It looks like you're new here. If you want to get involved, click one of these buttons!

I suspect that poster might be a collector's item now. Bogle welcomed the challenge and found it amusing.In July 1971, the first index fund was created by McQuown and Fouse with a $6 million contribution from the Samsonite Luggage pension fund, which had been referred to Fouse by Bill Sharpe, who was already teaching at Stanford. It was Sharpe’s academic work in the 1960s that formed the theoretical underpinning of indexing and would later earn him the Nobel Prize. The small initial fund performed well, and institutional managers and their trustees took note.....

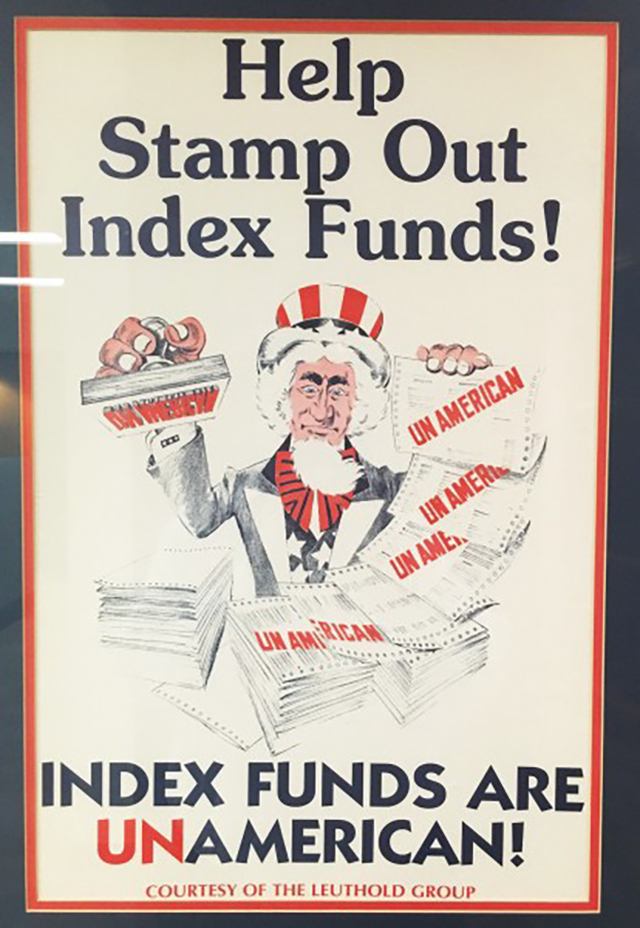

...But even in San Francisco, as in the country’s other financial centers, Fouse and McQuown’s findings were not a welcome development for brokers, portfolio managers, or anyone else who thrived on the industry’s high salaries and fees. As a result, the counterattack against indexing began to unfold. Fund managers denied that they had been gouging investors or that there was any conflict of interest in their profession. Workout gear appeared with the slogan “Beat the S&P 500,” and a Minneapolis-based firm, the Leuthold Group, distributed a large poster nationwide depicting the classic Uncle Sam character saying, “Index Funds Are UnAmerican,” implying that anyone who was not trying to beat the averages was nothing more than an unpatriotic wimp. (That poster still hangs on the office walls of many financial planners and fund managers.)

But inflation proved the perfect issue to enable Summers to regain the spotlight. Intellectually, Summers had been deeply formed by the monetarist revolution instigated by Milton Friedman in the 1970s—which held that a key way to hold down inflation was to raise interest rates in order to increase unemployment (and thereby keep wages in check). In early 2021, Summers began sounding the alarm that the stimulus spending Biden and the Democrats had used to keep the economy afloat during Covid was going to lead to a sharp rise in inflation. When inflation did in fact rise, Summers basked in the role of the prophet vindicated.

But Summers’s rehabilitation rested on an illusion. As Eric Levitz notes in a recent New York magazine article, all evidence suggests that while Summers was right to predict inflation, he was completely wrong about both the causes of that inflation and the best means to fight it. Speaking at the London School of Economics in June 2022, Summers said that “we need five years of unemployment above 5 percent to contain inflation—in other words, we need two years of 7.5 percent unemployment or five years of 6 percent unemployment or one year of 10 percent unemployment.” This is the standard Friedman prescription of a short, sharp shock of unemployment to defeat inflation—the same remedy followed by Paul Volcker in the late 1970s and early ’80s. Those policies, of course, led to the long-term defeat of American labor unions and the rise of Reaganite neoliberalism.

But that scenario was not repeated under Biden. As Levitz reports, Summers’s "call for austerity was premised on the notion that only a sharp increase in unemployment could prevent a ruinous wage-price spiral. In reality, both wage and price growth have been slowing for months, even as unemployment has remained near historic lows. Summers’s failure to anticipate this outcome should lead us to reconsider just how prescient his analysis of the post-Covid economy ever was."

The core problem, Levitz adds, is that from the beginning, [Summers’s] analysis was predicated on the idea that excessive stimulus would lead to unsustainably low unemployment and thus wage-driven inflation. There has never much reason to believe that the labor market was the primary driver of post-Covid price growth. And at this point, it’s abundantly clear that, in 2023 America, a tight labor market will not inevitably trigger a wage-price spiral.

If the Federal Reserve follows Summers’s advice and keeps raising interest rates until the economy hits “five years of unemployment above 5 percent,” then millions of people will suffer for absolutely no reason other than as human sacrifices to a discredited economic theory.

Far from vindicating Summers, inflation is yet another case where he got a big issue wrong. It joins a long list of such errors. As Binyamin Appelbaum documented in his fine book The Economists’ Hour (2015), while serving as deputy Treasury secretary in 1998, Summers took it upon himself to bully staffers who were pushing for the regulation of credit derivatives—the banking practice that led to the housing bubble and 2008 crash. Summers even called one staffer, Brooksley Born, the head of the Commodity Futures Trading Commission, into his office to scream, “I have 13 bankers in my office who tell me you’re going to cause the worst financial crisis since the end of World War II.” Ironically, it was Summers’s own failure to heed Born’s advice that caused that very crisis. In 2005, Summers derided critics of the deregulated credit default swap market as “slightly Luddites.”

Because doctors are highly skilled professionals who are not so easy to replace, I assumed that they would not be as reluctant to discuss the distressing conditions at their jobs as the low-wage workers I’d interviewed. But the physicians I contacted were afraid to talk openly. “I have since reconsidered this and do not feel this is something I can do right now,” one doctor wrote to me. Another texted, “Will need to be anon.” Some sources I tried to reach had signed nondisclosure agreements that prohibited them from speaking to the media without permission. Others worried they could be disciplined or fired if they angered their employers, a concern that seems particularly well founded in the growing swath of the health care system that has been taken over by private-equity firms. In March 2020, an emergency-room doctor named Ming Lin was removed from the rotation at his hospital after airing concerns about its Covid-19 safety protocols. Lin worked at St. Joseph Medical Center, in Bellingham, Wash. — but his actual employer was TeamHealth, a company owned by the Blackstone Group.

E.R. doctors have found themselves at the forefront of these trends as more and more hospitals have outsourced the staffing in emergency departments in order to cut costs. A 2013 study by Robert McNamara, the chairman of the emergency-medicine department at Temple University in Philadelphia, found that 62 percent of emergency physicians in the United States could be fired without due process. Nearly 20 percent of the 389 E.R. doctors surveyed said they had been threatened for raising quality-of-care concerns, and pressured to make decisions based on financial considerations that could be detrimental to the people in their care, like being pushed to discharge Medicare and Medicaid patients or being encouraged to order more testing than necessary. In another study, more than 70 percent of emergency physicians agreed that the corporatization of their field has had a negative or strongly negative impact on the quality of care and on their own job satisfaction.

There are, of course, plenty of doctors who like what they do and feel no need to speak out. Clinicians in high-paying specialties like orthopedics and plastic surgery “are doing just fine, thank you,” one physician I know joked. But more and more doctors are coming to believe that the pandemic merely worsened the strain on a health care system that was already failing because it prioritizes profits over patient care. They are noticing how the emphasis on the bottom line routinely puts them in moral binds, and young doctors in particular are contemplating how to resist. Some are mulling whether the sacrifices — and compromises — are even worth it. “I think a lot of doctors are feeling like something is troubling them, something deep in their core that they committed themselves to,” Dean says. She notes that the term moral injury was originally coined by the psychiatrist Jonathan Shay to describe the wound that forms when a person’s sense of what is right is betrayed by leaders in high-stakes situations. “Not only are clinicians feeling betrayed by their leadership,” she says, “but when they allow these barriers to get in the way, they are part of the betrayal. They’re the instruments of betrayal.”

Not long ago, I spoke to an emergency physician, whom I’ll call A., about her experience. (She did not want her name used, explaining that she knew several doctors who had been fired for voicing concerns about unsatisfactory working conditions or patient-safety issues.) A soft-spoken woman with a gentle manner, A. referred to the emergency room as a “sacred space,” a place she loved working because of the profound impact she could have on patients’ lives, even those who weren’t going to pull through. During her training, a patient with a terminal condition somberly informed her that his daughter couldn’t make it to the hospital to be with him in his final hours. A. promised the patient that he wouldn’t die alone and then held his hand until he passed away. Interactions like that one would not be possible today, she told me, because of the new emphasis on speed, efficiency and relative value units (R.V.U.), a metric used to measure physician reimbursement that some feel rewards doctors for doing tests and procedures and discourages them from spending too much time on less remunerative functions, like listening and talking to patients. “It’s all about R.V.U.s and going faster,” she said of the ethos that permeated the practice where she’d been working. “Your door-to-doctor time, your room-to-doctor time, your time from initial evaluation to discharge.”……

Forming unions is just one way that patient advocates are finding to push back against such inequities. Critics of private equity’s growing role in the health care system are also closely watching a California lawsuit that could have a major impact. In December 2021, the American Academy of Emergency Medicine Physician Group (A.A.E.M.P.G.), part of an association of doctors, residents and medical students, filed a lawsuit accusing Envision Healthcare, a private-equity-backed provider, of violating a California statute that prohibits nonmedical corporations from controlling the delivery of health services. Private-equity firms often circumvent these restrictions by transferring ownership, on paper, to doctors, even as the companies retain control over everything, including the terms of the physicians’ employment and the rates that patients are charged for care, according to the lawsuit. A.A.E.M.P.G.’s aim in bringing the suit is not to punish one company but rather to prohibit such arrangements altogether. “We’re not asking them to pay money, and we will not accept being paid to drop the case,” David Millstein, a lawyer for the A.A.E.M.P.G. has said of the suit. “We are simply asking the court to ban this practice model.” In May 2022, a judge rejected Envision’s motion to dismiss the case, raising hopes that such a ban may take effect

https://youtu.be/BraoC1LlomQBookstaber’s current analysis highlights several slow-motion risks that he believes pose significant threats to the economy, societal stability, and even civilization itself. These risks encompass climate change, demographic shifts, deglobalization, and artificial intelligence. Alongside these long-term concerns, Bookstaber also evaluates more immediate challenges that impact the economy and financial markets.

Hi @Old_Joe, you probably know the difference between a fairy tale and a sea story; but no kidding, this really happened.@WABC- Thanks for sharing some of your divestment experiences. I wasn't aware that anyone had even read my financial operations manual.

Students of seismic events, and informed residents of coastal areas, will remember that tsunamis are preceded by water calmly receding from the coast line.Now a $1 trillion tsunami of high-quality government paper is slated to hit markets before September, at a time when Michele warns the Fed is already draining $95 billion in liquidity—the oxygen that fuels asset prices—every month through quantitative tightening.

Who he? I didn't know either.“This [regional bank failures] does remind me an awful lot of that March-to-June period in 2008,” Michele told CNBC in an interview on Friday, citing the three-month rally that followed the Bear deal. “The markets viewed it as: there was a crisis, there was a policy response and the crisis is solved.”

He also sees problems in commercial real estate.Bob Michele, who is responsible for managing $700 billion in assets for the world’s most valuable bank [JP Morgan], believes there are too many current parallels to the 2008 global financial crisis to simply dismiss the idea of a repeat out of hand.

More than $1.4 trillion in U.S. CRE loans are due to mature by 2027, with $270 billion alone coming due this year, according to real estate data provider Trepp. Much of this debt will have to be rolled over at higher rates.

“There are a lot of companies sitting on very low-cost funding,” Michele said. “When they go to refinance, it will double, triple or they won’t be able to [roll it over] and they’ll have to go through some sort of restructuring or default.”

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla