Dear friends,

The Christmas of the early American republic – of the half century following the Revolution – would be barely recognizable to us. It was a holiday so minor as to be virtually invisible to the average person. You’ll remember the famous Christmas of 1776 when George Washington crossed the Delaware on Christmas and surprised the Hessian troops who, one historian tells us, were “in blissful ignorance of local custom” and had supposed that there would be celebration rather than fighting on Christmas. Between the founding of the Republic and 1820, New England’s premier newspaper – The Hartford Courant – had neither a single mention of Christmas-keeping nor a single ad for holiday gifts. In Pennsylvania, the Harrisburg Chronicle – the newspaper of the state’s capital – ran only nine holiday advertisements in a quarter century, and those were for New Year’s gifts. The great Presbyterian minister and abolitionist orator Henry Ward Beecher, born in 1813, admitted that he knew virtually nothing about Christmas until he was 30: “To me,” he writes, “Christmas was a foreign day.” In 1819, Washington Irving, author of The Legend of Sleepy Hollow and Rip van Winkle, mourned the passing of Christmas. And, in 1821, the anonymous author of Christmas-keeping lamented that “In London, as in all great cities … the observances of Christmas must soon be lost.” Though, he notes, “Christmas is still a festival in some parts of America.”

Why? At base, Christmas was suppressed by the actions and beliefs of just two groups: the rich people . . . and the poor people.

The rich — the Protestant descendants of the founding Puritans, concentrated in the booming commercial and cultural centers of the Northeast – reviled Christmas as pagan and unpatriotic. About which they were at least half right: pagan certainly, unpatriotic . . . ehhh, debatable.

Here we seem to have a contradiction in terms: a pagan Christmas. To resolve the contradiction, we need to separate a religious celebration of Christ’s birth from a celebration of Christ’s birth on December 25th. Why December 25th? The most important piece of the puzzle is obscured by the fact that we use a different calendar system – the Gregorian – than the early Christians did. Under their calendar, December 25th was the night of the winter solstice – the darkest day of the year but also the day on which light began to reassert itself against the darkness. It is an event so important that every ancient culture placed it as the centerpiece of their year. We have record of at least 40 holidays taking place on, or next to, the winter solstice. Our forebears rightly noted that the choice of December 25th with a calculated marketing decision meant to draw pagans away from one celebration and into another.

Here we seem to have a contradiction in terms: a pagan Christmas. To resolve the contradiction, we need to separate a religious celebration of Christ’s birth from a celebration of Christ’s birth on December 25th. Why December 25th? The most important piece of the puzzle is obscured by the fact that we use a different calendar system – the Gregorian – than the early Christians did. Under their calendar, December 25th was the night of the winter solstice – the darkest day of the year but also the day on which light began to reassert itself against the darkness. It is an event so important that every ancient culture placed it as the centerpiece of their year. We have record of at least 40 holidays taking place on, or next to, the winter solstice. Our forebears rightly noted that the choice of December 25th with a calculated marketing decision meant to draw pagans away from one celebration and into another.

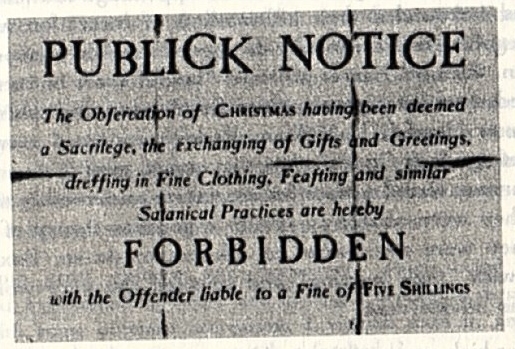

So the Puritans were correct when they pointed out – and they pointed this out a lot – that Christmas was simply a pagan feast in Christian garb. Increase Mather found it nothing but “mad mirth…highly dishonorable to the name of Christ.” Cromwell’s Puritan parliament banned Christmas-keeping in the 1640s and the Massachusetts Puritans did so in the 1650s.

So the Puritans were correct when they pointed out – and they pointed this out a lot – that Christmas was simply a pagan feast in Christian garb. Increase Mather found it nothing but “mad mirth…highly dishonorable to the name of Christ.” Cromwell’s Puritan parliament banned Christmas-keeping in the 1640s and the Massachusetts Puritans did so in the 1650s.

And while the legal bans on Christmas could not be sustained, the social ones largely were.

The rich, who didn’t party, were a problem. The poor, who did, were a far bigger one.

There was, by long European tradition, a period of wild festivity to celebrate New Year’s. Society’s lowest classes – slaves or serfs or peasants or blue collar toilers – temporarily slipped their yokes and engaged in a period of wild revelry and misrule.

In America, the parties were quite wild. Really quite wild.

Think: Young guys.

Lots of them.

With guns.

Drunk.

Ohhh . . . way drunk, lots of alcohol, to . . . uh, drive the cold winter away.

And a sense of entitlement – a sense that their social betters owed them good food, small bribes and more alcohol.

Then add lots more alcohol.

Roving gangs, called “callithumpian bands,” roamed night after night – by a contemporary account “shouting, singing, blowing trumpets and tin horns, beating on kettles, firing crackers … hurling missiles” and demanding some figgy pudding. Remember?

Oh, bring us a figgy pudding and a cup of good cheer

We won’t go until we get some;

We won’t go until we get some;

We won’t go until we get some, so bring some out here

Back then, that wasn’t a song. It was a set of non-negotiable demands.

In a perverse way, what saved Christmas was its commercialization. Beginning in New York around 1810 or 1820, merchants and civic groups began “discovering” old Dutch Christmas traditions (remember New York started as New Amsterdam) that surrounded family gatherings, communal meals and presents. Lots of presents. The commercial Christmas was a triumph of the middle class. Slowly, over a generation, they pushed aside old traditions of revelry and half-disguised violence. By creating a civic holiday which helped to bridge a centuries’ old divide between Christian denominations – the Christmas-keepers and the others – and gave people at least an opportunity to offer a fumbling apology, perhaps in the form of a Chia pet, for their idiocy in the year past and a pledge to try better in the year ahead.

In a perverse way, what saved Christmas was its commercialization. Beginning in New York around 1810 or 1820, merchants and civic groups began “discovering” old Dutch Christmas traditions (remember New York started as New Amsterdam) that surrounded family gatherings, communal meals and presents. Lots of presents. The commercial Christmas was a triumph of the middle class. Slowly, over a generation, they pushed aside old traditions of revelry and half-disguised violence. By creating a civic holiday which helped to bridge a centuries’ old divide between Christian denominations – the Christmas-keepers and the others – and gave people at least an opportunity to offer a fumbling apology, perhaps in the form of a Chia pet, for their idiocy in the year past and a pledge to try better in the year ahead.

I might even give it a try, minus regifting my Chia thing.

Harness the incomparable power of lethargy!

We are lazy, inconstant, wavering and inattentive. It’s time to start using it to our advantage. It’s time to set up a low minimum/low pain account with an automatic investment plan.

About a third of us have saved nothing. The reasons vary. Some of us simply can’t; about 60 million of us – the bottom 20% of the American population – are getting by (or not) on $21,000/year. Over the past 40 years, that group has actually seen their incomes decline by 1%. Folks with just high school diplomas have lost about 20% in purchasing power over that same period. NPR’s Planet Money team did a really good report on how the distribution of wealth in the US has changed over the past 40 years.

About a third of us have saved nothing. The reasons vary. Some of us simply can’t; about 60 million of us – the bottom 20% of the American population – are getting by (or not) on $21,000/year. Over the past 40 years, that group has actually seen their incomes decline by 1%. Folks with just high school diplomas have lost about 20% in purchasing power over that same period. NPR’s Planet Money team did a really good report on how the distribution of wealth in the US has changed over the past 40 years.

A rather larger group of us could save, or could save more, but we’re thwarted by the magnitude of the challenge. Picking funds is hard, filling out forms is scary and thinking about how far behind we are is numbing. So we sort of panic and freeze. That reaction is only so-so in possums; it pretty much reeks in financial planning.

Fortunately, you’ve got an out: low minimum accounts with automatic investment plans. That’s not the same as a low minimum mutual fund account. The difference is that low minimum accounts are a bad idea and an economic drain to all involved; when I started maintaining a list of funds for small investors in the 1990s, there were over 600 no-load options. Most of those are gone now because fund advisers discovered an ugly truth: small accounts stay small. Full of good intentions people would invest the required $250 or $500 or whatever, then bravely add $100 in the next month but find that cash was a bit tight in the next month and that the cat needed braces shortly thereafter. Fund companies ended up with thousands of accounts containing just a few hundred dollars each; those accounts might generate just $3 or 4 a year in fees, far below what it cost to keep them open. Left to its own a $250 account would take 20 years to reach $1,000, a nice amount but not a meaningful one.

But what if you could start small then determinedly add a pittance – say $50 – each month? Over that same 20 year period, your $250 account with a $50 monthly addition would grow to $29,000. Which, for most of us, is really meaningful.

Would you like to start moving in that direction? Here’s how.

If you do not have an emergency fund or if you mostly want to sleep well at night, make your first fund one that invests mostly in cash and bonds with just a dash of stocks. As we noted last month, such a stock-light portfolio has, over the past 65 years, captured 60% of the stock market’s gains with only 25% of its risks. Roughly 7% annual returns with a minimal risk of loss. That’s not world-beating but you don’t want world-beating. For a first fund or for the core of your emergency fund, you want steady, predictable and inflation-beating.

Consider one of these two:

TIAA-CREF Lifestyle Income Fund (TSILX). TIAA-CREF is primarily a retirement services provider to the non-profit world. This is a fund of other TIAA-CREF funds. About 20% of the fund is invested in dividend-paying stocks, 40% in short-term bonds and 40% in other fixed-income investments. It charges 0.83% per year in expenses. You can get started for just $100 as long as you set up an automatic investment of at least $100/month from your bank account. Here’s the link to the account application form. You’ll have to print off the pdf and mail it. Sorry that they’re being so mid-90s about it.

Manning & Napier Strategic Income, Conservative Series (MSCBX). Manning & Napier is a well-respected, cautious investment firm headquartered in Fairport, NY. Their funds are all managed by the same large team of people. Like TSILX, it’s a fund-of-funds and invests in just five of M&N’s other funds. About 30% of the fund is invested in stocks and 70% in bonds. The bond portfolio is a bit more aggressive than TSILX’s and the stock portfolio is larger, so this is a slightly more-aggressive choice. It charges 0.88% per year in expenses. You can get started for just $25 (jeez!) as long as you set up a $25 AIP. Do yourself a favor a set a noticeably higher bar than that, please. Here’s the direct link to the fund application form. Admittedly it’s a poorly designed one, where they stretch two pages of information they need over about eight pages of noise. Be patient with them and with yourself, it’s just not that hard to complete and you do get to fill it out online.

Where do you build from there? The number of advisers offering low or waived minimums continues to shrink, though once you’re through the door you’re usually safe even if the firm ups their requirement for newcomers.

Here’s a quick warning: Almost all of the online lists of funds with waived or reduced minimum contain a lot of mistakes. Morningstar, for instance, misreports the results for Artisan (which does waive its minimum) as well as for DoubleLine, Driehaus, TCW and Vanguard (which don’t). Others are a lot worse, so you really want to follow the “trust but verify” dictum.

Here are some of your best options for adding funds to your monthly investing portfolio:

|

Family |

AIP minimum |

Notes |

|

Amana |

$250 |

The Amana minimum does not require an automatic investment plan; a one-time $250 investment gets you in. Very solid, very risk-conscious. |

|

Ariel |

50 |

Six value-oriented, low turnover equity funds. |

|

Artisan |

50 |

Artisan has four Great Owl funds (Global Equity, Global Opportunities, Global Value, and International Value) but the whole collection is risk-conscious and disciplined. |

|

Azzad |

300 |

Two socially-responsible funds, one midcap and one focused on short-term fixed-income investments. |

|

Buffalo |

100 |

Ten funds across a range of equity and stock styles. Consistently above average with reasonable expenses. Look at Buffalo Flexible Income (BUFBX) which would qualify as a Great Owl except for a rocky stretch well more than a decade ago under different managers. |

|

FPA Funds |

100 |

These guys are first-rate, absolute return value investors. Translation: if nothing is worth buying, they’ll buy nothing. The funds have great long term records but lag in frothy markets. All are now no-load for the first time. |

|

Gabelli |

0 |

On AAA shares, anyway. Gabelli’s famous, he knows it and he overcharges. That said, he has a few solid funds including their one Great Owl, Gabelli ABC. It’s a market neutral fund with badly goofed up performance reporting from Morningstar. |

|

Guinness Atkinson |

100 |

Guinness offers nine funds, all of which fit into unique niches – Renminbi Yuan & Bond Fund (a Great Owl) or Inflation-Managed Dividend Fund, for instances |

|

Heartland |

0 |

Four value-oriented small to mid-cap funds, from a scandal-touched firm. Solid to really good. |

|

Hennessy |

100 |

Hennesy has a surprisingly large collection of Great Owls: Equity & Income, Focus, Gas Utility Index, Japan and Japan Small Cap. |

|

Homestead |

0 |

Seven funds (stock, bond, international), solid to really good performance (including the Great Owls: Short Term Bond and Small Company Stock), very fair expenses. |

|

Icon |

100 |

17 funds whose “I” or “S” class shares are no-load. These are sector or sector-rotation funds, a sort of odd bunch. |

|

James |

50 |

Four very solid funds, the most notable of which is James Balanced: Golden Rainbow (GLRBX), a quant-driven fund that keeps a smallish slice in stocks |

|

Laudus Mondrian |

100 |

An “institutional managers brought to the masses” bunch with links to Schwab. |

|

Manning & Napier |

25 |

The best fund company that you’ve never heard of. Thirty four diverse funds, including many mixed-asset funds, all managed by the same team. Their sole Great Owl is Target Income. |

|

Northern Trust |

250 |

One of the world’s largest advisers for the ultra-wealthy, Northern offers an outstanding array of low expense, low minimum funds – stock and bond, active and passive, individual and funds of funds. Their conservatism holds back performance but Equity Income is a Great Owl. |

|

Oberweis |

100 |

International Opportunities is both a Great Owl and was profiled by the Observer. |

|

Permanent Portfolio |

100 |

A spectacularly quirky bunch, the Permanent Portfolio family draws inspiration from the writings of libertarian Harry Browne who was looking to create a portfolio that even government ineptitude couldn’t screw up. |

|

Scout |

100 |

By far the most compelling options here are the fixed-income funds run by Reams Asset Management, a finalist for Morningstar’s fixed-income manager of the year award (2012). |

|

Steward Capital |

100 |

A small firm with a couple splendid funds, including Steward Capital Mid Cap, which we’ve profiled. |

|

TETON Westwood |

0 |

Formerly called GAMCO (for Gabelli Asset Management Co) Westwood, these are rebranded in 2013 but are the same funds that have been around for years. |

|

TIAA-CREF |

100 |

Their whole Lifecycle Index lineup of target-date funds has earned Great Owl designation. |

|

Tributary |

100 |

Four solid little funds, including Tributary Balanced (FOBAX) which we’ve profiled several times. |

|

USAA |

500 |

USAA primarily provides financial services for members of the U.S. military and their families. Their funds are available to anyone but you need to join USAA (it’s free) in order to learn anything about them. That said, 26 funds, some quite good. Ultra-Short Term Bond is a Great Owl. |

Do you have a fund family that really should be on this list but we missed? Sorry ‘bout that! But we’ll fix it if only you’ll let us know!

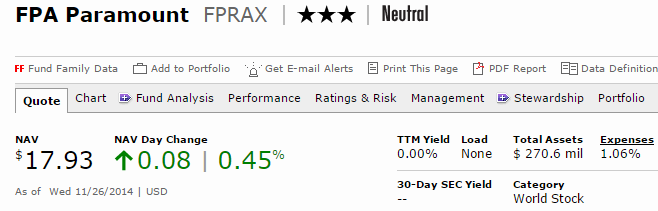

Correcting our misreport of FPA Paramount’s (FPRAX) expense ratio

In our November profile of FPRAX, we substantially misreported FPRAX’s expense ratio. The fund charges 1.26%, not 0.92% as we reported. . Morningstar, which had been reporting the 0.92% charge until late November, now reports a new figure. The annual report is the source for the 1.06% number, the prospectus gives 1.26%. The difference is that one is backward-looking, the other forward looking.

