It looks like you're new here. If you want to get involved, click one of these buttons!

Old Skeet, not necessarily my take as I blow with the wind - here today gone tomorrow. At my age, assets, and spending habits my preference going forward would be to be either 100% junk corporates or 100% junk munis or 100% cash. I freed up less than 10% yesterday from my 100% junk munis because I think junk corporates look intriguing (just need more of an upward trend) and always being a believer in the January effect like the diversified emerging markets. Would like to establish positions there and then add (quickly) if indeed they are the place to be in 2015. But I worry about everything, like can U.S. stocks make it seven years in a row or can rates here keep declining.Hi Junkster,

Thanks for posting your take on your asset class of choice for 2015.

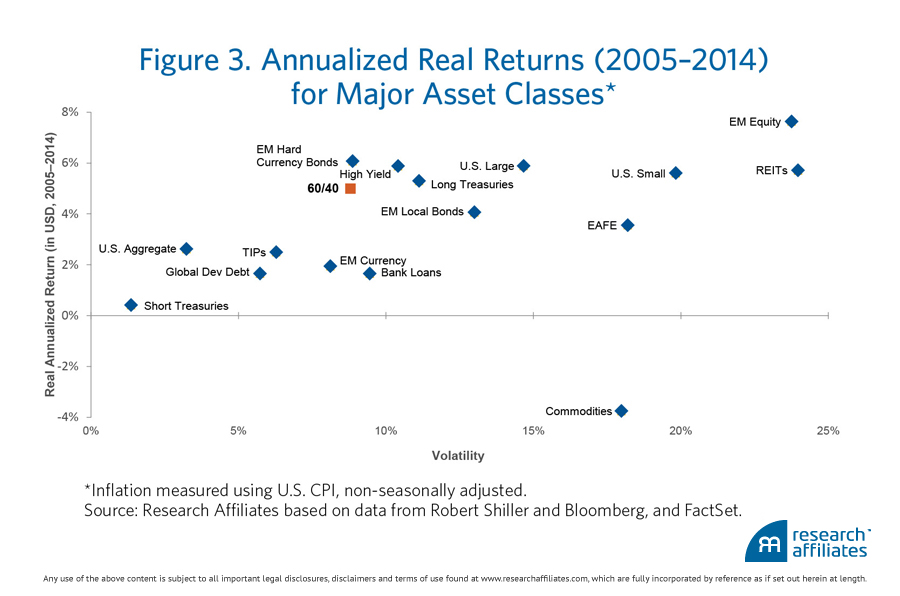

My "Big Three" themes that I am concentrating on and increasing my current positions in are in Europe, Emerging Markets and Commodities along with their producers. Why? Because I believe there is good value to be had in these areas; and, they are currenly selling for lower P/E Ratio multiples when compaired to others.

I wish you and all the others MFO members the very best in 2015.

Old_Skeet

Well Dex, you just explained why 529 and ALL federal programs for college should be scrapped. All it is doing is increasing the price of college. The only way colleges are able to raise prices at 3 times price of inflation is getting gullible people like me to spend every penny on 529,etc. Without 529s, loans ,etc, colleges would have to innovate. Most people who have gone to UC schools could have met at conference rooms in Holiday Inn and received the same education. Pay the professors directly, cut out the middle man??

Education is like the housing bubble:

Both were touted as a positive by Gov't, housing/Education industry and Wall Street.

Since the 1930s Gov't has provided programs to help housing in the hope it would help the economy.

Gov't has many programs for both.

Wall street makes money on both.

Housing or the Education system makes money

Yet in the housing bubble busting many buyers and bond holders lost money.

The current education bubble has not burst yet. But, many students are saddled with huge debts.

Many might attempt to praise education for success. But, that is like driving a car by only looking in the rear view mirror.

The Vets earned their benefits. It is in no way similar to the gov't and other programs associated with housing or education.

May be if parents had to write out a monthly check (instead of property taxes) for pre college schooling it would be better and client/student focused. Now education is there for the benefit of the Educational Industrial Complex (thank you Eisenhower).

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla