It looks like you're new here. If you want to get involved, click one of these buttons!

Don't you wish Bruce Fund offered a cash position? I have my H.S.A with Bruce and would like to park some of my money in a cash position instead of having to redeem shares when I need to pay for health related expenses.For an allocation fund whose performance has hugged the return of the S&P 500 for the past 10 years, go for the Bruce Fund (BRUFX). It's by far my biggest MF holding.

That's all a tad cynical, don't you think?This basically means they are acknowledging active management is worthless. Loads which are wrong in first place add insult to injury.

I'm sure ER is jacked up on those F1 class shares.

Emphasis added.While most financial writers--and many if not most of this column's readers--believe that commission-based advice is inherently worse than advice that is purchased by ongoing fees (mostly asset-based, sometimes flat), I do not. A front-end load fund that is bought and held for the long term is a relatively cheap investment and often a relatively good one at that. What matters is not the payment structure for the advice, but if it is offered solely in the client's best interest and comes at a fair cost.

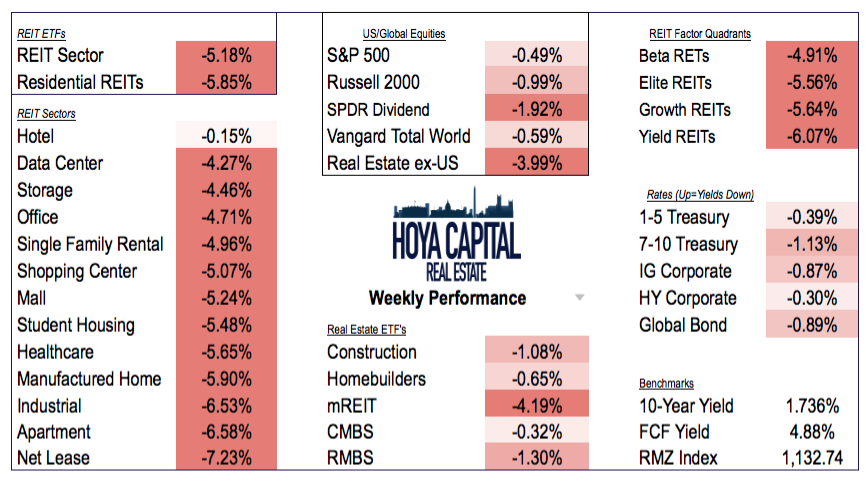

Yes, that's all interesting.REITS have had a rough couple weeks. Mine dropped 2% today on an otherwise up day for markets. It might serve well to read the comments from Ted's August 27 post: "A Good Time for REITS".

http://www.mutualfundobserver.com/discuss/discussion/comment/79901/#Comment_79901

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla