Objective and strategy

The fund tries to provide total return, rather than just income. The strategy is to divide the portfolio between two distinctive strategies. Oaktree Capital Management pursues a “barbell-shaped” strategy consisting of senior bank loans and high-yield debt. RiverNorth Capital Management pursues an opportunistic closed-end fund (CEF) strategy in which they buy income-producing CEFs when those funds are (1) in an attractive sector and (2) are selling at what the manager’s research estimates to be an unsustainable discount to NAV. In theory, the entire portfolio might be allocated to any one of the three strategies; in practice, RiverNorth anticipates a “neutral position” in which 25 – 33% of the portfolio is invested in CEFs.

Adviser

RiverNorth Capital Management. RiverNorth is a Chicago-based firm, founded in 2000 with a distinctive focus on closed-end fund arbitrage. They have since expanded their competence into other “under-followed, niche markets where the potential to exploit inefficiencies is greatest.” RiverNorth advises the five RiverNorth funds: Core (RNCOX, closed), Managed Volatility (RNBWX), Equity Opportunity (RNEOX), RiverNorth/DoubleLine Strategic Income (RNDLX) and this one. They manage about $1.9 billion through limited partnerships, mutual funds and employee benefit plans.

Manager

Patrick Galley and Stephen O’Neill of RiverNorth plus Desmund Shirazi, Sheldon M. Stone and Shannon Ward of Oaktree. Mr. Galley is RiverNorth’s founder, president and chief investment officer; Mr. O’Neill is the chief trader, a remarkably important position in a firm that makes arbitrage gains from trading on CEF discounts. Mr. Shirazi is one of Oaktree’s senior loan portfolio managers, former head of high-yield research and long-ago manager of TCW High Yield Bond. Ms. Ward, who joined this management team just a year ago, was a vice president for high-yield investments at AIG back when they were still identified with The Force. The RiverNorth portion of the team manages about $2 billion in assets. The Oaktree folks between them manage about $200 million in mutual fund assets and $25 billion in private accounts and funds.

Strategy capacity and closure

In the range of $1 billion, a number that the principals agree is pretty squishy. The major capacity limiter is the fund’s CEF strategy. When investors are complacent, CEF discounts shrink which leaves RiverNorth with few opportunities to add arbitrage gains. The managers believe, though, that two factors will help keep the strategy limit high. First, “fear is here to stay,” so investor irrationality will help create lots of mispricing. Second, on March 18 2014, RiverNorth received 12(d)1 exemptive relief from the SEC. That exemption allows the firm to own more than 3% of a CEF’s outstanding shares, which then expands the amount they might profitably invest.

Management’s stake in the fund

The RiverNorth Statement of Additional Information is slightly screwed-up on this point. It lists Mr. Galley as having either $0 (page 33) or “more than $100,000” (page 38). The former is incorrect and the latter doesn’t comply with the standard reporting requirement where the management stake is expressed in bands ($100,000-500,000, $500,000 – $1 million, over $1 million). Mr. O’Neill has between $10,000 and $50,000 in the fund. The Oaktree managers and, if the SAI is correct, the fund’s directors have no investment in the fund.

Opening date

December 28, 2012

Minimum investment

$5,000, reduced to $1,000 for IRAs.

Expense ratio

1.44% for “I” class shares and 1.69% for “R” class shares on assets of $54.9 million, as of July 2023.

Comments

In good times, markets are reasonably rational. In bad times, they’re bat-poop crazy. The folks are RiverNorth and Oaktree understand you need income regardless of the market’s mood, and so they’ve attempted to create a portfolio which operates well in each. We’ll talk about the strategies and then the managers.

What are these people up to?

The managers will invest in a variable mix of senior loans, high yield bonds and closed-end funds.

High yield bonds are a reasonably well understood asset class. Firms with shaky credit have to pay up to get access to capital. Structurally they’re like other bonds (that is, they suffer in rising rate environments) but much of their attraction arises from the relatively high returns an investor can earn on them. As investors become more optimistic about the economy, the premium they demand from lower-credit firms rises; as their view darkens, the amount of premium they demand rises. Over the past decade, high yield bonds have earned 8.4% annually versus 7.4% for large cap stocks and 6.5% for investment–grade corporate bonds. Sadly, investors crazed for yield have flooded into high-yield bonds, driving up their prices and driving their yield down to 5.4% in late May.

Senior loans represent a $500 billion asset class, which is about the size of the high-yield bond market. They represent loans made to the same sorts of companies which issue high-yield bonds. While the individual loans are private, collections of loans can be bundled together and sold to investors (a process called “securitizing the loans”). These loans have two particularly attractive structural features: they have built-in protection against loss of principal because they’re “senior” in the firm’s capital structure, which means that there’s collateral behind them and their owners would receive preferential treatment in the case of a bankruptcy. Second, they have built-in protection against loss of interest because they’re floating rate loans; as interest rates rise, so does the amount paid to the loan’s owner. These loans have posted positive returns in 15 of the past 16 years (2008 excepted).

In general, these loans yield a lot more than conventional investment grade bonds and operate with a near-zero correlation to the broad bond market.

Higher income. Protection against loss of capital. Protection against rising rates. High diversification value. Got it?

