It looks like you're new here. If you want to get involved, click one of these buttons!

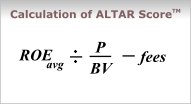

Here is the graphic they mention . . .For equities, we calculate the ALTAR Score™ using the formula on the right—itself a derivation of the old Dividend Discount Model—where:

Avg. ROE is the average return on equity of firms in the fund for the five (5) years up to and including the current forecast year

P/BV is the forward price-to-book value based on current market prices

fees is the annual expense ratio of the ETF

The relationship between Return on Equity and Price-to-Book Value multiples is well established in the academic literature. This formula is designed to forecast the likely internal rate of return to business owners. It is important to note that it is not a target price, and there are no timing or momentum components to it.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

I tried to find one for mutual funds but on google the only ones that popped up where either foreign site for funds in other countries, or funds in same family.

too bad M* has abandoned individual investors

MIRC made available via my library includes Portfolio X-Ray.

Portfolio X-Ray shows how the top 50 net stock holdings are distributed across a portfolio

and can be used to check duplicate holdings between two or more funds.

This tool may not list all duplicate stocks since only the top 50 holdings are displayed.

I'm not aware of any free tools which will list all duplicate holdings.