Revision: January 7, 2016 to reflect switch to Lipper database and subsequent updates.

Originally published in July 1, 2013 Commentary

The following is a summary of definitions of the various terms tabulated in the MFO rating system. A recap of the system’s methodology can be found in David’s June 2013 commentary under Introducing MFO Fund Ratings. For those interested in the mathematical formulas used in the system, they can be found on the MFO Discussion board under A Look at Risk Adjusted Returns.

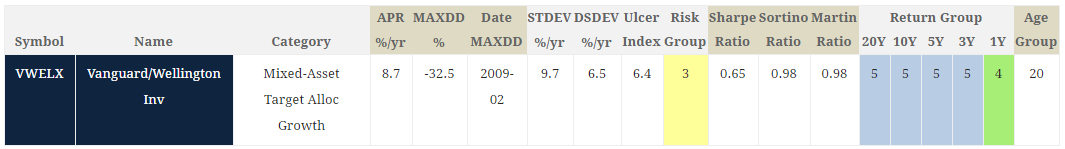

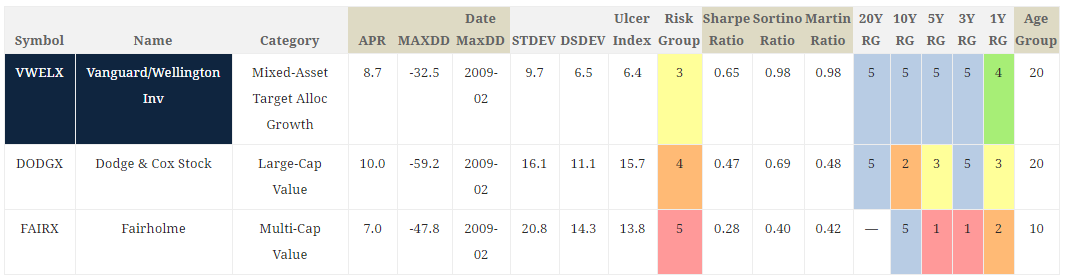

The following definitions are for metrics found in the output pages of our Risk Profile and Miraculous MultiSearch tools (examples depicted below):

Type

A fund’s broad investment approach. The MFO rating system groups funds into three types: Fixed Income (FI), Asset Allocation (AA), and Equity (EQ). Asset allocation funds typically manage a mixed portfolio of equities, bonds, cash and real property. Typically, but not always, equity funds principally invest in stocks, while fixed income funds principally invest in bonds.

Category

A fund’s current investment style as defined by Lipper. There are 155 such classifications or categories, like Large-Cap Value, Core Bond, and Alternative Long/Short Equity. A detailed description can be found here.

Annualized Percent Return (APR)

A fund’s annualized average rate of total return each year over period evaluated. It is an abstract number, or so-called “geometric return,” since actual annual returns can be well above or below the average, but annualizing greatly facilitates comparison of fund performance. APR is equivalent to CAGR, or compound annual rate of return. It reflects reinvestment of dividend and capital gain distributions, while deducting for fund expenses and fees. It excludes any sales loads.

Maximum Drawdown (MAXDD)

The percentage of greatest reduction in fund value below its previous maximum over period evaluated. MAXDD can be the most frightening of a fund’s many statistics, but surprisingly it is not widely published. Many top rated and renowned funds incurred maximum drawdowns of -60% or worse in 2009. The date (month/year) of MAXDD occurrence is also tabulated in the MFO rating system.

Standard Deviation (STDEV)

A measure of fund volatility. The higher a fund’s standard deviation, the more its return has varied over time. That can be both good and bad, since a rise or fall in value will cause standard deviation to increase. Typically, but not always, money market funds have lowest standard deviations, stocks funds have highest, while bond funds are in-between. In the MFO rating system, STDEV indicates the typical percentage variation above or below average return a fund has experienced in a year’s time. On good or bad years, variations from average returns have been two or three times the standard deviation, and every now and then even more.

Downside Deviation (DSDEV)

Another measure of fund volatility, but it measures only downward variation. Specifically, it measures a fund’s return below the risk free rate of return, which is the 90-day T-Bill rate (aka cash). Money market and very short term bond funds typically have downside deviations very close to zero, since they normally return T-Bill rate or higher. Stock funds typically have the highest downside deviations, especially in bear markets. In the MFO rating system, DSDEV indicates the typical percentage decline below its average excess return a fund has experienced in a year’s time.

Ulcer Index (UI)

A third measure of fund volatility and the most direct measure of a fund’s bouts with declining (and uncomfortable, hence its name) performance. It measures both magnitude and duration of drawdowns in value. A fund with high Ulcer Index means it has experienced deep or extended declines, or both. Ulcer Index for money market funds is typically zero. During bull markets, stock funds too can have a low Ulcer Index, but when the bull turns, watch out. In the MFO rating system, UI indicates the typical percentage decline in value a fund has experienced at some point during the period evaluated.

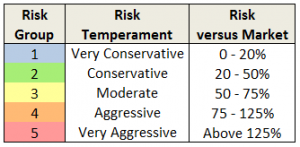

Risk Group

The score or ranking used in the MFO rating system to designate a fund’s risk relative to overall market, defined by SP500 index. Funds less than 20% of market are placed in risk group 1 and deemed “very conservative,” while those greater than 125% are placed in risk group 5 deemed “very aggressive.” Note that the system uses all three risk measures (STDEV, DSDEV, and UI) and all evaluation periods across a fund’s life when making the risk determination. The evaluation periods are 1, 3, 5, 10, and 20 years, as applicable. In this way, the system can be very sensitive to risk. For example, a fund with a 10 year record of moderate risk may get an elevated risk ranking, temporarily at least, if it experiences a rough patch in the past 12 months. Also, probably good to emphasize here that risk is fundamental to producing excess return and many top rated funds are also very aggressive. The reference market itself in the MFO system is deemed “aggressive” by definition.

The score or ranking used in the MFO rating system to designate a fund’s risk relative to overall market, defined by SP500 index. Funds less than 20% of market are placed in risk group 1 and deemed “very conservative,” while those greater than 125% are placed in risk group 5 deemed “very aggressive.” Note that the system uses all three risk measures (STDEV, DSDEV, and UI) and all evaluation periods across a fund’s life when making the risk determination. The evaluation periods are 1, 3, 5, 10, and 20 years, as applicable. In this way, the system can be very sensitive to risk. For example, a fund with a 10 year record of moderate risk may get an elevated risk ranking, temporarily at least, if it experiences a rough patch in the past 12 months. Also, probably good to emphasize here that risk is fundamental to producing excess return and many top rated funds are also very aggressive. The reference market itself in the MFO system is deemed “aggressive” by definition.

Sharpe Ratio

A measure of risk adjusted return, which is to say it helps quantify whether a fund is delivering returns commensurate with the risk it is taking. Specifically, it is the ratio of the fund’s annualized excess return divided its standard deviation. A fund’s “excess return” is any amount above risk-free investment, which is typically 90-day T-Bill. Sharpe is best used when comparing funds of same investment category over same evaluation period. The higher its Sharpe, the better a fund is performing relative to its risk, or more precisely, its volatility.

Sortino Ratio

Another measure of risk adjusted return, but in this case it is relative to the amount of downside volatility (DSDEV) a fund incurs. It is a modification of the Sharpe intended to address a criticism that Sharpe unfairly penalizes so-called good volatility (ie., rising value), which investors don’t mind at all. In other words, a fund that goes up much more than down may be underappreciated in Sharpe, but not Sortino. Like Shape, Sortino is best used when comparing funds of same investment category over same evaluation period.

Martin Ratio

A third measure of risk adjusted return. Like Sharpe and Sortino, it measures excess return, but relative to its typical drawdown. After the 2000 tech bubble and 2008 financial crisis, which together resulted in a “lost decade” for stocks, investors have grown very sensitive to drawdowns. Martin excels at identifying funds that have delivered superior returns while mitigating drawdowns. It too is best used when comparing funds of same investment category over same evaluation period – this very comparison is the basis for determining a fund’s Return Group rank in the MFO rating system.

Return Group

The score or ranking of a fund’s performance based on Martin Ratio relative to other funds in same investment category over same evaluation period. The evaluation periods are 1, 3, 5, 10, and 20 years, as applicable. Funds in the top 20 percentile are placed in return group 5, while those in bottom 20 percentile are in return group 1. MFO “Great Owl” designations are assigned to funds that have earned top performance rank for all evaluation periods 3 years or longer, as applicable.

Some other qualifications:

- The system includes oldest share class only.

- The system does not account for category drift.

- Funds are presented only once based on age group, but the return rankings reflect all funds existing. For example, if a 3 year fund scores a 5 return, it did so against all existing funds over the 3 year period, not just the 3 year olds.

- All calculations are made with using monthly total returns from Lipper Data Feed Service for U.S. Open End funds.

- The ratings are based strictly on historical returns.

- The ratings will be updated quarterly.