Closed-end funds share characteristics of traditional mutual funds and of other exchange-traded securities, like stocks and ETFs. Like mutual funds, they represent pools of professionally managed securities. The amount that one share of a mutual fund is worth is determined solely by the value of the securities in its portfolio. Like stocks and ETFs, CEFs trade on exchanges throughout the day. The amount one share of a CEF is worth is not the value of the securities in its portfolio; it’s whatever someone is willing to pay you for the share at any particular moment in time. Your CEF share might be backed by $100 in stocks but if you need to sell it today and the most anyone will offer is $70, then that share is worth $70. The first value ($100) is called the CEF’s net asset value (NAV) price, the second ($70) is called its market price. Individual CEFs have trading histories that show consistent patterns of discounts (or premiums). A particular fund might always have a market price that’s 3% below its NAV price. If that fund is sudden available at a 30% discount, an investor might buy a share that’s backed by $100 in securities for $70 and sell it for $97 when panic abates. Even if the market declined 10% in the interim, the investor could still sell a share purchased as $70 for $87 (a 10% NAV decline and a 3% discount) when rationality returns. As a result, you might pocket gains both from picking a good investment and from arbitrage as the irrational discount narrows; that arbitrage gain is independent of the general direction of the market.

RiverNorth/Oaktree High Income combines these three high-income strategies: an interest-rate insensitive loan strategy and a rate-sensitive high-yield one plus an opportunistic market-independent CEF arbitrage strategy.

Who are these guys, and why should we trust them?

Oaktree Capital Management was founded in April 1995 by former TCW professionals. They specialize in specialized credit investing: high yield bonds, convertible securities, distressed debt, real estate and control investments (that is, buying entire firms). They manage about $80 billion for clients on five continents. Among their clients are 100 of the 300 largest global pension plans, 75 of the 100 largest U.S. pension plans, 300 endowments and foundations, 11 sovereign wealth funds and 38 state retirement plans in the United States. Oaktree is widely recognized as an extraordinarily high-quality firm with a high-quality investment discipline.

To be clear: these are not the sorts of clients who tolerate carelessness, unwarranted risk taking or inconsistent performance.

RiverNorth Capital Management pursues strategies in what they consider to be niche markets where inefficiencies abound. They’re the country’s pre-eminent practitioner of closed-end fund arbitrage. That’s most visible in the (closed) RiverNorth Core Opportunity Fund (RNCOX), which has $700 million in assets and five-year returns in the top 13% of all moderate allocation funds. A $10,000 investment made in RNCOX at inception would be worth $19,000 by May 2014 while its average competitor would have returned $14,200.

Their plan is to grow your money steadily and carefully.

Patrick Galley describes this as “a risk-managed, high-yield portfolio” that’s been “constructed to maximize risk-adjusted returns over time, rather than shooting for pure short-term returns.” He argues that this is, in his mind, the central characteristic of a good institutional portfolio: it relies on time and discipline to steadily compound returns, rather than luck and boldness which might cause eye-catching short term returns. As a result, their intention is “wealth preservation: hit plenty of singles and doubles, rely on steady compounding, don’t screw up and get comfortable with the fact that you’re not going to look like a hero in any one year.”

Part of “not screwing up” requires recognizing and responding to the fact that the fund is investing in risky sectors. The managers have the tactical freedom to change the allocation between the three sleeves, depending on evolving market conditions. In the fourth quarter of 2013, for example, the managers observed wide discounts in CEFs and had healthy new capital flows, so they quickly increased CEF allocation to over 40% from a 25-33% neutral position. They’re now harvesting gains, and the CEF allocation is back under 30%.

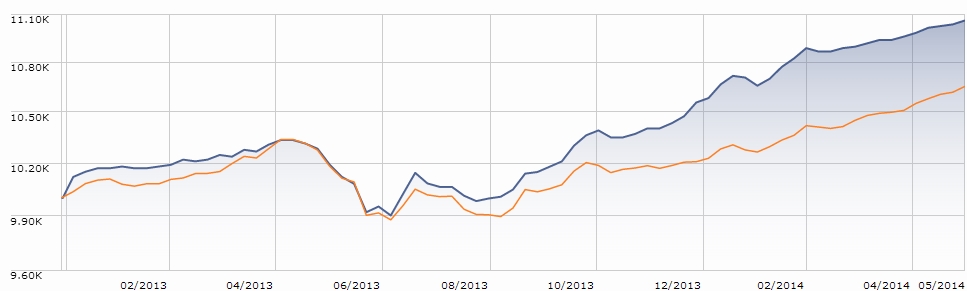

So far, they’ve quietly done exactly what they planned. The fund is yielding 4.6% over the past twelve months. It has outperformed its multi-sector bond benchmark every quarter so far. Below you can see the comparison of RNOTX (in blue) and its average peer (in orange) from inception through late May 2014.

Bottom Line

RNOTX is trying to be the most sensible take possible on investing in promising, risky assets. It combines two sets of extremely distinguished investors who understand the demands of conservative shareholders with an ongoing commitment to use opportunism in the service of careful compounding. While this is not a low-risk fund, it is both risk-managed and well worth the attention of folks who might otherwise lock themselves into a single set of high-yield assets.

Fund website

RiverNorth/Oaktree High Income. Interested in becoming a better investor while you’re browsing the web? You really owe it to yourself to read some of Howard Marks’ memos to Oaktree’s investors. They’re about as good as Buffett and Munger, but far less known by folks in the mutual fund world.

© Mutual Fund Observer, 2014. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.