It looks like you're new here. If you want to get involved, click one of these buttons!

Don’t sweat it @Mark. The company up in first-class isn’t usually that great anyway. Suggest you save your $$ and wait until they offer “tourist class” or “coach” seating.I would love to take a Blue Origin space trip but it's roughly $17, 990,000 out of my price range based on the winning auction bid of $18M.

Central Bankers Talk Down Concerns Over Digital Currency RisksBenoit Coeure, the head of the Bank for International Settlement’s Innovation Hub,....said the most likely setup will be a two-tier model, whereby digital currencies would be issued by central banks but distributed by commercial lenders.

Cecilia Skingsley, the first deputy governor of Sweden’s Riksbank, said central banks will play a “focused and narrow role” in providing the infrastructure on which the private sector can build, “and that’s where we are going to stay.”

Loaded terminology, "index based".I understand that neither DFA nor Adventis ETFs are index based funds. Some elements of factor based are used, and thus they are considered actively managed. Just want to learn more information on their strategies.

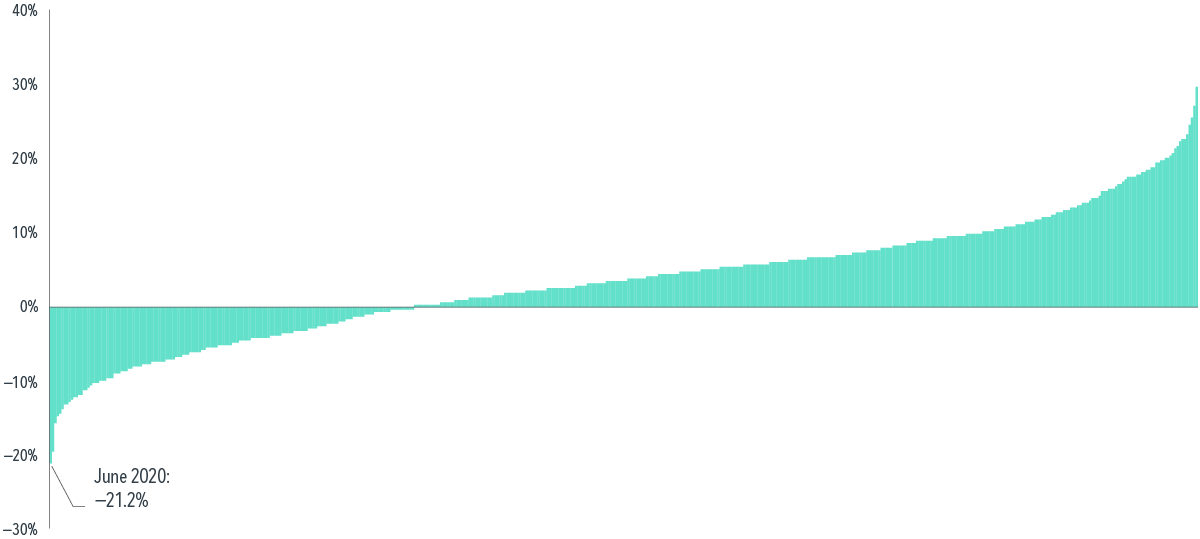

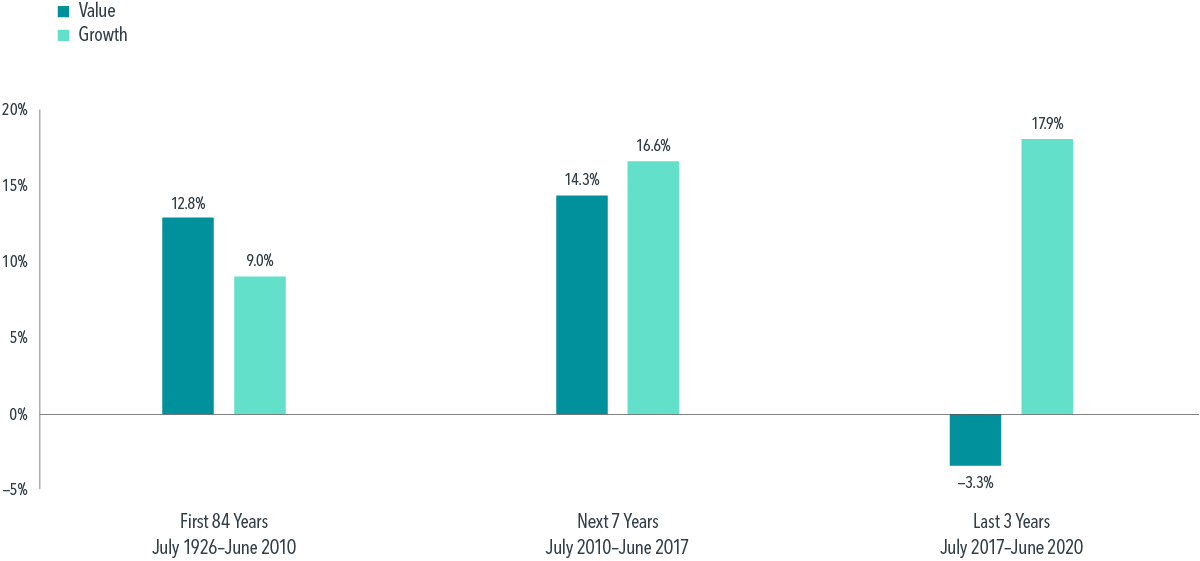

This three-year run [2017-2020] warrants further inspection—just how uncommon was this value premium magnitude? Literally unprecedented, as illustrated by the rolling three-year value premiums in Exhibit 2. Of the 1,093 rolling observations in US history, the three years ending in June 2020 ranked dead last. This is the very definition of an outlier.

ᴇxʜɪʙɪᴛ 2

Back of the Pack

Rolling 3-year annualized return differences for value versus growth,

US market, June 1929–June 2020

The BPI write ups are quite informative, but may not be entirely persuasive.

If by "need" additional Congressional authority you mean from a pragmatic perspective, I would tend to agree. Reading "need" as legally necessary, I'm not yet convinced.U.S. officials would only consider issuing a digital dollar if they believed there was a clear use and if the idea had widespread public and political buy-in.

https://www.cbsnews.com/news/full-transcript-fed-chair-jerome-powell-60-minutes-interview-economic-recovery-from-coronavirus-pandemic/PELLEY [60 Minutes]: Where does it come from? Do you just print it?

POWELL: We print it digitally. So as a central bank, we have the ability to create money digitally.

GS Goldman Sachs Group Inc 4.25

TXN Texas Instruments Inc 4.18

NOW ServiceNow Inc 4.02

CMG Chipotle Mexican Grill Inc 4.00

LRCX Lam Research Corp 3.81

HON Honeywell International Inc 3.55

FTNT Fortinet Inc 3.45

FOXA Fox Corp Class A 3.29

ORCL Oracle Corp 3.27

ADBE Adobe Inc 3.18

ORLY O'Reilly Automotive Inc 3.11

BLK BlackRock Inc 3.00

REGN Regeneron Pharmaceuticals Inc 2.98

ABBV AbbVie Inc 2.67

DISCK Discovery Inc C 2.58

AN AutoNation Inc 2.56

IIVI II-VI Inc 2.48

FANG Diamondback Energy Inc 2.40

REG Regency Centers Corp 2.40

ZBRA Zebra Technologies Corp 2.27

CAT Caterpillar Inc 2.16

LYB LyondellBasell Industries NV 2.13

BK Bank of New York Mellon Corp 2.09

PHM PulteGroup Inc 2.06

CVS CVS Health Corp 2.03

LHX L3Harris Technologies Inc 1.99

RTX Raytheon Technologies Corp 1.98

UNH UnitedHealth Group Inc 1.87

MDT Medtronic PLC 1.87

HSY The Hershey Co 1.79

CB Chubb Ltd 1.78

FGXXX First American Government Obligs X 1.78

D Dominion Energy Inc 1.74

FAST Fastenal Co 1.73

SYK Stryker Corp 1.71

TJX TJX Companies Inc 1.69

DLTR Dollar Tree Inc 1.62

PSX Phillips 66 1.59

HRL Hormel Foods Corp 1.50

KMB Kimberly-Clark Corp 1.43

The Fed is reviewing this specific issue within the framework of deciding if creating CBDC technology will be useful as a way to address the topics highlighted in my excerpt from the CFSAIS report (as well as other topics not mentioned). Deciding the new technology will probably be useful would lower the threshold the Fed would face when considering whether to extend that technology to include an alternative type of personal bank account.My point is simply that, to use your own words, we can create an "alternative type of bank account" without creating an alternative type of electronic cash. (Cash in a bank is already electronic.)

https://joinbankon.org/

A new type of currency is not necessary to provide such accounts. Nor does this new currency seem to hold any intrinsic advantage for these customers over traditional (dollar-based) digital currency. Rather, it appears to be an example of a purported benefit promulgated as a rationale for CBDCs.

In his drive to create the world’s most efficient company, Jeff Bezos discovered what he thought was another inefficiency worth eliminating: hourly employees who spent years working for the same company.

Longtime employees expected to receive raises. They also became less enthusiastic about the work, Amazon’s data suggested. And they were a potential source of internal discontent.

Bezos came to believe that an entrenched blue-collar work force represented “a march to mediocrity,” as David Niekerk, a former Amazon executive who built the company’s warehouse human resources operations, told The Times, as part of an investigative project being published this morning. “What he would say is that our nature as humans is to expend as little energy as possible to get what we want or need.”

In response, Amazon encouraged employee turnover. After three years on the job, hourly workers no longer received automatic raises, and the company offered bonuses to people who quit. It also offered limited upward mobility for hourly workers, preferring to hire managers from the outside.

As is often the case with one of Amazon’s business strategies, it worked.

Turnover at Amazon is much higher than at many other companies — with an annual rate of roughly 150 percent for warehouse workers, The Times’s story discloses, which means that the number who leave the company over a full year is larger than the level of total warehouse employment. The churn is so high that it’s visible in the government’s statistics on turnover in the entire warehouse industry: When Amazon opens a new fulfillment center, local turnover often surges....

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla