It looks like you're new here. If you want to get involved, click one of these buttons!

Days away from the first anniversary of President Trump’s second term in office, grocery prices are still rising, undercutting his administration’s rhetoric about how it is making life more affordable for average Americans. The price of beef has risen 16.4 percent over the last year. The price of coffee is up a whopping 19.8 percent. The price of lettuce is up 7.3 percent and frozen fish 8.6 percent.

Yet Mr. Trump continues to falsely claim otherwise. “Grocery prices are starting to go rapidly down,” he said Tuesday afternoon during a speech in Detroit. It’s not the first time that he has said food prices are down, even when data show they’re not.

There is no single reason that food is growing more expensive, and not all food products are pricier. The price of eggs — long a campaign topic — had dropped sharply over the past year. Some of the things that factor into price — fertilizer, machinery, labor and fuel costs, weather, where food is grown and what customers want — are difficult to control. Some of Mr. Trump’s actions, like tariffs and immigration crackdowns, have contributed to higher, rather than lower, costs. Low-income families are suffering the most, while middle-class shoppers are starting to take a hit.

Data released Tuesday by the Bureau of Labor Statistics found the cost of food at home rose 2.4 percent overall in the previous 12 months and 0.7 percent in December alone, the fastest single-month increase since October 2022. That month-over-month gain stood out in an otherwise subdued inflation report.

Professor Volpe, of the agribusiness department at Cal Poly, formerly worked at the Department of Agriculture and said: “This does hammer home the point that when the current administration claims that grocery prices are down, that is, of course, not correct.”

Higher prices are particularly affecting low-income consumers, some of whom temporarily lost their SNAP benefits during last year’s government shutdown. Those consumers are prioritizing essentials, trading down to cheaper products, buying less and making more frequent trips to the store instead of stocking up, according to grocery executives.

“Instead of buying steak, they’re buying ground beef and so forth,” Susan Morris, the chief executive of Albertsons, said on an earnings call last week. Ronald Sargent, the interim chief executive of Kroger, said last month that consumers were turning to promotions and store brands to save money. And both executives said they were beginning to see similar behavior from middle-income consumers.

Not everything is going up; some foods have declined in price. Eggs are 20.9 percent cheaper than a year ago, and the cost of most dairy products has declined modestly. But overall, prices are up in five of the six major food-at-home categories tracked by the Bureau of Labor Statistics. The Trump administration’s ever-changing tariff policies have directly affected only a small number of food items in the grocery store, because much of what is consumed in the United States is grown here. But there are some products — like coffee and tropical fruits and vegetables — that are primarily grown abroad and imported into the United States. Many of their prices have climbed on the heels of increased tariffs.

The cost of bananas, for instance, was up 5.9 percent in December from year-earlier levels. Consumers are most concerned about price increases in categories like beef, coffee and chocolate, Mr. Sargent said on a conference call last month. But tariffs are not only affecting the cost of food; they have driven up the cost of farming inputs, which are eventually reflected in price, as well as food packaging. Higher prices for canned and frozen foods, sodas and other drinks most likely reflect higher costs for aluminum and other packaging materials.

Coffee drinkers are likely to see some relief in the coming months; in November, Mr. Trump removed the 40 percent tariffs on imports from Brazil, a major coffee exporter. But beef eaters likely aren’t, as high prices are mostly linked to a half-decade-long drop in the supply of cattle, which will take as long to reverse. In December, ground beef hit a record $6.69 a pound, up from $5.61 a year earlier. Both coffee and beef were rising in price before Mr. Trump took office, highlighting why some consumers may feel that food costs have risen more than the 2.4 percent that the data say they have risen: It’s coming on top of years of elevated prices. Grocery store prices are nearly 26 percent higher than they were five years ago, according to the labor bureau.

“The headline number, the 2.4 percent increase, in food is not that encouraging, and it’s building on already higher numbers,” said Michael Swanson, the chief agricultural economist at Wells Fargo Agri-Food Institute. “That is what people really find a challenge.” The Agriculture Department expects food-at-home prices to rise 2.3 percent in 2026, about the same as they increased in 2025.

Anecdotally, the White House’s immigration crackdown has also played a role in driving up food costs. A lack of workers in some areas has led to cherries rotting in Oregon fields, blueberries rotting in New Jersey fields and Pennsylvania dairy farmers selling off cows. But the cost of other fresh fruits, which include berries, has fallen 1.2 percent over the last year, and the price of milk is down 1 percent.

