Falling knife, are you willing to get cut !

January MFO Ratings Posted The year turned out pretty good! The Great Normalization Bull is now in its 15th month. And, like has happened with each bull market for the past 100 years, the S&P 500 has recovered all previous drawdown and sits at a new all-time high, month-ending December.

Falling knife, are you willing to get cut ! @hankSince we've moved cash we had parked in a MM and a couple bond funds to TRP Cap App & Income (PRCFX), we are back to 95% with DG. 17

years and counting. Whenever I've moved some dollars away from DG through the

years it has always cost me money.

Falling knife, are you willing to get cut ! That’s where I’ve landed after

years of “over analyzing” / “over allocating”. Run a 10-part portfolio

@10% each. Various cash holdings constitute 10%. Another part consists of 3 individual stocks. The other 8 are single funds (OEMF, CEF, ETF).

Recently pitched a 10% weighted aggressive bond fund & replaced it with an investment grade short term fund. Had I

@rforno’s money, a move like that might have sent “ripples” through the markets!

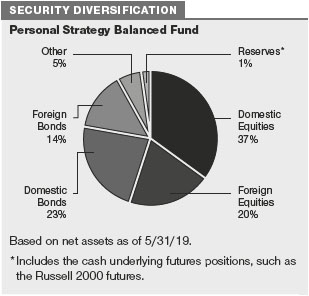

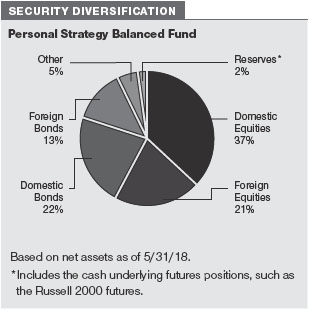

T Rowe Price outflows Your pie charts seem to confirm my view that high foreign investments have hurt its returns. TRPBX’s foreign holdings are much higher than FBALX. I don’t shun foreign investments, but will prefer to use dedicated foreign funds from now on, particularly since TRP’s foreign funds are so weak. After I sold TRPBX in my Roth IRA, I reinvested in FBALX plus my other TRP stock funds (TRMCX, TRVLX and PRDMX). Also put some of money in Fidelity’s FIVFX, which has outperformed TRP foreign funds. I’m planning to do a Roth conversion with part of the ARTKX shares in my regular IRA, and will put the remaining funds in that. I’m not comfortable holding 20% of the total assets of my Roth IRA in foreign stocks plus another 10-15% in foreign bonds, particularly given the higher risk and lower returns of foreign markets for many years.

T Rowe Price outflows I also tend to hold funds for quite some time, because funds have their own cycles and often when one fund underperforms another for some time, the pattern subsequently reverses.

Looking at the calendar year percentile rankings, one could say that it's not so much that TRPBX got worse as that it tended to be okay but not great. Or as rforno put it, "kind of 'meh'".

The fund had two bad

years, 2021 and 2022 (and FBALX had an even worse record in 2022). These weigh heavily on its three year performance and five year performance. Those two

years aside, its yearly performances were typically top third, just.

Even going back to your first decade with these funds (2003-2012), TRPBX

barely outpaced FBALX, 8.23% to 8.21%.

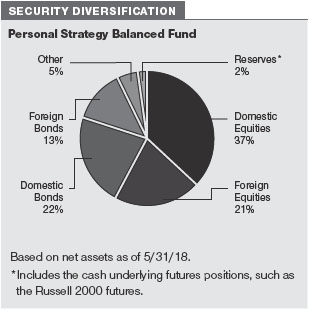

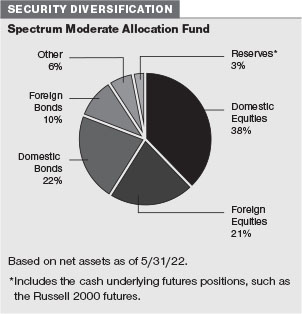

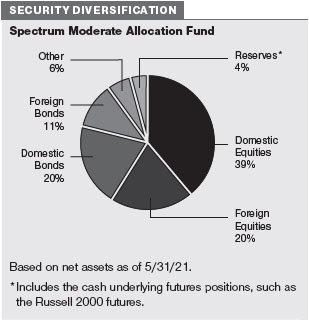

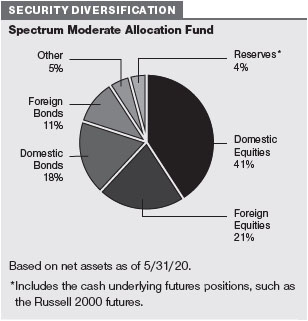

I suspect that the fraction of equity that's invested abroad hasn't shifted much in decades. A fund may be permitted to make major allocation changes without ever taking advantage of that freedom. Not worth going back past 2017, though, because earlier annual reports don't seem to contain that information.

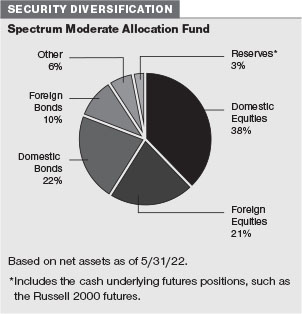

Sept 2023 (

M*): 32% foreign (19.01%/59.60%)

May 2022 (

annual report): 36% foreign (21%/59%)

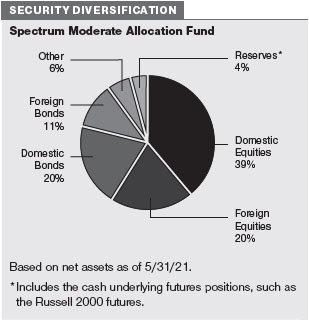

May 2021 (

annual report): 34% foreign (20%/59%)

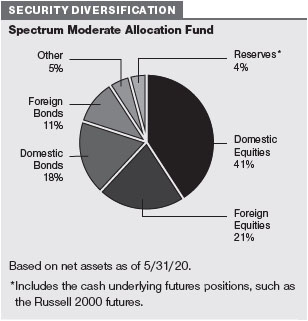

May 2020 (

annual report): 34% foreign (21%/62%)

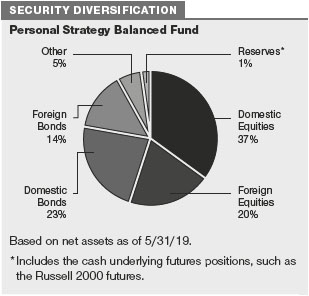

May 2019 (

annual report): 35% foreign (20%/57%)

May 2018 (

annual report): 36% foreign (21%/58%)

The 2017 annual report notes that T. Rowe Price made several changes to what were then called the Personal Strategy Funds.

On October 1, 2016, we introduced three new underlying investment strategies to the Personal Strategy Funds. ... The changes include a new allocation to alternatives through a hedge fund-of-funds, as well as initiating an investment in the T. Rowe Price Dynamic Global Bond Fund and an equity index option strategy.

T Rowe Price outflows @msfYou are correct that TRPBX slightly outperformed FBALX by about 1.1% in 2022.

However, over the following time periods, FBALX outperformed TRPBX annualized by this much:

1 year, 6.7%

3

years, 4.1%

5

years, 4.2%

10

years, 2.2%

Put another way, $10,000 invested in FBALX ten

years ago would be worth $23,262, compared to $17,743 with TRPBX. Since I had considerably more money invested in both funds over the past 10

years, the value of my FBALX holdings have increased by tens of thousands of dollars more than TRPBX — particularly since I’ve owned both funds for more than 20

years (until selling TRPBX earlier this year.)

Anyway, it’s my fault for sticking with TRP allocation funds for so long. They have underperformed

for a while, but I’m a patient buy-and-hold investor and kept expecting things to change. They did, but unfortunately for the worse.

T Rowe Price outflows FWIW -

RPGAX was one of my favorite funds when I invested directly with TRP. But haven’t owned or looked at it since. ISTM its performance was decent from inception on to about 2020 when I departed. I liked the idea of allocating approximately 10% to the Blackstone hedge fund. But that’s just me - always looking for a way to hedge the downside or step to a different drummer. True - the Blackstone holding was hard to justify on an expense basis. And it generally detracted from performance over those years. Still - I’m always looking for hedges - and that was the purpose.

T Rowe Price outflows TRP’s foreign stock funds have never performed very well, with a few exceptions … .

I’d agree with that.

Lipper loves TRRIX - 5's across the board (except for tax efficiency)

I pay a lot of attention to Lipper’s ratings. BTW - M* gives TRRIX a “silver” (2nd highest) rating which ain’t too shabby either. I like TRRIX too - or wouldn’t have 10% of portfolio devoted to it. Hard to beat the .49% ER for a pretty diverse basket of managed funds.

That said… No way should that fund have fell over 13% in 2022. Especially -

@msf will recall - that over the decades (far back as before the turn of the century) one commonly lauded aspect of TRP was their skill at allocating among different assets. They always seemed to have an edge in that one area. I’ve heard it here on this board over the

years and that conformed to my own view until recently. Lose that edge and a good part of the reason for investing with them is gone.

BYW - It appears they’ve recently added a bit of their Dynamic Income fund to the TRRIX fixed income mix. That fund uses bond shorts to hedge against rising rates. We’ll see how it all works out.

T Rowe Price outflows TRP certainly didn’t market or describe TRPBX as a global allocation fund when I started investing in it, although they’ve always had more foreign holdings than most balanced funds. If it’s a global allocation fund, then why did they create RPGAX? It’s my impression that they’ve increased foreign investments over the years. However, they have flexibility to increase or decrease foreign investments, so why do they keep pouring money into areas that aren’t panning out?. Finally, TRP’s foreign stock funds have never performed very well, with a few exceptions. I’ve also invested in Spectrum International (PSILX), which invests in a range of TRP foreign funds, and it has been a poor performer despite a low expense ratio.

A few differences I’ve noticed between TRP and Fidelity. If a Fidelity fund performs poorly, they replace or change the management team. If a Fidelity fund performs well, they generally don’t close it to their investors (although they have done so for limited time periods). Most Fidelity funds have the flexibility to invest in foreign assets, but they generally don’t load up on them unless the fund is clearly designated as global or international. FLPSX is the rare exception but it has continued to perform well despite holding a lot of foreign stocks.

FMSDX Fidelity Multi-Asset Income Fund From a non-expert corner. Not related to FMSDX. …

Be a bit careful if looking at funds (of any category) holding a lot of income-producing stocks. Oh - It’s a great sector / always has been - except that it looks like it’s been “hot as nails” for several years now. (Check out PRFDX.) The income producers can and do run in cycles.

I’ve seen Yogi’s description and it does not appear FMSDX is riding that wave - perversely, that might be a good sign. If you find something similar that’s wildly outperforming, take a look at the equity component before you leap.

I don’t own any Fidelity funds, but have been very impressed by the ones I’ve looked at. Steady performers, often with very low ERs.

T Rowe Price outflows @Tarwheel: "TRP also started investing about 10% of its assets in hedge funds, which from my view hasn’t helped performance a bit."

RPGAX (Global Allocation, now 10 yrs old IIRC) also has like 10-15% exposure in a black-box. To my knowledge they never really explained what *exactly* Blackrock was managing/investing in for the fund. But wow ... I didn't know their Spectrum funds also had a PE component, too!

I agree w/Hank that their fund offerings are kind of 'meh' and definitely have proliferated over the

years -- frankly I'd think they should consolidate/close some of them if for no other reason than to make their offerings list less cluttered with a lot of me-too funds that invest similarly to each other.

I only hold PRWCX but am keeping its income-oriented cousin (forgot the symbol) on watch as a possible holding down the road. I'll also track TCAF out of curiosity, but don't really have a need for it in my portfolios.

Bruce Fund (BRUFX) I own it in the wife's IRA. Only just more than 4% of the entire portfolio's total. Rates coming down ought to help, whenever that may start. Seems to me they "forgot" to take the annual small IRA maintenance fee.

I have lotsa free time. I check every day. BRUFX is heavy with SMIDs. Surely, that's a drawback. The elder Bruce died, yes, and I couldn't believe my eyes when Morningstar downgraded it because of personnel changes. Jayzuz. I admit I'm getting itchy. That big cash stake hurts.

"...The strategy's portfolio management team does not stand out and still needs to prove it has a competitive advantage. This earns the strategy an Average People Pillar rating, recently downgraded from Above Average. The strategy's effective investment approach earns an Above Average Process Pillar rating. Independent of the rating, analysis of the strategy's portfolio shows it has maintained a considerable underweight position in the Europe-Developed region and has a considerable overweight in developed markets regions compared with category peers. The strategy's parent organization is industry standard, albeit with some strong attributes like an experienced bench of portfolio managers, but is held back by low portfolio manager retention. This earns the firm an Average Parent Pillar rating...." ---Morningstar.

Ridiculous, risible. The ONLY Manager now is the younger Bruce, the son. Unless I missed an announcement?

Not only is the Fund heavy with SMIDs, but it's got a VALUE tilt. Looking back, it's not been VALUE'S time in the sun lately, right?

Fixed Income: 4.59%.

"Cash" 32.31%

There's something less than half a billion dollars AUM. If Mr. Bruce is bound and determined to be contrarian, I'd say the Fund's results are showing it. If that is the case, then performance comparisons won't be very-well focused, targeted. But no one should be pleased to end-up the year at THE very bottom of the pack.

YTD and 1-year: 100th percentile.

But looking backward over several years, performance has been quite good IN COMPARISON to its peers. But... who are its peers?

T Rowe Price outflows I wonder if much of the outflow isn't self-induced. My prior company's 401k accounts were with TRP for over 30 years. All accounts were transferred to a new custodian, Merrill Lynch, earlier this year. I wouldn't be surprised, just from this one company, they willingly sold off 10s of thousands of employee and past employee accounts. I doubt it was just this one specific company, so maybe the outflow is due to them not wanting to deal with employer sponsored 401k accounts anymore. Just speculating.

T Rowe Price outflows +1

Nice write-up

@Tarwheel. I’d been a happy camper with TRP since the mid to late 90s. Kept anywhere from 40-60% of my retirement funds there over more than 25

years with the rest spread around different fund houses. I left about 3

years ago after noticing their phone based client support had become abysmal to the point where i began to worry about (unwanted) paper statements ending up in someone else’s mailbox. Repeated calls didn’t help. Couldn’t stop the unwanted sporadic and unpredictable statement mailings. And when I finally moved out, they screwed up the transfer to Fidelity royally.

Their fixed income funds lagged up until the late 90s when a very talented woman took over. For a few

years, under her leadership they got a lot better. Not sure when she moved on. ISTM she left sometime after 2000 to take a government position in Washington DC. Fixed income fell back to mediocre not long after.

The Giroux affectionados here love the guy and everything he touches - with good reason. Maybe they’ll discover a way to clone him and put the

clowns clones in charge of everything. But I agree with you that their allocation funds ain’t what they once were. Likely it’s the fixed income component that’s causing the lackluster performance. I do own a slug of TRRIX (a 40/60 fund). ISTM it lost 10-12% in 2022. Worst showing I can ever remember (umm … other than 2008). It keeps most of its fixed income component in their New Income Fund (PRCIX) and most of the remainder in a short-immediate term TIPs fund. The former has always been a bit of a dog.

The world turns over every 24 hours. I’m sure the move to ETFs is hurting their bottom line and maybe (a guess) causing either some talent drain or cut-backs in research. Just guesses. BTW - their offerings have multiplied at least 5X since I joined them in the mid-90s. Not sure that kind of shotgun approach is in their best interest. But definitely got problems in

River City Baltimore.

Santa Claus Rally Continues When in doubt, claim seasonality?

Background: On another forum, you (finally) posted a near-real time BUY of the stock market in late Oct. You got UP a few % an sold your entire position.

The markets then promptly ran up HUGE gains in Nov and Dec. You justified your premature SELL by posting you don't need the extra money.

What followed was a slew of posts back-and-forth between several posters that ultimately caused you to be banned (again) from that forum, this time until EOY '23, for your incessant desire to post your crap.

That's why you are now posting here and on the Fido board - you have lost access to your main stomping grounds.

What's so odd about all that is that you have for YEARs posted about your impeccable trading abilities, ALWAYS making the right and best trades. Yet, on the ONE time that I know of (in over a DECADE) that you posted something near a real time trade, you made money, but only a fraction of what you coulda/shoulda made, and only a fraction of what others who you incessantly demean as inferior investors made.

Now you've graced the MFO platform with your astounding revelation that the market is UP due to seasonality. On the Fido board you recently used your standard "more buyers than sellers" line.

What would all of us stoopid investors do without you?

Santa Claus Rally Continues Here's Motley Fool:

https://www.fool.com/investing/stock-market/basics/santa-claus-rally/Understanding the Santa Claus rally

Generally, the Santa Claus rally refers to the stock market's history of rising over the last five trading days of the year and the first two market days of the new year.Also, the venerable Art Cashin has worked the NYSE for over 50

years. I really can't count how many times I've heard him say EXACTLY what MF states and EXACTLY what I've posted.

Foreign Mutual Fund Suggestions My experiences with foreign small caps and emerging markets have not been good. I invested in Artisan’s global small cap, and it performed so poorly that they closed it after a few years. I invested in MAPIX, and it was still losing money after more than 7 years. I invested in SFGIX, one of the better EM funds, and it had returned less than 4% annually after more than 11 years. These kind of funds tend to get destroyed in down markets, and it happens quickly.

I’m through investing in foreign SC and EM now, unless some of my broader foreign funds invest in them. My advice to anyone considering these markets, is to be prepared for a long wait before making any money— unless you get lucky with your timing. I’ll be 70 in January, and I might not live long enough to see them make money. Good luck!

I second the comments posted here. It is SO difficult to find any Foreign funds that perform comparable to Domestic funds. We get our Foreign exposure through a coupla Global funds, and that's it for us. Usually hold about 10% of our stock exposure in Foreign.

T Rowe Price outflows Interesting article in Financial Times about TRP’s loss of investors. I’m one of the long term investors who’ve been bailing out. Although I still invest in TRP funds, I transferred our Roth IRAs from there to Fidelity a couple

years ago. Convenience was a big factor because now all of our investments are with Fidelity. However, it was also due to a growing lack of confidence in TRP. A lot of my investments are in allocation funds, and I’m not pleased with TRP’s offerings, aside from PRWCX, which has been closed to new investors for a while. My wife and I have invested with TRP for more than 25

years, with more than $200K in our Roth IRAs, and they still wouldn’t let us invest in PRWCX.

So we invested heavily in TRPBX, which has been a major disappointment. It was considered a top moderate allocation fund when we started using it, but performance has steadily declined— which is ironic because PRWCX has been so successful. Much of the problem seems to be their asset allocation, with heavy stakes in foreign and emerging markets. Although the fund’s volatility is not bad on a day-to-day basis, it has been hurt by the high foreign allocations in down and up markets. TRP also started investing about 10% of its assets in hedge funds, which from my view hasn’t helped performance a bit.

We still own several TRP stock funds that have performed well, through the Fidelity funds network. However, we’ve ditched their bond and allocation funds. The Fidelity funds that replaced them have all had better performance. We’ll probably drop some of our remaining TRP funds if they don’t improve soon. At one time, I considered using TRP for all of our investments, but we decided to use Fidelity as well — and my Fidelity investments as a whole have greatly outperformed my TRP holdings.

https://www.ft.com/content/7cdd7cd9-f465-48ae-af18-aa8201f8fab8

Buy Sell Why: ad infinitum. Sold Vanguard International Growth (VWILX) yesterday.

Used proceeds to purchase Seafarer Overseas Value (SIVLX) today.

VWILX holdings overlapped with my core foreign stock fund.

My portfolio also had minimal EM equity exposure.

I haven't owned a dedicated EM equity fund for ~5 years.