Here's a statement of the obvious: The opinions expressed here are those of the participants, not those of the Mutual Fund Observer. We cannot vouch for the accuracy or appropriateness of any of it, though we do encourage civility and good humor.

The annual COLA adjustment, which is designed to help benefits keep pace with inflation, is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as calculated by the Bureau of Labor Statistics (BLS). If the CPI-W increases more than 0.1% year-over-year between the third quarter of the previous year and the third quarter of the current year, Social Security will raise benefits by the same amount. The exact calculation is complicated and may result in a new benefit amount that is slightly different from the amount you get by multiplying the new COLA by your current ben

Scoring at home, much of the increase is already baked in, the clock is about to run out and the inflation trend is higher/higher than expected, thus I'd be very surprised if the 2022 COLA is much less than the current projection, and as I said, likely higher than this projection.

That opinion and ten bucks will get you a Starbucks.

Is this the same calculation used to determine the new IRMAA brackets for Medicare premiums? David

Several differences. Whether the numeric difference is significant I leave for you to decide.

SS: based on CPU-W IRMAA: based on CPI-U

SS: Y/Y comparison period through end of September IRMAA: Y/Y comparison period through end of August

SS: compares average of Q3 vs Q3 of previous year (3 month averages) IRMAA: compares average of 12 months (ending Aug) with average of previous 12 months

SS: rounded to nearest 0.1% IRMAA: rounded to nearest $1,000

SS: never a negative adjustment IRMAA: threshold can adjust downward, but not below the 2018/2019 amount of $85K/$170K

(this is my read on how the IRMAA calculation is done - as an increase relative to the 2018 baseline; many others believe the threshold cannot be reduced, say from $88K currently to $87K)

davor originally quoted the article he linked that incorrectly states, "That would be the biggest cost-of-living adjustment (COLA) hike since 1983."

The correct statement in that regard is, "The projected increase of 6.1% for 2022 would be the biggest cost-of-living adjustment (COLA) hike since the 5.8% increase in 2008. The last increase higher than the 2022 projected increase was the 7.4% increase in 1982."

And no, based on the posts I've read here, I would NOT have hired anyone commenting on this thread except msf to any of my former audit departments.

The linked piece projecting a 6.1% increase specifically highlights gasoline and groceries as basket categories with rapidly increasing prices. These are two categories that are weighted less heavily in CPI-E than CPI-W. Gasoline comprises only 2.142% of the CPI-E basket vs. 3.613% of the CPI-W basket; groceries (food at home) comprise 7.402% of CPI-E vs. 8.962% of CPI-W.

More broadly, the encompassing categories with rapidly rising prices are weighted less heavily in CPI-E than in CPI-W: Transportation, 12.967% vs 16.853%, and Food & Beverages, 13.522% vs. 16.650%.

This underweighting in CPI-E of rapidly rising basket categories means that the rise in CPI-E will likely turn out to be significantly less than CPI-W.

What gets weighted more heavily in CPI-E are the broad areas of Medical Care (12.202% vs. 7.594%) and Housing (46.572% vs. 40.874%). These are basket components that have recently experienced much lower inflation. This overweighting in CPI-E of slower rising basket categories again means that CPI-E will likely be found to have risen significantly less than CPI-W.

The Fed graph below shows Y/Y percentage increases by month for medical (blue) and owner equivalent rent (brown), which is the majority component of housing. The last points on the graph represent Y/Y for June 2021/June 2020. They are 0.433% and 2.343%. Nowhere near 6%.

(You can reconstruct this graph by starting here and editing, changing time periods and adding lines.)

Note that increase in housing expenses is not the same as increase in the price of homes, which is a capital expense. "For the typical homeowner, their housing costs likely haven’t changed too much over the past year."

This M* article looks at current projections and remaining uncertainties that will impact the October COLA announcement and also considers potential changes to the Medicaire Part B premium: Social Security Cost-of-Living Adjustment Looks Uncertain

Here the Buying Power Study referenced in @davfor link and an image. Staying ahead of inflation when you no longer enjoy wage inflation (a raise from work income) is probably why Wade Pfau and Micheal Kitces recommend a increasing equity glide path from the date of retirement forward. Stocks stay ahead of inflation over the long term.

One thought on @bee 's comment. I finally realized I will not live forever as I looked at turning 70. After considering reasonable life cycle needs and set-aside goals for relatives and non-profits, I decided it was time to loosen up a bit on my equity side limit (mostly through more dividend producing equity investments) and to also loosen up a little bit on my withdrawal rate. Will digest changes made for a while. Don't know if I will increase equity percent further later but am comfortable with the increase implemented in 2019-2020. (I have enough flexibility to substantially decrease withdrawal rate if market conditions dictate this is advisable.)

What's shocking about the table is that they would not only cherry pick data, but double and triple count it. And not even label entries the same as in the study. And did you notice that this list of top ten costs has eleven items (see #8)? Makes one wonder about the basic arithmetic in the study.

#6, "Total medical out-of-pocket costs". In the study, that's called "Total medical expenses, not including premiums." Either way, one would naturally expect that to represent, well, everything that a "typical" senior paid for health care (doctors, hospitals, pharmaceuticals, durable (and not so durable) medical equipment, etc.). Everything outside of insurance premiums; at least that's what "out-of-pocket" usually means.

So many things are wrong with this line:

If this counts all medical expenses other than premiums, then including line 1, "prescription drug ... out-of-pocket" is a double count.

In reality, this line supposedly represents how much the government pays for Medicare expenses. So it's what seniors don't pay. According to the study, these figures come from the 2020 Medicare Trustee report, Table V.D1, p. 118 (pdf p.124). Further, while the 2020 figure matches the Trustee report, the 2000 figure doesn't quite.

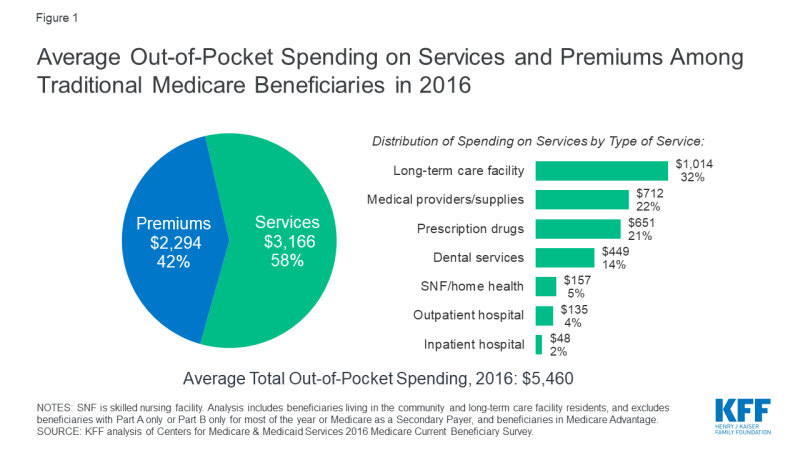

If one really compares Medicare out-of-pocket costs with Medicare premiums, they're much closer to 1-to-1 (2-1 if one excludes Medigap) than the 10-to-1 suggested by lines 2 and 6 in the top ten table). Here's a KFF graph from 2016 with a pie chart comparing the two. I doubt the ratios have shifted radically since then, especially given the way premiums are set. https://www.kff.org/medicare/issue-brief/how-much-do-medicare-beneficiaries-spend-out-of-pocket-on-health-care/

I'll take KFF any day over an advocacy group that doesn't explain how it comes up with its numbers and misrepresents what they mean.

In their supposed methodology document, the Senior Citizens League does not provide the criteria for selecting the 39 "typical" categories.

In saying that it "uses somewhat similar weightings" to CPI-E, it fails to explain why it deviates from the CPI-E weightings, let alone how it calculates the deviations. While it gives you broad categories weightings (e.g. it weights medical 14.1% vs. CPI-E's 12.2%), it doesn't give you a breakdown of weights for the various medical components like the aforementioned lines #2 (Part B premiums) and #1 (prescription drugs), or its several other "typical" medical categories.

But the worst part, the very worst, is that it prices 10 pound of potatoes (line item #7) at Sam's Club in Charlottesville Virginia. Now I ask you, how many seniors belong to Sam's Club and buy 10 pound sacks of potatoes at at time?

