It looks like you're new here. If you want to get involved, click one of these buttons!

Do you mind listing what %age of your portfolio is each fund? If you can easily list, also provide what %age up or down each fund price is today.Here's my portfolio, all commentary welcome! Some of the positions are due to 401k limitations.

QLEIX, CEDIX, QMNIX, NICHX, CELFX, CCLFX, QRPIX, IMPCX, GENIX, MRFOX, XPEBX, CPIEX, DODGX, DFALX, CPEFX, FPADX, TRAIX, CORFX, CBARX, FTIHX, JAAA, BIVIX, SPD, KRE, SIL, T, INDA.

**With the usual disclaimer: Buyer beware**

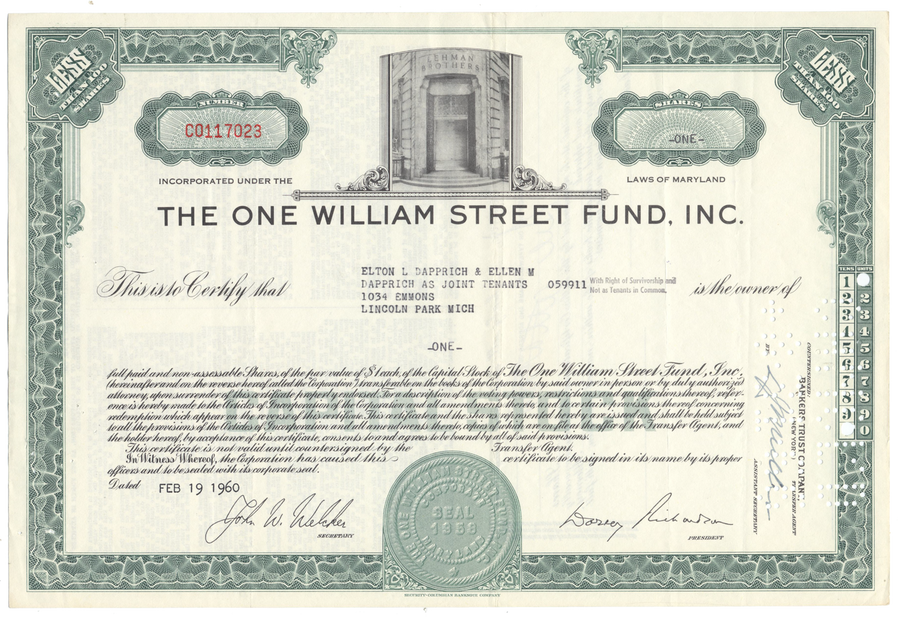

Excellent. I'm going to frame this. :-)OK.

Take 2.

1 if you're a purest.

2 if you're a traditionalist.

3 if you're an experimentalist.

5 if you're a conformist.

More than 5 funds, you should have your keys taken away.

c

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla