Objective and Strategy

The FPA Global Value Strategy will seek to provide above-average capital appreciation over the long term while attempting to minimize the risk of capital losses by investing in well-run, financially robust, high-quality businesses around the world, in both developed and emerging markets.

Adviser

FPA, formerly First Pacific Advisors, which is located in Los Angeles. The firm is entirely owned by its management which, in a singularly cool move, bought FPA from its parent company in 2006 and became independent for the first time in its 50 year history. The firm has 28 investment professionals and 72 employees in total. Currently, FPA manages about $25 billion across four equity strategies and one fixed income strategy. Each strategy is manifested in a mutual fund and in separately managed accounts; for example, the Contrarian Value strategy is manifested in FPA Crescent (FPACX), in nine separate accounts and a half dozen hedge funds. On April 1, 2013, all FPA funds became no-loads.

Managers

Pierre O. Py and Greg Herr. Mr. Py joined FPA in September 2011. Prior to that, he was an International Research Analyst for Harris Associates, adviser to the Oakmark funds, from 2004 to 2010. Mr. Py has managed FPA International Value (FPIVX) since launch. Mr. Herr joined the firm in 2007, after stints at Vontobel Asset Management, Sanford Bernstein and Bankers Trust. He received a BA in Art History at Colgate University. Mr. Herr co-manages FPA Perennial (FPPFX) and the closed-end Source Capital (SOR) funds with the team that used to co-manage FPA Paramount. Py and Herr will be supported by the two research analysts, Jason Dempsey and Victor Liu, who also contribute to FPIVX.

Management’s Stake in the Fund

As of the last SAI (September 30, 2012), Mr. Herr had invested between $1 and $10,000 in the fund and Mr. Py had no investment in it. Mr. Py did have a very large investment in his other charge, FPA International Value.

Opening date

September 8, 1958.

Minimum investment

$1,500, reduced to $100 for IRAs or accounts with automatic investing plans.

Expense ratio

0.94% on $323 million in assets, as of August 2013.

Comments

We’ve never before designated a 55-year-old fund as a “most intriguing new fund,” but the leadership and focus changes at FPRAX warrant the label.

I’ve written elsewhere that “Few fund companies get it consistently right. By “right” I don’t mean “in step with current market passions” or “at the top of the charts every year.” By “right” I mean two things: they have an excellent investment discipline and they treat their shareholders with profound respect.

FPA gets it consistently right.

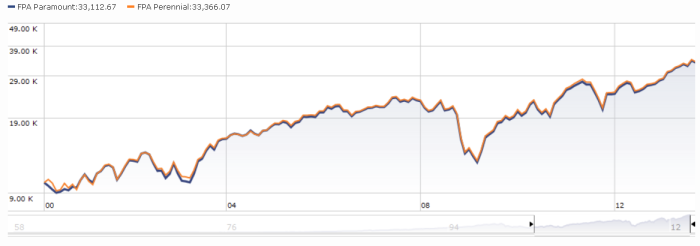

FPA has been getting it right with the two funds overseen by Eric Ende and Stephen Geist: FPA Paramount (since March 2000) and FPA Perennial (since 1995 and 1999, respectively). Morningstar designates Paramount as a five-star world stock fund and Perennial as a three-star domestic mid-cap growth fund (both as of August, 2013). That despite the fact that there’s a negligible difference in the fund’s asset allocation (cash/US stock/international stock) and no difference in their long-term performance. The chart below shows the two funds’ returns and volatility since Geist and Ende inherited Paramount.

To put it bluntly, both have consistently clubbed every plausible peer group (mid-cap growth, global stock) and benchmark (S&P 500, Total Stock Market, Morningstar US Growth composite) that I compared them to. By way of illustration, $10,000 invested in either of these funds in March 2000 would have grown to $35,000 by August 2013. The same amount in the Total Stock Market index would have hit $16,000 – and that’s the best of any of the comparison groups.

To be equally blunt, the funds mostly post distinctions without a difference. In theory Paramount has been more global than Perennial but, in practice, both remained mostly focused on high-quality U.S. stocks.

FPA has decided to change that. Geist and Ende will now focus on Perennial, while Py and Herr reshape Paramount. There are two immediately evident differences:

- The new team is likely to transition toward a more global portfolio. We spoke with Mr. Py after the announcement and he downplayed the magnitude of any immediate shifts. He does believe that the most attractive valuations globally lie overseas and the most attractive ones domestically lie among large cap stocks. That said, it’s unlikely the case that FPA brought over a young and promising international fund manager with the expectation that he’ll continue to skipper a portfolio with only 10-15% international exposure.

- The new team is certain to transition toward a more absolute value portfolio. Mr. Py’s investment approach, reflected in the FPIVX prospectus, stresses “Low Absolute Valuation. The Adviser only purchases shares when the Adviser believes they offer a significant margin of safety (i.e. when they trade at a significant discount to the Adviser’s estimate of their intrinsic value).” In consequence of that, “the limited number of holdings in the portfolio and the ability to hold cash are key aspects of the portfolio.” At the last portfolio report, International Value held 24 stocks and 38% cash while Paramount held 31 and 10%. Given that the investment universe here is broader than International’s, it’s unlikely to hold huge cash stakes but likely that it might drift well north of its current level at times.

Bottom Line

Paramount is apt to become a very solid, but very different fund under its new leadership. There will certainly be a portfolio restructuring and there will likely be some movement of assets as investors committed to Ende and Geist’s style migrate to Perennial. The pace of those changes will dictate the magnitude of the short-term tax burden that shareholders will bear.