Lawrence McDonald: "How To Listen When Markets Speak." Subtitle: Risks, Myths, and Investment Opportunities in a Radically Reshaped Economy.

Almost finished. The case he's making is cogent and crisply, sharply written. A quick read, though very meaty. His thesis is that smart investors, looking forward, must move from growth to value--- specifically into basic materials. Oil, gas. Gold, silver, copper, palladium, platinum.

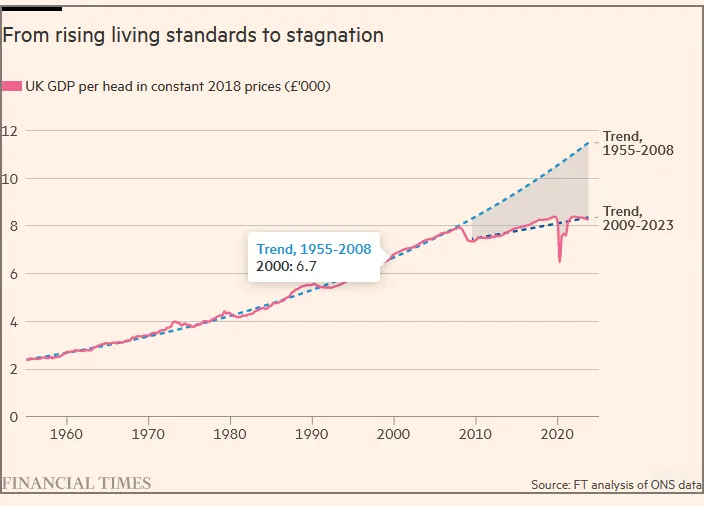

We are in decline, economically. I have said as much for several years, myself. Some of the reason for it is that the world has emerged and grown and thrived, following WW II. We're not the 800-pound gorilla in the room which can throw its weight around the way the USA was able to do, decades ago. A big part of the decline, says McDonald, is geopolitics and overspending Inevitably, the gummint will NOT be able to literally pay down the debt, ever again. It's too massive. In order to handle it, the gummint will have to continuously roll it all over as it matures, and play interest rate games to help cover it.

McDonald has no use for economic sanctions, like the sanctions imposed on Russia and specific Russians, following the Russian invasion of Ukraine. (Crimea was previously stolen, annexed.) Russia has friends in other directions. Most are not even communist. Russia is still feeding raw materials to China so the Chinese can manufacture stuff. Gotta keep the power on. And they're not operating with any "Green Revolution" imposed upon themselves.

I was not surprised, in his treatment of that stuff in particular, that he simply ignored the ethical implications of not responding to the Putin-monster, and just letting him have his way. There is no investing conversation or essay or book which will go near anything to do with ethics. Obama, so I read, confronted Putin at a meeting of big-wigs, and told him flat-out: "We can do stuff to you." Granted, because of the multi-polar economic and political environment today, sanctions are proving to be as useful as trying to use your finger to push a string across the table.

Breathtaking quotations that gobsmacked me:

"44% of all US dollars ever created, were created in 2020 and 2021." Ya, that was the Covid era. But holy jaypers. DEVALUATION, much?????

"The US dollar has lost 93% of its value since the year 1900."

******************************************

McDonald includes summaries of some interviews he's had with some remarkably smart Shining Lights in the Investment Industry. I just finished up reading his account of a conversation with Charlie Munger. Final, distilled thoughts from that meeting actually lifted my spirits. I've made my share of mistakes in investing, but in broad terms, I could take some satisfaction, realizing I'd been doing these things by instinct, for the most part:

Charlie told him: "Trade and invest less. Sit back and wait for those top two or three opportunities that come along each year. Measure your level of conviction and allocate your capital accordingly. Above all, never trade or invest out of boredom or a desire to find something to do. Keep up your high level of passion for markets. Growing wiser is a combination of humility and diligent curiosity. Without the first, the second is useless."