It looks like you're new here. If you want to get involved, click one of these buttons!

Bank of America Calls CBDCs ‘More Effective’ Than Cash in Research NoteBank of America (BofA) called central bank digital currencies “a much more effective payment system than cash,” in a research paper published Wednesday.

...CBDCs could “replace cash completely in the (distant) future.”

CBDCs qualified as money “by allowing store of value and being a unit of account and means of exchange,” differentiating them from cryptocurrencies that “do not meet these criteria. “Since they are traded, they could be seen as an asset class,”

CBDCs could lessen the need for stablecoins, noting that the latter could “present a material financial stability risk during times of market stress when there may be a crypto to fiat currency run.”

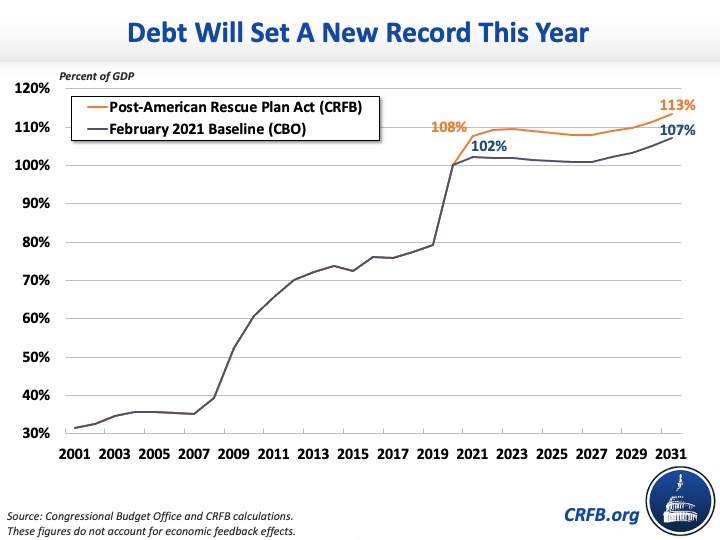

https://www.nytimes.com/2019/01/09/opinion/melting-snowballs-and-the-winter-of-debt.htmlAnd the dollar value of G.D.P. normally grows over time, due to both growth and inflation. Other things equal, this gradually melts the [debt] snowball: even if debt is rising in dollar terms, it will shrink as a percentage of G.D.P. if deficits aren’t too large.

Not sure, but your last comment appears to be in reference to fred495 who on Monday on armchairinvesting stated,I have been following the various discussions about OSTIX on various investment forums (MFO, Armchair, Big Bang). I have done some additional due diligence on this fund recently, just to see if I have some renewed interest in possibly owning it. I have concluded that I am not interested in purchasing this fund. I simply can find better alternatives, that offers similar total return, with lower risk metrics. Just owning it because if offers "dedicated HY Bond" exposure, is not enough of a reason to own it for me. I own several bond oefs from the multisector and nontraditional bond categories, that offers significant exposure to HY bonds, and find no compelling reason to own it, just because it is a dedicated sector HY bond fund. So, I will pass on it.

TOP TEN STOCKS AS OF JANUARY

31, 2000

% OF FUND'S NET ASSETS % OF FUND'S NET ASSETS 6

MONTHS AGO

Microsoft Corp. 9.7 8.8

Cisco Systems, Inc. 5.3 2.7

Amgen, Inc. 3.6 3.7

Intel Corp. 3.0 1.2

Dell Computer Corp. 2.5 0.5

BEA Systems, Inc. 2.3 0.0

Immunex Corp. 2.3 1.4

EMC Corp. 1.9 0.0

Telefonaktiebolaget LM 1.9 0.2

Ericsson sponsored ADR

Comverse Technology, Inc. 1.7 1.8

34.2 20.3

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla