It looks like you're new here. If you want to get involved, click one of these buttons!

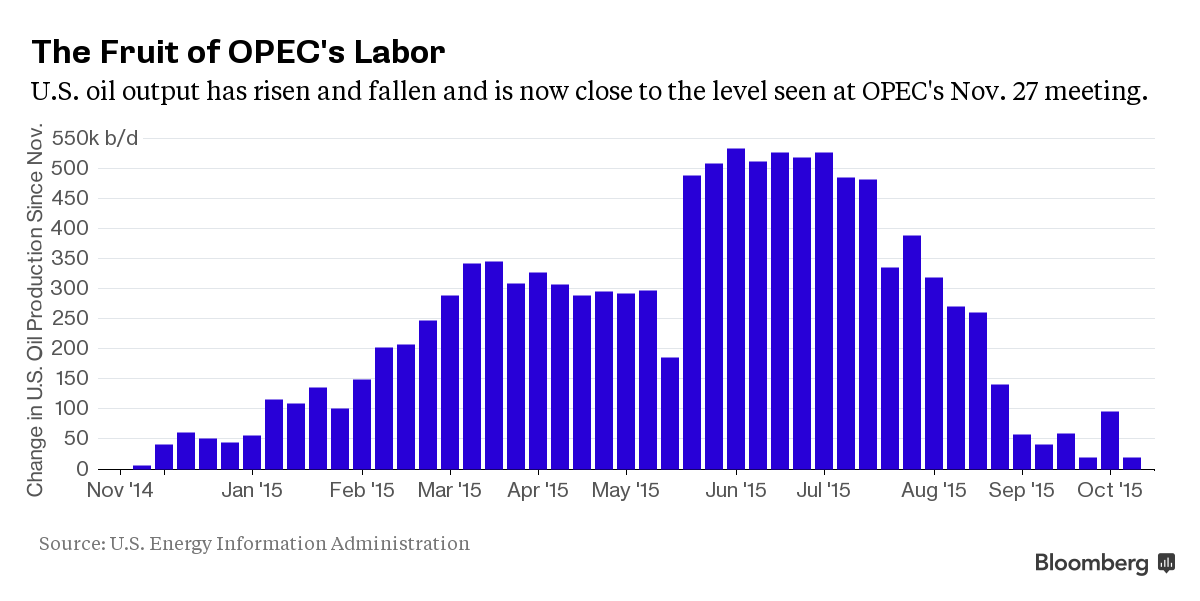

U.S. oil output almost back down to level of last OPEC meeting. Saudi-led strategy is paying off, says Societe Generale. After a year suffering the economic consequences of the oil price slump, OPEC is finally on the cusp of choking off growth in U.S. crude output. The nation’s production is almost back down to the level pumped in November 2014...

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

We reported total sales of copper during the quarter of 1 billion pounds, gold sales of 294,000 ounces, 23 million pounds of molybdenum, and 13.8 million barrels of oil equivalents.

Our average realized price for copper was $2.38 per pound. That was below last year's third quarter average of $3.12 per pound, and gold prices of $1,117 per ounce or below the year-ago quarter average of $1,220 per ounce. Our oil and gas realized price for crude was $55.88 per barrel that included about $11 per barrel of realized cash gains on derivative contracts. That was substantially below last year's average price of $88.58, which included $6.77 of cash losses on derivative contracts

Operating cash flows during the third quarter totaled $822 million and capital expenditures totaled $1.5 billion. We ended the quarter with total debt of $20.7 billion and consolidated cash of $338 million.

http://seekingalpha.com/article/3595956-freeport-mcmoran-fcx-richard-c-adkerson-on-q3-2015-results-earnings-call-transcript

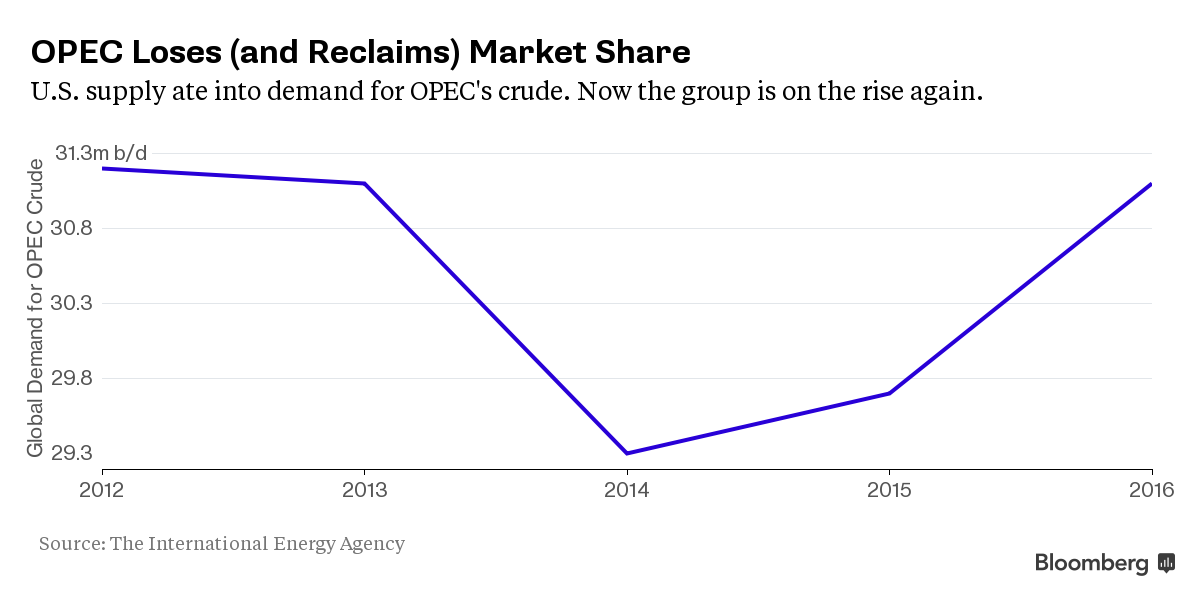

More Bears and OPEC similarities to previous price busts.

Oil’s big slump looks like the 1980s ‘Lost Decade’

Posted on October 22, 2015 | By Bloomberg

Crude oil’s collapse is bringing back memories of the decade of low prices that started in 1985 when Saudi Arabia began targeting market share.

http://fuelfix.com/blog/2015/10/22/oils-big-slump-looks-like-the-1980s-lost-decade/#35109101=0