Fruit farms and dairies are especially reliant on immigrant labor. Given that those prices have fallen, it isn’t clear if the immigration crackdown hasn’t yet affected them or if perhaps prices would have decreased more if labor was more readily available. Agriculture groups have warned that they are struggling to find workers, and in November, the Trump administration responded by making it easier for farmers to hire foreign workers.

“Labor is clearly the biggest cost driver and makes up about 50 percent of our industry’s expenses,” said Cathy Burns, the chief executive of the International Fresh Produce Association. She said that limits placed on immigration had made it more difficult for farmers to find workers, and that labor costs in agriculture had been rising for a decade. John David Rainey, the chief financial officer at Walmart, the country’s largest grocer, said at a conference last month that he expected “peak impact from the tariff cost to land around the beginning of the first quarter” before subsiding.

But even if that is true, labor challenges remain, extreme weather could always wreck a crop and the costs of farm inputs like fertilizer, seeds and equipment could continue to rise.

https://www.sdnewswatch.org/giga-fact-brief-sd-credit-card-companies-citi-wells-fargo/The lack of a usury law in South Dakota combined with a Supreme Court ruling that said companies could use the state’s laws where the company was headquartered led to a financial boom. Even if a card was used in another state, South Dakota laws governed interest rates.

The investigation of Jerome H. Powell, chair of the Federal Reserve, has prompted fierce blowback from Republicans, international policymakers, Wall Street and some Trump allies, and now threatens to undermine President Trump’s effort to assert dominance over economic decision-making. The swift and overwhelmingly negative response came after the U.S. attorney in Washington, Jeanine Pirro, informed Mr. Powell her office was initiating a criminal inquiry into the $2.5 billion renovation of the Fed’s headquarters and whether Mr. Powell had lied to Congress about the project.

The backlash is occurring at a time when Mr. Trump has become increasingly emboldened, declaring to The New York Times last week that the only limits on his power are his own “morality.” The Powell inquiry also laid bare some rare dissension within the top ranks of the Trump administration and public opposition from some of the president’s most loyal supporters.

The targeting of Mr. Powell threatens to upend the process of selecting and confirming his replacement in an orderly manner this year, potentially making it more difficult for Mr. Trump to achieve his goal of packing the Fed’s board with members who support substantially lower interest rates.

===========================

Ms. Pirro, the U.S. attorney...

Mr. Trump delivered a broader message to Ms. Pirro and dozens of U.S. attorneys who visited the White House for a meet-and-greet last week: They were too weak, and needed to step up the pace of investigations of his enemies, according to three administration officials briefed on the exchange. They spoke on condition of anonymity to discuss internal conversations.

A person with knowledge of Ms. Pirro’s actions said Ms. Pirro, the U.S. attorney, a former television judge and longtime Trump friend has not discussed the Powell case with him, they added. Her decision to move ahead with the case came after she read news reports about cost overruns in The New York Post and The Wall Street Journal, which prompted her to assign members of her team to begin an inquiry last November, that person said.

Senior officials at the department were stunned, and annoyed, that Ms. Pirro did not consult them on an investigation of such international importance, the officials with knowledge of her actions said. Ms. Pirro also did not share information with her bosses at the main headquarters of the Justice Department — including Attorney General Pam Bondi and her top deputy, Todd Blanche — citing the discretion granted local U.S. attorneys’ offices to investigate the head of the most powerful monetary policy body on earth, according to several officials with knowledge of her actions.

===========================

Treasury Secretary Scott Bessent...

When Treasury Secretary Scott Bessent, who is leading the process to find Mr. Powell’s replacement, caught wind of a potential investigation into the Fed chair late last year, he tried to prevent it. He thought he had been successful until last week.

When Mr. Bessent found out the investigation was moving forward, he called Mr. Trump directly. The two men spoke last Friday night and Mr. Bessent expressed frustration, telling the president the investigation could impede their plans to confirm a new chair of the Federal Reserve.

===========================

World Bankers...

The notion that the credibility of the world’s most important economic institution could be eroded continued to raise alarm among global economic leaders. On Tuesday, a dozen central bankers expressed their support for Mr. Powell in a statement, including Christine Lagarde, the president of the European Central Bank, which sets rates for the 21 eurozone countries; Andrew Bailey, the governor of the Bank of England; Tiff Macklem, the governor of the Bank of Canada; and Chang Yong Rhee, the governor of the Bank of Korea.