Where did the error originate? Before the fall of 2013, Paramount operated as a domestic small- to mid-cap fund which focused on high quality stocks. At that point the expense ratio was 0.92%. That fall FPA changed its mandate so that it now focuses on a global, absolute value portfolio. Attendant to that change, FPA raised the fund’s expense ratio from 0.92 to 1.26%. We didn’t catch it. Apologies for the error.

The next question: why did FPA decide to charge Paramount’s shareholders an extra 37%? I’ve had the opportunity to chat at some length with folks from FPA, including Greg Herr, who serves as one of the managers for Paramount. The shortest version of the explanation came in an email:

… the main reasons we sought a change in fees was because [of] the increased scope of the mandate and comparable fees charged by other world stocks funds.

FPA notes that the fund’s shareholders voted overwhelmingly to raise their fees. The proxy statement adds a bit of further detail:

FPA believes that the proposed fee would be competitive with other global funds, consistent with fees charged by FPA to other FPA Funds (and thus designed to create a proper alignment of internal incentives for the portfolio management team), and would allow FPA to attract and retain high quality investment and trading personnel to successfully manage the Fund into the future.

Based on our conversations and the proxy text, here’s my best summary of the arguments in favor of a higher expense ratio:

- It’s competitive with what other companies charge

- The fund has higher costs now

- The fund may have higher costs in the future, for example higher salaries and larger analyst teams

- FPA wants to charge the same fee to all of our shareholders

Given the fund’s current size ($304 million), the additional 34 bps translates to an additional $1.03 million/year transferred from shareholders to the adviser.

Let’s start with the easy part. Even after the repricing, Paramount remains competitively priced. We screened for all retail, no-load global funds with between $100-500 million in their portfolios, and then made sure to add the few other global funds that the Observer already profiled. There are 35 such funds. Twelve are cheaper than Paramount, 21 are more expensive. Great Owls appear in highlighted blue rows, while profiled funds have links to their MFO profiles.

|

Expense ratio |

Size (million) |

||

|

Vanguard Global Minimum Volatility |

VMVFX |

0.30 |

475 |

|

GAINX |

0.68 |

5 |

|

|

T. Rowe Price Global Stock |

PRGSX |

0.91 |

488 |

|

Polaris Global Value |

PGVFX |

0.99 |

289 |

|

Dreyfus Global Equity Income I |

DQEIX |

1.06 |

299 |

|

Deutsche World Dividend S |

SCGEX |

1.09 |

362 |

|

Voya Global Equity Dividend W |

IGEWX |

1.11 |

108 |

|

Invesco Global Growth Y |

AGGYX |

1.18 |

359 |

|

PIMCO EqS® Dividend D |

PQDDX |

1.19 |

166 |

|

Deutsche CROCI Sector Opps S |

DSOSX |

1.20 |

152 |

|

Hartford Global Equity Income |

HLEJX |

1.20 |

288 |

|

Deutsche Global Small Cap S |

SGSCX |

1.25 |

499 |

|

FPRAX |

1.26 |

276 |

|

|

First Investors Global |

FIITX |

1.27 |

430 |

|

Invesco Global Low Volatility |

GTNYX |

1.29 |

206 |

|

Perkins Global Value S |

JPPSX |

1.29 |

285 |

|

Cambiar Aggressive Value |

CAMAX |

1.35 |

165 |

|

Motley Fool Independence |

FOOLX |

1.36 |

427 |

|

Artisan Global Value |

ARTGX |

1.37 |

1800 |

|

Portfolio 21 Global Equity R |

PORTX |

1.42 |

494 |

|

Columbia Global Equity W |

CGEWX |

1.45 |

391 |

|

Guinness Atkinson Global Innovators |

IWIRX |

1.46 |

147 |

|

Artisan Global Equity |

ARTHX |

1.50 |

247 |

|

Artisan Global Small Cap |

ARTWX |

1.50 |

169 |

|

BBH Global Core Select |

BBGRX |

1.50 |

130 |

|

William Blair Global Leaders N |

WGGNX |

1.50 |

162 |

|

Grandeur Peak Global Reach |

GPROX |

1.60 |

324 |

|

AllianzGI Global Small-Cap D |

DGSNX |

1.61 |

209 |

|

EVGBX |

1.62 |

249 |

|

|

Grandeur Peak Global Opportunities |

GPGOX |

1.68 |

709 |

|

Royce Global Value |

RIVFX |

1.69 |

154 |

|

Wasatch World Innovators |

WAGTX |

1.77 |

237 |

|

WAGOX |

1.80 |

195 |

|

|

average |

1.32% |

$325M |

Unfortunately other people’s expenses are a pretty poor explanation for FPA’s prices.

There are two ways of reading FPA’s decision:

- We’re going to charge what the market will bear. Welcome to capitalism. The cynical reading starts with the suspicion that the fund’s expenses haven’t risen by a million dollars. While FPA cites research, trading, settlement and compliance expenses that are higher in a global fund than in a domestic fund, the fact that every international stock in Paramount’s portfolio was already in International Value’s means that the change required no additional analysts, no additional research trips, no additional registrations, certifications or subscriptions. While Paramount’s shareholders might need to share the cost of those reports with International Value’s (which lowers the cost of running International Value), at best it’s a wash: International Value’s expenses should fall as Paramount’s rise.

- We need to raise fees a lot in the short term to be sure we can do right by our shareholders in the long term. There are increased expenses, they were fully disclosed to the fund’s board, and that the board acted thoughtfully and in good faith in deciding to propose a higher expense ratio. They also argue that it makes sense that Paramount and International Value’s shareholders should pay the same rate for their manager’s services, the so-called management fee, since they’ve got the same managers and objectives. Before the change, FPIVX shareholders paid 1% and FPRAX shareholders paid 0.65%. The complete list of FPA management fees:

FPA New Income

Non-traditional bond

0.50

FPA Capital

Mid-cap value

0.65

FPA Perennial

Mid-cap growth

0.65

FPA Crescent

Free-range chicken

1.00

FPA International Value

International all-cap

1.00

FPA Paramount

Global

1.00

Finally, the new expenses create a sort of war-chest or contingency fund which will give the adviser the resources to address opportunities that are not yet manifest.

So what do we make of all this? I don’t know. I respect and admire FPA but this decision is disquieting and opaque. I’m short on evidence, which is frustrating.

That, sadly, is where we need to leave it.

Whitney George and the Royce Funds part ways

We report each month on manager changes, primarily at equity and balanced funds. All told, nearly 700 funds have reported changes so far in 2014. Most of those changes have a pretty marginal effect. Of the 68 manager changes we reported in our November issue, only 12 represented house cleanings. The remainder were simply adding a new member to an existing team (20 instances) or replacing part of an existing team (36 funds).

Occasionally, though, manager departures are legitimate news and serious business, both for a fund’s shareholders and the larger investing community.

And so it is with the departure of Whitney George from Royce Funds.

Mr. George has been with Royce Funds for 23 years, both as portfolio manager and with founder Charles Royce, co-Chief Investment Officer. He manages the $65 million Royce Privet hedge fund (‘cause “privet” is a kind of hedge, you see) and the $170 million Royce Focus Trust (FUND), an all-cap, closed-end fund. On November 10, Royce announced that Mr. George was leaving to join Toronto-based Sprott Asset Management and that, pending shareholder approval, Privet and Focus were going with him. At the same time he stepped aside from the management (sole, co- or assistant) of five open-end funds: Royce Global Value (RIVFX), Low-Priced Stock (RYLPX), Premier (RPFFX), SMid-Cap Value (RMVSX) and Value (RYVFX). They are all, by Morningstar’s reckoning, one- or two-star funds. As of May 2014, Mr. George was connected with the management of more than $15 billion in assets.

Why? The firm’s leadership was contemplating long term succession planning for Chuck and decided on an executive transition that did not include Whitney. The position of president went to Chris Clark. Sometime thereafter, he concluded that his greatest contributions and greatest natural strengths lay in managing investments for Canadians and began negotiating a separation. He’ll remain with Royce through the end of the first quarter of 2015, and will remain domiciled in New York City rather than moving to Toronto and feigning an interest in the Maple Leafs, Blue Jays, Rock, Raptors or round bacon.

What’s worth knowing?

- The media got it wrong. In 2009, Mr. George was named co-chief investment officer along with Chuck Royce. At the time Royce was clear that this was not succession planning (this was “not in preparation for Mr. Royce retiring at some point”); which is to say, Mr. George was not being named heir apparent. Outsiders knew better: “The succession plan has become clearer recently: Whitney George was promoted to co-chief investment officer in 2009, and for now he serves alongside Chuck Royce” Karen Anderson, Morningstar, 12/01/10.

- Succession is clearer now. Royce’s David Gruber allowed that the 2009 move was contingency planning, not succession planning. There now are succession plans: the firm has created a management committee to help Mr. Royce, who is 75, run the firm. While Mr. Royce has no plans on retiring, they “would rather make these decisions now than when Chuck is 85” and imagine that “Chris Clark will become CEO in the next several years.” Mr. Clark has been with Royce for over seven years, has been a manager for them and used to be a hedge fund manager. He’s now their co-CIO.

- The change will make a difference in the funds. David Nadel, an international equity specialist for them, will take over the international sleeve of Global Value. Mr. Royce assumes the lead on Premier, his 13th Most significantly, James Stoeffel intends to reorient the Low-Priced Stock portfolio toward, well, low-priced stocks. The argument is that low-priced stocks are inefficiently priced stocks. They have limited interest to institutions for some reason, especially those priced below $10. Stocks priced below $5 cannot be purchased on margin, which further limits their market. Mr. Stoeffel intends to look more closely now at stocks priced near $10 rather than those in the upper end of the allowable range ($25). Up until the last three years, RLPSX has stayed step-for-step with Joel Tillinghast and the remarkable Fidelity Low-Priced Stock Fund (FLPSX). If they can regain that traction, it would be a powerful addition to Royce’s lagging lineup.

- Royce is making interesting decisions. Messrs. George and Royce served as co-CIOs from 2009 to the end of 2013. At that point, the firm appointed Chris Clark and Francis Gannon to the role. The argument strikes me as interesting: Royce does not want their senior portfolio managers serving as CIOs (or, for that matter, as CEO). They believe that the CIO should complement the portfolio managers, rather than just being managers. The vision is that Clark and Gannon function as the firm’s lead risk managers, trying to understand the bigger picture of threats and challenges and working with a new risk management committee to find ways around them. And the CEO should have demonstrated business management skills, rather than demonstrated investment management ones. That’s rather at odds with the prevailing “great man” ideology. And, frankly, being at odds with the prevailing ideology strikes me as fundamentally healthy.

Succession is an iffy business, especially when a firm’s founder was a titanic personality. We learned that in the barely civil transition from Jack Bogle to John Brennan and some fear that we’re seeing it as Marty Whitman becomes marginalized at Third Avenue. We’ll follow-up on the Third Avenue transition in our January issue and, for now, continue to watch Royce Funds to see if they’re able to regain their footing in the year ahead.

Top developments in fund industry litigation – November 2014

![]() Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before.

“We built Fundfox from the ground up for mutual fund insiders,” says attorney-founder David M. Smith. “Directors and advisory personnel now have easier and more affordable access to industry-specific litigation intelligence than even most law firms had before.”

The core offering is a database of case information and primary court documents for hundreds of industry cases filed in federal courts from 2005 through the present. A Premium Subscription also includes robust database searching—by fund family, subject matter, claim, and more.

Orders

- In a win for Fidelity, the U.S. Supreme Court denied a certiorari petition in an ERISA class action regarding the float income generated by transactions in plan accounts. (Tussey v. ABB Inc.)

- Extending the fund industry’s losing streak, the court denied Harbor’s motion to dismiss excessive fee litigation regarding the subadvised International Fund: “Although it is far from clear that Zehrer [the plaintiff-shareholder] will be able to meet the high standard for liability under § 36(b), he has alleged sufficient facts specific to the fees paid to Harbor Capital to survive a motion to dismiss.” (Zehrer v. Harbor Capital Advisors, Inc.)

- The court dismissed Nuveen from an ERISA class action regarding services rendered by FAF Advisors, holding that the contract for Nuveen’s purchase of FAF “unambiguously indicates that Nuveen did not assume any liability that FAF may have had” with respect to the plan at issue. (Adedipe v. U.S. Bank, N.A.)

Briefs

- Genworth filed a motion for summary judgment in the class action alleging that defendants misrepresented the role that Robert Brinker played in the management of the BJ Group Services portfolio. (Goodman v. Genworth Fin. Wealth Mgmt., Inc.)

- SEI Investments filed a motion to dismiss an amended complaint challenging advisory and transfer agent fees for five funds. (Curd v. SEI Invs. Mgmt. Corp.)

- In the ERISA class action regarding TIAA-CREF’s account closing procedures, defendants filed a motion seeking dismissal of interrelated state-law claims as preempted by ERISA. (Cummings v. TIAA-CREF.)

Amended Complaint

- Plaintiffs filed an amended complaint in a consolidated class action regarding an alleged Ponzi scheme related to “TelexFree Memberships.” Defendants include a number of investment service providers, including Waddell & Reed. (Abdelgadir v. TelexElectric, LLLP.)

Supplemental Complaint

- In the class action regarding Northern Trust’s securities lending program, a pension fund’s board of trustees filed a supplemental complaint asserting individual non-class claims. (La. Firefighters’ Ret. Sys. v. N. Trust Invs., N.A.)

The Alt Perspective: Commentary and news from DailyAlts.

Brian Haskin publishes and edits the DailyAlts site, which is devoted to the fastest-growing segment of the fund universe, liquid alternative investments. Here’s his quick take on the DailyAlts mission:

Brian Haskin publishes and edits the DailyAlts site, which is devoted to the fastest-growing segment of the fund universe, liquid alternative investments. Here’s his quick take on the DailyAlts mission:

Our aim is to provide our readers (investment advisors, family offices, institutional investors, investment consultants and other industry professionals) with a centralized source for high quality news, research and other information on one of the most dynamic and fastest growing segments of the investment industry: liquid alternative investments.

Brian offers this as his take on the month just past.

NO PLACE TO HIDE

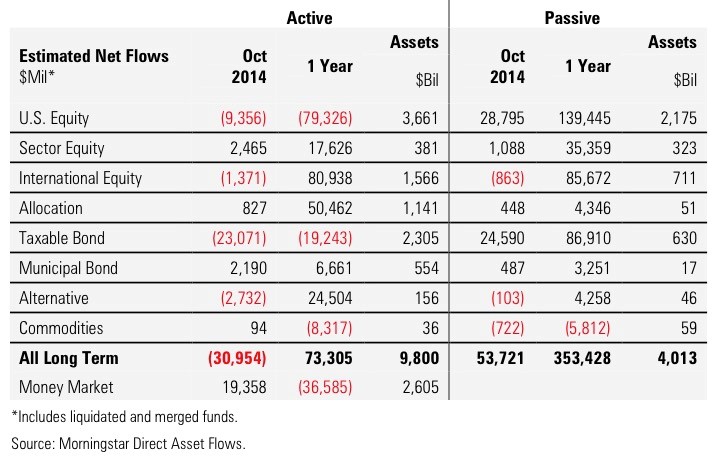

Asset flows into and out of mutual funds and ETFs provide the market with insights about investor behavior, and in this past month it was clear that investors were not happy about active management and underperformance. While the data is lagged a month (October flow data becomes available in November, for instance), asset flows out of alternative mutual funds and ETFs exceeded inflows for the first time in…. well quite a while.

As noted in the table below, alternatives suffered $2.8 billion in outflows across both active and passive strategies. This is a stark change from previous months whereby the category generated consistent positive inflows. Of the $2.8 billion in outflows however, the MainStay Marketfield Fund, a long/short equity fund, contributed $2.2 billion. Market neutral funds also suffered outflows, while managed futures, multi-alternative and commodity funds all saw reasonable inflows.

However, alternatives were not the only category hit in October. Actively managed funds were hit to the tune of $31 billion in outflows, while passive funds recorded $54 billion in inflows. Definitely a shift in investor preferences as active funds in general struggle to keep up with their passive counterparts.

