This fund has been liquidated.

Objective and strategy

TCW/Gargoyle Hedged Value seeks long-term capital appreciation while exposing investors to less risk than broad stock market indices. The strategy is to hold a diversified portfolio mid- to large-cap value stocks, mostly domestic, and to hedge part of the stock market risk by selling a blend of index call options. In theory, the mix will allow investors to enjoy most of the market’s upside while being buffered for a fair chunk of its downside.

Adviser

TCW. TCW, based in Los Angeles, was founded in 1971 as Trust Company of the West. About $140 billion of that are in fixed income assets. The Carlyle Group owns about 60% of the adviser while TCW’s employees own the remainder. They advise 22 TCW funds, as well as nine Metropolitan West funds with a new series of TCW Alternative funds in registration. As of June 30, 2015, the firm had about $180 billion in AUM; of that, $18 billion resides in TCW funds and $76 billion in the mostly fixed-income MetWest funds.

Manager

Joshua B. Parker and Alan Salzbank. Messrs. Parker and Salzbank are the Managing Partners of Gargoyle Investment Advisor, LLC. They were the architects of the combined strategy and managed the hedge fund which became RiverPark/Gargoyle, and now TCW/Gargoyle, and also oversee about a half billion in separate accounts. Mr. Parker, a securities lawyer by training is also an internationally competitive bridge player (Gates, Buffett, Parker…) and there’s some reason to believe that the habits of mind that make for successful bridge play also makes for successful options trading. They both have over three decades of experience and all of the investment folks who support them at Gargoyle have at least 20 years of experience in the industry.

Strategy capacity and closure

The managers estimate that they could manage about $2 billion in the stock portion of the portfolio and a vastly greater sum in the large, liquid options market. TCW appears not to have any clear standards controlling fund closures.

Active share

“Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. Gargoyle has calculated the active share of the equity portion of the portfolio but is legally constrained from making that information public. Given the portfolio’s distinctive construction, it’s apt to be reasonably high.

Management’s stake in the fund

As of January 2014, the managers had $5 million invested in the strategy (including $500,000 in this fund). Gargoyle Partners and employees have over $10 million invested in the strategy.

Opening date

The strategy was originally embodied in a hedge fund which launched December 31, 1999. The hedge fund converted to a mutual fund on April 30, 2012. TCW adopted the RiverPark fund on June 26, 2015.

Minimum investment

$5000, reduced to $1000 for retirement accounts. There’s also an institutional share class (TFHIX) with a $1 million minimum and 1.25% expense ratio.

Expense ratio

1.50%, after waivers, on assets of $74.5 million, as of July, 2015.

Comments

Shakespeare was right. Juliet, the world’s most famously confused 13-year-old, decries the harm that a name can do:

‘Tis but thy name that is my enemy;

Thou art thyself, though not a Montague.

What’s Montague? it is nor hand, nor foot,

Nor arm, nor face, nor any other part

Belonging to a man. O, be some other name!

What’s in a name? that which we call a rose

By any other name would smell as sweet;

So Romeo would, were he not Romeo call’d,

Retain that dear perfection which he owes

Without that title.

Her point is clear: people react to the name, no matter how little sense that makes. In many ways, they make the same mistake with this fund. The word “hedged” as the first significant term of the name leads many people to think “low volatility,” “mild-mannered,” “market neutral” or something comparable. Those who understand the fund’s strategy recognize that it isn’t any of those things.

The Gargoyle fund has two components. The fund combines an unleveraged long portfolio and a 50% short portfolio, for a steady market exposure of 50%. The portfolio rebalances between those strategies monthly, but monitors and trades its options portfolio “in real time” throughout the month.

The long portfolio is 80-120 stocks, and stock selection is algorithmic. They screen the 1000 largest US stocks on four valuation criteria (price to book, earnings, cash flow and sales) and then assign a “J score” to each stock based on how its current valuation compares with (1) its historic valuation and (2) its industry peers’ valuation. They then buy the hundred most undervalued stocks, but maintain sector weightings that are close to the S&P 500’s.

The options portfolio is index call options. At base, they’re selling insurance policies to nervous investors. Those policies pay an average premium of 2% per month and rise in value as the market falls. That 2% is a long-term average, during the market panic in the fall of 2008, their options were generating 8% per month in premiums.

Why index calls? Two reasons: (1) they are systematically mispriced, and so they generate more profit (or suffer less of a loss) than they theoretically should. Apparently anxious investors are not as price-sensitive as they should be. In particular, these options are overpriced by about 35 basis points per month 88% of the time. For sellers such as Gargoyle, that means something like a 35 bps free lunch. Moreover, (2) selling calls on their individual stocks – that is, betting that the stocks in their long portfolio will fall – would reduce returns. They believe that their long portfolio is a collection of stocks superior to any index and so they don’t want to hedge away any of their stock-specific upside. By managing their options overlay, the team can react to changes in the extent to which their investors are exposed to the stock markets movements. At base, as they sell more index options, they reduce the degree to which the fund is exposed to the market. Their plan is to keep net market exposure somewhere in the range of 35-65%, with a 50% average and a healthy amount of income.

On whole, the strategy works.

The entire strategy has outperformed the S&P. Since inception, its returns have roughly doubled those of the S&P 500. It’s done so with modestly less volatility.

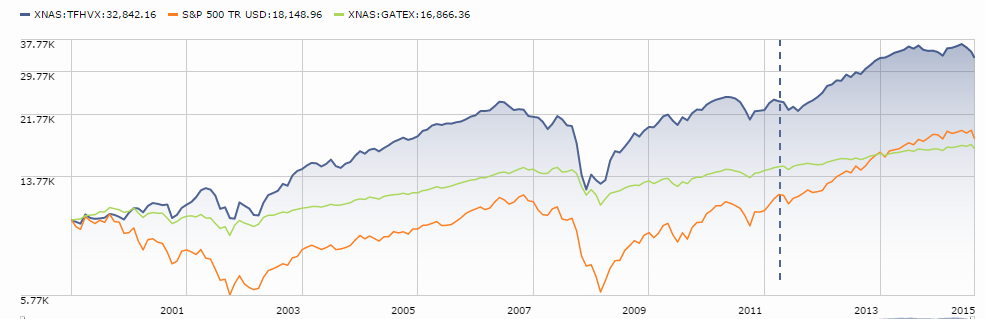

Throughout, it has sort of clubbed its actively-managed long-short peers. More significantly, it has substantially outperformed the gargantuan Gateway Fund (GATEX). At $7.8 billion, Gateway is – for many institutions and advisors – the automatic go-to fund for an options-hedged portfolio. It’s not clear to me that it should be. Here’s the long-term performance of Gateway (green) versus Gargoyle (blue):

Two things stand out: an initial investment in Gargoyle fifteen years ago would have returned more than twice as much as the same investment at the same time in Gateway (or the S&P 500). That outperformance is neither a fluke nor a one-time occurrence: Gargoyle leads Gateway over the past one, three, five, seven and ten-year periods as well.

The second thing that stands out is Gargoyle’s weak performance in the 2008 crash. The fund’s maximum drawdown was 48%, between 10/07 and 03/09. The managers attribute that loss to the nature of the fund’s long portfolio: it buys stocks in badly dented companies when the price of the stock is even lower than the company’s dents would warrant. Unfortunately in the meltdown, those were the stocks people least wanted to own so they got killed. The fund’s discipline kept them from wavering: they stayed 100% invested and rebalanced monthly to buy more of the stocks that were cratering. The payback come in 2009 when they posted a 42% return against the S&P’s 26% and again in 2010 when they made 18% to the index’s 15%.

The managers believe that ’08 was exceptional, and note that the strategy actually made money from 2000-02 when the market suffered from the bursting of the dot-com bubble. Morty Schaja, president of River Park Funds, notes that “We are going to have meltdowns in the future, but it is unlikely that they will play out the same way as it did 2008 . . . a market decline that is substantial but lasts a long time, would play better for Gargoyle that sells 1-2% option premium and therefore has that as a cushion every month as compared to a sudden drop in one quarter where they are more exposed. Similarly, a market decline that experiences movement from growth stocks to value stocks would benefit a Gargoyle, as compared to a 2008.” I concur. Just as the French obsession with avoiding a repeat of WW1 led to the disastrous decision to build the Maginot Line in the 1930s, so an investor’s obsession with avoiding “another ‘08” will lead him badly astray.

What about the ETF option? Josh and Alan anticipate clubbing the emerging bevy of buy-write ETFs. The guys identify two structural advantages they have over an ETF: (1) they buy stocks superior to those in broad indexes, and (2) they manage their options portfolio moment by moment, while the ETF just sits and takes hits for 29 out of 30 days each month.

There’s evidence that they’re right. The ETFs are largely based on the CBOE S&P Buy-Write Index (BXM). Between 2000 and 2012, the S&P 500 returned 24% and the BXM returned 52%; the options portion of the Gargoyle portfolio returned 110% while the long portfolio crushed the S&P.

Nonetheless, investors need to know that returns are lumpy; it’s quite capable of beating the S&P 500 for three or four years in a row, and then trailing it for the next three or four. The fund’s returns are not highly correlated with the returns of the S&P 500; the fund may lose money when the index makes money, and vice versa. That’s true in the short term – it beat the S&P 500 during August’s turbulence but substantially trailed during the quieter July – as well as the long-term. All of that is driven by the fact that this is a fairly aggressive value portfolio. In years when value investing is out of favor and momentum rules the day, the fund will lag.

Bottom line

On average and over time, a value-oriented portfolio works. It outperforms growth-oriented portfolios and generally does so with lower volatility. On average and over time, an options overlay works and an actively-managed one works better. It generates substantial income and effectively buffers market volatility with modest loss of upside potential. There will always be periods, such as the rapidly rising market of the past several years, where their performance is merely solid rather than spectacular. That said, Messrs. Parker and Salzbank have been doing this and doing this well for decades. What’s the role of the fund in a portfolio? For the guys, it’s virtually 100% of their US equity exposure. In talking with investors, they discuss it as a substitute for a large-cap value investment; so if your asset allocation plan is 20% LCV, then you could profitably invest up to 20% of your portfolio in Gargoyle. Indeed, the record suggests “very profitably.”

Fund website

TCW/Gargoyle Hedged Value homepage. If you’re a fan of web video, there’s even a sort of infomercial for Gargoyle on Vimeo but relatively little additional information on the Gargoyle Group website.

© Mutual Fund Observer, 2015. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.