CrossingBridge Low Duration High Yield Fund to change name and changes to investment strategies Expanding the strategy beyond HY to include preferreds, equities (SPACs), private credits, foreign credits.

"The income producing fixed income securities in which the Fund invests include: bills, notes, bonds, debentures, convertible bonds, bank loans, loan participations, mortgage- and asset-backed securities, Rule 144A fixed income securities, zero coupon securities, syndicated loan assignments, sovereign debt and other evidence of indebtedness issued by U.S. or foreign corporations, governments, government agencies or government instrumentalities, including floating-rate securities (i.e., fixed income securities that provide income that can increase or decrease with interest rates), commercial paper, and preferred stocks. The Fund may also invest in fixed income-like equity securities such as special purpose acquisition companies (“SPACs”) that provide interest income and/or the potential for capital appreciation while having an effective maturity. The Fund invests in individual fixed income securities without restriction as to issuer credit quality, capitalization or security maturity. The Fund may invest up to 100% of its assets in lower-quality fixed income securities — commonly known as “high yield” or “junk” bonds."

Repost - 5 Star Bond Fund HOBIX loses over 2.70% in four trading days this week Anyone remember the Schwab short term bond fund “Schwab Yield Plus”? That was a serious debacle. SWYSX. Fell about 35% in 2011.

CrossingBridge Low Duration High Yield Fund to change name and changes to investment strategies

Repost - 5 Star Bond Fund HOBIX loses over 2.70% in four trading days this week Scroll down to the holdings section near the bottom of the M* page. There you'll see 82.5% in bonds. I don't know why it doesn't match the 70% fixed income at the top of the page. Clearly this difference is coming from the 24% "other" allocation at the top of the page.

Perhaps not all the bonds are "fixed" income? You might be right about convertibles. Have to check M*'s definitions.

The 17% "other" in the holdings is a MMF (3.63%) and preferred (13% or so).