NEW FUND LAUNCHES IN NOVEMBER

Year to date, we have seen 80 new alternative funds hit the market, and six of those were launched in November (this may be revised upward in the next few days; see List of New Funds for more information). Both the global macro and managed futures categories had two new entrants, while other new funds fell into the long/short equity and mutli-alternative categories. Two notable new funds are as follows:

- Neuberger Berman Global Long Short Fund – There are not many pure global long/short funds, yet a larger opportunity set creates more potential for value added. The portfolio manager is new to Neuberger Berman, but not new to global investing. With its global mandate, this fund has the potential to work well alongside a US focused long/short fund.

- Eaton Vance Global Macro Capital Opportunities Fund – This fund is also global but looks for opportunities across multiple asset classes including equity and fixed income securities. The fund carries a moderate fee relative to other multi-alternative funds, and Eaton Vance has had longer-term success with other global macro funds.

FUND REGISTRATIONS IN NOVEMBER

October was the final month to register a fund and still get it launched in 2014, and as a result, November only saw eight new alternative funds enter the registration process, all of which fall into the alternative fixed income or multi-alternative categories. Two of these that look promising are:

- Franklin Mutual Recovery Fund – If you like distressed fixed income, then keep an eye out for the launch of this fund. This fund goes beyond junk and looks for bonds and other fixed income securities of distressed or bankrupt companies.

- Collins Long/Short Credit Fund – If interest rates ever rise, long/short credit funds can help get out of the way of volatile fixed income markets. The sub-advisor of this new fund has a record of delivering fairly steady returns over past several years while beating the Barclays Aggregate Bond Index.

NOVEMBER’S TOP RESEARCH / EDUCATIONAL ARTICLES

Education is critical when it comes to newer and more complex investment approaches, and liquid alternatives fit that description. The good news is that asset managers, investment consultants and other thought leaders in the industry publish a wide range of research papers that are available to the public. At DailyAlts, we provide summaries of these papers, along with links to the full versions. The top three research related articles in November were:

- The Sharpe Ratio is Not the Best Metric for Maximizing Portfolio Efficiency

- MLP Investment Guide for Taxable and Non-Taxable Investors

- The Free Lunch Effect: The Value of Decoupling Diversification and Risk

OTHER NEWS

Probably the most interesting news during the month was the SEC’s approval of Eaton Vance’s proposal to launch Exchange Traded Managed Funds, which essentially combines the intra-day trading, brokerage account availability and lower operating costs of exchange traded funds (ETFs) with the less frequent transparency (at least quarterly disclosure of holdings) of mutual funds. Think of actively managed mutual funds in an ETF wrapper.

Why is this significant? The ETF market is growing at a much faster rate than the mutual fund market, and so far most of the flows into ETFs have been into indexed ETFs. Now the door is open for actively managed ETFs with less transparency than a typical ETF, so expect to see over the next few years a long line of active fund management companies shift gears away from mutual funds and prepping new ETMF structures on the heels of Eaton Vance’s approval from the SEC. Many active fund managers that have wanted to tap the growth of the ETF market now have a mechanism to do so, assuming they can either create their own structure without violating patents held by Eaton Vance, or license the technology directly from Eaton Vance.

Visit us at DailyAlts.com for ongoing news and information about liquid alternatives.

Dodging the tax bullet

We’re entering capital gains season, a time when funds make the distributions that will come back to bite you around April 15th. Because funds operate as pass-through vehicles for tax purposes, investors can end up paying taxes in two annoying circumstances: when they haven’t sold a single share of a fund and when the fund is losing money. The sooner you know about a potential hit, the better you’re able to work on offsetting strategies. We’re offering two short-term resources to help you sort through.

Our colleague The Shadow, one of our discussion board’s most vigilant members, has assembled links to the announced distributions for over 160 fund families. If you want to go directly there, let your mouse hover over the Resources tab at the top of this page and the link will appear.

Beyond that, Mark Wilson has launched Cap Gains Valet to help you. In addition to being Chief Valet, Mark is chief investment officer for The Tarbox Group in Newport Beach, CA. He is, they report, “one of only four people in the nation that has both the Certified Financial Planner® and Accredited Pension Administrator (APA) designations.” Mark’s site, which is also free and public, offers a nice search engine, interpretive articles and a list of funds with the most horrifyingly large distributions. Here’s a friendly suggestion to any of you invested in the Turner Funds: go now! There’s a good chance that you’re going to say something that rhymes with “oh spit.”

We asked Mark what advice he could offer to avoid taking another hit next year. Here’s his year-end planning list for you:

Keeping More of What You Make

Between holiday shopping, decorating and goodie eating there is more than enough going on this time of year without worrying about the tax consequences from mutual fund capital gain distributions.

I have already counted over 450 funds that will distribute more than 10% of their net asset value (NAV) this year, and 50 of these are expected to distribute in excess of 20%! Mutual fund information providers, fund marketers, and most fund managers focus on total investment returns, so they do not care much about taxable distributions. Of course, total returns are very important, but it is not what you make, it is what you keep! After-tax returns are what are most important for the taxable investor.

You can keep more of what you make by considering these factors before you make your investment:

- Use funds with embedded losses or low potential capital gains exposures. Are there really quality funds that have little/no gains? Yes, and Mutual Fund Observer (MFO) is a great site to find these opportunities. The most likely situations are when an experienced manager opens his/her own shop or when one takes over a failing fund and makes it their own.

- Use funds with low turnover and with a long-term investment philosophy. Paying taxes on annual long-term capital gains is not pleasant; however, it is the short-term gains that are the real killer. Short-term gains are taxed at your ordinary income tax rates. Worse yet, short-term capital gains distributions are not offset by other types of capital losses, as these are reported on a completely different tax schedule. Fund managers who trade frequently might have attractive returns, but their returns have to be substantially higher than tax-efficient managers to offset the higher tax bite they are generating.

- Think about asset location. Putting your most tax-inefficient holdings in your tax-deferred accounts will help you avoid these issues. Funds that typically have significant taxable income, high turnover, or mostly short-term gains should be placed in your IRA, Roth IRA, etc. High yield funds, REIT funds and many alternative strategies are usually ideal funds to place in tax-deferred accounts.

- Use index funds or broad based indexed ETFs. I know MFO is not an index fund site, but it is clear that it is not easy to choose funds that beat comparable broad based, low cost index funds or ETFs. When taxes are added to the equation, the hurdle gets even higher. Using index-based holdings in taxable accounts and active fund managers in tax-deferred accounts can make for a great compromise.

I hope considering these strategies will leave you with a little more to spend on the holidays in 2015. Mark.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

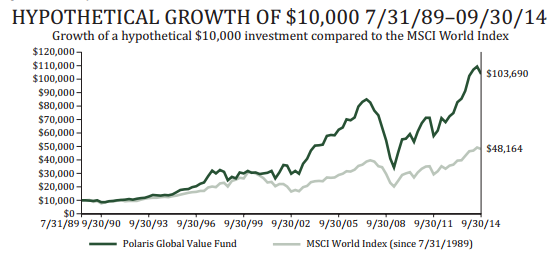

Polaris Global Value (PGVFX) Polaris sports one of the longer records among global stock funds, low expenses, excellent tax efficiency, dogged independence and excellent long term returns. Well, no wonder they have such a small fund!

RiverPark Structural Alpha (RSAFX) Structural Alpha starts with a simple premise: people are consistently willing to overpay in order to hedge their risks. That makes the business of selling insurance to them consistently profitable if you know what you’re doing and don’t get greedy. Justin and Jeremy have proven over the course of years that (1) they do and (2) they don’t, much to their investors’ gain. For folks disgusted with bonds and overexposed to stocks, it’s an interesting alternative.

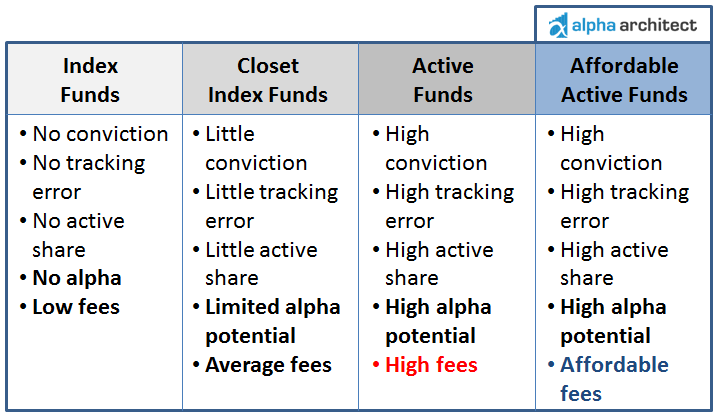

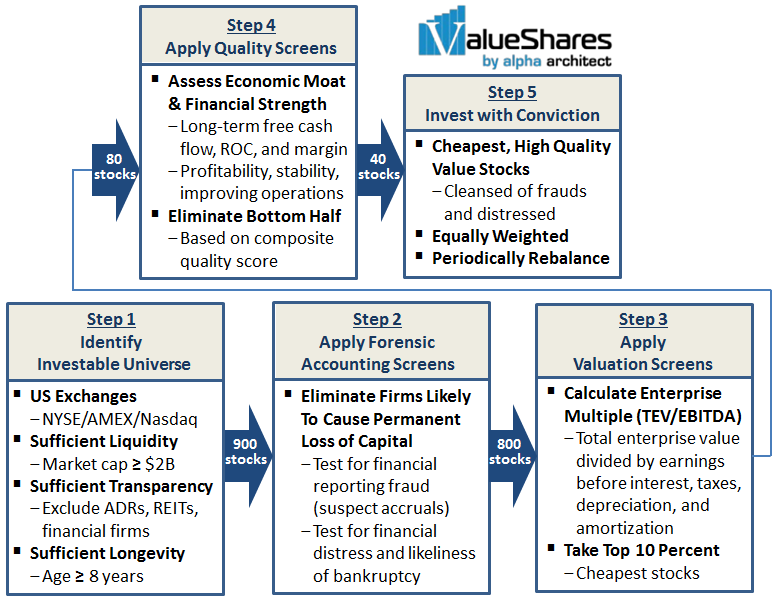

ValueShares US Quantitative Value (QVAL) We don’t typically profile ETFs, but our colleague Charles Boccadoro has been in an extended conversation with Wesley Gray, chief architect of Alpha Architect, and he offers an extended profile with a wealth of unusual detail for this quant’s take on buying “the cheapest, highest quality value stocks.”

Conference call with Mitch Rubin, CIO and PM, RiverPark Large Growth Fund, December 17th, 7:00 Eastern

We’d be delighted if you’d join us on Wednesday, December 17th, for a conversation with Mitch Rubin, chief investment officer for the RiverPark Funds. Over the past several years, the Observer has hosted a series of hour-long conference calls between remarkable investors and, well, you. The format’s always the same: you register to join the call. We share an 800-number with you and send you an emailed reminder on the day of the call. We divide our hour together roughly in thirds: in the first third, our guest talks with us, generally about his or her fund’s genesis and strategy. In the middle third I pose a series of questions, often those raised by readers. Here’s the cool part, in the final third you get to ask questions directly to our guest; none of this wimpy-wompy “you submit a written question in advance, which a fund rep rewords and reads blankly.” Nay nay. It’s your question, you ask it.

We’d be delighted if you’d join us on Wednesday, December 17th, for a conversation with Mitch Rubin, chief investment officer for the RiverPark Funds. Over the past several years, the Observer has hosted a series of hour-long conference calls between remarkable investors and, well, you. The format’s always the same: you register to join the call. We share an 800-number with you and send you an emailed reminder on the day of the call. We divide our hour together roughly in thirds: in the first third, our guest talks with us, generally about his or her fund’s genesis and strategy. In the middle third I pose a series of questions, often those raised by readers. Here’s the cool part, in the final third you get to ask questions directly to our guest; none of this wimpy-wompy “you submit a written question in advance, which a fund rep rewords and reads blankly.” Nay nay. It’s your question, you ask it.

The stability of the Chinese economy has been on a lot of minds lately. Between the perennial risks of the unregulated shadow banking sector and speculation fueled by central bank policies to the prospect of a sudden crackdown on whatever the bureaucrats designate as “corruption,” the world’s second largest stock market – and second largest economy – has been excessively interesting.

Mr. Rubin and his fund have a fair amount of exposure to China. In the second week of December, he and his team will embark on a research trip to the region. They’ve agreed to speak with us about the trip and the positioning of his fund almost immediately after the jet lag has passed.

RiverPark’s president Morty Schaja is coordinating the call and offers this explanation from why you might want to join it.

Given the planned openings of new casinos and the expected completion of the bridge from Hong Kong to Macau, Mitch and his team believe that the current stock weakness presents an unusual opportunity for investors.

Generally speaking Mitch is excited about the opportunity for the Fund post a period of relative underperformance. This year many of the fund’s positions – relative to both the market and, more importantly, to their expected growth – are now as inexpensive as they have been in some time. The Fund is trading at a weighted average price-earnings ratio (PE) of about 13x 2016 earnings, a discount to the market as a whole. This valuation is, in Mitch’s view, especially compelling given that their holdings have demonstrated substantially faster earnings growth of 15-20% or more as compared with the 7% historical earnings growth for the market. Given these valuations and the team’s continued confidence in the long-term earnings growth of the companies, they believe the Fund is especially well positioned going into year end.

It will be an interesting opportunity to talk with Mitch about how he thinks about the vicissitudes of “relative performance” (three excellent years are being followed by one poor one) and shareholder twitchiness.

HOW CAN YOU JOIN IN?

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

Remember: registering for one call does not automatically register you for another. You need to click each separately. Likewise, registering for the conference call mailing list doesn’t register you for a call; it just lets you know when an opportunity comes up.

WOULD AN ADDITIONAL HEADS UP HELP?

Over two hundred readers have signed up for a conference call mailing list. About a week ahead of each call, I write to everyone on the list to remind them of what might make the call special and how to register. If you’d like to be added to the conference call list, just drop me a line.

Funds in registration

There were remarkably few funds in registration with the SEC this month, just four and a half. That reflects, in part, the fact that advisers wanted to get new funds launched by December 30th and the funds in registration now won’t be available until February. It might also reflect a loss of confidence within the fund industry, since it’s the lowest total we’ve recorded in nine years. That said, several of the new registrations will end up being solid and useful offerings: T. Rowe Price is launching a global high income bond fund and a global unconstrained bond fund while Vanguard will offer an ultra-short bond fund for the ultra-nervous. They’re all detailed on the Funds in Registration page.

Manager changes

This month also saw a modest level of manager turnover; 53 funds reported changes, the most immediately noticeable of which was Mr. George’s departure from various Royce funds. More-intriguing changes include the appointment of former Janus manager and founding partner of Arrowpoint Minyoung Sohn to manage Meridian Equity Income (MEIFX). At about the same time, Bernard Horn and Polaris Capital were appointed to manage Pear Tree Columbia Small Cap Fund (USBNX) which I assume will become Pear Tree Polaris Small Cap Fund on January 1. Polaris already subadvises Pear Tree Polaris Foreign Value Small Cap Fund (QUSOX / QUSIX) which has earned both five stars from Morningstar and a Great Owl designation from the Observer.

We know you’re communicating in new ways …

But why don’t you communicate in simple ones? It turns out that fund firms are, with varying degrees of conviction, invading the world of cat videos. A group called Corporate Insights maintains a series of Mutual Fund Monitor reports, the most recent of which is “Fund Films Go Viral: The Diverse Strategies of Fund Firms on YouTube.” They were kind enough to share a copy and a quick reading suggests that firms have a long way to go if they intend to use sites like YouTube to reach younger prospective investors. We’ll talk with the report’s authors in December and pass along what we learn.

In the meanwhile: all fund firms have immediate access to a simple technology that could dramatically increase the number of people noticing what you’ve written and published. And you’re not using it. Why is that?

Chip, our technical director and founding partner, has been looking at the possibility of aggregating interesting content from fund advisers and making it widely available. The technology to acquire that content is called Real Simple Syndication, or RSS for short. At base the technology simply pushes your new content out to folks who’ve already expressed an interest in it; the Observer, for example, subscribes to the New York Times RSS feed for mutual funds. When they write it there, it pops up here.

Journalists, analysts, investors and advisers could all receive your analyses automatically, without needing to remember to visit your site, in their inboxes. And yet, Chip discovered, almost no one uses the feed (or, in at least one case, made a simple coding mistake that made their feed ineffective).

If you work with or for a fund company, would you let us know why? And if you don’t know, would you ask someone in web services? In either case, drop Chip a note to let her know what’s up. We’d be happy to foster the common good by getting more people to notice high-quality independent shops, but we’d need your help. Thanks!

Briefly noted . . .

If you ever wondered I look like, you’re in luck. The Wall Street Journal ran a nice interview with me, entitled, “Mutual Funds’ Professor Can Flunk Them.” Embarrassed that the only professional pictures of me were from my high school graduation, I duped a very talented colleague into taking a new set, one of which appears in the Journal article. Pieces of the article, though not the radiant portrait, were picked up by Ben Carlson, at A Wealth of Common Sense; Cullen Roche, at Pragmatic Capitalism; and Joshua Brown, at The Reformed Broker.

A reader has requested that we share word of Seafarer‘s upcoming conference call. Here it is:

SMALL WINS FOR INVESTORS

DuPont Capital Emerging Markets Fund (DCMEX) reopened to new investors on December 1, 2014. It sports a $1 million minimum, $348 million portfolio and record that trails 96% of its peers over the past three years. On the upside, the fund appointed two additional managers in mid-October.

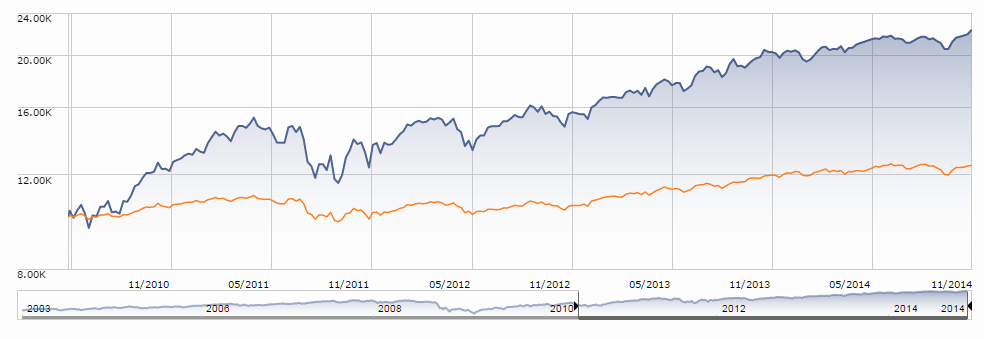

Guggenheim Alpha Opportunity Fund (SAOAX) reopens to new and existing investors on January 28th. At the same time they’ll get a new long/short strategy and management team. Okay, I’m baffled. Here’s the fund’s performance under its current strategy and managers (blue line) versus long/short benchmark (orange line):

If you’d invested $10,000 in the average long/short fund on the day the SAOAX team came on board, your account would have grown by 25%. If you’d given your money to the SAOAX team, it would have grown by 122%. That’s rarely grounds for kicking the scoundrels out. Admittedly the fund has a minuscule asset base ($11 million after 11 years) but that seems like a reason to change the marketing team, doesn’t it?

As a guy who likes redemption fees since they benefit long-term fund holders at the expense of traders, I’m never sure of whether their elimination qualifies as a “small win” or a “small loss.” In the holiday spirit, we’ll classify the elimination of those fees from four Guinness Atkinson funds (Inflation-Managed Dividend, Global Innovators, Alternative Energy, Global Energy and Alternative Energy) as “wins.” After the New Year, though, we’re back to calling them losses.

Invesco European Small Company Fund (ESMAX) has reopened to existing investors though it remains closed to new ones. It’s the best open-end fund in its space, but then it’s almost the only open-end mutual fund in its space. Its two competitors are Royce European Smaller-Companies (RESNX) and DFA Continental Small Company (DFCSX). ESMAX handily outperforms either. There are a couple ETF alternatives to it, the best being WisdomTree Europe SmallCap Dividend ETF (DFE). DFE’s a bit more volatile but a lot cheaper (58 bps versus 146), available and has posted near-identical returns over the past five years.

Loomis Sayles gives new meaning to “grandfathered-in.” While several Loomis Sayles funds (notably Small Cap Growth and Small Cap Value) remain closed to new investors, as of November 19, 2014 they became available to Natixis employees … and to their grandparents. Also grandkids. Had I mentioned mothers-in-law? The institutional share classes of a half dozen funds are available to family members without a minimum investment requirement. Yes, indeed, if your wretched son-in-law (really, none of us have any idea of what your daughter saw in that ne’er do well) works for Natixis you can at least comfort yourself with your newly gained access to first-rate investment management.

Market Vectors lowered the expense cap on Market Vectors Investment Grade Floating Rate ETF (NYSE Arca: FLTR) from 0.19% to 0.14%. As the release discusses, FLTR is an interesting option for income investors looking to decrease interest rate sensitivity in their portfolios. The fund was recently recognized by Morningstar at the end of September with a 5-star overall rating.

CLOSINGS (and related inconveniences)

None that I could find. I’m not sure what to make of the fact that the Dow has had 29 record closes through late November, and still advisers aren’t finding cause to close any funds. It might be that stock market records aren’t translating to fund flows, or it might be that advisers are seeing flows but are loathe to close the doors.

OLD WINE, NEW BOTTLES

Effective January 28, 2015, AQR is renaming … well, pretty much everything.

|

Current Name |

New Name |

|

AQR Core Equity |

AQR Large Cap Multi-Style |

|

AQR Small Cap Core Equity |

AQR Small Cap Multi-Style |

|

AQR International Core Equity |

AQR International Multi-Style |

|

AQR Emerging Core Equity |

AQR Emerging Multi-Style |

|

AQR Momentum |

AQR Large Cap Momentum Style |

|

AQR Small Cap Momentum |

AQR Small Cap Momentum Style |

|

AQR International Momentum |

AQR International Momentum Style |

|

AQR Emerging Momentum |

AQR Emerging Momentum Style |

|

AQR Tax-Managed Momentum |

AQR TM Large Cap Momentum Style |

|

AQR Tax-Managed Small Cap Momentum |

AQR TM Small Cap Momentum Style |

|

AQR Tax-Managed International Momentum |

AQR TM International Momentum Style |

|

AQR U.S. Defensive Equity |

AQR Large Cap Defensive Style |

|

AQR International Defensive Equity |

AQR International Defensive Style |

|

AQR Emerging Defensive Equity |

AQR Emerging Defensive Style |

The ticker symbols remain the same.

Effective December 19, 2014, a handful of BMO funds add the trendy “allocation” moniker to their names:

|

Current Name |

Revised Name |

|

BMO Diversified Income Fund |

BMO Conservative Allocation Fund |

|

BMO Moderate Balanced Fund |

BMO Moderate Allocation Fund |

|

BMO Growth Balanced Fund |

BMO Balanced Allocation Fund |

|

BMO Aggressive Allocation Fund |

BMO Growth Allocation Fund |

On January 14, 2015, Cloud Capital Strategic Large Cap Fund (CCILX) is becoming Cloud Capital Strategic All Cap Fund. It will be as strategic as ever, but now will be able to ply that strategy on firms with capitalizations down to $169 million.

Effective December 30, 2014, the name of the CMG Managed High Yield Fund (CHYOX) will be changed to CMG Tactical Bond Fund. And “high yield bond” will disappear from the mandate. Additionally, effective January 28, 2015, the Fund will no longer have a non-fundamental policy of investing at least 80% of its assets in fixed income securities.

Crystal Strategy Leveraged Alternative Fund has become the Crystal Strategy Absolute Return Plus Fund (CSLFX). That change occurred less than a year after launch but that fund has attracted only $5 million, which might be linked to high expenses (2.3%), a high sales load and losing money while their multi-alternative peers were making it. It’s another instance where “change the name” doesn’t seem to be the greatest imperative.

Deutsche International Fund (SUIAX) has changed its name to Deutsche CROCI® International Fund and Deutsche Equity Dividend (KDHAX) has become Deutsche CROCI® Equity Dividend Fund. Oddly the name change does not appear to be accompanied by any explanation of what’s up with the CROCI (cash return on capital invested??) thing. CROCI was part of Deutsche Bank’s research operation until late 2013.

Effective December 8, 2014, Guinness Atkinson Asia Pacific Dividend Fund (GAADX) will be renamed Guinness Atkinson Asia Pacific Dividend Builder Fund with this strategy clarification:

The Advisor uses fundamental analysis to assess a company’s ability to maintain consistent, real (after inflation) dividend growth. The Advisor seeks to invest in companies that have returned a real cash flow return on investment of at least 8% for each of the last eight years, and, in the opinion of the Advisor, are likely to grow their dividend over time.

At the same time, Guinness Atkinson Inflation Managed Dividend Fund (GAINX) becomes Guinness Atkinson Inflation Managed Dividend Builder Fund.

RESQ Absolute Income Fund has become the RESQ Strategic Income Fund (RQIAX). It now “seeks income with an emphasis on total return and capital preservation as a secondary objective.” “Capital appreciation” is out; “total return” is in. And again, the fund has been around for less than a year so changing the name and strategy doesn’t seem like evidence of patience and planning. Oh, too, RESQ Absolute Equity Fund is now RESQ Dynamic Allocation Fund (RQEAX). It appears to be heightening the visibility of international equities in the investment plan and adding popular words to the name.

Orion/Monetta Intermediate Bond Fund is now Varsity/Monetta Intermediate Bond Fund (MIBFX). Sorry, Orion, you’ve been chopped!

Effective November 12, 2014, Virtus Mid-Cap Value Fund became Virtus Contrarian Value Fund (FMIVX). By the end of January 2015, the principle investment strategy be tweaked but in reading the old and new text side-by-side, I couldn’t quite figure out what was changing. A performance chart of the fund suggests that it’s pretty much a mid-cap value index fund with slightly elevated volatility and noticeably elevated expenses.

OFF TO THE DUSTBIN OF HISTORY

Aberdeen Global Select Opportunities Fund (BJGQX), formerly Artio Select Opportunities, formerly Artio Global Equity, formerly Julius Baer Global Equity Fund, is disappearing. Either shareholders will approve a merger with Aberdeen Global Equity Fund or the trustees will liquidate it. Note from the Observer: vote for the merger. Global Equity has been a dramatically better fund.

AIS Tactical Asset Allocation Portfolio (TAPAX) has closed and will liquidate by December 15, 2014.

AllianceBernstein Global Value Fund (ABAGX) will liquidate and dissolve around January 16, 2015. Not to be picking on the decedent, but don’t “liquidate” and “dissolve” conjure the exact same image, sort of what happened to the witch in The Wizard of Oz?

In distinction to most such actions, the Board of Trustees of the ALPS ETF Trust ordered “an orderly liquidation” of the VelocityShares Emerging Markets DR ETF, VelocityShares Russia Select DR ETF and VelocityShares Emerging Asia DR ETF. All are now “former options.”

BMO Pyrford Global Strategic Return Fund (BPGAX) and BMO Global Natural Resources Fund (BAGNX) are both scheduled to be liquidated on December 23, 2014, perhaps part of an early Christmas present to their investors. BAGNX has, in six short months of existence, parlayed a $1,000 investment into an $820 portfolio, rather more dismal than even its average peer.

BTS Bond Asset Allocation Fund (BTSAX) will be merging into the BTS Tactical Fixed Income Fund (BTFAX) on December 12, 2014.

DSM Small-Mid Cap Growth Fund (DSMQX) will liquidate on December 2, 2014.

Eaton Vance Asian Small Companies Fund (EVASX) bites the dust on or about January 23, 2015. Despite the addition of How Teng Chiou as a co-manager in March (I’m fascinated by that name), the fund has drawn neither assets nor kudos.

Huntington Income Generation Fund (HIGAX) is another victim of poor planning, impatience and the redundant “dissolve and liquidate” fate. The fund launched in January 2014, performed miserably, for which reason the D&L is scheduled for December 19, 2014.

MassMutual Premier Focused International Fund was dissolved, liquidated and terminated, all on November 14th. We’re not sure of the order of occurrence.

The 20 year old, $150 million Victory Special Value Fund (SSVSX) has merged into the two year old, $8 million Victory Dividend Growth Fund (VDGAX). Cynics would suggest an attempt to bury Special Value’s record of trailing 85% of its peers by merging into a tiny fund run by the same manager. We wouldn’t, of course. Only cynics would say that.

Virginia Equity Fund decided to liquidate before it launched. Here’s the official word: “the Fund’s investment adviser, recommended to the Board to approve the Plan based on the inability to raise sufficient capital necessary to commence operations. As a result, the Board of Trustees has concluded that it is in the best interest of the sole shareholder to liquidate the Fund.”

Wright Total Return Bond Fund (WTRBX) disappears at the same moment that 2014 does.

In Closing . . .

In November we picked up about 1500 new registrants for our monthly email notification. Greetings to you all and, especially, to the nice folks at Smart Chicken. Love your work! Welcome to one and all.

A number of readers deserve thanks for their support in the month just passed. And so to the amazing Madame Nadler: “thanks! We’re not going anywhere.” To the folks at Gaia Capital: cool logo, though I’m still not sure that “proactive” is a word. To Jason, Matt and Tyler: “thanks” are in the mail! (Soon, anyway.) For Jason and our other British readers, by the way, we are trying to extend the Amazon partnership to Amazon UK. Finally thanks, as always, to our two stalwart subscribers, Deb and Greg. Do let us know how we can make the beta version of the premium site better.

November also saw us pass the 30,000 “unique visitors” threshold for the first time. Thanks to you all, but dropping by and imagining possibilities smarter and better than behemoth funds and treacherous, trendy trading products.

Finally, I promise I won’t mention this again (in 2014): Frankly it would help a lot if folks who haven’t already done so would take a moment to bookmark our Amazon link. Our traffic has grown by almost 80% in the past 12 months and that extra traffic increases our operating expenses by a fair bit. At the same time our Amazon revenue for November grew by (get ready!) $1.48 from last year, a full one-third of one percent. While we’re grateful for the extra $1.48, it doesn’t quite cover the added hosting and mail expenses.

The Amazon thing is remarkably quick, painless and helpful. The short story is that Amazon will rebate to us an amount equivalent to about 6% of whatever you purchase through our Associates link. It costs you nothing, since it’s built into Amazon’s marketing budget. It adds no steps to your shopping. And it doesn’t require that you come to the Observer to use it. Just set it as a bookmark, use it as your homepage or use it as one of the opening tabs in your browser. Okay, here’s our link. Click on it then click on the star on the address bar of your browser – they all use the same symbol now to signal “make a bookmark!” If you want to Amazon as your homepage or use it as one of your opening tabs but don’t know how, just drop me a note with your browser’s name and we’ll send off a paragraph.

There are, in addition, way cool smaller retailers that we’ve come across but that you might not have heard of. The Observer has no financial stake in any of this stuff but I like sharing word of things that strike me as really first-rate.

Some guys wear ties rarely enough that they need to keep that little “how to tie a tie” diagram taped to their bathroom mirrors. Other guys really wish that they had a job where they wore ties rarely enough that they needed to keep that little “how to tie a tie” diagram taped up.

Duluth sells clothes, and accessories, for them. I own rather a lot of it. Their stuff is remarkably well-made and, more importantly, thoughtfully made. Their clothes are designed, for example, to allow a great deal of freedom of motion; they accomplish that by adding panels where other folks just have seams. Admittedly they cost more than department store stuff. Their sweatshirts, by way of example, are $45-50 when they’re not on sale. JCPenney claims that their sweatshirts are $55 but on perma-sale for $20 or so. The difference is that Duluth’s are substantially better: thicker fabric, longer cut, with thoughtful touches like expandable/stretchy side panels.

QuoteArts.com is a small shop that consistently offers a bunch of the most attractive, best written greeting cards (and refrigerator magnets) that I’ve seen. Steve Metivier, who runs the site, shared one of his favorites:

The text reads “’tis not too late to seek a newer world.” The original cards are, of course, sharper and don’t have the copyright watermark. Steve writes that “we’ve found that a number of advisors and other professionals buy our cards to keep in touch with their clients throughout the year. So, we offer a volume discount of 100 or more cards. The details can be found on our specials page.”

We hope it’s a joyful holiday season for you all, and we look forward to seeing you in the New Year.

Okay, if that one six quarter period didn’t exist, Polaris would be about the world’s finest fund and Mr. Horn wouldn’t have any explaining to do.

Okay, if that one six quarter period didn’t exist, Polaris would be about the world’s finest fund and Mr. Horn wouldn’t have any explaining to do.