Will President Biden’s economic stimulus cause inflation? Economists are unsure Note the language in the original story that the survey of economists was done by "the Initiative on Global Markets Forum (the University of Chicago Booth School of Business." These are Harvard, Yale, Princeton, and Stanford economists surveyed by a business school--not exactly bastions of radical leftwing ideology. Dalio has a particular world view, which slants towards Ayn Rand, yet even he recently acknowledged something has to be done about inequality. But his economic predictions have been wrong in the past, in fact quite recently:

https://bloombergquint.com/business/for-bridgewater-a-year-of-losses-withdrawals-and-uneasy-staff And hedge fund/money managers in general have had a particular anti-Keynesian libertarian slant that has proven them wrong many times:

https://theatlantic.com/business/archive/2013/05/if-hedge-funders-are-so-smart-why-are-they-so-relentlessly-wrong/275700/ The thing is educated people disagree on this subject of inflation, but one thing the stats show is that the notion that there is a one-to-one correlation between the money supply and fiscal spending with inflation is a political fallacy. The causes are complex. I've posted this before but it's worth reposting:

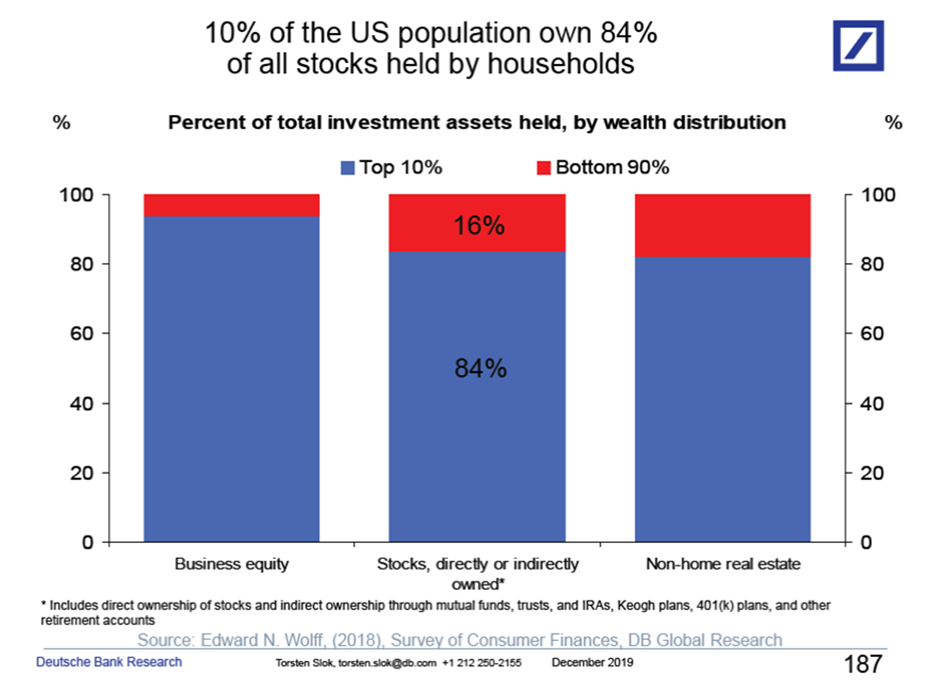

https://gmo.com/americas/research-library/part-1-inflation--tall-tales-and-true-causes/Moreover, I would add, as you mentioned, that depending on one's perspective inflation isn't all bad, depending on the kind, size and duration of inflation. A lot of money managers dread wage inflation, and it may be the source of real broader inflation. But I think wages for average Americans have stagnated for decades on a real inflation-adjusted basis and have actually declined since the 1970s for the lowest paid workers. Some wage inflation even if it filtered into the rest of the CPI would be a good thing for many people. A higher minimum wage is absolutely in order.

But the thing I would stress is that no one really knows whether the current economic policies will bring about a period of extended high inflation, and the fearmongering from the rightwing has less to do with economic reality than concerns about having to pay workers more and their taxes potentially going up. The truest response in perhaps the most unsettling one: We just don't know. In fact, inflation from my perspective may be more influenced by Covid-inspired global supply shortages than monetary or fiscal policy.