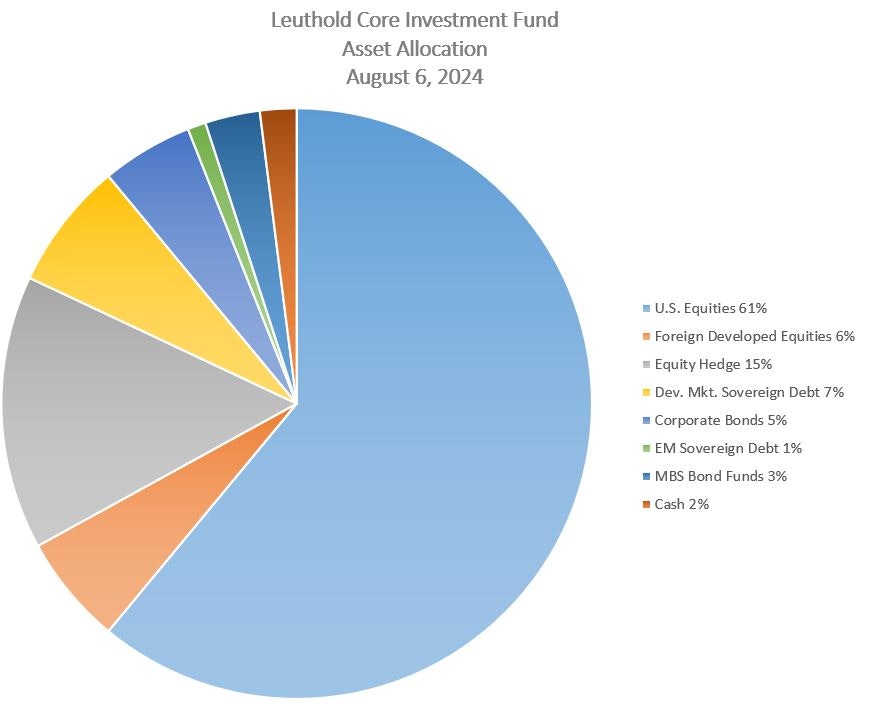

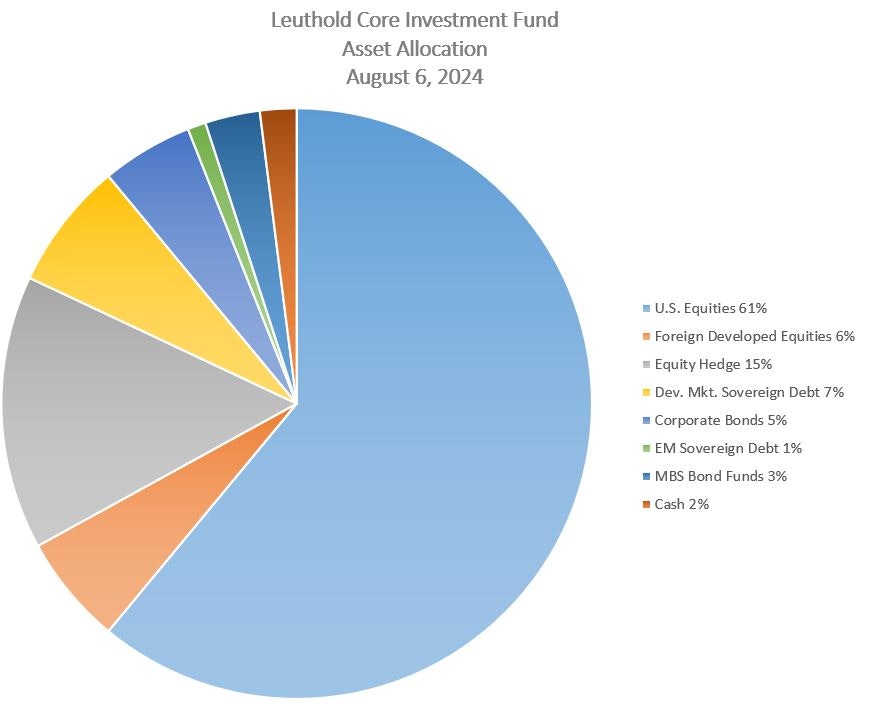

Leuthold: going anywhere Ty

@msf and

@David_SnowballI was placing a LCR buy order this AM (teeny position just to have it on my radar) but I noticed the bid size to be

12. This combined with the small AUM makes it too illiquid for me.

Dave Giroux Explains TCAF's Portfolio Construction

GMO U.S. Quality ETF (QLTY) Thanks

@Sven and

@MikeW; hadn't seen that. It explains a lot about how they run it, and why it holds up so well most of the time. Still my #

1 choice for a U.S. equity fund. (Conservative investor here.)

thinking about correlations within my non-retirement portfolio During 2022, the correlation between stocks and bonds approached 1.0 when the FED raised rate. Other time period, the correlation was much smaller. Having said that, one has to look at longer periods, 5 years or more to smooth out the year of 2022.

Another parameter worth to look at is recovery period under MFO Premium. For allocation funds with flexible or tactical mandates, recovery period reveals how the funds perform through the drawdowns.

thinking about correlations within my non-retirement portfolio Well, PVCMX isn't correlated with any of the other 10 funds in my portfolio. The cross-correlations range from 0.19 - 0.56, which is the link to GP Global Micro.

As to the others, the correlations with Crescent are nearly identical for all four funds at 86 - 88. Given the negligible overlap in holdings (even with LCORX, the differences in region, sector, asset class and size are substantial) between them (FPACX has 0.26% in EM equity, for instance, and 1.4% in microcaps), I found the results fascinating. Apparently there are common drivers of performance that span the five portfolios?

It's the sort of puzzle that I sort of enjoy, until my brain starts to bubble.

Your guess?

Two abrdn funds to be converted into ETFs Ummm ... yeah, about that.

CEO Stephen Bird wanted to sell the entire investment business in 2022. The board forbade it. Investors pulled 10 billion Euro in 2022 and 13 billion in 2023, leading Mr. Bird to receive an 800,000 Euro bonus - a mere third of his desired reward (and pretty much the chauffeur allowance for the average American CEO).

Leuthold: going anywhere You need to account for the portfolio's hedge to determine net equity exposure.

66% gross, 5

1% net, I'd guess.

Repost - 5 Star Bond Fund HOBIX loses over 2.70% in four trading days this week I drafted this also while you were deleting and as Yogi was posting. Largely duplicative of Yogi's post, but hey, I had already put the words to paper.

The fund is reasonably diversified on the bond side. But it has significant issue risk on the "other" (preferreds) side. At the end of July, 4.22% of its portfolio was in Riley, which means that the manager should have been paying close attention to the company. Also 3.42% of its portfolio is in Babcock & Wilcox Enterprises. It's not just the size of these holdings but the total holdings outside of bonds and cash (about 13%).

Those are numbers that one might see in multisector bond funds (which is how M* originally classified the fund in 2017). Despite M* rating the fund as currently (3 year) risk as below average, this looks like a fund built for risk. Its five year M*risk rating is high, so "things" may also have happened in the past.

I agree that when a short term fund loses half a year's typical gains in a year it begs attention. Though with these other holdings (especially concentrated) it shouldn't be viewed as a short term fund.

Repost - 5 Star Bond Fund HOBIX loses over 2.70% in four trading days this week

Repost - 5 Star Bond Fund HOBIX loses over 2.70% in four trading days this week Just checked X/Twitter comments - awful. Not taking them at face value, there may be something to those.

Much of the M* report on HOBIX is computer-generated gobbledygook. Overall, it looks like run of the mill ST bond funds. But one M* comment in passing was an alert - its 5-yr SD was much higher than its 3-yr SD. Then I noted in M* Portfolio details that while total junk % is small, lot of it is in securitized credit with underlying shaky firms.

So, I looked at TestFol that is based in daily data - not monthly data used by M*, PV, MFO Premium, etc. I ran with both 36-mo and 60-mo (default) rolling-periods and one can see that it was a disaster in 2020 pandemic and post-pandemic, but suddenly started doing better in early-2023.

IMO, ST bonds aren't for speculation, but the category is so wide that almost anything goes. There isn't even a distinction between ST-inv-gr and ST-HY. And the fact that generic overviews (M*, etc) may look OK (as for HOBIX) points to dangers lurking in ST bonds. I suppose that the lessons learned during the GFC were forgotten.

Rolling 36-mo

HOBIX-36Rolling 60-mo

HOBIX-60

Leuthold: going anywhere The discrepancy may have to do with how one counts "Equity Hedge".

According to M*, as of June 30th (the date of the

last monthly filing, and pretty close in time to

Aug 6), LCORX was 75.66% long, but had only 62.57% in equity, net.

That is consistent with the

Semi-Annual Report with March 3

1 holdings. It has a

pie chart showing 62.5% in traded US equities, 7.9% short US traded equities, short equity funds (

1.8% + 0.7%), and noise. The Schedule of Investments

reports 69.5% in common stocks and separately reports 9% short in common stocks.

LCORX seems to have held a pretty consistent 60%+ in equities this year, net.

Two abrdn funds to be converted into ETFs Wiki explains,

https://en.wikipedia.org/wiki/Abrdn"In February 202

1, the company announced that it was considering selling or abandoning use of the Standard Life name.[

16][

17] In April 202

1, the company announced that – having sold the Standard Life Insurance business to Phoenix in 20

18 and having sold the Standard Life name to Phoenix in 202

1[

18] – it would be

rebranding as abrdn.[

19] The new brand, pronounced "Aberdeen" and developed by the branding agency Wolff Olins, was criticised as difficult to pronounce, but was said by chief executive Stephen Bird to reflect a "clarity of focus".[20] Part of the motivation was that the

Aberdeen.com domain was owned by another business.[2

1] The change of name and the rebranding took place in July 202

1.[22] The name was met with widespread ridicule and was the butt of online jokes. An online poll of investors described the rebrand as an "act of corporate insanity".[23][24][25] In 2024, Peter Branner, Abrdn's chief investment officer, accused the media of being "childish" for ridiculing the disemvowelled name and said that the company was a victim of "corporate bullying".[2

1]"

thinking about correlations within my non-retirement portfolio Re #

1 - Agree with

@Sven (LCORX). Process of elimination. The 3 remaining choices would not appear very well correlated based on holdings.

Re #2 - TMSRX is liable to go anywhere. Presently

net short equities by

10%. So it is not presently correlated with FPA Crescent - or much else. But PVCMX does not appear correlated either with only

14% in equity and most of the remainder split between cash and bonds. Small cap performance tends to diverge from large cap. PVCMX’s emphasis on value further promotes the divergence. M* is not displaying bond quality, but I’ll guess it’s very high.

To answer the question, I’d say PVCMX is less correlated with FPFRX over longer stretches.

66% gross, 51% net, I'd guess.

66% gross, 51% net, I'd guess.