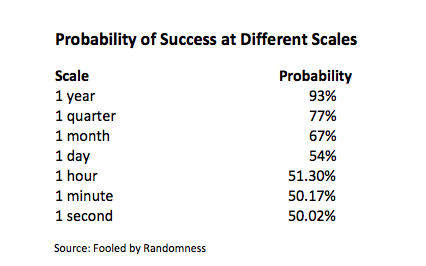

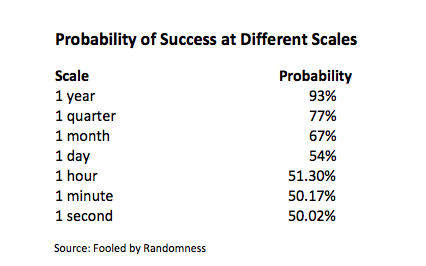

“Warren Buffett doesn't have a computer on his desk ...”“Nicholas Taleb, in his profound book, 'Fooled by Randomness', talks about the difference between noise and meaning. He uses the example of the happily retired dentist who builds himself a nice trading desk in his attic, aiming to spend every business day watching the market while sipping decaffeinated coffee. He watches his inventory of stocks via a spreadsheet with live price updates.”Chart

“Warren Buffett doesn't have a computer on his desk ...”“Nicholas Taleb, in his profound book, 'Fooled by Randomness', talks about the difference between noise and meaning. He uses the example of the happily retired dentist who builds himself a nice trading desk in his attic, aiming to spend every business day watching the market while sipping decaffeinated coffee. He watches his inventory of stocks via a spreadsheet with live price updates.”Chart shows that near-term “gains” or “losses” are relatively insignificant when compared to a portfolio’s longer term probability of success. (Cannot vouch for the accuracy of the statistics - but they appear reasonable.)

Read full story here

Read full story here

Comments

I often check daily performance.

There is no really good reason for this since I don't trade too often.

A scatterbrained article citing a half dozen or so knowledgeable investors. But there seems to be a few pertinent take-aways. One relates to the mental stress of checking too often. Another suggests that we are prone to sell too early after a quick gain - diminishing the potential for far greater gains.

Another Good Link - Study shows nearly half of all investors check their performance at least once a day.

I/we worked hard for the money we have invested; and treat investing as an ongoing education. If we don't pay attention, the learning stops and it is time to contact an advisor who you think has as much skill as you.

With observing selected market information; not just one's holdings, it is possible to develop some amount of intuition that won't cause one's investments great harm and should be a positive.

And as @Mark noted; there is satisfaction in growing a garden and investments, too.

I review markets at least once every business day, if I'm home. A weekly review of the portfolio finds its place on the weekend.

From the paper print days some 40 years ago through the value I find at Bloomberg and MFO; I'm a wiser person to investing.

Satisfied I am.

Lastly, writing about advisors above......I'm trying to imagine their phone calls and emails to clients about the choices made, and the YTD returns.

Remain curious,

Catch

• If it's down, yes.

• If it's up, no.

PRWCX beats me more often than not. Because I beat PRWCX once in a while, I tell myself I have a hope to get better. When it beats me more regularly, I will take the cue and adopt a passive approach.

---

MarcelProust. oops. correction: VOLTAIRE.I like to check-in on the portfolio more often, now that I own some single stocks. Rather like spending time with my garden, just watching it grow. seems to me it does most of its growing overnight, in the dark. but i still like to sit out there, among the flowers. and the vegetables. call it conscientiousness. also, alertness, and satisfaction. i don't trade a lot. still building some of my positions. so i look at the markets and the portfolio to catch good entry moments, to buy more shares, not trading in and out.

For @Mark, @Catch22, @Crash and others who liken portfolios to gardens, here’s a great opening scene from “On a Clear Day You Can See Forever” (1970) with a very young and lovely Barbara Streisand.

An apology of sorts. I wasn’t really asking folks if they check their portfolios too often or implying anyone did. The thread’s caption is simply the title of the article I attached. I’ve discovered that since broadening out from owning only mutual funds to now having ETFs and stocks in the mix that I do check a lot more often than before. Enough that I’m concerned it might affect my good judgment in terms of buying and selling. Trying hard to maintain a long term focus and not react to all the incoming static day to day.

Thanks again for all the comments. I do understand the garden analogy. Makes perfect sense. Just playing a bit of Devil’s Advocate.

What do you mean by also checking against the daily relative price movement of your portfolio constituents? And, how do you use that information?

Voltaire kept meticulous accounts of his business dealings and his gardens at his chateau at Ferney. Maybe he checked his portfolio a lot, it seems likely. Proust, however, was profligate, even going so far as to buy an airplane for his chauffeur with whom he was in love.

Goodness, that was enlightening. I truly appreciate it.