Interestingly, from a leftwing MMT perspective you can hear some very different viewpoints from the prevailing ones in the original survey in this interview with Stephanie Kelton who wrote

The Deficit Myth:

https://dissentmagazine.org/online_articles/monetary-mythbusting-an-interview-with-stephanie-kelton

FSRRX My apologize, but are you trying to create a catastrophe or avoid one with FSRRX?

Here are FSRRX stats (source Portfolio Visualizer):

FSRRX has had no clear advantage over a conservatively allocated fund similar to VWINX.

It's almost 32% draw down in July of 2008 took over 2 years to dig out of. It Real return (after inflation) is barely 2% over the last 1

5 years. I believe Fidelity offers MM Mutual funds that might achieve this.

As a hedge against bad outcomes what about PRPFX..not perfect but better at dealing with equity market catastrophes.

FSRRX

FSRRX @ron : This isn't a bond fund 23% stock

52% bond 17-19 % (?) other. Max draw-down 14%.

Derf

Will President Biden’s economic stimulus cause inflation? Economists are unsure @LewisBrahamYour last entry reminds me of Ray Dalio's presentation on "How the Economic Machine Works". I recall one quote form his presentation that goes something like:

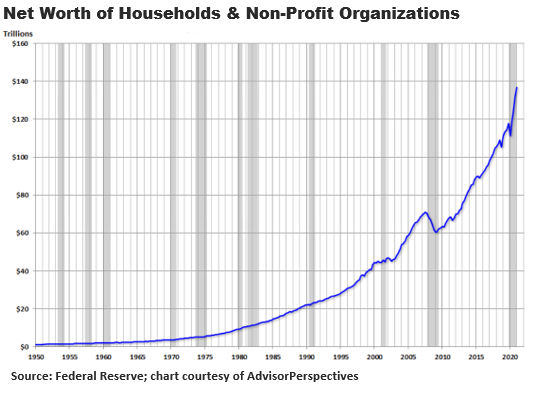

"One man's debt (liability) is another man's income (asset)"Debt creates what he describes as the long and short term debt cycles. Individuals need to service (repay) there debt (Principal & interest) to the borrower (usually the bank). An arrangement exists whereby the government injects liquidity into the system at a very low interest rate (overnight bank rate). The bank in turns loans this liquidity (money) to individuals and corporations so that they can receive and offer goods and services.

The money loaned to individuals and corporations needs to be repaid to the bank (both principal and interest). The money borrowed by the bank is only repaid to the government to the extent that it is borrowed and the banks only outlay is the overnight rate of interest. The government repo's (soaks up) any liquidity (borrowed money) that was not used by the bank to extend credit to credit worthy borrowers.

If credit worthy borrowers add value (labor, innovation, good & services, demand for financial assets) they are able to both pay back the bank and grow the economy. It all works.

When borrowers default, the systems grinds to a halt.

I'm sure you understand all of this, but too many (myself included) Ray Dalio does a great job explaining it all (see video below).

Getting back to inflation. It seems a strong economy should both inflate (have elements good inflation) and deflate (have elements good deflation) simultaneously (would be nice).

IMHO, Biden's bill should be looked at through that lens.

When is Inflation good?

how-can-inflation-be-good-economywhy-is-inflation-goodWhen is Deflation good?

can-deflation-be-goodRay Dalio's Presentation:

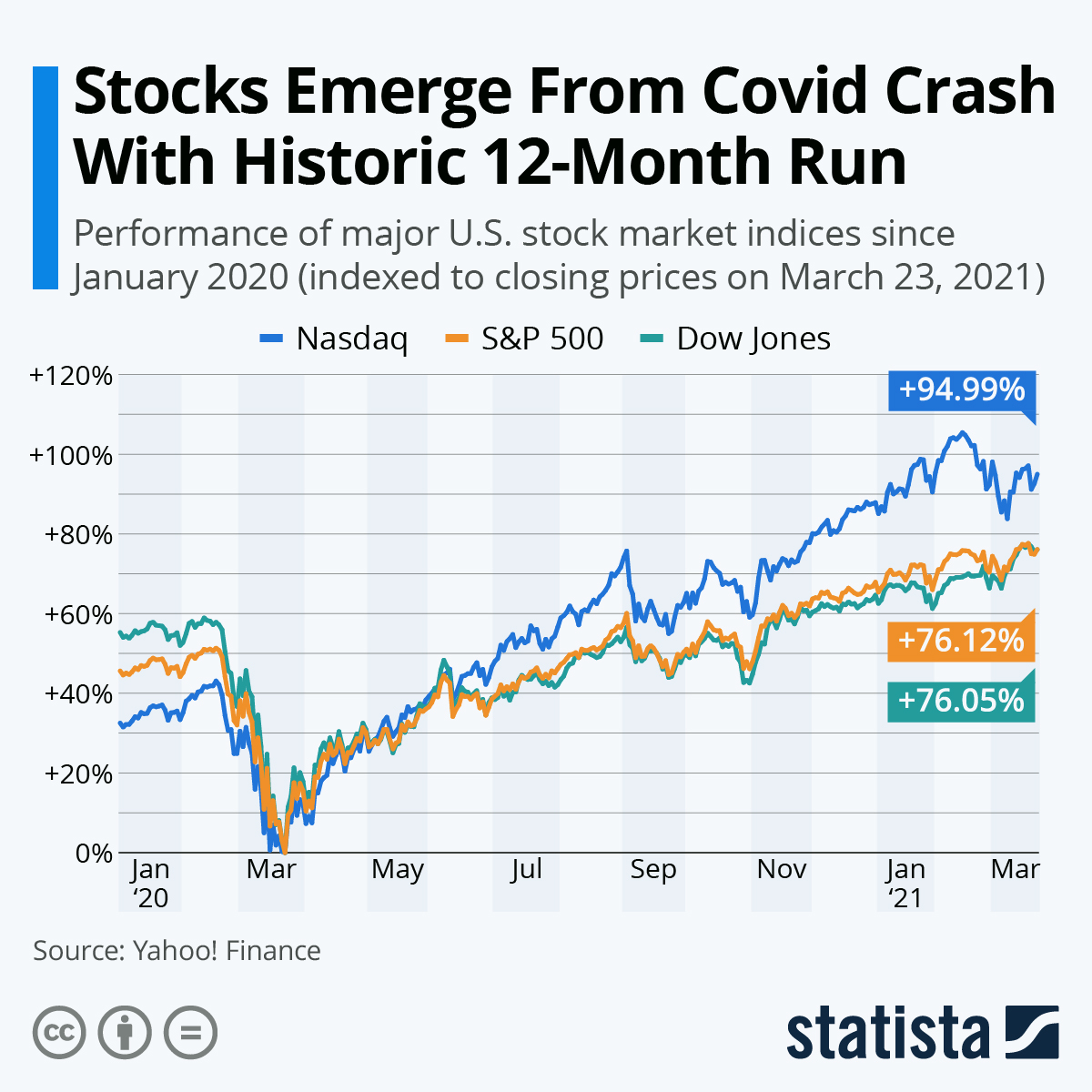

Selling or buying the dip ?!

Will President Biden’s economic stimulus cause inflation? Economists are unsure

Edward Studzinski commentary MFO I first heard him as a child in the 1950s, and it came to help me understand thoughtless reactionary minds and their frights. Plus wannabe-droll delivery.

Edward Studzinski commentary MFO Paul Harvey? Boy, you are old! :)

Maybe not.

"In late August [2001], 83-year-old broadcasting legend Paul Harvey returned full-time to radio land. For three months, he'd been out of commission thanks to a lingering virus that zapped his once invincible voice box."

https://www.salon.com/2001/09/25/harvey_2/Paul Harvey Noon News and Comment - Feb. 16, 2009 (Last one by Paul)

And now you know ... the rest of the story.

Selling or buying the dip ?!

Alternative Strategies Fund changing its investment strategy “Currently, the Fund’s fundamental policy regarding industry concentration requires the Fund to invest more than 25% of its assets in securities related to the real estate industry. The Board also approved a change in the Fund’s industry concentration policy such that the Fund will no longer be required to invest more than 25% of its assets in securities related to the real estate industry.”

Speaks for itself.

Selling or buying the dip ?! @stillers said:

GoldmanSachs for one I trust......

This is where you lose me. GS knows how to make money for GS, but that does not imply that they give out their best proprietary information (or important guidance) to the general public. Nor does any brokerage house.

What I said was

GoldmanSachs for one I trust uses some pretty sophisticated programs and their "guess" (if you can call it that) is for a S&P 9% gain in Q4.Well I happen to pay the BIG bucks for a coupla newsletters (not GS) and they're saying pretty much the same thing.

Still lost?

If you know the history of the S&P's average annual path since 19

50 as compared to this year's and that over 70% of semis stocks are already in Correction mode, you know that given that history and the current state of BIG tech, a 9%-10% move UP in Q4 2020 is a REAL possibility. And as I and people in much higher pay grades than me are saying, is likely.

And FWIW on the free stuff, GS is not alone in projecting a Q4 move UP:

https://www.marketwatch.com/story/rate-fears-just-another-white-knuckle-moment-for-tech-stocks-says-this-analyst-whos-forecasting-rebound-of-at-least-10-11633427803?siteid=yhoof2Excerpt:...To closely followed tech analyst Dan Ives of Wedbush Securities, this is just a “white knuckle moment” that will soon pass. Ives says the worries around rising yields and growth stock valuations will give way to a year-end rally of at least 10% in the tech space...

Selling or buying the dip ?! Event based markets are difficult to bet on, especially when the event is 2 weeks away. Small and micro caps are in red today. So, it is not full on risk, notwithstanding a decent up day in large cap averages.

Yep. Anybody’s guess how it will all play out. Not only the debt question, but Evergrande and a lot of other newsworthy issues. I’d expect a “relief bounce” in many markets lasting a day of two if / when the debt issue is settled. However, I still think the path of least resistance near term is down - if we’re talking about the major indexes. That’s not to say some individual stocks and sectors won’t do well.

Well, for many it goes a bit beyond guessing.

GoldmanSachs for one I trust uses some pretty sophisticated programs and their "guess" (if you can call it that) is for a S&P 9% gain in Q4.

https://www.cnbc.com/2021/10/05/goldman-sachs-sees-a-big-4th-quarter-with-a-9percent-sp-500-gain-from-here.html=======================

Having been an auditor/audit manager for 30+ years, I'm pretty anal about words as I've seen one incorrect word in a FS footnote can change a person's interpretation of a company's entire financial outlook. (I know, I've read that incorrect "one word" many times and sadly applied ones myself more than I care to remember.)

"Relief bounces" or more commonly "Relief rallies" are generally associated with secular bear markets:

https://www.investopedia.com/terms/r/relief-rally.aspFWIW, IMO, this is NOT a "relief rally" an I've NOT heard a single person in the biz refer to it as that. Just sayin'.

Selling or buying the dip ?! In case anyone has NOT noticed this, the national biz media tends to get a wee bit overly excited about SMALL moves DOWN in markets. Break the 50 dma and there's probably gonna be a CNBC "Markets in turmoil" special coming pretty soon. Ring the registers!

I'm simply reporting on a level below the 50 that we haven't seen in quite a while. There is NOTHING definitive about what's happening. What you do with the info is your business. PERIOD.

I'll stop shouting in caps if you agree to do the same.

That's life on the internet pretty much all the time/Life in America in 2021...

Um, I was NOT (sorry for the emphasis here but I can't say it's not necessary since you are incorrectly blasting me) responding directly to you.

It was a general comment (as noted by my SPECIFIC use of the word "anyone") based on the scores of articles and posts I've read during the recent Dip/Diplet.

If I'm responding directly to you, I'll quote you.

BTW, it's not shouting with me, it's emphasis. I learned from three decades of communicating directly to senior management of many firms that people many times (1) don't read what was written, I mean literally, they don't read it, (2) many times do not open links and if they do they read only the headlines and/or first para, and (3) miss the main points of what is written unless they are bolded or capitalized.

Selling or buying the dip ?! In case anyone has NOT noticed this, the national biz media tends to get a wee bit overly excited about SMALL moves DOWN in markets. Break the 50 dma and there's probably gonna be a CNBC "Markets in turmoil" special coming pretty soon. Ring the registers!

I'm simply reporting on a level below the

50 that we haven't seen in quite a while. There is NOTHING definitive about what's happening. What you do with the info is your business. PERIOD.

I'll stop shouting in caps if you agree to do the same.