“We stand in full solidarity with the Federal Reserve System and its Chair Jerome H. Powell,” the statement published on Tuesday said. “The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve.” The central bankers praised Mr. Powell’s service and commitment to the public interest. “To us, he is a respected colleague who is held in the highest regard by all who have worked with him,” they wrote.

===========================

Wall Street...

The attack on Mr. Powell also prompted pushback from Wall Street. “Everyone believes in Fed independence,” Jamie Dimon, the chief executive of JPMorgan Chase, said on Tuesday after the bank released its quarterly earnings. “Anything that chips away at that is probably not a great idea and in my view will have reverse consequences,” he said, predicting higher inflation expectations and “probably” increased rates over time.

Calls to preserve the Fed’s independence did not deter Mr. Trump from criticizing Mr. Powell. In a Truth Social post on Tuesday, the president reprimanded him for being “too late” if he does not cut interest rates. In a speech on the economy later on Tuesday, the president took it a step further: “That jerk will be gone soon.”

Their Retirement Plan:

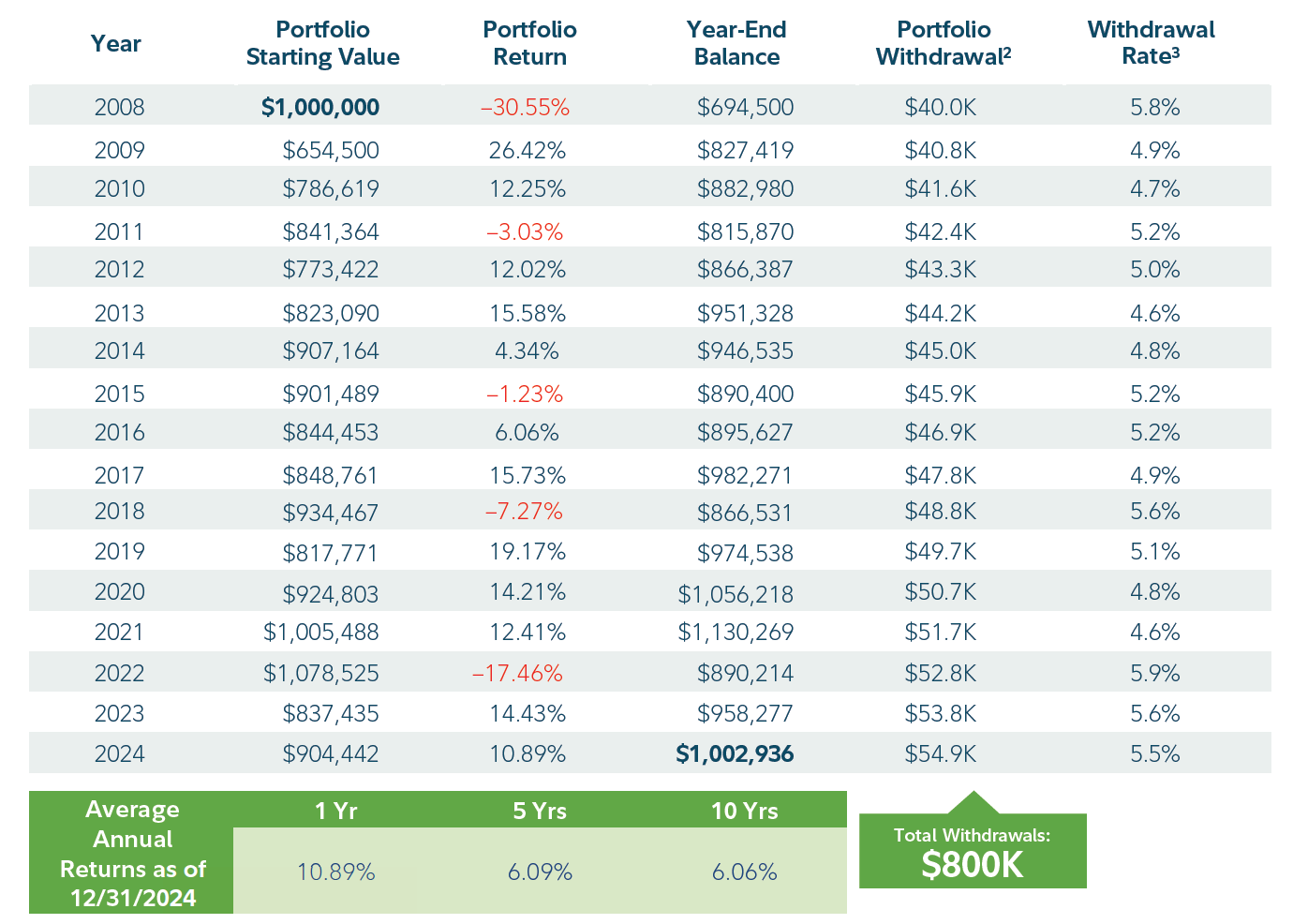

After talking it over with their advisor, Jordan and Shawna decided to invest $1 million in a diversified, professionally managed account. "When devising a plan for a client, we start by evaluating their needs," says McAdam. "We want to know what their goal is and what it is they’re saving for, so we can better understand their tolerance for risk. When we can determine how much money they might need to achieve that goal, that helps us design a portfolio that’s equipped to help them reach it." Based on Jordan and Shawna’s expected needs, the couple determined that they would need to withdraw $40,000 in the first year of retirement to fund their lifestyle and planned to increase their withdrawal amount by 2% each year, to account for inflation.

Market Turns Bear-ish the First Year of Their Retirement Plan:

Jordan and Shawna’s million-dollar investment runs headfirst into the 2008 financial crisis. In the very first year of their retirement, Jordan and Shawna watched their portfolio—their hard-earned savings—lose more than 30% of its value. And after withdrawing the $40,000 to pay their day-to-day expenses, they were left with about $650,000 and a feeling of unease about what the future might hold for them and their portfolio.

Many firms do this to protect you when your snail mails are lost or stolen. You can look at an older statement and write down the full a/c numbers somewhere for all financial accounts.

Dear Leader has no legal authority to impose a cap, so I don't know what legal options the banking sector would need to pursue.JPMorgan dipped more than 2% after CFO Jeremy Barnum signaled that the banking industry could push back against President Donald Trump’s call for a one-year 10% cap on credit card interest rates. Goldman Sachs followed JPMorgan lower, declining more than 1%. Other financial stocks such as Mastercard and Visa traded down roughly 5% each. The State Street Financial Select Sector SPDR ETF (XLF) and Invesco KBW Bank ETF (KBWB) were also under pressure.

“The path forward isn’t necessarily clear,” Tim Holland, chief investment officer at Orion, said, adding that he anticipates pushback from both a legal and Congressional point of view if Trump were to move forward with his demand for price controls. He also said that he doesn’t believe the development is “that meaningful” in the near term.

On Sunday evening, news broke that the Trump administration was targeting Jerome Powell — the Federal Reserve chair, whom President Trump has been raging about for months — with a highly dubious criminal investigation into supposed financial improprieties. Usually reserved in his public statements, Mr. Powell posted a video bluntly calling the allegations a dishonest attempt at revenge for the Fed’s refusal to simply follow the president’s wishes.

The episode is a shocking violation of the central bank’s historical independence, one that puts the United States in league with authoritarian nations careening toward financial ruin. On Monday, markets reacted with something along the lines of “meh”: The dollar and stock prices edged down, while gold prices and interest rates rose.

Mr. Trump’s attack on the Fed is a breathtaking departure from precedent, a dangerous and scary power grab, but it’s already backfiring. If anything, this latest episode has weakened his ability to bend the institution to his will, at least in the short run. It definitely increases the chance that Mr. Powell, whose term as chair ends in May, but whose appointment as a board member does not, will remain at the Fed longer than he might otherwise have. It will also raise the hurdle for whoever Mr. Trump nominates as the next Fed chair. And it will make other members of that body a lot less likely to go along with the president’s agenda.

As recently as November 2024, Mr. Powell was saying as little as possible, replying simply “no” when asked whether he would resign if requested to do so by Mr. Trump. That restraint is what made the video he released on Sunday night so powerful. This is not a man looking to become a resistance hero.

When Mr. Powell’s term as chair ends in May, he could stay on as a governor — and one of 12 voters on monetary policy — through January 2028. With threats intensifying, the case for his continued presence as a quiet but firm defender of Fed independence grows only stronger.

Mr. Trump has made it harder for his nominee as the next Fed chair to be confirmed. Almost immediately after news of the criminal investigation broke, Senator Thom Tillis, a Republican member of the Banking Committee, issued a striking statement: “If there were any remaining doubt whether advisers within the Trump administration are actively pushing to end the independence of the Federal Reserve, there should now be none.” He added, “I will oppose the confirmation of any nominee for the Fed — including the upcoming Fed chair vacancy — until this legal matter is fully resolved.” Another Republican senator, Lisa Murkowski, endorsed that view, as did several Democrats.

Further complicating matters, Mr. Trump’s attack on the Fed ensures that when a successor is eventually confirmed, he or she will have to do more to demonstrate independence, or else be remembered as the person who surrendered it. The Fed’s 11 other monetary-policy voters have increasingly been voting their own views. That is likely to accelerate if they feel that the new chair is just trying to please the president, rather than working in the best interests of the economy.

We have a relatively rapid feedback mechanism to measure the success of economic policy: Markets and business leaders react in real time, in a way they do not on issues like immigration enforcement and whether to invade Greenland.

The Fed is likely to win this battle. The broader war will probably continue as long as Mr. Trump remains president. One possible consequence is that the Fed becomes a victim of its own success, with people mistaking the markets’ mild initial response for proof that independence is no big deal. In reality, that calm reflects confidence in the defenses that were rapidly deployed: senators from both parties, former economic officials, the politically neutral judgment of markets themselves and ultimately the wisdom of the public.

The greater risk is time. Independence will not be lost overnight, but at least every two years the president can nominate a new governor for the Fed. With sustained effort over six to eight years, an administration could gradually transform the institution. That would require patience from Mr. Trump and complacency from everyone else. So far, at least, on this issue we are seeing neither.

Social Security, the Louisiana Purchase, and the National Institutes of Health are just a few of the major investments that define America. Financial thought leader Charles Ellis discusses his soon-to-be-published book, Great American Investments.

I was aware of the QE effort on the short side of duration. I try to keep a weather eye on the money supply. Hasn't that been mentioned here, by you at least?"In a vaguely worded NYFed policy change on Dec. 10—which not one of the major financial news organizations has reported—the Fed flung its vaults wide open to troubled banks."

Powell's new QE announcement on Dec 10 is as loud as it can get. This QE will take in T-Bills & T-Notes up to 3-yr maturity. Some wondered why when there is a big repo facility already. Fed QE, repo & other money-market operations are through NY Fed.

There is an alarmist tone to the piece, but there are some good points.

Many banks are involved in the commodity business. They aren't the biggest commodity players, but are significant. With parabolic move in silver, somebody somewhere is probably hurt & we will know that in due course. Nobody will buy silver in $70-80 range with their serious money - those buys are probably forced liquidation of shorts.

https://schrts.co/SIxquvcu

Here is the list from Google AI:

Major Banks Involved in Commodities

Large investment banks have significant commodity trading desks, particularly in futures, options, and derivatives markets.

Goldman Sachs: Historically a major force, it maintains a strong presence.

JPMorgan Chase: A leading global investment bank with a significant commodity business.

Citigroup: A major player in commodity-trading banking.

Morgan Stanley: Has a top-ranking commodities business among banks.

Bank of America Merrill Lynch: Part of the group of top U.S. clearing banks in derivatives.

Macquarie Group: Known for strength in commodities, especially in the U.S. physical natural gas market.

Barclays, BNP Paribas, Deutsche Bank, and UBS are also major global banks with notable U.S. commodity operations.

Thumb is directly on scale. One big butt smooch will get them all re-started, plus a "promise" to fund GOP candidates, no doubt.trumpedo tells his technofascist supporters to suck energy from any\every source, and china deploys an 'india's-worth' of renewables each year. (not mention probably redirecting taxpayer funding for his fusion\social media scam)

i can't imagine trump attempting to thwart wind in texas, so the only remaining factor must be be insufficient bribes in frequency and quantity from these offshore, usually bluestate adjacent, projects.

its always the simplest explanation for all things MAGA.

by the way, one may be surprised to know that some states have a dominant utility that instructs legislators to slap on very high grid and nuisance taxes so as to make personal solar a high financial risk proposition for consumers. (see energy, Duke)

https://content.naic.org/sites/default/files/capital-markets-primer-collateralized-loan-obligations.pdfFor diversification purposes, CLOs are structured with specific investment limitations, such as issuer and industry concentrations, which aim to protect investors from potential losses. For example, a CLO’s underlying portfolio may consist of 100 or more issuers across several industries.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla