S&P 500 Concentration Risk My strategy has been the same for several decades. My equity exposure has come down a lot in the last few years as I approach retirement. But my overall equity strategy has remained the same. I anchor my equity portfolio with the S&P and then enhance returns by owning sector funds that are doing well at any given time (growth, value, small, mid, INTL, tech, healthcare, etc). I also have approximately 11-12% of my portfolio dedicated to individual stocks, which I tend to buy/hold, and they lean toward value/DJIA. These are often opportunistic buys, many were acquired during market routs, like Dotcom, GFC or covid. A few I bought when I was first starting out and used DRIPs (WMT, HD, ALL, T).

When any sector starts to revert to mean, I sell and move to wherever the momentum currently is. In the last several years I sold value, healthcare, small, mid, INTL and a few individual stocks that were underperforming. In the last twelve months, I started selling growth funds, as their results began to lag the S&P. I have since been acquiring value, INTL, small & mid.

My main mechanism to limit risk is to shift allocation from equity to FI. This is particularly effective in this falling rate environment. If I got really concerned I would move more towards FI and add to cash. Then I would await an opportunity to buy when "there was blood in the streets". I am not there yet.

I am looking hard at certain FI to beat equities in 2026. Some already is. Some did that in 2025. Some came very close. There have been times that FI was not a lucrative safe haven. Right now it looks pretty enticing. My biggest holdup is that I can only invest 50% of my largest portfolio (401K) in a SDB. This limits my options, particularly with CEFs and bond OEFs.

I may have veered OT a bit here. But, I think it all is still relevant to the overall topic: risk.

The more I think about it, my vanilla bond fund, in my 401K, is beating both the large index and all-cap index right now, 6 weeks into 2026! Hmmm.

S&P 500 Concentration Risk I think it really depends on your time frame. A retiree who was only in the SP500 in 2000 would have had to wait almost 13 years before his account value returned to that original level and stayed there. Pretty hard to take if you needed to sell to pay the rent.

Value and small caps did very well however.

The Buffett Indicator - A Big Red Flag Warning

Instead, pay attention to what the markets are actually telling you and invest accordingly.

Examples:

* SCHD: I liked it for years, then it struggled for about three years (2023–2025), which I posted about at the time. Year-to-date, it’s been performing very well again.

Ah, wow, who has ever thought of paying attention like that.

JQUA has pounded SCHD for 7y or so except the last couple weeks. (And there are others similar.) Perhaps they are 'investing accordingly'?

7

years isn't good.

I recommended it until 2023, not good in 2023-4-5, and good again in 2026.

★ Top US medical body to review vaccine effectiveness as government ‘abdicates responsibility’ @msf said,

On a personal note, I've been dealing with a mild bout of RSV over the past week. Except for one day, I've been pretty functional. My PCP attributes that to my having gotten an RSV vaccine. Like Covid vaccines, it may not give complete protection but does make the illness much less severe.

My 90

years old father-in-law was infected with COVID and nearly died from it due to his age. His COVID vaccination reduced the severity and the quick treatment with anti-viral medication saved him on time. Another friend inflected before the COVID vaccine was developed, he barely survived in the ICU and now he is living as a long COVID patient. In both cases, the quality of life post-infection is vastly different. Clearly, the COVID vaccine is a modern day miracle.

RFK, jr and Metmet Oz are not qualified to serve in their positions to keep all Americans safe!

EPA rollback of regulations

Fidelity Launches Two CLO ETFs Fidelity just launched two actively managed CLO ETFs.

FAAA will invest at least 80% of its assets in AAA-rated CLOs.

FCLO will have the majority of its portfolio in CLOs rated from BBB+ down to B-.

Management fees will be waived for both funds during the first twelve months.

Afterward, gross expense ratios will be 0.20% and 0.45% for FAAA and FCLO respectively.

CLO ETf assets have increased significantly over the past five

years or so.

Some industry participants have said that the AAA segment has become crowded.

https://www.investmentnews.com/etfs/fidelity-debuts-pair-of-active-clo-etfs-as-investor-appetite-broadens/265258

Utility rate increases doubling the inflation rate So sez CNBC reporting on a

"research note" from Goldman Sachs

Prices will continue to rise through the end of the decade, as data centers make up 40% of electricity demand growth, the analysts said. This will lower disposable income, drag down consumer spending and slightly slow economic growth in the coming years, they said.

Households will see electricity prices rise an additional 6% through 2027, the analysts said. Price inflation will then slow to 3% in 2028 on lower natural gas prices, they said. Consumer spending growth will fall 0.2% through 2027 and economic growth will slow 0.1% as a result, according to Goldman.

The trajectory of electricity prices, however, will vary widely across the U.S. based on different regional market structures and what regulatory choices are made, the bank said.

This does not seem to have dented utes today. GRID was dented. It seems to move--an anecdotal observation only--with the AI trade.

I can't help but wonder if there will be political retaliation against Goldman Sachs.

★ Top US medical body to review vaccine effectiveness as government ‘abdicates responsibility’ Unfortunately, as

@sma3's letters from last year make clear, this is nothing new. Though initial actions were directed more internationally, the anti-vaccine chickens are coming home to roost.

The Trump administration intends to terminate the United States’ financial support for Gavi, the organization that has helped purchase critical vaccines for children in developing countries, saving millions of lives over the past quarter century, and to significantly scale back support for efforts to combat malaria, one of the biggest killers globally.

...

Gavi is estimated to have saved the lives of 19 million children since it was set up 25 years ago. The United States contributes 13 percent of its budget.

NYTimes, March 25, 2025

https://www.nytimes.com/2025/03/26/health/usaid-cuts-gavi-bird-flu.htmlUS has wasted hundreds of thousands of vaccines meant for Africa, health officials there say

The U.S. has sent 91,000 out of the more than 1 million the Biden administration pledged, and 220,000 mpox vaccine doses have enough shelf life to ship if the Trump administration signs off, according to an Africa CDC spokesperson.

The loss of the mpox shots comes after President Donald Trump cut back foreign aid programs and closed the U.S. Agency for International Development, which administered most of them.

Congress this week passed a bill requested by Trump rescinding hundreds of millions of dollars in global health funding.

Politico, July 17, 2025

https://www.politico.com/news/2025/07/17/us-has-wasted-hundreds-of-thousands-of-vaccines-meant-for-africa-health-officials-there-say-00460290On a personal note, I've been dealing with a mild bout of RSV over the past week. Except for one day, I've been pretty functional. My PCP attributes that to my having gotten an RSV vaccine. Like Covid vaccines, it may not give complete protection but does make the illness much less severe.

Anthropic's new Claude model blackmailed an engineer having an affair in test runs I just asked Google's AI how many computer engineers have extra-marital affairs in a years's time?

"Based on data suggesting a high prevalence of infidelity in the information technology field and general statistics on workplace affairs, a significant number of U.S. computer engineers likely engage in extramarital relations, with some studies indicating IT professionals are among the top professions for such behavior.

Industry Trends: Data from PR Newswire shows men in information technology are more prone to infidelity.

Workplace Infidelity: Roughly 31% to 85% of affairs start at work, with 40% of workplace romances involving cheating on a partner with a coworker.

General Infidelity Rates: Studies show 20% of men and 13% of women report cheating on a spouse.

While there is no specific, publicly cited number for "computer engineers" alone, applying these high-prevalence rates to the roughly 1.5 million+ computer engineers in the U.S. suggests tens of thousands may engage in such relationships annually."

★ Top US medical body to review vaccine effectiveness as government ‘abdicates responsibility’ Most of you know I am a retired Board certified Internal Medicine specialist with 40+ years of experience in practice. I have been writing letters to the Editor of our Community paper about RFK since last year, hoping to convince a few MAGA folks he is rapidly destroying the US biotech and medical leadership, which will kill people and cause untold economic damage.

