $44 million, a 37% annual increase..."

https://beyondspx.com/quote/BLX/analysis/bladex-forges-a-digital-future-in-latin-american-trade-finance-driving-record-returns-nyse-blx

This Day in Markets History From Markets A.M. newsletter by Aaron Back.

On this day in 1958, American Express introduced its charge card, which was made of paper printed

with purple ink to match the color of Amex’s travelers’ checks. (Plastic came along in 1959.)

The $6 annual fee was 20% higher than that of the competing Diners Club card.

Don't leave home without it!

Wasatch International Small Cap Value & Wasatch Global Small Cap Value funds - now available

fed shutdown? mr.mkt doesnt care From

The Independent Vanguard Adviser newsletter:

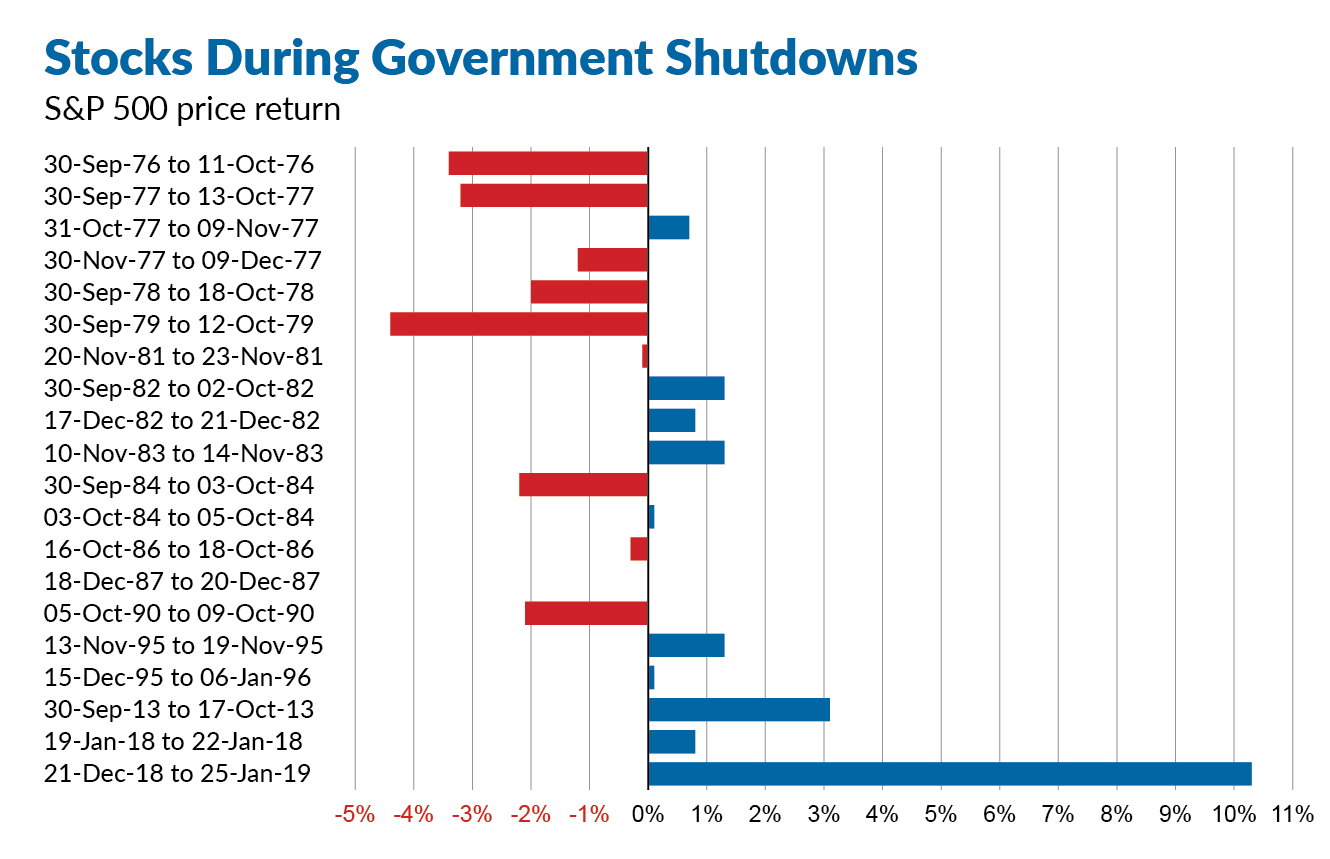

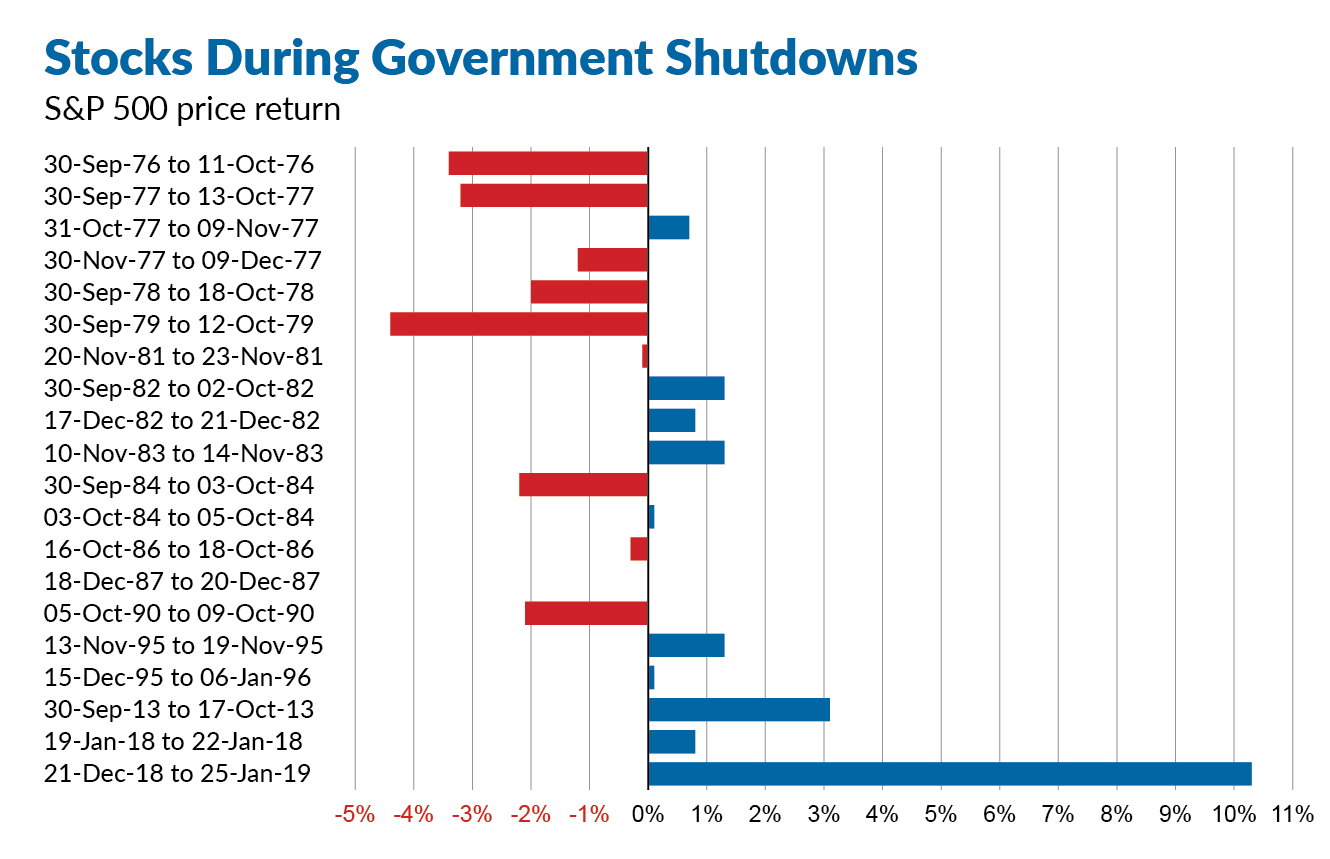

"The U.S. government has shut down 20 times since the mid-1970s, according to data from the

House of Representatives. The S&P 500 averaged a microscopic 0.04% gain during those closures.

However, if we exclude one outlier—the 10% return during the 2018–2019 shutdown—the S&P 500’s

average return falls from 0.04% to -0.49%. In other words, the market sometimes dipped, sometimes rose,

but it never cratered. In fact, stocks gained ground during half of all prior government shutdowns."

"Core" Bond Fund Replacement Holy Grail is the term I had in mind (at least for the last 5 years) but free lunch works too. Below is direct from the article.

However, at least in the case of CCLFX, which restricts investments to private credit that is senior, secured, and backed by private equity, the risk of stale pricing is minimal, and doesn’t even exist beyond a month from an economic and statistical significance viewpoint. The takeaway is that the volatility of CCLFX is somewhat understated somewhat when looking at one-month returns. However, when looking at volatility on a quarterly, or longer, basis that is not the case. The bottom line is that CCLFX provides investors with access to the credit premium and the illiquidity premium of private credit without being concerned about the risk of stale pricing. And for investors who don’t need liquidity for at least some portion of their portfolio the illiquidity premium is as close to a free lunch as one can find. Thus, one should eat as much of it as possible!

Full Disclosure: I own shares of CCLFX.

Larry Swedroe is the author or co-author of 18 books on investing. His latest is Enrich Your Future

"Core" Bond Fund Replacement It's not just that CCLFX is an interval fund. It's also that the supposed lack of volatility of the NAV is due to the somewhat fictitious

fair value pricing of a mostly illiquid portfolio (typical of interval funds).

The Fund calculates its NAV on a daily basis using the quarterly valuations provided by the Fund Managers. However, it is important to note that these valuations may not capture market changes or other events that take place after the end of the quarter. The Fund will adjust the valuation of its holdings in investment funds to account for such events, in accordance with its valuation policies.

Prospectus, July 25, 2025 (p. 34)

So the valuations are at best guesses on a quarterly basis with numbers slightly tweaked in between. What

little portfolio data M* does show for this fund suggests that it is somewhat leveraged (around 10%). And M* puts its

risk score at 56 (bond funds typically fall between 1 and 1

5 or so).

The good news is that according to Larry Swedroe the prices are not too stale, and if you're invested for the long term things average out. Then again, if you're invested for the long term with an OEF, price fluctuations also average out. That is, day to day or month to month volatility is not all that important for the long term investor.

The empirical research findings demonstrate that stale pricing exists with funds that provide more liquidity than exists for their underlying assets. That creates the risk of wealth transference through NAV timing. This is especially true for private equity and private real estate funds. However, at least in the case of CCLFX, which restricts investments to private credit that is senior, secured, and backed by private equity, the risk of stale pricing is minimal, and doesn’t even exist beyond a month from an economic and statistical significance viewpoint. The takeaway is that the volatility of CCLFX is somewhat understated somewhat when looking at one-month returns. However, when looking at volatility on a quarterly, or longer, basis that is not the case.

https://alphaarchitect.com/nav-time/If you don't want to go through an adviser, you can invest directly with the fund for a mere $10M. (Thanks to yogi for the link to

the application.)

FIJEX For FIJEX, Morningstar (M*) shows duration of 5.23 that seems high for short-term (ST) bond. So, some bonds can have long duration or maturities.

M* ST bond category is also very broad. It would be helpful if it was broken into core and core-plus, like the IT category.

FIJEX The annual report 7/31/25 shows the following:

• The Fund’s best sector aggregate returns before fees during the year were ABS at just over 7%, CMBS with a return of just over 6.5%, CLOs at 6.25% and

RMBS at approximately 5.5%. The sector with the lowest aggregate total return before fees during the year was the U.S. Treasury sector with a return of

just over 0.5%.

My question pertains to the last sentence, return of .5%

They do hold bonds & notes of lengthy terms, 2035 - 2044

Government Statistics: Trump fires labor statistics chief after weaker than expected jobs report

giroux m* update “It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.”

― Mark Twain

Here’s what I know for sure….I would never pay a fee to have someone else manage my money. So all actively managed funds would be out for me. Since before PRWCX inception, we’ve owned Berkshire Hathaway stock and a S&P

500 index fund. Have continued buying more of those securities for over four decades. That’s worked out pretty well. No fees to any fund manager. David Giroux has never owned Berkshire Hathaway because he thinks the stock is overpriced.