Seems to me that you're kind of nitpicking that table. The colors are pretty nice... (kind of patriotic), the font looks OK, and all of the lines are straight.

@Old_Joe : You maybe right, but as the OLD saying goes, They walk among us. Bakers two at a time, otherwise 5# bags. It's potato salad season !! Stay Kool if You can, Derf

Not to be too much of a wet blanket here, but the point of the COLA adjustment is for SS payments to keep pace with inflation, not to put recipients in a better position. Large adjustment, small adjustment, doesn't matter; the adjustment in real dollars is supposed to be virtually zero.

Higher COLA comes from higher inflation. That makes the real yield on fixed income securities even more negative. IMHO this is not a good thing.

Regarding the 6.2% COLA estimate, consider the source. The Senior Citizens League. Last month, its estimate was at the high end of projections.

Estimates for the 2022 COLA range[d] from 4.5 percent from Moody's Analytics to 6.1 percent from The Senior Citizens League. Economist Bill McBride, who writes the finance and economics blog Calculated Risk, estimate[d] the 2022 COLA at 5.5 percent.

It looks like the SCL made the most naive estimate possible: it seems to have assumed that the M/M percentage increase in CPI-W for July to Aug, and from Aug to Sept, would be the same as the M/M percentage increase from June to July. It extrapolated from this single data point, not caring at all about trends in the data let alone trends in the economy.

[I came up with 6.22%, which is rounded to 6.2%, when calculating COLA this way.]

Here's the relevant data presented in the opinion column: "consumer prices rose a lot less in July than they did in June."

At least that's two data points (July and June inflation figures) as opposed to the single data point that the Senior Citizens League seems to have used. Though hard numbers, even just those two, would have been informative.

In addition, since COLA is calculated using the consumer price "shadows", it really doesn't matter for the purpose of projecting COLA what the shadows represent. All that matters is how the shadows are flickering along the wall.

For a 3% COLA, the consumer price shadows (CPI-W) observed in August and September will have to average 3.8% lower than in July. That is, the CPI-W figure for July is 267.789, and the August and September values will have to average 257.628 (3.8% lower).

It's a simple calculation: Avg CPI-W = (Aug 2021 + Sept 2021)/2 = [(July 2020 + Aug 2020 + Sept 2020) x 1.03 - July 2021]/2 https://www.ssa.gov/oact/STATS/cpiw.html

Yes, it's just supposed to keep us even-steven. But I can choose NOT to spend that 6.2% and INVEST it! Yaba daba doo.

Which means that the value of the remaining portion of your SS check, i.e. what you're spending, is 6.2% less than last year.

(Technically 1 - 1/(1.062) = 5.8% less, but that's a distraction.)

If inflation were 0%, you could do the same thing: spend 6.2% less and invest that 6.2%. If inflation were 10%, you could do the same thing: spend 6.2% less and invest that 6.2%.

Comments

As noted here, the annual COLA bump is announced in October using the following methodology. It's all about the 3rd Qtr YOY CPI-W change.

https://www.investopedia.com/social-security-2021-cola-of-1-3-announced-5081979

Excerpt:

COLA Specifics

The annual COLA adjustment, which is designed to help benefits keep pace with inflation, is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as calculated by the Bureau of Labor Statistics (BLS). If the CPI-W increases more than 0.1% year-over-year between the third quarter of the previous year and the third quarter of the current year, Social Security will raise benefits by the same amount. The exact calculation is complicated and may result in a new benefit amount that is slightly different from the amount you get by multiplying the new COLA by your current ben

Scoring at home, much of the increase is already baked in, the clock is about to run out and the inflation trend is higher/higher than expected, thus I'd be very surprised if the 2022 COLA is much less than the current projection, and as I said, likely higher than this projection.

That opinion and ten bucks will get you a Starbucks.

David

SS: based on CPU-W

IRMAA: based on CPI-U

SS: Y/Y comparison period through end of September

IRMAA: Y/Y comparison period through end of August

SS: compares average of Q3 vs Q3 of previous year (3 month averages)

IRMAA: compares average of 12 months (ending Aug) with average of previous 12 months

SS: rounded to nearest 0.1%

IRMAA: rounded to nearest $1,000

SS: never a negative adjustment

IRMAA: threshold can adjust downward, but not below the 2018/2019 amount of $85K/$170K

(this is my read on how the IRMAA calculation is done - as an increase relative to the 2018 baseline; many others believe the threshold cannot be reduced, say from $88K currently to $87K)

https://www.ssa.gov/oact/cola/latestCOLA.html

https://www.law.cornell.edu/uscode/text/42/1395r#i_4_C_ii_II

davor originally quoted the article he linked that incorrectly states,

"That would be the biggest cost-of-living adjustment (COLA) hike since 1983."

The correct statement in that regard is,

"The projected increase of 6.1% for 2022 would be the biggest cost-of-living adjustment (COLA) hike since the 5.8% increase in 2008. The last increase higher than the 2022 projected increase was the 7.4% increase in 1982."

And no, based on the posts I've read here, I would NOT have hired anyone commenting on this thread except msf to any of my former audit departments.

Another recent/worthy article on the topic:

https://www.cnbc.com/2021/07/14/social-security-cost-of-living-increase-for-2022-may-be-largest-in-decades.html

The latest (Dec 2020) relative weightings of the different basket components of CPI-E and CPI-W can be found here: https://www.bls.gov/cpi/tables/relative-importance/home.htm

Specifically: CPI-W (HTML) and CPI-E (XML)

The linked piece projecting a 6.1% increase specifically highlights gasoline and groceries as basket categories with rapidly increasing prices. These are two categories that are weighted less heavily in CPI-E than CPI-W. Gasoline comprises only 2.142% of the CPI-E basket vs. 3.613% of the CPI-W basket; groceries (food at home) comprise 7.402% of CPI-E vs. 8.962% of CPI-W.

More broadly, the encompassing categories with rapidly rising prices are weighted less heavily in CPI-E than in CPI-W:

Transportation, 12.967% vs 16.853%, and

Food & Beverages, 13.522% vs. 16.650%.

This underweighting in CPI-E of rapidly rising basket categories means that the rise in CPI-E will likely turn out to be significantly less than CPI-W.

What gets weighted more heavily in CPI-E are the broad areas of Medical Care (12.202% vs. 7.594%) and Housing (46.572% vs. 40.874%). These are basket components that have recently experienced much lower inflation.

This overweighting in CPI-E of slower rising basket categories again means that CPI-E will likely be found to have risen significantly less than CPI-W.

The Fed graph below shows Y/Y percentage increases by month for medical (blue) and owner equivalent rent (brown), which is the majority component of housing. The last points on the graph represent Y/Y for June 2021/June 2020. They are 0.433% and 2.343%. Nowhere near 6%.

(You can reconstruct this graph by starting here and editing, changing time periods and adding lines.)

Note that increase in housing expenses is not the same as increase in the price of homes, which is a capital expense. "For the typical homeowner, their housing costs likely haven’t changed too much over the past year."

https://www.marketwatch.com/story/an-inflation-storm-is-coming-for-the-u-s-housing-market-11623419869

Social Security Cost-of-Living Adjustment Looks Uncertain

Should Equity Exposure Decrease In Retirement, Or Is A Rising Equity Glidepath Actually Better?

should-equity-exposure-decrease-in-retirement-or-is-a-rising-equity-glidepath-actually-better

Social Security Buying Power

temporary-improvement-in-social-security-buying-power-wiped-out-by-soaring-inflation

Derf

Reducing Retirement Risk with a Rising Equity Glidepath

Rising Equity Glidepath

#6, "Total medical out-of-pocket costs". In the study, that's called "Total medical expenses, not including premiums." Either way, one would naturally expect that to represent, well, everything that a "typical" senior paid for health care (doctors, hospitals, pharmaceuticals, durable (and not so durable) medical equipment, etc.). Everything outside of insurance premiums; at least that's what "out-of-pocket" usually means.

So many things are wrong with this line:

- If this counts all medical expenses other than premiums, then including line 1, "prescription drug ... out-of-pocket" is a double count.

- In reality, this line supposedly represents how much the government pays for Medicare expenses. So it's what seniors don't pay. According to the study, these figures come from the 2020 Medicare Trustee report, Table V.D1, p. 118 (pdf p.124). Further, while the 2020 figure matches the Trustee report, the 2000 figure doesn't quite.

- If one really compares Medicare out-of-pocket costs with Medicare premiums, they're much closer to 1-to-1 (2-1 if one excludes Medigap) than the 10-to-1 suggested by lines 2 and 6 in the top ten table). Here's a KFF graph from 2016 with a pie chart comparing the two. I doubt the ratios have shifted radically since then, especially given the way premiums are set.

I'll take KFF any day over an advocacy group that doesn't explain how it comes up with its numbers and misrepresents what they mean.https://www.kff.org/medicare/issue-brief/how-much-do-medicare-beneficiaries-spend-out-of-pocket-on-health-care/

In their supposed methodology document, the Senior Citizens League does not provide the criteria for selecting the 39 "typical" categories.

In saying that it "uses somewhat similar weightings" to CPI-E, it fails to explain why it deviates from the CPI-E weightings, let alone how it calculates the deviations. While it gives you broad categories weightings (e.g. it weights medical 14.1% vs. CPI-E's 12.2%), it doesn't give you a breakdown of weights for the various medical components like the aforementioned lines #2 (Part B premiums) and #1 (prescription drugs), or its several other "typical" medical categories.

But the worst part, the very worst, is that it prices 10 pound of potatoes (line item #7) at Sam's Club in Charlottesville Virginia. Now I ask you, how many seniors belong to Sam's Club and buy 10 pound sacks of potatoes at at time?

I'm still looking for that answer, how many seniors belong to Sam's Club and buy 10 pound sacks of potatoes at at time?

Derf

Stay Kool if You can, Derf

Social Security cost-of-living adjustment could be 6.2% in 2022

Higher COLA comes from higher inflation. That makes the real yield on fixed income securities even more negative. IMHO this is not a good thing.

[The Fed seems to be looking more at the economy (including delta strain) than inflation in determining when to begin reducing (tapering) the $120B/mo in bonds it is buying (QE).]

Regarding the 6.2% COLA estimate, consider the source. The Senior Citizens League. Last month, its estimate was at the high end of projections. https://states.aarp.org/west-virginia/2022-social-security-cost-of-living-adjustment-could-be-5-percent

It looks like the SCL made the most naive estimate possible: it seems to have assumed that the M/M percentage increase in CPI-W for July to Aug, and from Aug to Sept, would be the same as the M/M percentage increase from June to July. It extrapolated from this single data point, not caring at all about trends in the data let alone trends in the economy.

[I came up with 6.22%, which is rounded to 6.2%, when calculating COLA this way.]

Consider CNN's recent headline: "Inflation moderated in July but prices are still rising in America". This is enough to suggest that SCL overestimated what COLA will be.

https://www.cnn.com/2021/08/11/economy/july-consumer-price-inflation/index.html

Core definitions and the shadows on the cave wall:

https://www.nytimes.com/2021/08/13/opinion/us-transitory-core-inflation.html

"consumer prices rose a lot less in July than they did in June."

At least that's two data points (July and June inflation figures) as opposed to the single data point that the Senior Citizens League seems to have used. Though hard numbers, even just those two, would have been informative.

In addition, since COLA is calculated using the consumer price "shadows", it really doesn't matter for the purpose of projecting COLA what the shadows represent. All that matters is how the shadows are flickering along the wall.

For a 3% COLA, the consumer price shadows (CPI-W) observed in August and September will have to average 3.8% lower than in July. That is, the CPI-W figure for July is 267.789, and the August and September values will have to average 257.628 (3.8% lower).

It's a simple calculation:

Avg CPI-W = (Aug 2021 + Sept 2021)/2 = [(July 2020 + Aug 2020 + Sept 2020) x 1.03 - July 2021]/2

https://www.ssa.gov/oact/STATS/cpiw.html

(Technically 1 - 1/(1.062) = 5.8% less, but that's a distraction.)

If inflation were 0%, you could do the same thing: spend 6.2% less and invest that 6.2%.

If inflation were 10%, you could do the same thing: spend 6.2% less and invest that 6.2%.

The nominal increase is objectively meaningless, with some exceptions such as its interplay with the SS hold harmless provision.

https://blog.ssa.gov/how-the-hold-harmless-provision-protects-your-benefits/