I do not know if I have been successful.

Here is the letter I wrote last fall, updated to ad the 1000 more measles cases in 2025. People who were born after the 1970s do not remember the consequences for these deadly diseases

Vaccine Policies Misguided ( (/24/2025)

To the Editor

Early in my medical career, I saw measles, pertussis (whooping cough), rubella (german measles) and diphtheria cripple and kill people. Soon after medical school (1978), vaccine mandates made these diseases very rare.

A two year San Antonio diphtheria epidemic in 1970 infected 250 people; 3 died. Without vaccine requirements, only 33% of children were immunized.

In medical school we were powerless to help infants with whooping cough, unable to breathe because of the cough’s severity, or save kids with measles, 1-3% of whom died. Congenital rubella caused birth defects (blindness, heart defects, intellectual disabilities) in 20,000 babies a year.

Vaccine requirements eliminated diphtheria and most pertussis by 1980, all measles in 2000, and rubella in 2004.

Now with “personal exemption laws” vaccination rates have fallen to 56% in Idaho, 62% in Texas and 68% in Florida. (Massachusetts without “personal exemptions but still allowing "religious" ones ” is still 86%). There have been 2275 US measles cases in 2025 (285 in all of 2024). Pertussis cases are up 25 times since 2023 and infects even older adults.

Our national vaccine access is under serious threat from Robert Kennedy Jr, who has replaced vaccine experts and physicians at the CDC with non scientists and vaccine skeptics.

A venture capitalist now runs the CDC.

RFK is reviewing all vaccine requirements, and eliminated the COVID vaccine recommendation for pregnant women and healthy people without a provider visit.

RFK believes the COVID vaccine is “the deadliest vaccine ever made”. But vaccinated “Blue “counties had 47 % to 150% fewer COVID deaths than less vaccinated “Red” counties.

This attack on vaccines will cause a rapid increase in deaths, congenital birth defects and disability similar to the 19th century. Is this what we want for our children and grandchildren?

Buy Sell Why: ad infinitum. True to Chauncey Gardiner's promise that seeds will sprout in the spring, I dumped some $$ into my 5 biggest losers in the stock basket. Essentially brought them up to neutral weight. AJG is by far the worst of the lot. Owned it years ago with much better results!

Overall, the basket is up in its first month, but not by a lot. Foreign holdings have outperformed. It does seem to move differently than the overall stock market and most days dampens volatility. That was the main thing I was looking for. I also continue to take profits from RAPAX which moves with real estate, commodities & natural resource stocks.

Hesgeth let Customs and Border Protection fire anti-drone laser near El Paso "Federal Aviation Administration officials said privately that the agency did not have enough time or information to assess the technology’s risk to commercial aircraft, according to people briefed on the situation."

Then it should not have been used in the absense of formal testing unless it was an absolute no-shite emergency, which i highly doubt this was. But still, 10 days closure is insane. It's like saying "we're going to shoot intruders, but you can't walk past the crime scene for 10 days."

This crew in DC figures if something sounds good, why not use it....as Donnie said years ago about nuclear weapons, "we've got them, why shouldn't we use them?"

This is a totally reckless crew running the show. Hell, KegBreath already killed off the majority of the nonpartisan Congressionally-mandated office of Operational Test & Evaluation at the Pentagon that does this kind of formal testing.

China continues to reduce holdings of U.S. Treasuries MFO often doesn't display images unless their URL ends in something like jpg, jpeg, png. Here's a shorter link to yogi's graph (still doesn't display, so you'll have to click on it):

https://pbs.twimg.com/media/HAuDpHqWAAAatSw?format=jpgThe graphic is a guesstimate of the amount of Chinese money invested in Treasuries via Belgium. It looks like a reasonable guess, but it is still a guess. From one of the recent (Feb 11) Bloomberg pieces on this topic (not paywalled):

the actual decline in China’s holdings may be smaller than official figures suggest.

Brad Setser, a senior fellow at the Council on Foreign Relations, estimates that China’s “true” holdings of US Treasuries exceed $1 trillion, far above the $683 billion reported by the US Treasury.

That’s because Beijing may have obscured its footprint by shifting assets to custodians in Europe. Belgium — whose holdings are considered to include some of those Chinese accounts — has seen its Treasury ownership quadruple since the end of 2017 to $481 billion.

https://www.fa-mag.com/news/china-s-years-long-retreat-from-treasurys-flags-bigger-risks-85841.htmlAs one can read from the Treasury table, or see more clearly from the graphics in this (Feb 10)

Atlantic Council piece, over the past year Chinese Treasury holdings decreased by $86B while Belgium's increased by $119B. 3/4 of Belgium inflow would have to be attributable to China for Chinese holdings to have remained stable. Not unreasonable but also hard to verify.

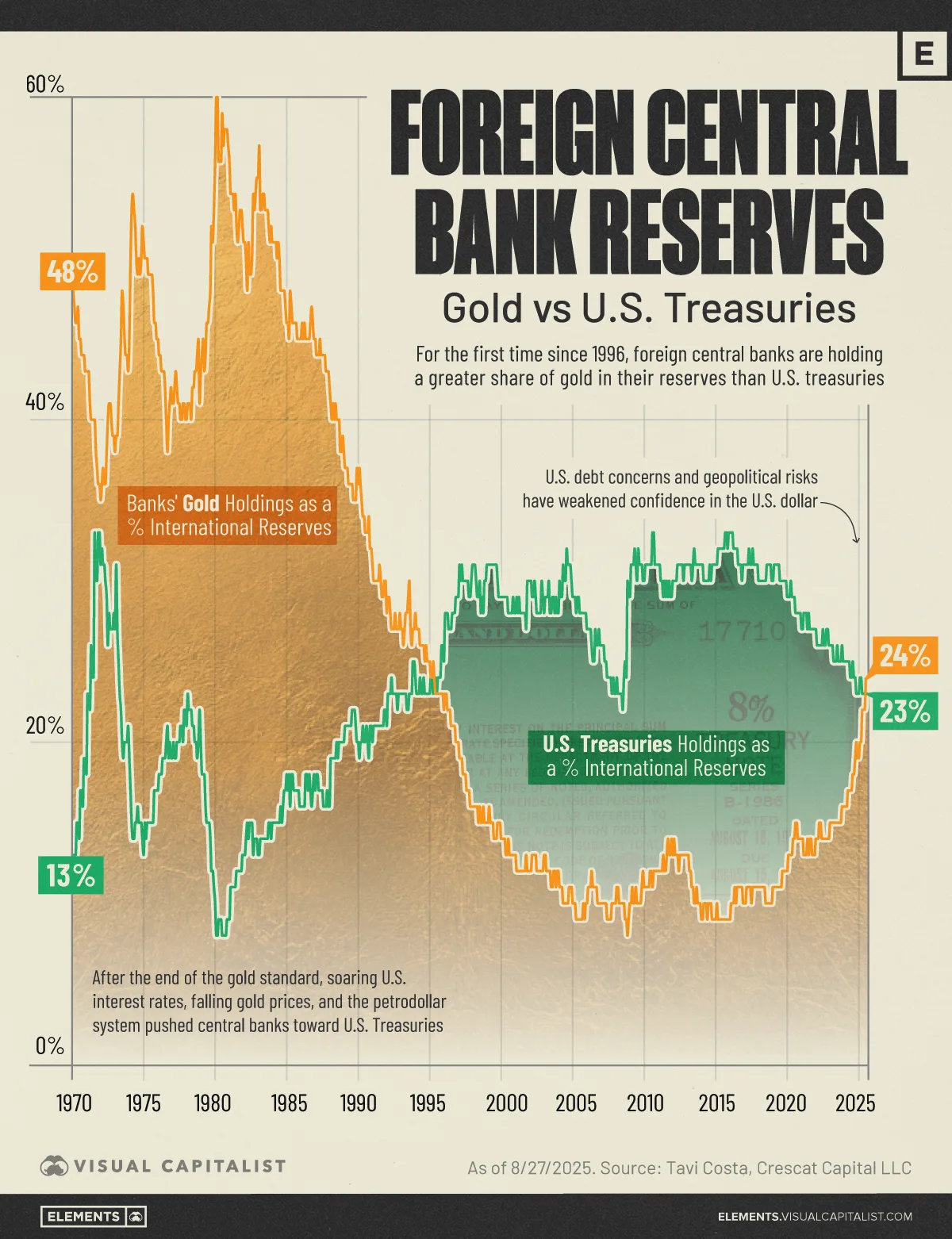

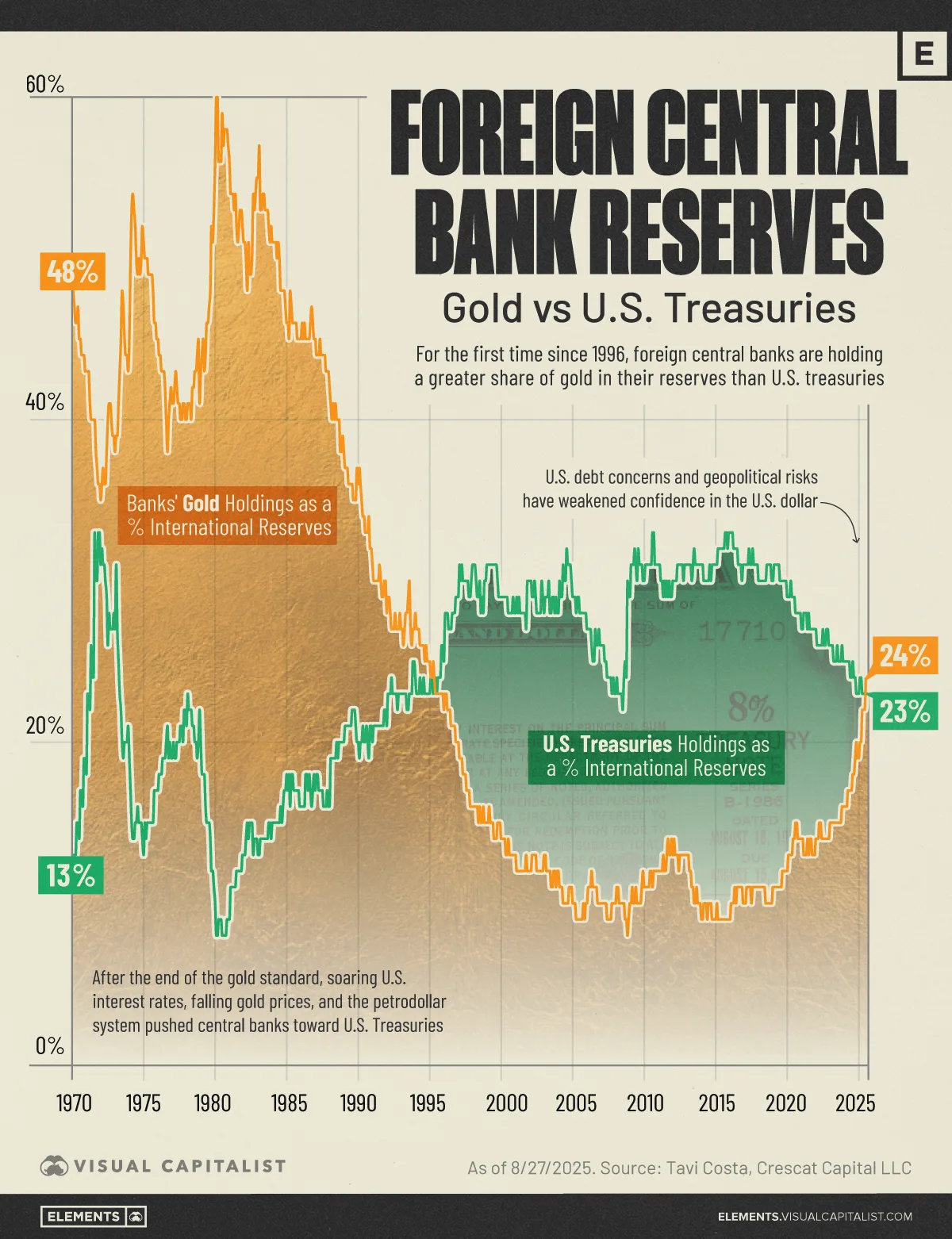

Where did all the petrodollars go? Gold, at least in part.

From Petrodollars to De-Dollarization

...

Seen as an

alternative to heavily indebted fiat currencies,

especially the U.S. dollar, the share of gold in central bank reserves has increased most among emerging market economies. China, Russia, and Türkiye have been the largest official buyers over the past decade.

https://www.visualcapitalist.com/central-banks-now-hold-more-gold-than-u-s-treasuries/

According to the

IMF, gold’s share of global reserves climbed to about 18% in 2024, up sharply from mid-2010s levels, reflecting a structural reweighting toward tangible assets.

A Chinese expression 美金 can be taken as US paper money, yellow gold. That is, one stashes cash in Treasuries and gold. Now that's tipping toward gold.

On the matter of PRCFX At first glance, the M* list of best balanced funds (

link from equalizer's post) appears to give each fund's

cheapest not

oldest share class. This may be why the list includes several less familiar tickers.

For example:

TRAIX (Dec 2015) rather than PRWCX (June 1986)

AMBFX (Aug 2008) rather than ABALX (July 1975)

DOXBX (May 2022) rather than DODBX (June

1931)

Sometimes that makes obvious sense, because the share class listed has a higher "medal" rating than the oldest share class. AMBFX is silver, while ABALX is merely bronze. Arguably even if the medal ratings are the same for two share classes of a fund, the cheaper share class is objectively better. It has the same portfolio as the more expensive share class, thus the same gross returns and better net returns.

But then why list TRPBX (ER 0.76%) instead of the cheaper share class TPPAX (ER 0.62%)? They're both rated silver. M* couldn't be so stupid as to list the former because it has four stars as opposed to TPPAX's three stars? That's an artifact of M*'s granular methodology, not a reflection of which share class is better. TPPAX won't have a ten year record for three more months, so its star rating calculation disregards nearly five

years of its performance.

And even if M* were looking at star ratings as a tie breaker, that still doesn't explain why it listed VBINX (ER 0.18%, silver, four star) rather than VBAIX (ER 0.06%, silver, four star).

China continues to reduce holdings of U.S. Treasuries Another source provides additional insights.

As the footnote in the Treasury link notes, the data in the table is only from the Treasuries held at US-based custodians and broker-dealers. Treasury doesn't know how much Treasuries, say, China may be holding through non-US firms. The link below shows (using data from Bloomberg and Treasury) that China also holds substantial amounts of US Treasuries through firms in Brussels. So, if one adds Treasuries held by China with firms in US (orange bars) and Brussel (pink bars), the total has been

stable over the

years.

This also explains why some countries such as Cayman Islands and Luxembourg hold so much US Treasuries - they are probably held for other countries.

Kraft Heinz Reverses Course on Company Split as Sales Continue to Slide Are there even other brands than Heinz ketchup or Skippy Super Chunk peanut butter? :)

No. Of course not. But I don't want to think too much about the company that makes Spam also makes Skippy. :-D

Per the OP:

Mr. Cahillane said that over the last few years, the industry, responding to commodity inflation, “busted through four or five levels of price points in a very accelerated fashion.” He added: “The consumer was left very disappointed in that, and that’s been very well understood and obvious.”

I'll say they did. In spades. I doubt I'll ever by another box of Triscuits now that I know Kroger makes a fine alternative at half the price.

Trump Allies Near ‘Total Victory’ in Wiping Out U.S. Climate Regulation Here's some heavily abridged excerpts from Mark's

New York Times report. I recommend checking out the entire report, which is very detailed.

Trump Allies Near ‘Total Victory’ in Wiping Out U.S. Climate RegulationA small group of conservative activists has worked for 16 years to stop all government efforts to fight climate change. Their efforts seem poised to pay off.

In the summer of 2022, Democrats in Congress were racing to pass the biggest climate law in the country’s history. But behind the scenes, four Trump administration veterans were plotting to obliterate federal climate efforts once Republicans regained control in Washington, according to more than a dozen people familiar with the matter.

Two of them, Russell T. Vought and Jeffrey B. Clark, drafted executive orders for the next Republican president to dismantle climate initiatives. The other two collected an “arsenal of information” to chip away at the scientific consensus that the planet is warming.

The overwhelming majority of scientists around the world agree that carbon dioxide, methane and other greenhouse gases are dangerously heating the planet and supercharging storms, droughts, heat waves and sea level rise, directly contradicting the four conservatives.

Their efforts are now paying off: the Environmental Protection Agency is expected to revoke a determination that has underpinned the federal government’s ability to fight global warming since 2009. That scientific conclusion, known as the endangerment finding, determined that greenhouse gases threaten public health and welfare. It required the federal government to regulate these gases, which result from the burning of oil, gas and coal.

In revoking that determination, the Trump administration would erase limits on greenhouse gases from cars, power plants and industries that generate the planet-warming pollution. “We are pretty close to total victory,” said Myron Ebell, who helped the first Trump administration set up its operations at the E.P.A. and has been attacking climate science and policies for nearly three decades.

“No amount of outside public support would have done anything if there hadn’t been those four people: Russ and Jeff and John and Mandy,” he said.

Still, some conservative activists who insisted that the threat of climate change was overblown kept up the fight during the Biden years. One of them was Ms. Gunasekara, who served as E.P.A. chief of staff during Mr. Trump’s first term and wrote the E.P.A. chapter in Project 2025.

The Heritage Foundation eventually agreed to fund some of this work, although it is unclear whether the group provided the full $2 million, according to two people familiar with the matter. Ms. Gunasekara said in a text message that she was “extremely proud of the work I and others produced at the Heritage Foundation to rebut junk science and expose the Green New Scam.”

In 2022, under Mr. Vought’s supervision, Mr. Clark drafted executive orders that a future president could use to swiftly scrap Mr. Biden’s climate policies, according to two people familiar with the matter. He also brainstormed legal arguments that the future administration could use to repeal the endangerment finding.

Mr. Clark has called climate initiatives part of a plot to “control” Americans” and to undermine the U.S. economy. He has called environmentalists a “crazy climate cult. He is “an ideologue with very, very strong views that E.P.A. shouldn’t regulate greenhouse gases,” said a professor of environmental law at Harvard Law School.

At the time that he was hired by Mr. Vought, Mr. Clark was facing a criminal investigation in connection with Mr. Trump’s effort to overturn the 2020 election results in Georgia. President Trump preemptively pardoned Mr. Clark in November and the Georgia case was dismissed. With Mr. Trump’s return to the White House last year, Mr. Clark became the government’s top regulatory official as the acting head of the White House Office of Information and Regulatory Affairs. Mr. Vought is once again the White House budget director and Mr. Clark’s boss.

A spokeswoman for the White House Office of Management and Budget declined to make Mr. Clark available for an interview or respond to questions about his work. She said in a statement that Trump administration officials were “working in lock step to execute on the president’s deregulation agenda.”

Neil Chatterjee, a Republican who led the Federal Energy Regulatory Commission in the first Trump administration, said conservative activists had helped sustain the fight against the endangerment finding even after businesses backed out. “It’s not the corporate interests,” Mr. Chatterjee said, adding, “It’s the pure ideological activists who believe that climate change is a hoax, who believe that this was about transferring wealth and driving socialism and destroying renewable energy and promoting left-wing ideology.”

“This is their moment,” Mr. Chatterjee said.

Comment: No, we decline to make Mr. Clark available for an interview or respond to questions about his work: citizens and taxpayers have no right to question anything or anyone in our administration.

I'm wondering if it will even be possible to ever mitigate this attack on science and reality.

Lower Unemployment Rate Supports Longer Pause for Fed Following are heavily edited excerpts from

a current report in The New York Times:

January’s jobs data, released on Wednesday, bolstered expectations that the Federal Reserve will hold interest rates steady for longer than previously expected.

Strong monthly jobs growth and easing unemployment have pushed back expectations about when the Federal Reserve will lower interest rates again, suggesting the central bank is poised for an extended pause. Data released on Wednesday by the Bureau of Labor Statistics showed monthly jobs growth of 130,000 positions, almost double what economists had forecast, and the unemployment rate ticking down to 4.3 percent. That is down from a recent peak of 4.5 percent in January and slightly lower than December’s level.

The unemployment rate has become a focal point for the Fed, as President Trump's immigration restrictions have decreased the supply of new workers available for hire, and the number of new jobs the economy needs to keep the unemployment rate stable has dropped as a result, with research suggesting it could turn negative by this year.

Price pressures have mounted as Mr. Trump’s tariffs have taken effect, and officials at the Fed broadly expect the peak impact from those levies to hit in the first quarter of this year. January’s Consumer Price Index report will give policymakers insight into whether that forecast is bearing out. Economists expect annual inflation to tick down to 2.5 percent after a 0.3 percent increase in monthly prices. “Core” inflation, which strips out volatile food and energy items, is expected to stay sticky at 2.5 percent, only slightly lower than the previous 2.6 percent annual pace.

But in a sign that labor-related price pressures remain muted, the employment cost index, a quarterly measure from the Labor Department that tracks changes in wages and benefits, unexpectedly slowed in the final three months of 2025. Economists at Evercore ISI said that data confirmed their view that the “economy is cooling under the hood.”

Stephen I. Miran, who has dissented at every meeting since he joined the Fed in September, voted in favor of a quarter-point cut. He was joined by Christopher J. Waller, who, In explaining his dissent, said that revisions to the jobs data would likely show no growth in employment last year: “Zero. Zip. Nada,” Mr. Waller said- “this does not remotely look like a healthy labor market.”

Note: Mr. Waller seems to have been prescient: The Bureau of Labor Statistics said on Wednesday that "job growth over the past two years was far weaker than previously believed: U.S. employers added just 181,000 jobs last year."

Further cuts appear to hinge on the labor market breaking out of its current “low hire, low fire” state and layoffs beginning to pick up in a more broad-based way, or inflation significantly slowing. Mr. Powell last month downplayed the possibility of a rate increase this year.

In a social media post on Wednesday after January’s report was released, the president again called for the country to be paying the lowest interest rate in the world and said it would lead to cost savings of at least $1 trillion a year related to payments to service the national debt. But the Fed does not take into consideration interest payments on the debt when setting policy. It is congressionally mandated to pursue low, stable inflation and a healthy labor market.

Comment: In editing these reports for brevity every effort is made to retain the general perspective of the original reporting. But I've found this particular report to be somewhat confusing, and a real challenge. For instance:

• In the first paragraph we see, "Data released ... by the Bureau of Labor Statistics showed monthly jobs growth of 130,000 positions.

• In the note which I inserted from a different NYTimes report, we see "U.S. employers added just 181,000 jobs last year."

I'm completely confused by the seeming contradiction in reporting here: wouldn't 130,000 x 12 ~ 1,560,000 "jobs last year"?